- Home

- »

- Research

- »

-

U.S. Beverage Grade Carbon Dioxide Market Report, 2033GVR Report cover

![U.S. Beverage Grade Carbon Dioxide Market Size, Share & Trends Report]()

U.S. Beverage Grade Carbon Dioxide Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Carbonated Soft Drinks, Beer & Brewing, Sparkling Water & Functional Drinks), By Country (Northeast, Gulf Coast), And Segment Forecasts

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Beverage Grade Carbon Dioxide Market Summary

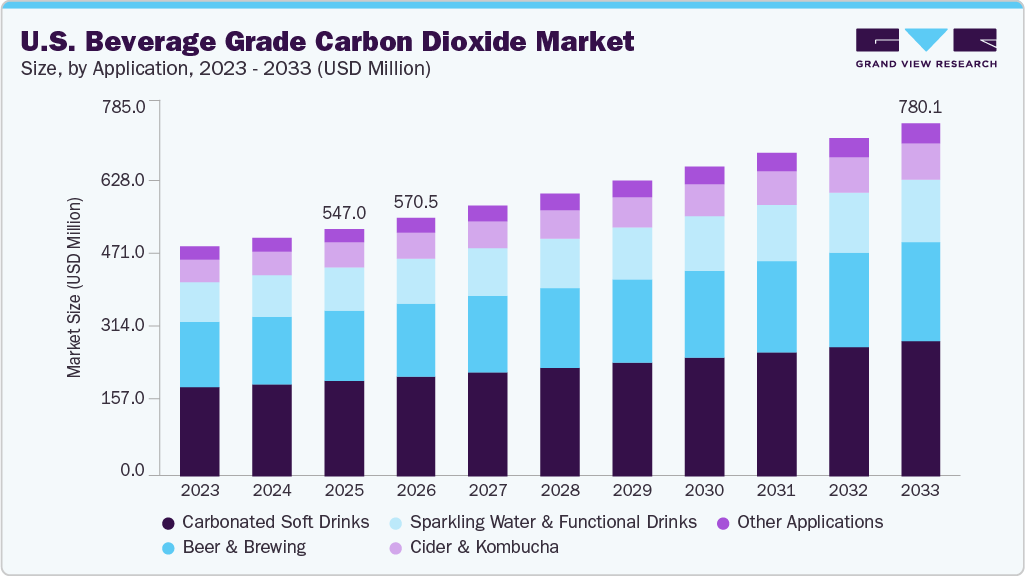

The U.S. beverage grade carbon dioxide market size was estimated at USD 547.0 million in 2025 and is projected to reach USD 780.1 million by 2033, growing at a CAGR of 4.6% from 2026 to 2033. The U.S. beverage industry continues to experience steady demand for carbonated soft drinks, sparkling water, beer, and ready-to-drink beverages, which directly supports the consumption of beverage-grade carbon dioxide.

Key Market Trends & Insights

- By application, the carbonated soft drinks segment dominated the market with the largest revenue share of 38.6% in 2025.

- By application, the cider & kombucha segment is expected to grow at the fastest CAGR of 5.0% from 2026 to 2033 in terms of revenue.

