- Home

- »

- Medical Devices

- »

-

U.S. Cardiovascular Devices Market, Industry Report, 2033GVR Report cover

![U.S. Cardiovascular Devices Market Size, Share & Trends Report]()

U.S. Cardiovascular Devices Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Diagnostic & Monitoring, Surgical Devices), By End-use (Hospitals, Ambulatory Surgical Centers, Diagnostic Centers), And Segment Forecasts

- Report ID: GVR-4-68040-631-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Cardiovascular Devices Market Summary

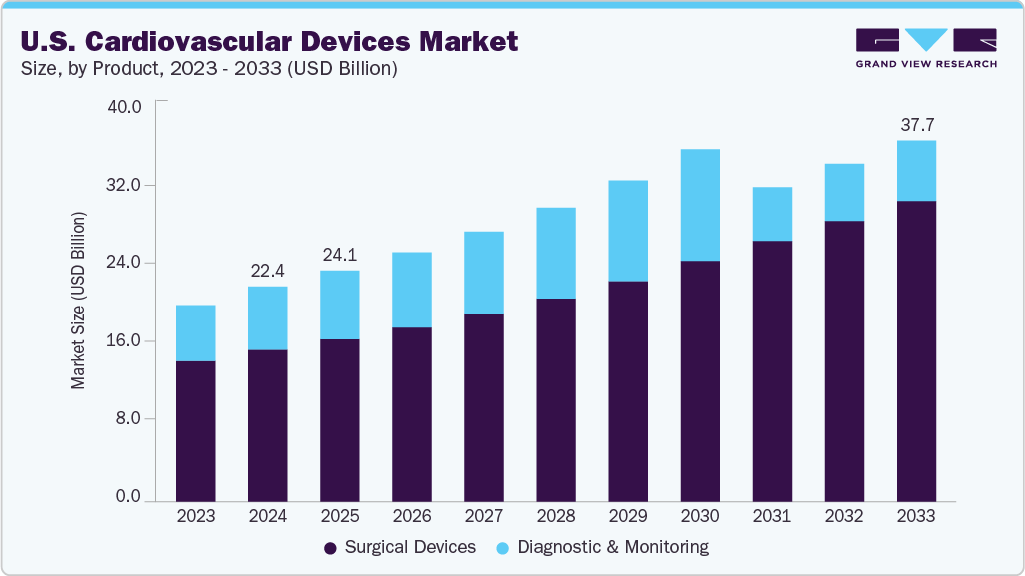

The U.S. cardiovascular devices market size was estimated at USD 22.39 billion in 2024 and is projected to reach USD 37.66 billion by 2033, growing at a CAGR of 5.8% from 2025 to 2033. A cardiovascular device is a medical tool explicitly used to diagnose or treat diseases of the heart and blood vessels, including instruments like pacemakers, stents, artificial valves, defibrillators, angioplasty tools, and cardiac catheters.

The rising incidence of cardiovascular diseases is one of the factors boosting market growth. According to the America Heart Association (AHA), in January 2024, there were 931,578 deaths in the U.S. attributed to cardiovascular disease, marking an increase of nearly 3,000 compared to the previous year. Additionally, the age-adjusted death rate from cardiovascular conditions rose to 233.3 per 100,000 individuals, reflecting a 4.0% increase from the prior year. This upward trend in mortality rates emphasizes the ongoing challenges posed by cardiovascular diseases, highlighting the critical need for innovative cardiovascular devices and interventions.

Moreover, as per the American Heart Association (AHA) article published in June 2024, cardiovascular disease (CVD) could affect over 184 million Americans, more than 61% of the population, by 2050. Alongside this expected rise in prevalence, CVD-related healthcare costs are expected to escalate dramatically, potentially reaching USD 1.8 trillion. This forecasted growth in cases and associated costs highlights an urgent need for advancements in cardiovascular devices. Therefore, the U.S. cardiovascular devices market is positioned for substantial growth as demand intensifies for innovative technologies that support early diagnosis, preventive care, and effective treatment solutions to manage the widespread impact of CVD on public health.

Increasing awareness campaigns and government-initiated screening programs for early detection of CVDs contribute to market expansion by ensuring more patients receive timely diagnosis and treatment. According to the American Heart Association, Inc. article published in November 2023, the 2023 guidelines from the American Heart Association (AHA), American College of Cardiology (ACC), American College of Chest Physicians (ACCP), and the Heart Rhythm Society (HRS) for the diagnosis & management of AFib stress the importance of raising awareness and implementing routine screening, especially in high-risk groups like older adults. These guidelines advocate for regular pulse and ECG screenings to ensure early detection and effective management of CVDs. For instance, early identification and treatment of AFib are crucial as they can significantly lower the risk of stroke and other serious complications.

