- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Bioprocess Containers Market Size, Share Report, 2033GVR Report cover

![U.S. Bioprocess Containers Market Size, Share & Trends Report]()

U.S. Bioprocess Containers Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (2D U.S. Bioprocess Containers, 3D U.S. Bioprocess Containers), By Application (Upstream Process, Downstream Process), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-635-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Bioprocess Containers Market Summary

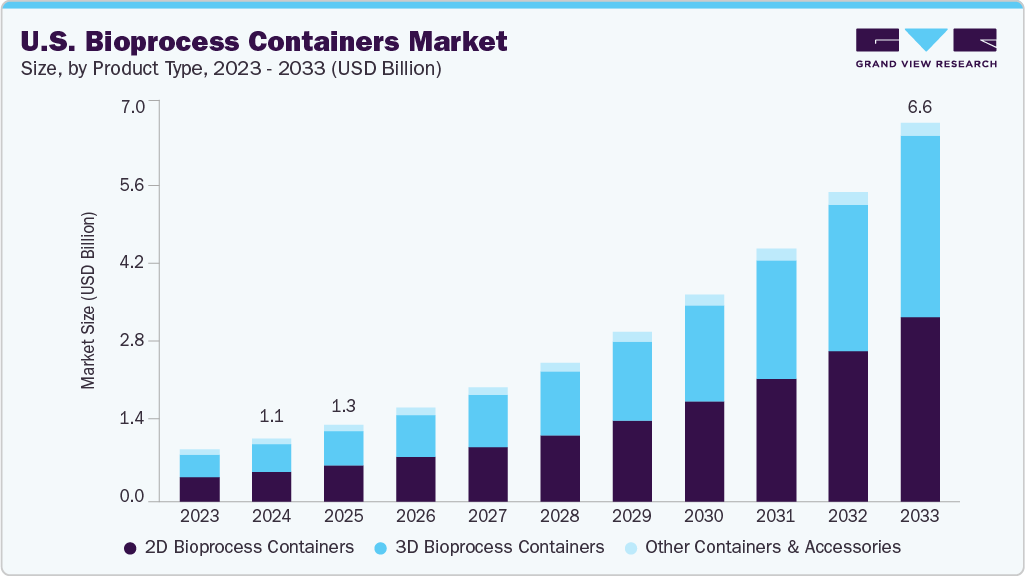

The U.S. bioprocess containers market size was estimated at USD 1.09 billion in 2024, and is projected to reach USD 6.55 billion by 2033, growing at a CAGR of 22.1% from 2025 to 2033. The industry is driven by the increasing adoption of single-use technologies in biopharmaceutical manufacturing and the growing demand for flexible, scalable solutions for biologics and vaccine production.

Key Market Trends & Insights

- By product type, the 3D bioprocess containers segment is expected to grow at a considerable CAGR of 23.1% from 2025 to 2033 in terms of revenue.

- By application, the upstream processes segment is expected to grow at a considerable CAGR of 22.9% from 2025 to 2033 in terms of revenue.

- By end use, the contract research organizations & contract manufacturing organizations segment is expected to grow at a considerable CAGR of 22.9% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 1.09 Billion

- 2033 Projected Market Size: USD 6.55 Billion

- CAGR (2025-2033): 22.1%

Additionally, strong R&D investments and supportive regulatory frameworks further accelerate market growth.The market is primarily driven by the rapid growth of the biopharmaceutical industry, particularly the increasing demand for monoclonal antibodies, cell and gene therapies, and vaccines. Single-use bioprocess containers (SUBCs) offer flexibility, cost-efficiency, and reduced contamination risks compared to traditional stainless-steel systems, making them ideal for modern biomanufacturing. For example, the surge in mRNA vaccine production during the COVID-19 pandemic highlighted the need for scalable, disposable solutions, with companies such as Pfizer and Moderna relying heavily on single-use technologies to accelerate production timelines.

Another key factor is the shift toward personalized medicine and small-batch production, which favors single-use systems due to their adaptability and lower operational costs. Cell and gene therapies, such as CAR-T cell treatments, require specialized, sterile environments that SUBCs can provide without extensive cleaning or validation. Companies such as Thermo Fisher Scientific Inc. and Sartorius AG have expanded their portfolios to include customizable bioprocess containers tailored for these advanced therapies. Additionally, regulatory support from agencies such as the FDA, which encourages innovation in biomanufacturing, further propels market growth.