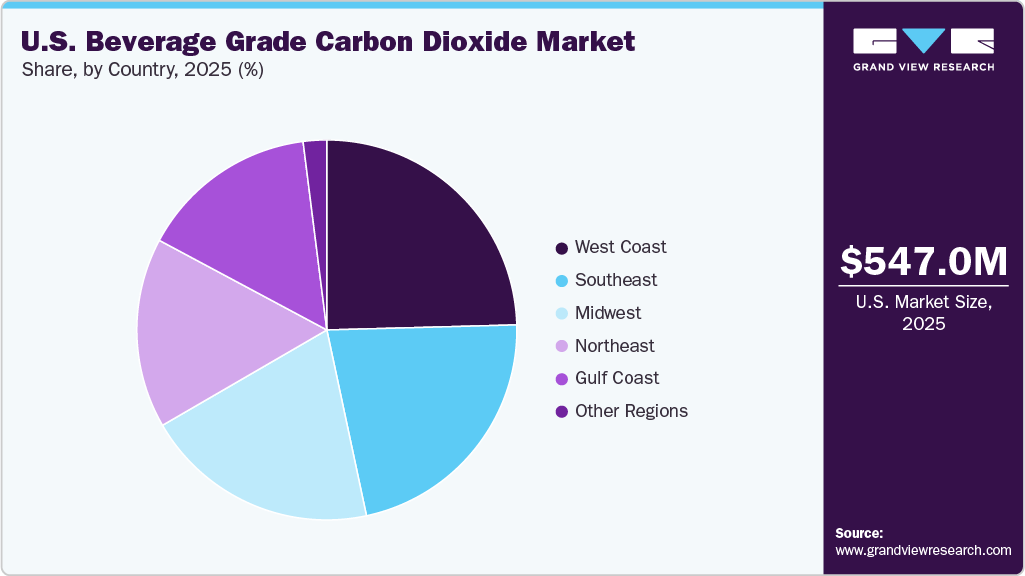

- By region, the West Coast captured the largest revenue share of 24.6% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 547.0 Million

- 2033 Projected Market Size: USD 780.1 Million

- CAGR (2026-2033): 4.6%

- Asia Pacific: Largest market in 2025

Growth in craft breweries, premium sodas, and functional sparkling drinks has increased the need for high-purity CO₂ to ensure consistent carbonation, taste, and product quality, making it a critical input for beverage manufacturers. Rising regulatory scrutiny and quality standards in the U.S. beverage industry are driving demand for certified beverage-grade carbon dioxide. Beverage manufacturers are prioritizing high-purity CO₂ with reliable supply and traceability to meet FDA and food safety requirements, encouraging long-term partnerships with established suppliers and supporting premium pricing in the market.

The rapid expansion of low-alcohol, non-alcoholic, and functional beverage segments in the U.S. presents a significant opportunity for beverage-grade carbon dioxide suppliers. These products rely heavily on precise carbonation to enhance mouthfeel and consumer experience, creating new demand streams and allowing suppliers to align with emerging beverage brands through customized supply agreements.

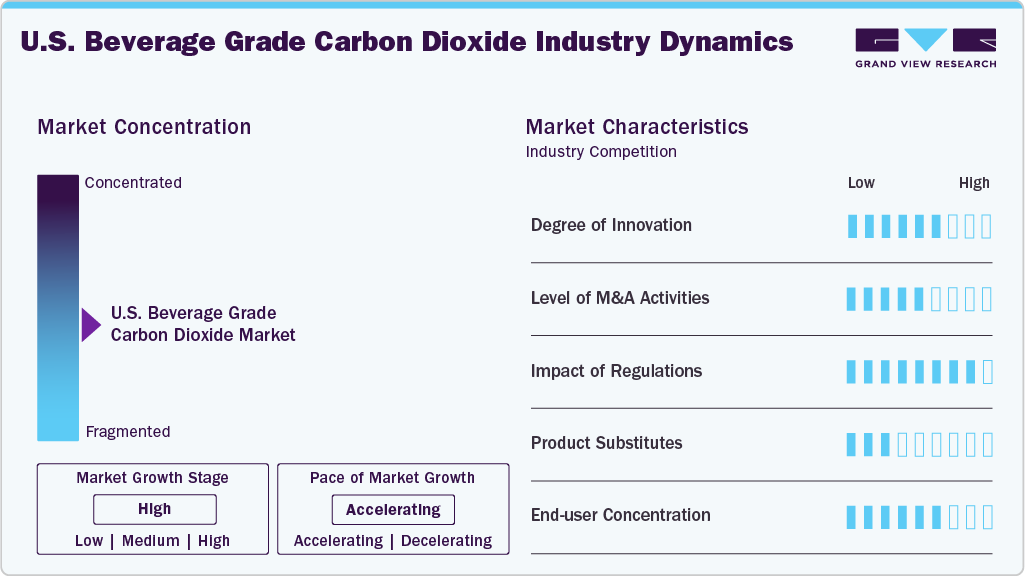

Market Concentration & Characteristics

The U.S. beverage grade carbon dioxide market is moderately concentrated, with a limited number of large industrial gas producers accounting for a significant share of the supply. These players benefit from extensive production networks, long-term contracts with beverage manufacturers, and integrated distribution capabilities, creating high entry barriers for smaller or new suppliers.

