- Home

- »

- Advanced Interior Materials

- »

-

U.S. Bromine Market Size And Share, Industry Report, 2033GVR Report cover

![U.S. Bromine Market Size, Share & Trend Report]()

U.S. Bromine Market (2025 - 2033) Size, Share & Trend Analysis Report By Product (Elemental Bromine, Calcium Bromide Sodium Bromide), By Application (Clear Brine Fluids, Flame Retardants, Biocides, Bromine Based Batteries), And Segment Forecasts

- Report ID: GVR-4-68040-646-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Bromine Market Summary

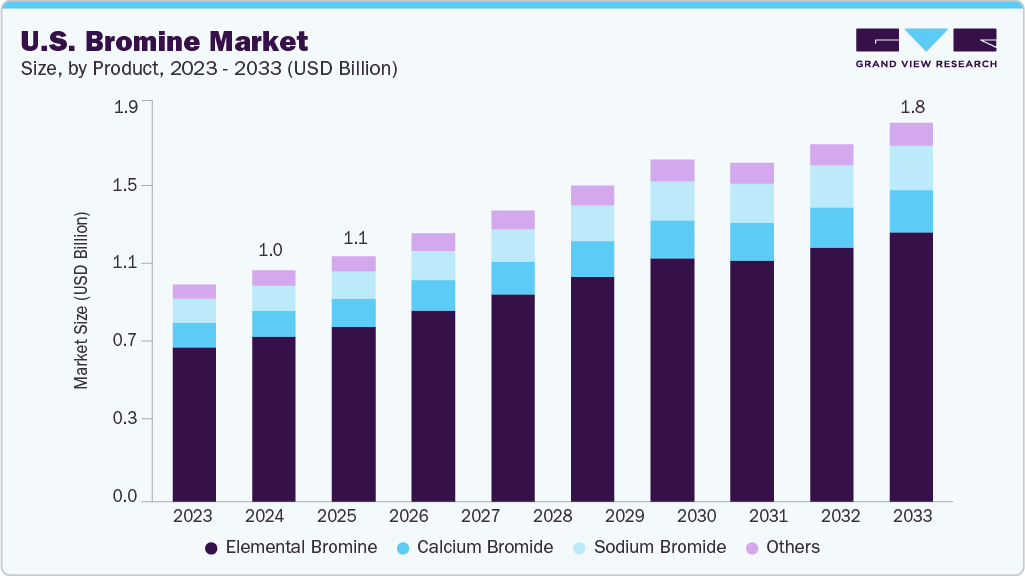

The U.S. bromine market size was estimated at USD 1.01 billion in 2024 and is projected to reach USD 1.76 billion by 2033, at a CAGR of 6.3% from 2025 to 2033. The U.S. oil and gas sector continues to be a major driver of bromine demand, particularly due to its use in clear brine fluids for drilling and well completion.

Key Market Trends & Insights

- Bromine market in the U.S. is expected to grow at a substantial CAGR of 6.3% from 2025 to 2033.

- By product, the elemental bromine segment accounted for the largest market revenue share in 2024.

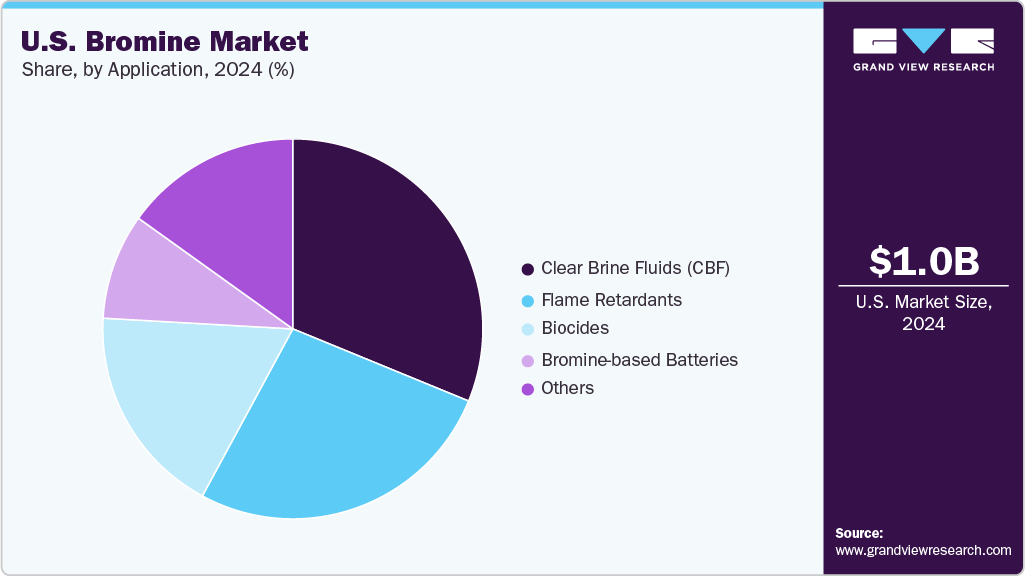

- By application, the clear brine fluids segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.01 Billion