Moreover, sustainability and operational efficiency are driving adoption, as single-use containers reduce water and energy consumption compared to traditional systems. Pharmaceutical companies are under pressure to minimize their environmental footprint, and SUBCs help achieve this by eliminating the need for cleaning and sterilization. As biopharmaceutical pipelines expand and manufacturers prioritize agility, the U.S. bioprocess containers market is expected to grow steadily, supported by technological advancements and evolving industry needs.

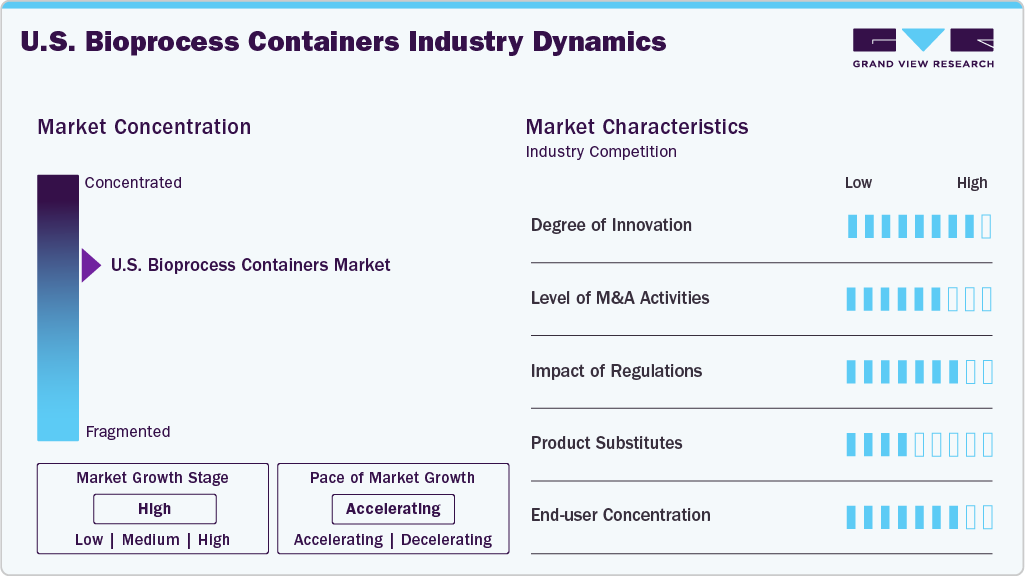

Market Concentration & Characteristics

The industry is marked by continuous innovation, particularly in single-use technologies and advanced polymer films. Bioprocess containers are increasingly being integrated with sensors, tubing assemblies, and automation systems to ensure better process control, sterility, and scalability.

As bioprocess containers play a critical role in the manufacturing of biologics, vaccines, and cell/gene therapies, the market is subject to strict oversight by regulatory bodies such as the FDA. Products must comply with cGMP (current Good Manufacturing Practices), USP Class VI, and ISO 9001 standards. Consequently, the industry is quality-intensive, featuring rigorous testing protocols for sterility, extractables/leachables, and physical integrity. This raises barriers to entry and benefits established players with proven regulatory compliance records.

The market is increasingly customer-driven, as biopharma clients require custom-sized containers and application-specific features, such as 2D/3D containers, sterile connectors, and multi-port configurations. Demand is split between standard off-the-shelf products and tailored solutions, making operational flexibility a key differentiator. Furthermore, contract development and manufacturing organizations (CDMOs) and research institutions comprise a growing share of end users, as they seek versatile solutions to manage multiple biologics or personalized therapies under tight timelines.

Product Type Insights

The 2D bioprocess containers segment recorded the largest market revenue share of over 47.0% in 2024. These are flat, disposable bags primarily utilized in low-volume operations, including fluid sampling, temporary storage, solution mixing, and media transfer. Constructed from multi-layer polymer films, these containers provide excellent chemical resistance, allow for effective sterilization, and maintain compatibility with diverse biopharmaceutical compounds. They are commonly equipped with integrated tubing and connectors, facilitating seamless incorporation into both upstream and downstream bioprocess workflows.