Strict quality and purity requirements, stable demand patterns, and strong dependence on the beverage and foodservice industries characterize the market. Supply reliability, compliance with food-grade regulations, and proximity to end-use facilities are key competitive factors. At the same time, pricing is influenced by feedstock availability, logistics costs, and long-term contractual agreements.

Application Insights

The carbonated soft drinks segment led the U.S. beverage grade carbon dioxide industry, capturing the largest revenue share of 38.6% in 2025, driving consistent demand for beverage grade carbon dioxide. Large bottlers and multinational brands operate high-capacity production lines that require an uninterrupted and high-purity CO₂ supply for carbonation, reinforcing this segment’s dominant share.

The cider & kombucha segment is the fastest-growing application area in the market with a CAGR of 5.0% during the forecast period. Growing consumer interest in craft, organic, and functional beverages is driving demand for cider and kombucha in the U.S. These beverages rely on controlled carbonation to enhance their taste and mouthfeel, thereby increasing the need for high-quality beverage-grade carbon dioxide as producers scale up their operations.

Region Insights

The U.S. beverage grade carbon dioxide market is estimated to grow at a significant CAGR of 4.6% from 2026-2033. The U.S. hosts a large and diversified beverage manufacturing base, encompassing carbonated soft drinks, alcoholic beverages, and functional drinks, which drives sustained demand for beverage-grade carbon dioxide. High production volumes and nationwide bottling networks support long-term, contract-based CO₂ procurement.

West Coast (California, Arizona, Washington, Oregon) Beverage Grade Carbon Dioxide Market Trends

The West Coast dominated the market, accounting for a 24.6% revenue share in 2025. The West Coast leads to the adoption of premium sodas, sparkling water, kombucha, and craft cider. Driving increased demand for precise and high-quality carbonation. This trend supports higher consumption of beverage-grade carbon dioxide, particularly from specialized suppliers.

Southeast (Florida, Virginia, Carolinas) region Beverage Grade Carbon Dioxide Market Trends

The Southeast region is expected to grow at the fastest CAGR of 5.7% from 2026 to 2033. The Southeast benefits from strong tourism, hospitality, and theme park industries, driving high demand for fountain beverages and draft drinks. This supports consistent consumption of beverage-grade carbon dioxide across on-premises channels.

Gulf Coast (Texas, Louisiana) Beverage Grade Carbon Dioxide Market Trends

The Gulf Coast has a well-established industrial gas and petrochemical infrastructure, enabling large-scale CO₂ production and efficient distribution. This enhances supply reliability and supports the growth of beverage manufacturing activity in the region.

Northeast (New York, Pennsylvania, New England) Beverage Grade Carbon Dioxide Market Trends

High population density and strong urban consumption patterns in the Northeast support significant demand for carbonated beverages. This drives steady use of beverage-grade carbon dioxide across retail and foodservice channels.

Midwest (Illinois, Ohio, Indiana, Iowa) Beverage Grade Carbon Dioxide Market Trends

The Midwest is a key hub for large-scale beverage bottling and food processing plants due to its central location and logistics advantages. This concentration drives steady, high-volume demand for beverage-grade carbon dioxide for carbonation and packaging applications.

Key U.S. Beverage Grade Carbon Dioxide Company Insights

Some of the key players operating in the U.S. beverage grade carbon dioxide industry include Linde plc, Air Liquide, Air Products & Chemicals, Messer Group, and TAIYO NIPPON SANSO.

