- Home

- »

- Alcohol & Tobacco

- »

-

U.S. CBD Pouches Market Size, Share, Industry Report 2033GVR Report cover

![U.S. CBD Pouches Market Size, Share & Trends Report]()

U.S. CBD Pouches Market (2025 - 2033) Size, Share & Trends Analysis Report By Content (Up to 10 mg, 10 mg - 20 mg), By Type (Flavored, Unflavored), By Distribution Channel (Offline, Online), Segment Forecasts

- Report ID: GVR-4-68040-673-4

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. CBD Pouches Market Summary

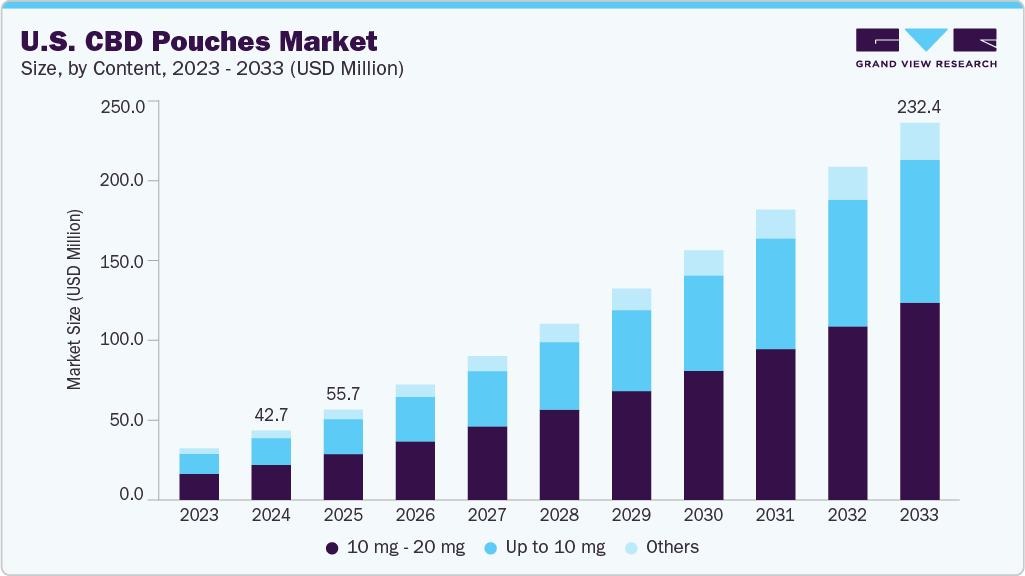

The U.S. CBD pouches market size was estimated at USD 42.69 million in 2024 and is projected to reach USD 232.36 million by 2033, growing at a CAGR of 19.5% from 2025 to 2033. The CBD pouches market in the U.S. is growing rapidly due to rising consumer demand for smokeless, discreet wellness products and increasing awareness of CBD’s potential benefits. Innovations in flavors and formats are also expanding appeal among younger, health-conscious users.

Key Market Trends & Insights

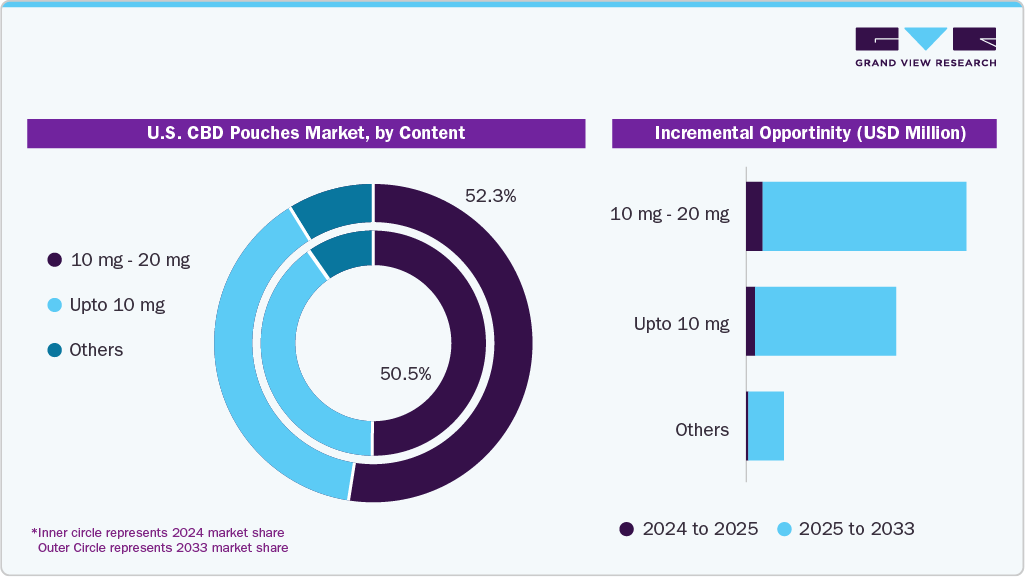

- By content, 10 mg - 20 mg segment led the market and accounted for a share of 50.51% in 2024.

