- Home

- »

- Homecare & Decor

- »

-

U.S. Car Rental Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Car Rental Market Size, Share & Trends Report]()

U.S. Car Rental Market (2025 - 2030) Size, Share & Trends Analysis Report By Vehicle Type (Luxury Cars, Executive Cars, Economy Cars), By Application (Local Usage, Airport Transport, Outstation), By Booking Mode (Online, Offline/Direct), And Segment Forecasts

- Report ID: GVR-4-68040-553-6

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Car Rental Market Size & Trends

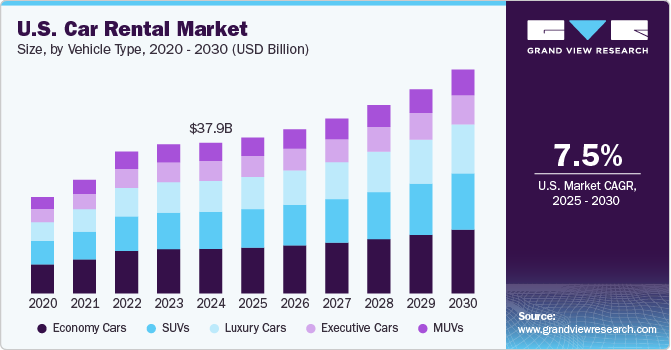

The U.S. car rental market size was valued at USD 37.88 billion in 2024 and is projected to grow at a CAGR of 7.5% from 2025 to 2030. The increasing demand for tourism-related travel has significantly boosted the market. Travelers, both domestic and international, are opting for rental vehicles to explore destinations with greater flexibility and comfort. This trend is further supported by the rise in leisure and business travel, which has created a consistent need for convenient transportation options. This growth is particularly pronounced in urban centers, tourism hubs, and business corridors.

Following the relaxation of pandemic-related restrictions, the United States has witnessed a resurgence in both domestic and international tourism. According to the U.S. Travel Association, domestic travel spending surpassed pre-pandemic levels in 2023, while inbound travel continued its recovery trajectory. This upswing has directly benefited airport-based and leisure-focused car rental providers, particularly in high-traffic destinations such as Orlando, Las Vegas, and Los Angeles.

Consumers are increasingly valuing flexibility over ownership, particularly in urban environments where the total cost of vehicle ownership-factoring in insurance, parking, and depreciation-has escalated significantly. This trend is further amplified among younger demographics and business travelers who seek convenience and reduced commitment. For instance, Hertz and Enterprise have reported growing interest in subscription-based rental models and short-duration rentals facilitated through mobile apps.

As business travel resumes, albeit selectively, car rental companies are witnessing an uptick in demand from corporate clients, particularly for regional travel and inter-city movement. Companies are also turning to rental fleets to supplement transportation needs for employees in hybrid work models. For example, Avis Budget Group highlighted in its quarterly filings that business travel volume was contributing to revenue stabilization and growth in key markets.

Technological advancements have revolutionized the U.S. car rental industry. Integrating online platforms and mobile applications has streamlined the booking process, making it more accessible and user-friendly. Features such as digital payments, vehicle selection, and app-based unlocking have enhanced customer satisfaction and expanded the market. For instance, Enterprise, National, and Alamo leverage digital platforms and IoT for streamlined booking, contactless operations, and enhanced fleet management.

The adoption of electric vehicles (EVs) in rental fleets is gaining traction. As consumers become more environmentally conscious, rental companies are incorporating EVs to meet the demand for sustainable transportation solutions. This shift aligns with global sustainability goals and attracts eco-minded travelers. For instance, in August 2022, European electric vehicle rental startup UFODrive launched in San Francisco, marking its entry into the U.S. market. The company offers contact-free EV rentals amid high gas prices, rental car shortages, and rising demand for electric vehicles. UFODrive was launched in New York and Austin in October, followed by rapid European growth.

The growing emphasis on hygiene and safety protocols, especially post-pandemic, has increased consumer confidence in car rental services. Companies are investing in sanitization measures and offering diverse vehicle options to cater to varying customer preferences, further driving market growth.

