- Home

- »

- Biotechnology

- »

-

U.S. Cell Culture Supplements Market Size Report, 2033GVR Report cover

![U.S. Cell Culture Supplements Market Size, Share & Trends Report]()

U.S. Cell Culture Supplements Market (2025 - 2033) Size, Share & Trends Analysis Report By Product Type, By Application (Biopharmaceutical Manufacturing, Cell & Gene Therapy, Drug Discovery), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-700-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Cell Culture Supplements Market Trends

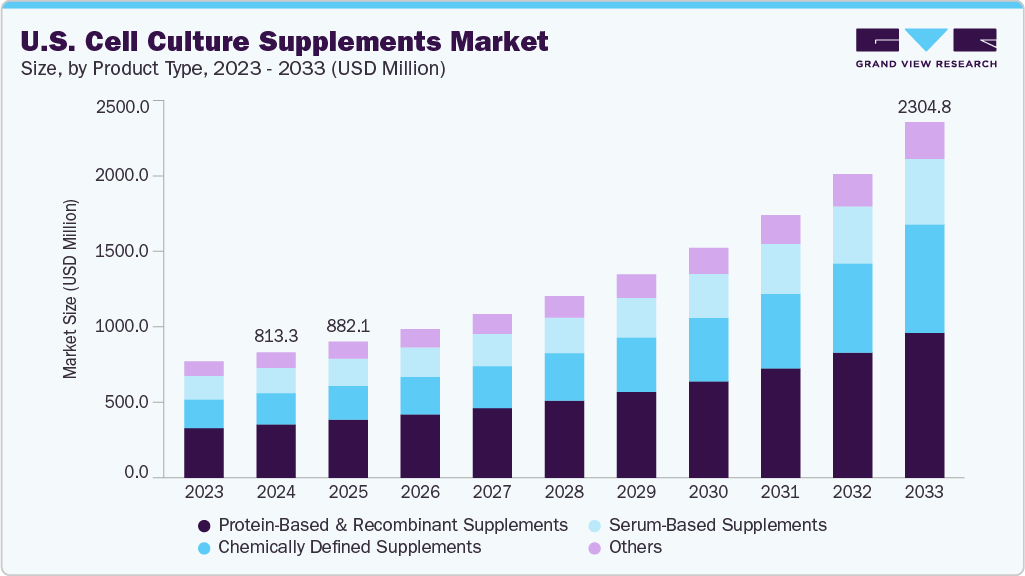

The U.S. cell culture supplements market size was valued at USD 813.3 million in 2024 and is anticipated to reach USD 2304.8 million by 2033, growing at a CAGR of 12.76% from 2025 to 2033, driven by increasing demand for biopharmaceuticals, advancements in cell culture technologies, and expanding research activities in regenerative medicine and cell-based therapies.

Rising Biologics and Biosimilars Production

The increasing demand for biologics and biosimilars is a key driver of the U.S. cell culture supplements industry. Biologics, including monoclonal antibodies, recombinant proteins, and cell-based therapies, require advanced cell culture systems for production. Biopharmaceutical manufacturers are heavily investing in optimizing their upstream processes as these therapies become more crucial for treating chronic and complex diseases such as cancer and autoimmune disorders. High-quality cell culture supplements, like growth factors, recombinant proteins, and amino acid blends, are vital to maintaining consistent yields, product stability, and regulatory compliance.