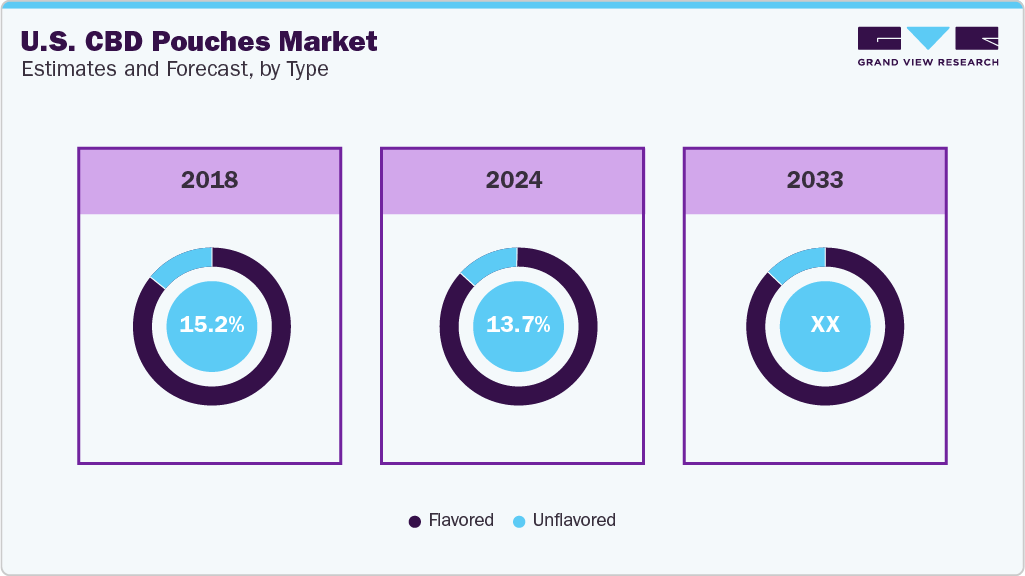

- By type, the flavored segment dominated the U.S. market, with a share of 86.26% in 2024.

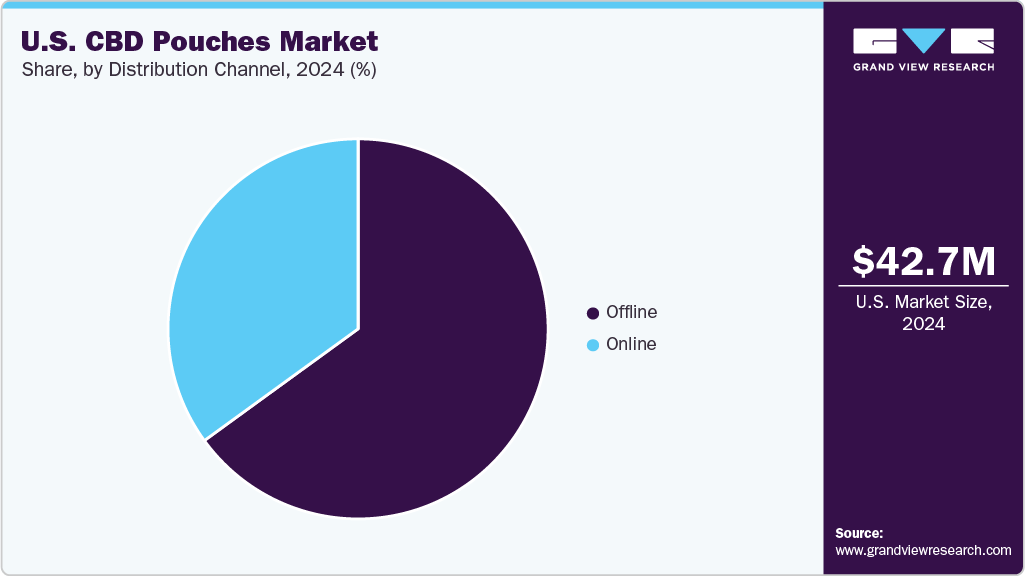

- By distribution channel, offline channels sales held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 42.69 Million