Consumer Survey & Insights

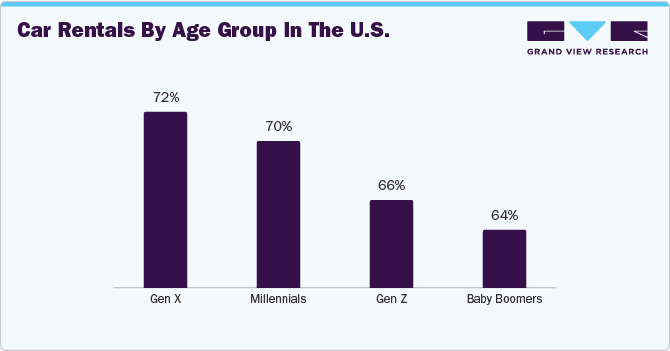

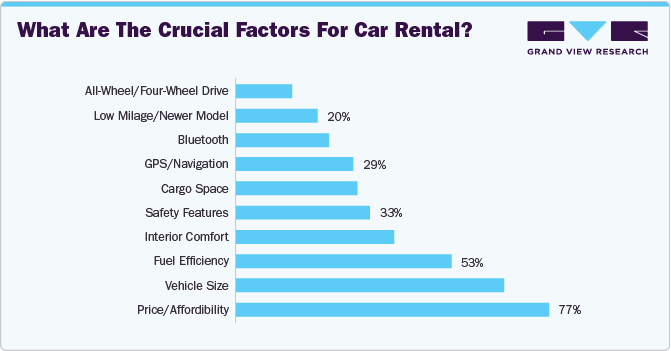

A nationwide survey by Zubie highlighted key trends in rental car behavior and preferences in 2024 - 2025. In 2023, 48 million Americans rented cars, reflecting a 19.4% increase from the previous year, with 74% renting primarily for vacation and leisure. It found that 69% of consumers rented a car in the past year, and Tampa, Florida, recorded the highest online searches related to rental car accidents. Men were twice as likely as women to drive recklessly in rental vehicles. Furthermore, 50% of Americans plan to travel during the holiday season, with 33% renting cars for Thanksgiving travel, budgeting an average of USD 86.04 daily. Among age groups, Gen X leads in car rentals (72%), closely followed by Millennials (70%), Gen Z (66%), and Baby Boomers (64%), showcasing generational preferences for rental vehicles.

Vehicle Type Insights

Economy cars accounted for a revenue of 29.6% in the overall U.S. car rental industry in 2024. The growing preference for affordability among consumers, especially in times of economic uncertainty, played a significant role. Additionally, economy cars are known for their fuel efficiency, which aligns well with the increasing consumer demand for cost-effective travel options and environmentally friendly choices. The expansion of car rental networks and accessibility in smaller cities and suburban areas further enhanced the popularity of economy rentals. Furthermore, the rise of short-term rentals for business travel and leisure trips bolstered the demand for this segment, making it a practical choice for various travel needs.

Demand for luxury car rental is expected to grow at a CAGR of 8.6% from 2025 to 2030. Increasing disposable income levels and a growing preference for premium travel experiences are significant drivers as customers seek vehicles that provide comfort, style, and exclusivity. Additionally, the rise in high-net-worth individuals and luxury tourism has fueled the demand for upscale rental options. Technological advancements in luxury vehicles, such as innovative safety features and electric luxury cars, have also enhanced their appeal to a broader audience. Furthermore, corporate clients and special occasions, such as weddings and events, continue to bolster this segment, making luxury car rentals a sought-after choice in the market.

Application Insights

Local usage accounted for a revenue share of 46.7% in the overall U.S. car rental industry in 2024. The rise in urban populations and the growing need for convenient, short-term mobility solutions fueled the demand for local car rentals. Additionally, the increasing use of rental cars for daily commutes, errands, and occasional trips eliminated the need for long-term vehicle ownership in many cases. The flexibility offered by local rentals, combined with competitive pricing and improved accessibility through digital booking platforms, also contributed to their popularity.

Airport transport car rental service is expected to grow at a CAGR of 8.8% from 2025 to 2030. The steady increase in air travel, both for business and leisure, is a major driver, as passengers often require seamless transportation to and from airports. Additionally, the convenience and flexibility offered by car rental services, compared to alternative options like public transport, make them an attractive choice for travelers. The expansion of airports and improvements in connectivity in various regions further bolster this demand. Moreover, the rising adoption of technology-driven services, such as online bookings and app-based rentals, has made these services more accessible and efficient, fueling their anticipated growth.

Booking Mode Insights

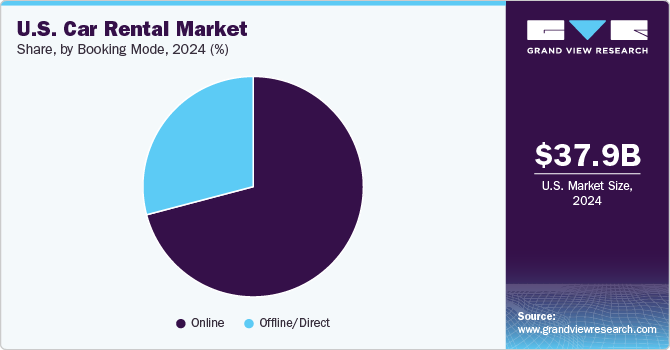

Booking through online channels accounted for a revenue share of 70.1% in the overall U.S. car rental industry in 2024. The convenience and ease of online platforms, enabling users to browse, compare, and book rentals from anywhere, proved to be a major catalyst. Additionally, the widespread adoption of smartphones and internet access enhanced the popularity of digital booking channels. Attractive deals, promotions, and personalized recommendations offered online further incentivized customers to utilize these platforms. Moreover, the integration of advanced technologies, such as user-friendly interfaces and secure payment options, contributed to the seamless booking experience, making online channels the preferred choice for car rentals.