- 2033 Projected Market Size: USD 1.76 Billion

- CAGR (2025-2033): 6.3%

Bromine's role as a flame retardant in the manufacturing sector is gaining more attention amid evolving safety regulations. It is commonly used in electronics like circuit boards, televisions, and household appliances, as well as in automotive components and building insulation materials. For instance, in producing polyurethane foam used in furniture and car seats, brominated flame retardants ensure compliance with U.S. fire resistance standards. As building codes are tightened in states like California and New York, manufacturers are turning more frequently to bromine-based compounds to meet strict flammability requirements without sacrificing product performance or durability.Water treatment applications in the U.S. are another key growth area for bromine. Its use in disinfecting industrial cooling systems, municipal water supplies, and recreational facilities like public swimming pools has grown in response to stricter water safety norms. Bromine-based biocides, such as BCDMH (bromochlorodimethylhydantoin), are particularly effective in killing bacteria, algae, and other harmful organisms. These compounds maintain clean, efficient cooling systems in industrial settings, such as paper mills or power plants. With heightened public awareness around waterborne diseases, bromine's advantages over traditional chlorine-based systems-such as reduced odor and better performance at high temperatures are increasing its popularity.

The U.S. is also seeing emerging demand for bromine in advanced energy systems. Zinc-bromine batteries, for example, are being explored by American energy companies as alternatives to lithium-ion technology for grid storage. These batteries offer longer cycle life and greater safety, making them suitable for utility-scale applications. Companies like Redflow and EOS Energy have piloted such systems for renewable energy integration and backup power. Similarly, hydrogen bromide is being investigated in hydrogen fuel cells and industrial synthesis. These developments position bromine not just as a commodity chemical but as a potential enabler of the clean energy transition in the U.S.

Lastly, the bromine market in the U.S. benefits from its strong integration into global supply chains and the ability to import from large producers like Israel and Jordan. Domestic production is concentrated in Arkansas, where companies like Albemarle operate brine extraction and processing facilities. These operations serve local and international demand, with bromine derivatives being exported for flame retardants, drilling fluids, and water treatment chemicals. At the same time, U.S. importers ensure a steady supply of bromine compounds that are not economically feasible to produce domestically. This well-balanced mix of local production and international sourcing allows the U.S. market to remain resilient, adaptable, and competitive in a rapidly changing global chemicals landscape.

Drivers, Opportunities & Restraints

The U.S. bromine market is primarily driven by its widespread application in oil and gas drilling, flame retardants, and water treatment. Clear brine fluids formulated with bromine compounds such as calcium bromide and zinc bromide are essential for pressure control in deep and complex wells. These applications are closely linked with ongoing shale exploration and offshore drilling activities. In addition, increasing regulatory pressure to improve fire safety in buildings, electronics, and transportation has intensified demand for brominated flame retardants. In the water treatment industry, bromine-based biocides are gaining traction due to their effectiveness in high-temperature and variable pH environments, especially for industrial cooling towers and recreational water systems.

Emerging applications in energy storage and advanced materials present significant growth opportunities for the U.S. bromine market. Developing zinc-bromine and hydrogen-bromide flow batteries offers a promising path toward scalable, long-duration energy storage, an essential component for integrating renewable energy into the national grid. Furthermore, research into bromine-based catalysts and specialty chemicals for pharmaceuticals, agrochemicals, and semiconductors could open new high-value segments. Technological advancements and government incentives for clean energy and grid modernization further enhance the commercial viability of these novel bromine applications, positioning the U.S. as a potential innovation hub for bromine derivatives.

Despite its advantages, the U.S. bromine market faces several restraints. Environmental and health concerns related to the toxicity and persistence of certain brominated compounds have led to increased scrutiny and restrictions, especially in consumer products and electronics. Regulatory challenges, particularly under frameworks such as the Toxic Substances Control Act (TSCA), can slow the development and approval of new bromine-based chemicals. Additionally, the domestic supply is geographically concentrated, mainly in Arkansas, which makes the market vulnerable to regional production disruptions.

Product Insights

Elemental bromine held the revenue share of 71.2% in 2024. Extracted predominantly from brine wells, elemental bromine serves as the raw material for producing derivatives such as calcium bromide, sodium bromide, and various brominated organics. In the U.S., companies like Albemarle operate significant bromine extraction facilities in Arkansas, supplying both domestic manufacturers and international clients. Elemental bromine is directly utilized in the formulation of flame retardants and drilling fluids, where its high reactivity and compatibility with other elements make it an ideal precursor for complex chemical synthesis. The product benefits from stable demand across industries, including energy, construction, electronics, and water treatment.