- 2033 Projected Market Size: USD 232.36 Million

- CAGR (2025-2033): 19.5%

The growth trajectory of the U.S. market is underpinned by a confluence of socio-behavioral, regulatory, and technological factors. Rising consumer inclination toward non-combustible, discreet cannabidiol delivery systems reflects a broader shift toward health-conscious and convenience-oriented consumption patterns. CBD pouches, in particular, offer a smokeless, mess-free alternative that caters to individuals seeking the therapeutic benefits of cannabidiol-such as anxiolytic, analgesic, and neuroprotective effects-without the stigma or complexity associated with traditional formats like tinctures or vapes. This trend is further reinforced by expanding scientific validation of CBD’s efficacy, growing public discourse around mental wellness, and favorable legislative developments facilitating product accessibility. Moreover, advances in product formulation, flavor innovation, and strategic retail penetration-both online and offline-are collectively accelerating adoption across a diverse and increasingly mainstream consumer base.

The U.S. CBD pouches industry is witnessing robust growth, driven by evolving consumer preferences that favor discreet, convenient, and non-inhalable CBD delivery systems. Unlike traditional formats such as oils, vapes, or edibles, CBD pouches offer a smoke-free, odorless, and easy-to-use alternative, making them particularly attractive to consumers seeking wellness benefits without social stigma or legal ambiguities. The convenience of the pouch format-similar to nicotine pouches-enables on-the-go use and precise dosing, making it attractive to working professionals and younger adults.

Furthermore, the perceived health benefits of cannabidiol are a significant driver behind market adoption. Clinical and anecdotal evidence continues to support CBD’s role in alleviating anxiety, promoting better sleep, and managing chronic pain-all of which are top wellness concerns in the U.S. A survey by HelloMD and Brightfield Group revealed that 65% of respondents used CBD to treat anxiety, while 60% used it for insomnia or sleep issues. As the general population becomes more aware of these benefits-amplified by media coverage, influencer marketing, and health brand endorsements-CBD pouches are increasingly positioned as functional wellness products rather than niche supplements.

Moreover, market expansion is being facilitated by both product innovation and regulatory normalization. Companies such as Cannadips and Velo CBD are actively innovating with enhanced bioavailability, diverse flavor profiles (e.g., citrus, mint, coffee), and sugar-free or vegan-friendly options to cater to lifestyle preferences. Concurrently, the regulatory environment has become more conducive since the passage of the 2018 Farm Bill, which federally legalized hemp-derived CBD products with less than 0.3% THC. This has enabled a proliferation of CBD offerings in mainstream retail channels such as CVS, Walgreens, and Amazon.