Culture Media Supplements

Supplement Type

Description

Commercial Example

Sera

Cell-free, highly processed animal blood fraction

HyQ characterized FBS (HyClone, Logan, UT)

Fortified sera

Serum with added nutrients/co-factors

HyQ bovine growth serum (HyClone)

Screened sera

Selected lots of sera tested for specific performance

HyQ ES screened FBS (HyClone)

Serum fractions

Mixtures of selected serum components

EX-CYTE (Celliance, Norcross, GA)

Serum replacements

Cocktails of protein, nutrients, vitamins, growth factors

Lipumin (PAA Labs, Les Mureaux, France)

Tissue extracts

Mixtures of selected plant or animal tissue components

BPE (Fisher Scientific, Pittsburgh, PA)

Hydrolysates/peptones

Partially acid hydrolyzed or enzymatically digested tissues/cells/seed flours

Yeast extract (Marcor, Carlstadt, NJ)

Hormones/growth factors

Cell-proliferation-active polypeptides, proteins, steroids

IGF-1 (Biosource, Camarillo, CA)

Cell cycle regulators

Lectin-based mitogens and synthetic caspase inhibitors

Z-D-CH2-DCB (Calbiochem, San Diego, CA)

Matrix/attachment factors

Gelatin, collagen, laminins, fibronectin, etc.

ZHS 8949 (TCS CellWorks, Buckingham, UK)

Antibiotics/antimycotics

Metabolism-based inhibitors of bacteria and fungi

Pen-Strep Solution (HyClone)

Nutrient/vitamin concentrates

Defined cocktails of amino acids, vitamins, metal ions

NEAA 100x (HyClone)

Simple nutrients/salts

Glutamine, glucose, pyruvate, Na2HCO3, CaCl2

L-Glutamine (HyClone)

Lipid concentrates

Stabilized sterols, fatty acids, lecithin, fat-soluble vitamins

HyQ LS250 (HyClone)

Selection agents

Toxins, analogs, inhibitors, salvage pathway precursors

MSX (Sigma, St. Louis, MO)

Media kits

Sets of basal media, supplement mixtures, defined supplements

ProMEDIA SELECT (Cambrex, Nottingham, UK)

pH buffers

Selected buffers like NaH2PO4, NaHCO3, β-Glycerophosphate

Hepes buffer 1M (HyClone)

Iron transporters

Iron associated with natural or synthetic chelators

Human Transferrin (Celliance, Norcross, GA)

Synthetic HMW polymers

Methylcellulose, polyvinylpyrrolidone, pluronic acids

Methylcellulose (Fluka, Mulhouse, France)

Source: Secondary Research, Grandview Research, Inc.

The rise of biosimilars, driven by the expiration of major biologic patents, further accelerates the need for reliable and scalable cell culture solutions. These products must meet strict quality standards, making chemically defined and serum-free supplements even more important. As companies expand production capabilities and collaborate with CDMOs, the need for advanced, reproducible, and GMP-compliant cell culture supplements continues to grow, solidifying biologics and biosimilar manufacturing as a key market driver.

Growth of Cell and Gene Therapy

The accelerating growth of cell and gene therapy is a significant driver for the U.S. cell culture supplements market. These advanced therapeutic modalities from CAR-T cell therapies to stem cell-based treatments and gene editing technologies like CRISPR rely heavily on specialized cell culture systems. Unlike traditional pharmaceuticals, cell and gene therapies manipulate living cells, requiring highly controlled, nutrient-rich environments to ensure optimal viability, expansion, and functionality. As a result, the demand for high-performance, specialized cell culture supplements such as xeno-free, serum-free, and chemically defined components is rising rapidly to meet the complex needs of these cutting-edge therapies.

Moreover, manufacturers are increasing their production capabilities as more cell and gene therapies progress through clinical trials and gain regulatory approvals. This move from lab-scale to commercial-scale production requires robust and consistent culture conditions, boosting the need for high-quality, GMP-compliant supplements. Additionally, the personalized nature of many cell therapies, such as autologous treatments, demands precision and customization in culture formulations, further fueling innovation and demand in the supplements sector. The U.S., a global leader in regenerative medicine research and biotech innovation, is at the forefront of this growth, making cell and gene therapy a key driver for expanding the cell culture supplements market.