Booking through offline/direct is expected to grow at a CAGR of 6.7% from 2025 to 203 Consumers often value the personalized service and trust associated with direct interactions, which can enhance their confidence in the booking process. Additionally, offline bookings provide flexibility and convenience, particularly for last-minute plans or for those who are less comfortable with online platforms. The expansion of physical rental locations in key areas also contributes, making it easier for customers to access services directly.

Key U.S. Car Rental Company Insights

The U.S. car rental market is fragmented primarily due to the presence of several globally recognized players as well as regional players. Some key companies in the U.S. car rental industry include Enterprise Holdings, Inc., The Hertz Corporation, Avis Budget Group, and others.

-

Enterprise Holdings, Inc. is a leading player in the U.S. car rental market, operating brands such as Enterprise Rent-A-Car, Alamo Rent-A-Car, and National Car Rental. It boasts over 6,000 locations and a fleet of approximately 1.1 million vehicles, generating an estimated revenue of USD 30 billion. The company emphasizes customer service and sustainability, incorporating eco-friendly vehicles into its offerings.

-

The Hertz Corporation, another major competitor, owns brands like Dollar and Thrifty. With over 5,500 locations, including 1,900 at airports, Hertz focuses on leisure travel, which accounts for 68% of its rentals.

Key U.S. Car Rental Companies:

- Enterprise Holdings, Inc.

- The Hertz Corporation

- Avis Budget Group

- Sixt

- Fox Rent A Car

- Turo

- Getaround

- Midway Car Rental

- Dollar

- Europcar

Recent Developments

-

In March 2025, SIXT inaugurated its newest U.S. branch at the Seminole Hard Rock Hotel & Casino in Hollywood, Florida, marking its 24th Florida location. This launch began with a partnership with Hard Rock International and Seminole Gaming, offering exclusive discounts for Unity by Hard Rock members at SIXT branches nationwide. The Unity loyalty program provides redeemable points for perks across Hard Rock venues and reciprocal benefits from Royal Caribbean and Celebrity Cruises. Leaders from SIXT and Hard Rock have expressed enthusiasm for this collaboration.

-

In January 2025, SIXT USA, a global mobility leader Sixt SE subsidiary, inaugurated its first Louisiana branch at Louis Armstrong New Orleans International Airport (MSY). This expansion brings SIXT's footprint to 51 U.S. airports and over 100 locations across 26 states. Strategically located at the airport's rental car center, the branch offers a premium fleet of standard and luxury vehicles to cater to diverse needs and budgets.

U.S. Car Rental Market Report Scope

Report Attribute

Details

Market revenue in 2025

USD 39.20 billion

Revenue forecast in 2030

USD 56.27 billion

Growth rate (Revenue)

CAGR of 7.5% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle type, application, booking mode

Country scope

U.S.

Key companies profiled

Enterprise Holdings, Inc.; The Hertz Corporation; Avis Budget Group; Sixt; Fox Rent A Car; Turo; Getaround; Midway Car Rental; Dollar; Europcar

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Car Rental Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. car rental market report based on vehicle type, application, and booking mode:

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

Luxury cars

-

Executive cars

-

Economy cars

-

SUVs

-

MUVs

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Local usage

-

Airport transport

-

Outstation

-

Others

-

-

Booking Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline/Direct

-

Online

-

Frequently Asked Questions About This Report

b. The U.S. car rental market was estimated at USD 37.88 billion in 2024 and is expected to reach USD 39.20 billion in 2025.

b. The U.S. car rental market is expected to grow at a compound annual growth rate of 7.5% from 2025 to 2030, reaching USD 56.27 billion by 2030.

b. The U.S. car rental market dominated the overall car rental market with a share of 1.03% in 2024. This is due to the growing emphasis on hygiene and safety protocols, especially post-pandemic, which has increased consumer confidence in car rental services.

b. Some of the key players in the U.S. car rental market include Enterprise Holdings, Inc., The Hertz Corporation, Avis Budget Group, Sixt, Fox Rent A Car, Turo, Getaround, Midway Car Rental, Dollar, and Europcar.

b. The growth of the U.S. car rental market is majorly driven by the increasing demand for tourism-related travel, which has significantly boosted the market. Travelers, both domestic and international, are opting for rental vehicles to explore destinations with greater flexibility and comfort.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.