Sodium bromide is anticipated to register the fastest CAGR over the forecast period. In the oilfield sector, sodium bromide is widely used in clear brine formulations for well completion and workover operations, particularly in high-pressure and high-temperature wells. Its ability to control formation pressure without damaging the reservoir makes it a preferred choice among operators, especially in active basins like the Permian and the Gulf of Mexico. Additionally, sodium bromide is employed in industrial water treatment as a biocide when combined with oxidizing agents, helping to control microbial growth in cooling towers and closed-loop systems. Its effectiveness in a broad pH range enhances its value in municipal and industrial applications.

Application Insights

Clear Brine Fluids (CBF) held the revenue share of 31.2% in 2024. CBFs are widely used as completion and workover fluids due to their superior thermal stability, density control, and compatibility with formation chemistry. With expanding exploration efforts in regions such as the Permian Basin and Eagle Ford, the demand for high-performance fluids like bromine-based CBFs has surged. These fluids help maintain wellbore stability and minimize formation damage, crucial for enhancing well productivity in deep and high-pressure reservoirs.

Flame retardants are anticipated to register the fastest CAGR over the forecast period. The flame retardants segment in the U.S. bromine market is growing due to strict fire safety regulations in electronics, construction, and automotive industries. Bromine-based compounds, especially TBBPA, are commonly used in printed circuit boards, plastic casings, and insulation materials. As construction activity increases and electric vehicles become more popular, the need for fire-resistant materials in wiring and components is rising. Government safety standards and building codes continue to push demand for effective flame retardant solutions.

Key U.S. Bromine Company Insights

Some key players operating in the market include ICL‑IP America Inc., Albemarle Corporation, and others

-

ICL‑IP America Inc. is the U.S. subsidiary of ICL Group Ltd, a global leader in specialty minerals and chemicals. As part of ICL Industrial Products, ICL‑IP America is headquartered in Creve Coeur, Missouri, with key operations centered on the bromine value chain. The company is the world’s largest producer of bromine and its derivatives, leveraging extensive extraction infrastructure around the Dead Sea and Arkansas brine deposits. Domestically, its U.S. presence supports industries ranging from energy and water treatment to flame retardants and chemical manufacturing, relying on robust R&D capabilities and a network of innovation centers to maintain leadership in bromine-based solutions.

-

Albemarle Corporation, based in the U.S. and listed on the S&P 500, stands as one of the largest global producers of bromine and derivatives, sourcing from brine deposits in Arkansas and via a joint venture in Jordan. Albemarle’s Bromine Specialties business supplies high-performance products for flame retardants, energy storage, pharmaceuticals, agriculture, and water treatment. Their vertically integrated operation, from brine extraction to refining and derivatives production, supports diverse industrial applications, particularly in specialty chemicals.

Key U.S. Bromine Companies:

- Albemarle Corporation

- LANXESS Corporation

- TETRA Technologies Inc.

- ICL-IP America Inc.

- Clearon Corp.

- Honeywell International Inc.

- Great Lakes Solutions

- Eastman Chemical Company

- Polybrom United

Recent Development

- In April 2025, Tetra Technologies announced the completion of a definitive feasibility study for its Arkansas bromine project, detailing plans for a Phase I plant capable of producing 75 million pounds of bromine annually. The update confirmed the project’s economic viability and marked a significant step forward in expanding U.S.-based bromine capacity.

U.S. Bromine Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.08 billion

Revenue forecast in 2033

USD 1.76 billion

Growth rate

CAGR of 6.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative Units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

Albemarle Corporation; LANXESS Corporation; TETRA Technologies Inc.; ICL-IP America Inc.; Clearon Corp.; Honeywell International Inc.; Great Lakes Solutions; Eastman Chemical Company; Polybrom United

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Bromine Market Report Segmentation

This report forecasts revenue and volume growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. bromine market report based on the product and application.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Elemental Bromine

-

Calcium Bromide

-

Sodium Bromide

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Clear Brine Fluids (CBF)

-

Flame Retardants

-

Biocides

-

Bromine-based Batteries

-

Other

-

Frequently Asked Questions About This Report

b. The U.S. bromine market size was estimated at USD 1.01 billion in 2024 and is expected to reach USD 1.08 billion in 2025.

b. The U.S. bromine market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2033 to reach USD 1.76 billion by 2033.

b. The elemental bromine segment dominated the market with a revenue share of 71.2% in 2024.

b. Some of the key players of the U.S. bromine market are Albemarle Corporation, LANXESS Corporation, TETRA Technologies Inc., ICL-IP America Inc., Clearon Corp., Honeywell International Inc., Great Lakes Solutions, Eastman Chemical Company, Polybrom United, and others.

b. The key factor that is driving the growth of the U.S. bromine market is driven by the rising demand for bromine-based flame retardants, particularly in electronics, automotive, and construction industries, along with increasing use in water treatment, oil & gas drilling fluids, and pharmaceuticals.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.