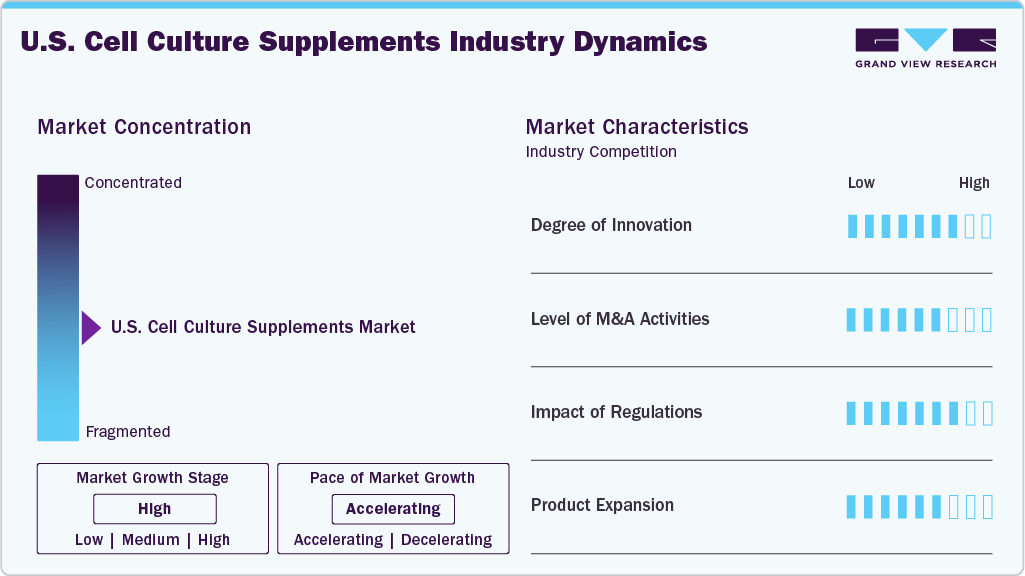

Market Concentration & Characteristics

A high degree of innovation is a key driver in the U.S. cell culture supplements industry, as advancements in bioprocessing and therapeutic development demand more sophisticated and specialized formulations. The shift toward chemically defined, serum-free, and xeno-free supplements has improved consistency, safety, and regulatory compliance, particularly for applications in biologics and cell and gene therapies. Emerging technologies such as 3D cell culture, organoids, and organ-on-chip platforms further fuel the need for tailored supplements that closely replicate physiological conditions. Companies invest heavily in R&D, strategic partnerships, and proprietary technologies to meet these evolving requirements, positioning innovation as a central force behind market growth and differentiation.

Mergers and acquisitions (M&A) are driving growth and consolidation in the U.S. cell culture supplements industry. Leading companies actively pursue strategic acquisitions and partnerships to expand their product portfolios, improve technological capabilities, and increase their geographic reach. For example, in April 2023, AnaBios, based in the US, acquired Cell Systems, broadening its human cell portfolio to boost drug discovery capabilities and strengthen its position in the biotechnology market. These M&A activities allow firms to combine complementary expertise, accelerate innovation, and better meet the rising demand for specialized biologics, cell and gene therapies, and regenerative medicine supplements. As the market grows more competitive and complex, ongoing M&A efforts are expected to shape industry dynamics, drive expansion, and solidify the positions of key players.

Regulations significantly impact the U.S. cell culture supplements market by shaping product development, quality standards, and market access. Strict regulatory requirements around safety, purity, and traceability, especially for supplements used in biologics and cell and gene therapies, drive manufacturers to adopt rigorous quality control measures and favor chemically defined, animal-free formulations. Compliance with guidelines from agencies such as the FDA ensures that products meet necessary clinical and commercial use standards, which increases production costs and builds trust and reliability among end-users. As regulatory frameworks evolve to address emerging therapies and novel technologies, companies that proactively align with these standards gain a competitive advantage, while non-compliance can limit market opportunities.