The 3D bioprocess containers segment is expected to grow at the fastest CAGR of 23.1% during the forecast period. These are typically cube-shaped or rectangular and are intended for high-volume applications, usually ranging from 50 liters up to more than 2,000 liters. These containers are widely utilized for bulk media and buffer preparation, storage, and transportation. They serve critical roles in processes such as bioreactor feeding, harvest collection, and handling intermediate products within biopharmaceutical manufacturing. The growing scale of biologics and biosimilar production is a key driver behind the increasing demand for these 3D containers.

Application Insights

The upstream processes segment recorded the largest market revenue share of over 57.0% in 2024 and is expected to grow at the fastest CAGR of 22.9% during the forecast period. Upstream processes in biopharmaceutical manufacturing encompass the early phases of product development, such as cell culture, fermentation, and media preparation. The use of bioprocess containers in these stages is rising due to the growing adoption of single-use technologies in biologics production, especially for monoclonal antibodies (mAbs) and cell and gene therapies. Additionally, the increasing popularity of modular biomanufacturing and the need to shorten time-to-market for new therapies are fueling the shift toward disposable systems in upstream operations. The move toward smaller batch production and personalized medicine further drives demand for scalable and adaptable upstream solutions.

Downstream processing focuses on the purification and recovery of biopharmaceutical products following fermentation or cell culture. This phase encompasses steps such as clarification, chromatography, and filtration. In the U.S., bioprocess containers play a crucial role in storing buffers, intermediates, and final drug substances while maintaining sterility and minimizing contamination. These containers improve operational efficiency by reducing manual intervention and ensuring consistent product quality. The rising complexity of biologic drug purification and the demand for cost-effective, closed-system solutions to reduce contamination risks are key factors driving the adoption of bioprocess containers in downstream operations.

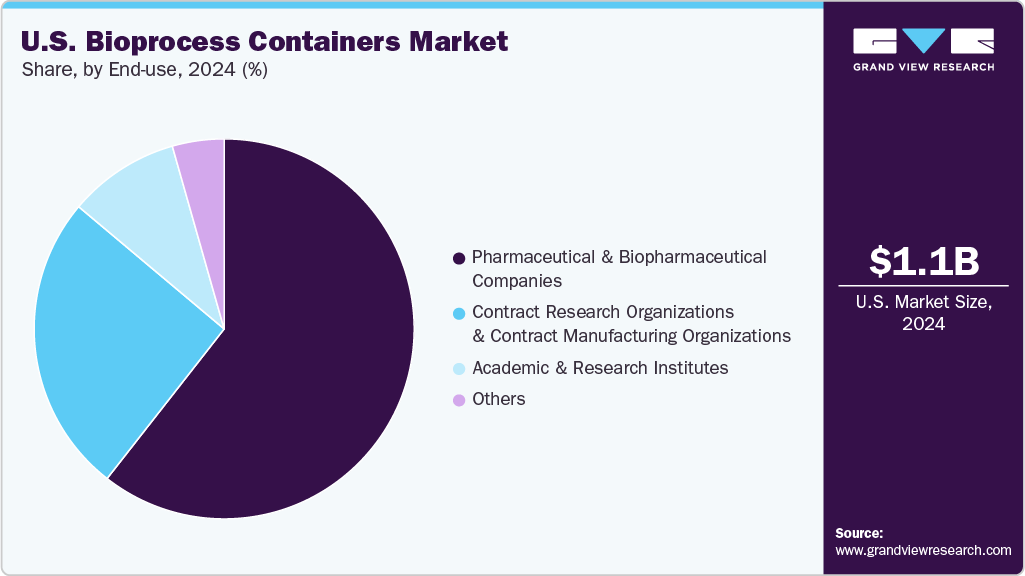

End Use Insights

The pharmaceutical & biopharmaceutical companies segment recorded the largest market share of over 60.0% in 2024. Pharmaceutical and biopharmaceutical companies represent the primary consumers of bioprocess containers, utilizing them extensively in both upstream and downstream processes such as media preparation, fermentation, harvesting, and buffer storage. These companies increasingly adopt single-use technologies to enhance operational flexibility, minimize the risk of cross-contamination, and accelerate turnaround between production batches. The key growth driver is the rising demand for biologics, including monoclonal antibodies, vaccines, and cell and gene therapies.