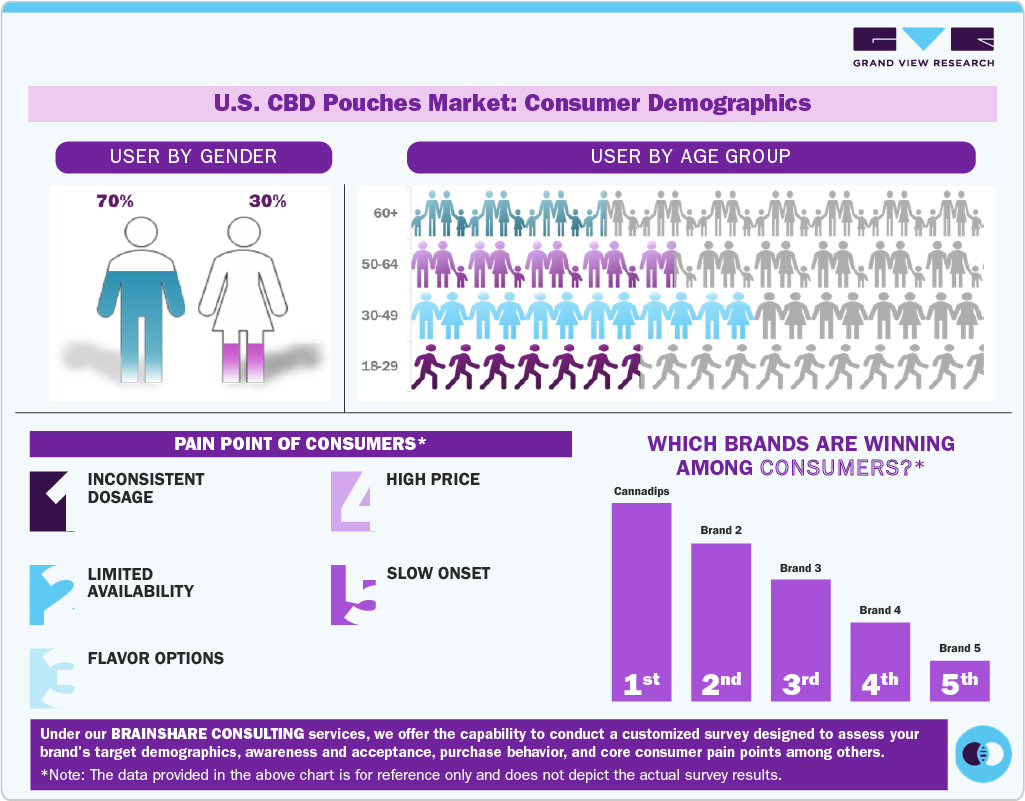

CBD Usage by Gender: Men make up a larger share of regular CBD users, accounting for around 70% of the market, while women represent about 30%. Though trial rates are somewhat balanced, men are more likely to adopt CBD products like pouches for consistent use.

Top CBD Pouch Brands: Leading brands gaining traction in the U.S. include Cannadips, VELO CBD, Holistic Wellness, CBDfx, and Grinds. These brands are popular for their convenience, flavor variety, and trusted sourcing, with Cannadips often seen as a market pioneer.

Consumer Pain Points: Key frustrations in the CBD pouch market include inconsistent dosage, high pricing, limited retail access, slow effect onset, and lack of appealing flavors-factors that brands must address to increase long-term adoption.

The demographic composition of CBD users in the U.S.-with White/Caucasians accounting for 64%-has direct implications for the adoption of emerging product formats like CBD pouches. This dominant user group tends to be early adopters of wellness and alternative health products, contributing significantly to the rising popularity of discreet, smokeless CBD delivery methods. As CBD pouches offer convenience, portability, and social acceptability, they align well with the preferences of this majority demographic. Conversely, lower adoption among minority groups, such as Asian/Asian Americans (4%) and Black/African Americans (5%), may reflect cultural stigma, limited targeted marketing, or lower access, highlighting an opportunity for broader outreach and education to drive inclusive market growth.

Content Insights

CBD pouches with 10 mg -20 mg content accounted for a revenue share of 50.51% in 2024 in the U.S. This dosage range strikes an optimal balance between efficacy and safety for mainstream users seeking stress relief, focus, or mild pain management without sedation or psychoactive effects. This moderate dose appeals to both new and regular consumers, offering noticeable benefits while minimizing the risk of overconsumption.

The up to 10 mg segment is anticipated to witness a CAGR of 19.2% from 2025 to 2033, due to rising demand from first-time users and health-conscious consumers seeking low-dose, entry-level products for mild stress relief or daily wellness routines. This segment is especially attractive to cautious adopters, including older adults and professionals, who prefer microdosing to avoid side effects or drowsiness. Brands are increasingly offering 5-10 mg pouches with clean-label formulations, natural flavors, and precise dosing to appeal to this emerging audience, thereby driving rapid growth within this category.

Type Insights

The flavored CBD pouches segment held the largest revenue share, accounting for 86.26% in 2024. This is owing to flavors significantly enhancing user experience, masking the natural bitterness of hemp extract, and making the product more enjoyable and socially acceptable. Flavors such as mint, citrus, coffee, and berry appeal to a wide range of consumer tastes and encourage repeat usage, especially among younger and first-time users. Leading brands like Cannadips and VELO CBD offer multiple flavored variants-such as "Tropical Mango" or "American Spice"-that align with wellness and lifestyle branding, helping them gain traction in both retail and online channels. This flavor-driven innovation is key to attracting and retaining customers in a market that values both efficacy and sensory appeal.

The unflavored CBD pouches segment is the fastest-growing segment, expected to grow at a CAGR of 17.3% from 2025 to 2033, due to increasing demand from health-focused and purist consumers seeking clean-label, additive-free products. This group values the natural taste of hemp and often associates unflavored options with greater authenticity, fewer allergens, and reduced risk of artificial ingredients or sweeteners. In addition, some medical or therapeutic users prefer unflavored pouches to avoid sensory overstimulation. Brands like Holistic Wellness and CBDfx have responded by offering unflavored or “natural” variants targeted at experienced users or those with dietary sensitivities, fueling strong growth in this niche.