Product expansion is a key growth driver in the U.S. cell culture supplements market as companies continuously develop and introduce new formulations to meet the diverse and evolving needs of biopharmaceutical manufacturing, research, and advanced therapies. By broadening their product portfolios, manufacturers can cater to a wider range of end-users from large-scale biologics producers to academic research labs while addressing demands for improved consistency, scalability, and regulatory compliance. Continuous product innovation and expansion enable companies to stay competitive and capture emerging opportunities in this dynamic market.

Product Type Insights

Protein-based and recombinant supplements led the U.S. cell culture supplements market in 2024, capturing the largest revenue share of 42.59%. This leadership is due to their essential role in supporting cell growth, proliferation, and differentiation, especially in biopharmaceutical production and advanced cell-based research. Their high efficiency, consistency, and lower contamination risk compared to animal-derived components have made them a top choice across various end-user segments. For example, in August 2023, US-based Omeat introduced Plenty, a humane and affordable alternative to fetal bovine serum (FBS). Sourced from live cows, Plenty aids cell culture for regenerative medicine and cultivated meat.

Chemically defined supplements are expected to grow at the highest CAGR from 2025 to 2033. This growth is driven by the increasing demand for high-quality, consistent, and animal-free components in cell culture processes. As the biopharmaceutical and regenerative medicine sectors continue to emphasize product safety, reproducibility, and regulatory compliance, the adoption of chemically defined formulations is rising rapidly, positioning them as a key growth driver over the forecast period.

Application Insights

The biopharmaceutical manufacturing segment led the U.S. cell culture supplements industry in 2024, capturing the largest revenue share of 48.78%. This dominance is mainly due to the increasing demand for biologics, such as monoclonal antibodies, vaccines, and recombinant proteins, which depend heavily on advanced cell culture systems. The segment's growth is also driven by ongoing investments in biologics R&D, greater outsourcing of manufacturing processes, and the expanding pipeline of cell- and gene-based therapies.

The cell & gene therapy segment is expected to grow at the highest CAGR over the forecast period. This rapid growth is driven by increasing clinical advancements, FDA approvals, and growing investments in personalized medicine. As demand for innovative, targeted therapies continues to rise, the need for specialized and high-performance cell culture supplements in this segment is accelerating, positioning it as a major contributor to market expansion through the forecast period.