The CROs and CMOs segment is projected to grow at the fastest CAGR of 22.9% during the forecast period. CRO and CMOs rely on bioprocess containers to enable flexible and rapid biomanufacturing across various production scales. Given their role in managing R&D, clinical trials, and manufacturing for multiple clients, modular single-use systems are well-suited to accommodate the diverse and shifting needs of their operations. A key growth driver is the ongoing trend of outsourcing within the pharmaceutical and biotech sectors, as companies aim to reduce capital investment in infrastructure and accelerate product development by collaborating with CROs and CMOs. This outsourcing model, coupled with the surge in biologics development by small and mid-sized firms, continues to drive demand for disposable bioprocessing technologies that support multi-product workflows and short-run manufacturing cycles.

Key U.S. Bioprocess Containers Company Insights

Key players operating in the U.S. bioprocess containers market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Bioprocess Containers Companies:

- Thermo Fisher Scientific Inc.

- Merck

- Saint-Gobain

- Parker Hannifin Corp

- Kiefel

- Sartorius AG

- CellBios

- Entegris

- Liquidyne Process Technologies, Inc.

- Vonco Products, LLC

- Anlagenbau GmbH

- Avantor, Inc.

- ILC Dover

Recent Developments

-

In November 2024, Sartorius AG, a biopharmaceutical industry partner, opened a new Center for Bioprocess Innovation in Marlborough, Massachusetts, designed to encourage collaboration and learning with customers and innovation partners.

-

In May 2022, ILC Dover launched its liquid single-use bioprocessing bags, designed for sterile liquid handling in the biotherapeutics and cell and gene therapy markets. These bags are highly configurable with various sizes, ports, and components to safely store and transfer buffers, media, and bulk cGMP products. Constructed from medical-grade Renolit 9101 film, which has low gas permeability and minimal extractables and leachables, the bags meet stringent BPOG, ISO, and USP standards. This launch expands ILC Dover’s comprehensive line of single-use solutions aimed at improving efficiency, sterility, and safety in biopharmaceutical manufacturing processes.

U.S. Bioprocess Containers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.32 billion

Revenue forecast in 2033

USD 6.55 billion

Growth rate

CAGR of 22.1% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use

Key companies profiled

Thermo Fisher Scientific Inc.; Merck; Saint-Gobain; Parker Hannifin Corp; Kiefel; Sartorius AG; CellBios; Entegris; Liquidyne Process Technologies, Inc.; Vonco Products, LLC; Anlagenbau GmbH; Avantor, Inc.; ILC Dover

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Bioprocess Containers Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. bioprocess containers market report based on product type, application, and end use:

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

2D U.S. Bioprocess Containers

-

3D U.S. Bioprocess Containers

-

Other Containers & Accessories

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Upstream Processes

-

Downstream Processes

-

Process Developments

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceutical & Biopharmaceutical Companies

-

Contract Research Organizations & Contract Manufacturing Organizations

-

Academic & Research Institutes

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. bioprocess containers market was estimated at around USD 1.09 billion in the year 2024 and is expected to reach around USD 1.32 billion in 2025.

b. The U.S. bioprocess containers market is expected to grow at a compound annual growth rate of 22.1% from 2025 to 2030 to reach around USD 6.55 billion by 2030.

b. Pharmaceutical & biopharmaceutical companies dominated the end-use segment of the market in 2024 with over 60.0% value share due to their high demand for advanced drug development, biologics production, and extensive R&D investments.

b. The key players in the U.S. bioprocess containers market include Thermo Fisher Scientific Inc.; Merck; Saint-Gobain; Parker Hannifin Corp; Kiefel; Sartorius AG; CellBios; Entegris; Liquidyne Process Technologies, Inc.; Vonco Products, LLC; Anlagenbau GmbH; Avantor, Inc.; ILC Dover

b. The U.S. bioprocess containers market is driven by increasing demand for biologics and biosimilars, advancements in single-use technologies, and the need for cost-effective and flexible manufacturing solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.