The efficiency of targeted screening programs for CVDs fuels market growth. According to Springer Nature, in June 2024, a review of cardiology reports will examine the impact of screening programs. It highlights findings from multicenter studies, such as STROKESTOP and AF-SCREEN, which show that targeted screening greatly enhances the detection of CVDs, especially among older adults. The review strongly supports establishing national screening initiatives to address the growing burden of AFib-related complications, highlighting the critical role of early detection and intervention.

U.S. cardiovascular devices imports and exports to the worldwide market

Year

Import

(USD Million)

Export

(USD Million)

2021

8,926.1

7,571.0

2022

9,426.0

8,274.5

2023

9,982.1

9,114.2

Source: Grand View Research

A technologically advanced product offered by the key player drives the market's growth. For instance, in April 2024, Abbott announced FDA approval for its TriClip transcatheter edge-to-edge repair (TEER) system, an advanced device tailored to treat tricuspid regurgitation (TR), a condition caused by a leaky tricuspid valve. Findings from the TRILUMINATE Pivotal trial showed that patients who received the TriClip experienced notable reductions in symptom severity and enhancements in quality of life, with these improvements sustained for up to a year.

Moreover, in August 2024, Johnson & Johnson recently launched the MatrixSternum fixation system within the U.S. cardiovascular devices market. This advanced system is developed to stabilize and secure the sternum or front part of the chest wall following critical surgical procedures such as open-heart surgery and other thoracic operations. Providing reliable chest wall support, the MatrixSternum system aims to facilitate healing, improve patient recovery times, and minimize the risk of post-operative complications. This addition enhances the array of cardiovascular devices available in the U.S., reinforcing Johnson & Johnson’s commitment to advancing surgical outcomes in cardiac care.

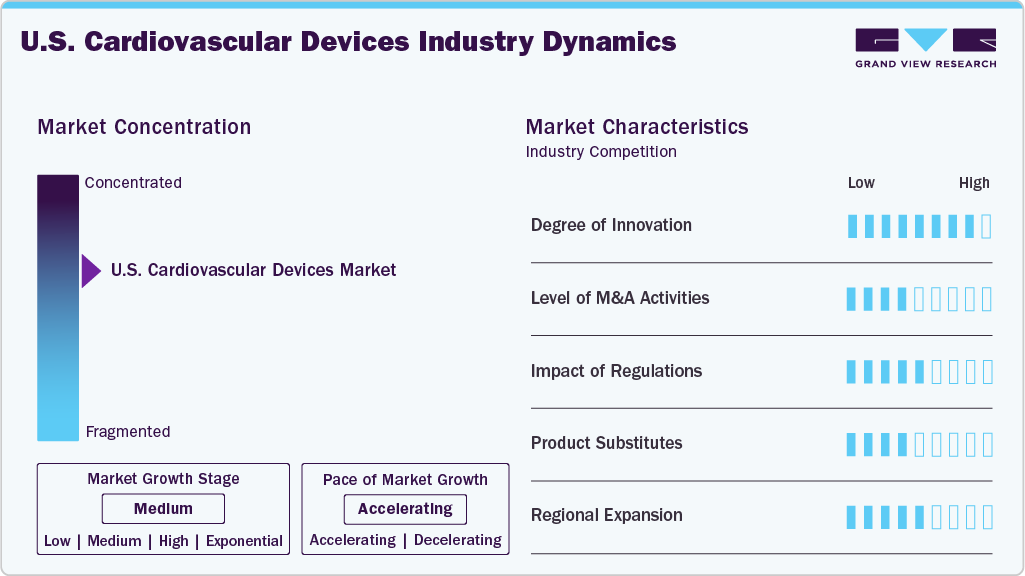

Market Concentration & Characteristics

The U.S. cardiovascular devices industry is witnessing high innovation, highlighted by integrating innovative technologies, advanced biomaterials, and minimally invasive techniques. Recent advancements include AI-powered diagnostic tools, next-generation drug-eluting stents, and leadless pacemakers that enhance accuracy, reduce surgical risks, and support personalized treatment. These innovations improve patient outcomes and recovery times and streamline clinical workflows, encouraging widespread adoption among healthcare providers aiming to deliver efficient and high-quality cardiovascular care.

Several key players in the U.S. cardiovascular devices industry, including Abbott, Medtronic, Boston Scientific Corporation, and Edwards Lifesciences Corporation, actively pursue strategic initiatives such as product innovation, technology integration, and global expansion. For instance, in August 2024, Edwards Lifesciences acquired JC Medical, a U.S.-based company specializing in transcatheter aortic valve replacement (TAVR), from Singapore's Genesis MedTech. The financial details of the transaction were not disclosed.