Distribution Channel Insights

The sales of CBD pouches through offline channels dominated the market, accounting for a share of around 65.09% in 2024, owing to increasing consumer preference for in-person purchases where they can receive guidance, verify authenticity, and avoid shipping delays or legal uncertainties. Many buyers, especially first-time users or older demographics, feel more comfortable purchasing from trusted retail environments such as pharmacies, vape shops, or wellness stores where staff can explain usage, dosage, and effects. In addition, large national chains like Circle K and select CVS or convenience stores have begun stocking flavored CBD pouches from brands like Cannadips, expanding retail access and visibility. This physical presence builds trust and impulse-buying opportunities, which are harder to replicate online, especially for a still-evolving category like CBD.

Sales of CBD pouches through online channels are the fastest-growing segment, expected to grow at a CAGR of 20.2% from 2025 to 2033, due to increasing consumer comfort with e-commerce, better product availability, and greater access to detailed product information, reviews, and promotions. Younger, tech-savvy consumers prefer buying directly from brand websites or marketplaces like Amazon and CBD-specific platforms such as DirectCBD or CBD American Shaman, which offer discreet delivery and subscription models. In addition, online channels allow users to compare flavors, potency, and lab test results, enhancing transparency and trust. Brands like Cannadips and Holistic Wellness have capitalized on this trend by offering exclusive online bundles, loyalty programs, and educational content, driving higher engagement and repeat purchases through digital channels.

Key U.S. CBD Pouches Company Insights

The U.S. CBD pouches industry is becoming increasingly competitive as both established brands and new entrants focus on product innovation, quality improvements, and competitive pricing. Leading manufacturers are actively expanding their presence across both offline retail and online platforms to improve accessibility and consumer reach. In addition, companies are investing in advanced delivery technologies to boost the bioavailability and effectiveness of CBD. The entry of major tobacco companies is further reshaping the landscape, bringing deep resources, extensive distribution networks, and regulatory expertise to the sector. As consumer demand grows for discreet, smoke-free CBD formats, and regulatory clarity continues to improve, the market is poised for sustained growth in the coming years.

Key U.S. CBD Pouches Companies:

- Cannadips

- VELO CBD

- Holistic Wellness

- CBDfx

- Grinds

- SNUSSIE

- Cannobie

- Rogue

- Hempire

- Jakobsson’s

Recent Developments

-

In November 2024, Cannadips partnered with Dark Horse Cannabis to bring their smokeless cannabis pouches to Arkansas, marking the brand’s first cannabis-specific product rollout outside California. The move included various flavors and formulations designed for discreet, fast-acting consumption via Arkansas dispensaries.

-

In April 2024, GRN (Green Revolution) announced the launch of its 10-pack "Megas" in Missouri, expanding its product offerings within the state's cannabis market. The new MEGA packs contain 10 MEGAs totaling 1,000 milligrams of THC per package.

U.S. CBD Pouches Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 55.71 million

Revenue Forecast in 2033

USD 232.36 million

Growth Rate

CAGR of 19.5% from 2025 to 2033

Historical Data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Content, type, distribution channel

Key companies profiled

Cannadips; VELO CBD; Holistic Wellness; CBDfx; Grinds; SNUSSIE; Cannobie; Rogue; Hempire; Jakobsson’s.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options U.S. CBD Pouches Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the U.S. CBD pouches market report by content, type, and distribution channel:

-

Content Outlook (Revenue, USD Million); 2021 - 2033)

-

Up to 10 mg

-

10 mg - 20 mg

-

Others

-

-

Type Outlook (Revenue, USD Million); 2021 - 2033)

-

Flavored

-

Unflavored

-

-

Distribution Channel Outlook (Revenue, USD Million), 2021 - 2033)

-

Offline

-

Online

-

Frequently Asked Questions About This Report

b. The U.S. CBD pouches market size was estimated at USD 42.69 million in 2024 and is expected to reach USD 55.71 billion in 2025.

b. The U.S. CBD pouches market is expected to grow at a compound annual growth rate (CAGR) of 19.5 % from 2025 to 2033 to reach USD 232.36 billion by 2033.

b. CBD pouches with 10 mg -20 mg content accounted for a revenue share of 50.51% in 2024 in the U.S., as the moderate dose appeals to both new and regular consumers, offering noticeable benefits while minimizing the risk of overconsumption.

b. Some key players operating in the U.S. CBD pouches market include Cannadips, VELO CBD, Holistic Wellness, CBDfx, Grinds, SNUSSIE, Cannobie, Rogue, Hempire, and Jakobsson’s.

b. The CBD pouches market in the U.S. is growing rapidly due to rising consumer demand for smokeless, discreet wellness products and increasing awareness of CBD’s potential benefits. Innovations in flavors and formats are also expanding appeal among younger, health-conscious users.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.