-

Linde plc holds a dominant position in the U.S. beverage-grade carbon dioxide industry due to its extensive production footprint, integrated supply chain, and long-standing relationships with major beverage manufacturers. The company’s ability to ensure high-purity, food-grade CO₂ with reliable distribution across key consumption regions supports large-scale bottlers and foodservice customers, reinforcing its leadership through long-term contracts and supply reliability.

-

Air Liquide is a key market leader in the U.S. beverage grade carbon dioxide market, supported by its strong industrial gas infrastructure and advanced purification capabilities. The company leverages its nationwide distribution network and focuses on quality compliance and sustainability-driven CO₂ sourcing to serve multinational beverage brands, enabling consistent supply and strengthening its competitive position in the market.

Key U.S. Beverage Grade Carbon Dioxide Companies:

- Linde plc

- Air Liquide

- Air Products & Chemicals

- Messer Group

- TAIYO NIPPON SANSO

- Reliant Holdings

- Holston Gases

- Zephyr Solutions, LLC

Recent Developments

- In September 2025, CleanCycle Carbon announced plans to commission 10 new biogenic CO₂ plants across North America, which are expected to supply approximately 340 tonnes per day of beverage-grade carbon dioxide. The expansion is aimed at easing supply constraints while strengthening the availability of sustainably sourced CO₂ for beverage and food industry applications.

U.S. Beverage Grade Carbon Dioxide Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 570.5 million

Revenue forecast in 2033

USD 780.1 million

Growth rate

CAGR of 4.6% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, country

Country scope

Northeast (New York, Pennsylvania, New England); Gulf Coast (Texas, Louisiana); Midwest (Illinois, Ohio, Indiana, Iowa); Southeast (Florida, Virginia, Carolinas); West Coast (California, Arizona, Washington, Oregon)

Key companies profiled

Linde plc; Air Liquide; Air Products & Chemicals; Messer Group; TAIYO NIPPON SANSO; Reliant Holdings; Holston Gases; Zephyr Solutions, LLC

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Beverage Grade Carbon Dioxide Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the U.S. beverage grade carbon dioxide market report based on application and country:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Carbonated Soft Drinks

-

Beer & Brewing

-

Sparkling Water & Functional Drinks

-

Cider & Kombucha

-

Other Applications

-

-

Country Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Northeast (New York, Pennsylvania, New England)

-

Gulf Coast (Texas, Louisiana)

-

Midwest (Illinois, Ohio, Indiana, Iowa)

-

Southeast (Florida, Virginia, Carolinas)

-

West Coast (California, Arizona, Washington, Oregon)

-

Frequently Asked Questions About This Report

b. The U.S. beverage grade carbon dioxide market size was estimated at USD 547.0 million in 2025 and is expected to reach USD 570.5 million in 2026.

b. The U.S. beverage grade carbon dioxide market is expected to grow at a compound annual growth rate (CAGR) of 4.6% from 2026 to 2033, reaching USD 780.1 million by 2033.

b. The carbonated soft drinks segment captured the largest revenue share of 38.6% in 2025, driving consistent demand for beverage-grade carbon dioxide. Large bottlers and multinational brands operate high-capacity production lines that require an uninterrupted and high-purity CO₂ supply for carbonation, reinforcing this segment’s dominant share.

b. Some of the key players operating in the U.S. beverage grade carbon dioxide market include Linde plc, Air Liquide, Air Products & Chemicals, Messer Group, TAIYO NIPPON SANSO, Reliant Holdings, Holston Gases, Zephyr Solutions, LLC.

b. The U.S. beverage industry continues to experience steady demand for carbonated soft drinks, sparkling water, beer, and ready-to-drink beverages, which directly supports the consumption of beverage-grade carbon dioxide. Growth in craft breweries, premium sodas, and functional sparkling drinks has increased the need for high-purity CO₂ to ensure consistent carbonation, taste, and product quality, making it a critical input for beverage manufacturers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.