Regulatory bodies such as the U.S. Food and Drug Administration (FDA) are critical in overseeing the cardiovascular devices market. Before reaching patients, they ensure that devices comply with rigorous safety, efficacy, and quality standards. While the regulatory approval can be time-consuming, recent efforts to streamline pathways, such as the FDA’s Breakthrough Devices Program, support faster access to innovative cardiovascular technologies. These initiatives are helping manufacturers introduce safer, more effective solutions that address critical heart and vascular health needs across the U.S. healthcare system.

There are no direct substitutes for cardiovascular devices in managing and treating critical heart conditions. While medications and lifestyle changes can help control symptoms, devices such as pacemakers, stents, and implantable defibrillators provide essential, targeted intervention. These technologies play a vital role in restoring and maintaining heart function, making them indispensable in treating various cardiovascular diseases across the U.S. healthcare system.

Key cardiovascular device manufacturers in the U.S. are expanding their presence by targeting underserved healthcare regions, forming partnerships with local providers, and developing devices tailored to diverse patient needs. These efforts enhance access to advanced cardiac care and support the growing demand for effective, life-saving cardiovascular treatments nationwide.

Product Insights

The surgical devices segment held the largest revenue share of over 71.0% in 2024. Surgical devices encompass various products designed to diagnose, treat, and manage heart-related conditions. These devices include surgical instruments used during procedures, such as Coronary Artery Bypass Grafting (CABG), valve repair or replacement surgeries, and minimally invasive techniques such as catheter-based interventions.

Rapid technological advancements and a growing emphasis on patient-centric solutions drive the market's growth. For instance, in November 2023, Medtronic plc introduced its Penditure LAA Exclusion System in the U.S., an innovative, implantable clip for managing the left atrial appendage during cardiac surgeries. Its unique features include a curved design for better anatomical fit, non-fabric material for less inflammation, and the ability to be recaptured and repositioned by surgeons during a procedure.

The diagnostic and monitoring segment is expected to grow at the fastest CAGR over the forecast period. Diagnostic and monitoring devices play a critical role in the early detection, prevention, and management of cardiovascular diseases (CVDs). Technological advancements have enhanced the accuracy and efficiency of these devices, making them essential for both in-hospital and remote patient monitoring.

For instance, in April 2024, GE HealthCare received 510(k) clearance from the U.S. FDA for its Portrait VSM vital signs monitor. Building on the DINAMAP legacy, the Portrait VSM uses the advanced SuperSTAT non-invasive blood pressure algorithm, ensuring highly accurate and reliable readings. This portable monitor features wireless connectivity and integrates smoothly with electronic medical records (EMR), streamlining clinical workflows. Offering customizable Early Warning Scores (EWS) and automating routine tasks, the Portrait VSM supports care teams in efficiently monitoring cardiovascular health and making timely, informed decisions for patient care.