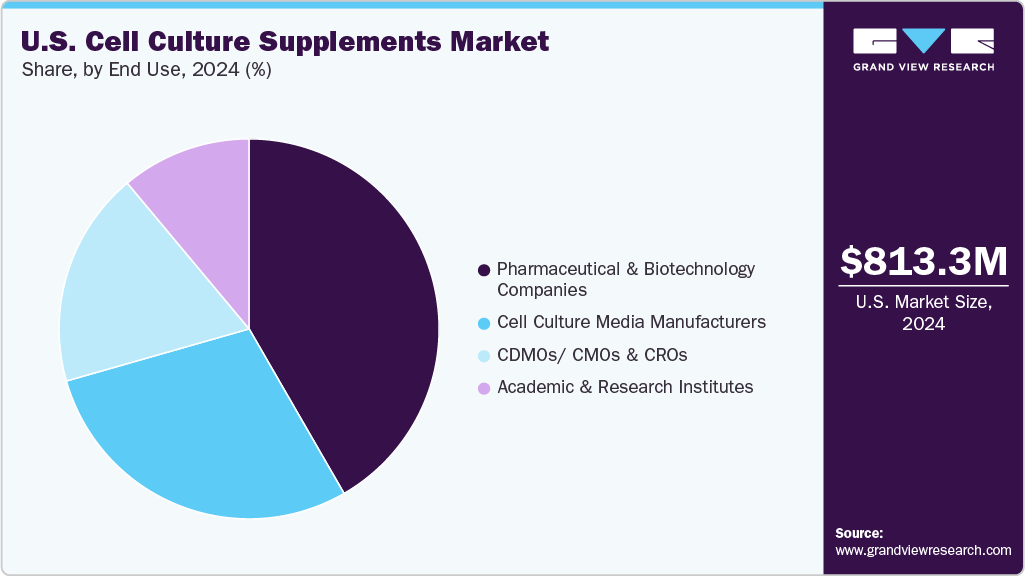

End Use Insights

The pharmaceutical and biotechnology companies segment led the market with the largest revenue share of 41.67% in 2024. This leadership is driven by the increasing demand for advanced therapies, including biologics and biosimilars, and the rapid growth of R&D activities focused on drug discovery and development. These companies heavily invest in high-quality cell culture technologies to ensure scalability, reproducibility, and regulatory compliance, further fueling demand for reliable and efficient supplements across various production and research applications.

The CDMOs/CMOs and CROs sector is expected to grow at the fastest compound annual growth rate (CAGR) during the forecast period in the U.S. cell culture supplements industry. This growth is fueled by the increasing trend of outsourcing drug development and manufacturing activities, as pharmaceutical and biotech companies aim to cut costs, speed up time-to-market, and access specialized expertise. The growing demand for biologics, personalized medicine, and complex therapies has heightened reliance on contract organizations. This, in turn, drives the need for high-quality, scalable cell culture supplements to meet diverse research and production demands.

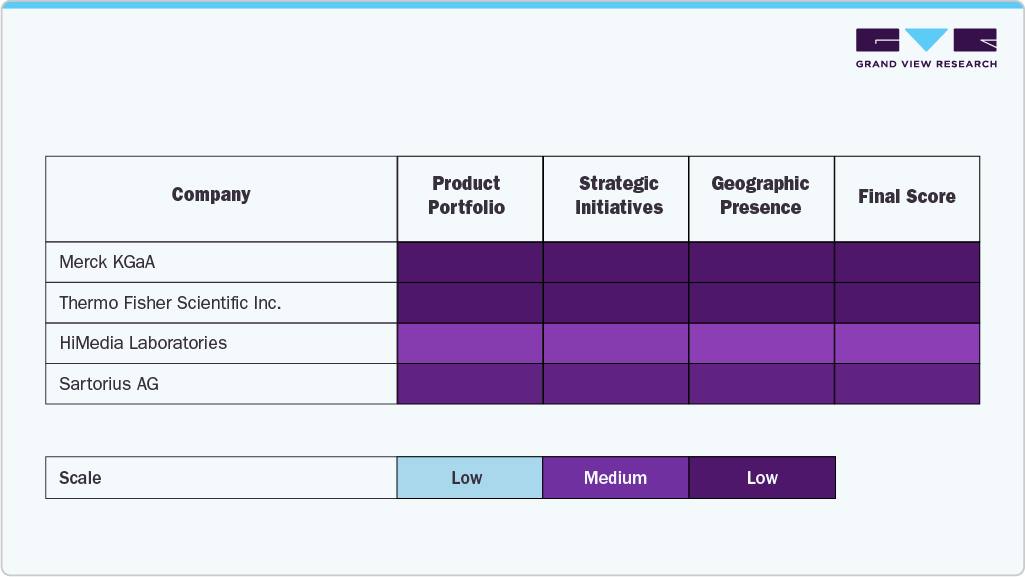

Key U.S. Cell Culture Supplements Company Insights

The U.S. cell culture supplements industry is driven by a mix of well-established leaders and emerging innovators, all contributing to a rapidly changing and competitive environment. Major companies like Thermo Fisher Scientific Inc., Merck KGaA, Danaher, Sartorius AG, and Corning Inc. lead the market with broad product ranges, extensive global distribution, and ongoing investments in research and development. These firms utilize advanced manufacturing techniques and technological advances to support various applications in biopharmaceutical manufacturing, academic research, and regenerative medicine.

R&D Systems (Bio-Techne), STEMCELL Technologies, Repligen Corporation, and Proteintech Group, Inc. are expanding their market presence by offering highly specialized and customizable supplements tailored to the needs of precision cell culture, including serum-free, xeno-free, and chemically defined formulations. These firms focus on delivering high-quality, reproducible products that align with current industry demands for standardization, scalability, and regulatory compliance.

Companies like HiMedia Laboratories are gaining momentum by targeting cost-sensitive markets while maintaining innovation and product quality, providing comprehensive solutions for research and industrial-scale cell culture. Meanwhile, ongoing strategic collaborations, acquisitions, and technology partnerships are increasing competition, allowing firms to expand their product ranges and strengthen their positions in emerging therapeutic areas such as cell and gene therapy, immunotherapy, and 3D cell culture.

As demand for biologics, personalized medicine, and advanced therapies grows, the U.S. cell culture supplements market is driven by quality, ethical sourcing, cost-efficiency, and regulatory readiness. Combining industrial maturity with innovation, companies that blend advanced science with customer-focused services and stay agile and collaborative are best positioned to lead the market’s next growth phase and shape the future of U.S. biotechnology.

Key U.S. Cell Culture Supplements Companies:

- Merck KGaA

- Thermo Fisher Scientific Inc.

- HiMedia Laboratories

- Danaher

- Sartorius AG

- Corning Inc.

- R&D Systems (Bio-Techne)

- STEMCELL Technologies

- Repligen Corporation

- Proteintech Group, Inc

Recent Developments

-

In April 2025, RoosterBio, a US-based company, announced a collaboration with Thermo Fisher Scientific to advance cell and exosome therapy manufacturing, aiming to accelerate development in regenerative medicine.

U.S. Cell Culture Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 882.1 million

Revenue forecast in 2033

USD 2304.8 million

Growth rate

CAGR of 12.76% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, end use

Key companies profiled

Merck KGaA; Thermo Fisher Scientific Inc.; HiMedia Laboratories; Danaher; Sartorius AG; Corning Inc.; R&D Systems (Bio-Techne); STEMCELL Technologies; Repligen Corporation; Proteintech Group, Inc

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Cell Culture Supplements Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the U.S. cell culture supplements market on the basis of product type, application, and end use:

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Serum-Based Supplements

-

Protein-Based & Recombinant Supplements

-

Chemically Defined Supplements

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Biopharmaceutical Manufacturing

-

Cell & Gene Therapy

-

Drug Discovery

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Cell Culture Media Manufacturers

-

Pharmaceutical & Biotechnology Companies

-

CDMOs/ CMOs & CROs

-

Academic & Research Institutes

-

Frequently Asked Questions About This Report

b. The U.S. cell culture supplements market size was estimated at USD 813.3 million in 2024 and is expected to reach USD 882.1 million in 2025.

b. The U.S. cell culture supplements market is expected to grow at a compound annual growth rate of 12.76% from 2025 to 2033 to reach USD 2.30 billion by 2033.

b. Protein-based & recombinant supplements segment dominated the U.S. cell culture supplements market with a share of 42.59% in 2024. This is attributed to their essential role in promoting cell proliferation and maintaining consistency in culture conditions. Growing use in biopharma R&D and clinical production further supports their dominance.

b. Some key players operating in the U.S. cell culture supplements market include Merck KGaA; Thermo Fisher Scientific Inc.; HiMedia Laboratories; Danaher; Sartorius AG; Corning Inc.; R&D Systems (Bio-Techne); STEMCELL Technologies; Repligen Corporation; Proteintech Group, Inc.

b. Key factors that are driving the U.S. cell culture supplements market growth include rising demand for biopharmaceuticals and cell-based therapies such as vaccines and gene therapies. Advancements in recombinant technologies and adoption of serum-free, chemically defined media are enhancing scalability and consistency. Additionally, increasing R&D investments and focus on personalized medicine are boosting the need for specialized supplements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.