End-use Insights

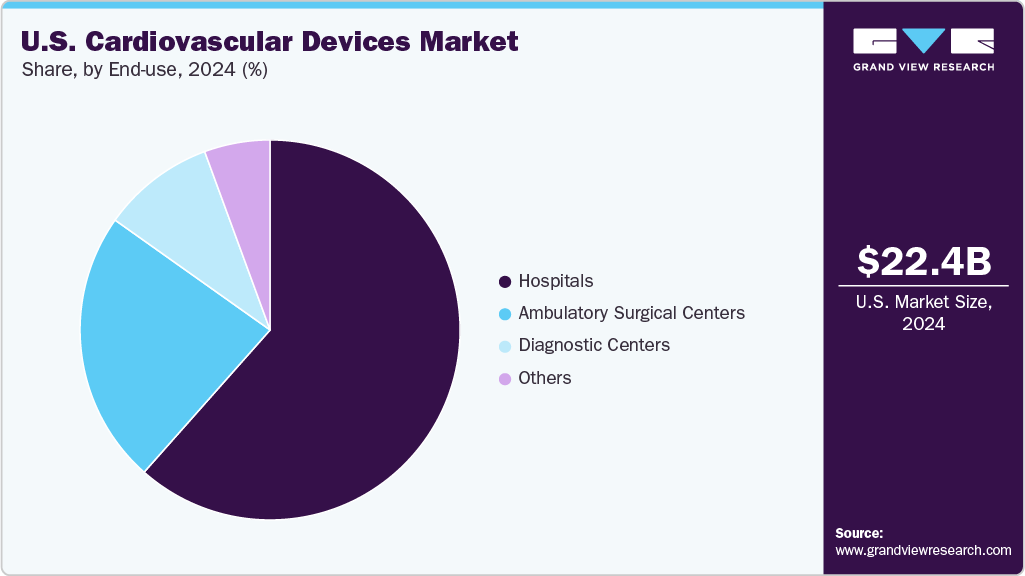

The hospitals segment held the largest revenue share of over 61.6% in 2024. Hospitals’ role as primary providers of advanced care for heart disease and related conditions. Hospitals depend on specialized equipment like echocardiography, cardiac MRI, pacemakers, defibrillators, and heart-lung machines to support cardiac care. The rise of dedicated cardiovascular centers further boosts demand by enabling advanced procedures and comprehensive treatment.

According to the Baystate Health article published in February 2024, coronary artery bypass graft (CABG) surgeries total nearly 400,000 annually and are among the most significant contributors to this market segment. Hospitals serve as the primary setting for these complex heart bypass procedures, which are essential for managing severe coronary artery disease. CABG procedures require a wide array of devices, from heart-lung machines to specialized grafting and monitoring equipment, underscoring the importance of hospital procurement in this market. Additionally, advances in surgical techniques and equipment, including minimally invasive and robotic-assisted methods, enhance hospital capabilities and improve patient outcomes.

The ambulatory surgical centers segment is projected to grow at the fastest rate during the forecast period. The ongoing shift of surgical procedures from traditional hospital settings to outpatient facilities. According to the ormanagement article in January 2024, over the past few decades, ASCs have established themselves as convenient and cost-effective alternatives for various surgical interventions, including those requiring cardiovascular devices. The trend indicates a strong preference for outpatient services in the U.S., with a significant increase in procedures performed in ASCs, rising from 57 million in a decade to over 30 million during the pandemic. This movement towards ASCs is particularly notable in specialties like orthopedics, which is expected to drive demand for cardiovascular devices used in these settings.

Key U.S. Cardiovascular Devices Company Insights

Some key players operating in the industry include Abbott, Medtronic, and Boston Scientific Corporation. The company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences. For instance, LivaNova, Inc. and Canon Medical Systems are emerging players in the U.S. cardiovascular devices market.

Key U.S. Cardiovascular Devices Companies:

- Abbott

- GE HealthCare

- Edwards Lifesciences Corporation

- Siemens Healthineers AG

- Canon Medical Systems

- B. Braun SE

- LivaNova, Inc.

- Cardinal Health

- Medtronic

- Boston Scientific Corporation

- W. L. Gore & Associates, Inc.

- BIOTRONIK SE & Co. KG

Recent Developments

-

In September 2024, GE HealthCare introduced a new handheld, wireless ultrasound imaging device to quickly assess cardiac and vascular conditions at the point of care. The Vscan Air SL, the latest member of the Vscan product line, is developed to assist healthcare professionals in making faster diagnoses and treatment decisions.

-

In April 2024, Medtronic launched its latest development in cardiac surgery, the Avalus Ultra valve. This state-of-the-art surgical aortic tissue valve is engineered to enhance ease of implantation and improve long-term patient management.

-

In March 2024, Boston Scientific Corporation received FDA approval for AGENT Drug-Coated Balloon. This device is indicated for treating coronary In-Stent Restenosis in patients with coronary artery disease. In this condition, a stented vessel becomes obstructed or narrowed by plaque or scar tissue.

U.S. Cardiovascular Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.07 billion

Revenue forecast in 2033

USD 37.66 billion

Growth rate

CAGR of 5.8% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Country scope

U.S.

Key companies profiled

Abbott; GE HealthCare; Edwards Lifesciences Corporation; Siemens Healthineers AG; Canon Medical Systems; B. Braun SE; LivaNova, Inc.; Cardinal Health; Medtronic; Boston Scientific Corporation; W. L. Gore & Associates, Inc.; BIOTRONIK SE & Co. KG.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cardiovascular Devices Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. cardiovascular devices market report based on product, and end-use:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Diagnostic & Monitoring

-

ECG

-

Implantable Cardiac Monitors

-

Holter Monitors

-

Mobile Cardiac Telemetry

-

MRI

-

Cardiovascular Ultrasound

-

Cardiac Diagnostic Catheters

-

PET Scanner

-

-

Surgical Devices

-

Cardiac Resynchronization Therapy (CRT)

-

Implantable Cardioverter Defibrillators (ICDs)

-

Pacemakers

-

Coronary Stents

-

Catheters

-

Guidewires

-

Cannula

-

Valves

-

Occlusion Devices

-

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgical Centers

-

Diagnostic Centers

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.