- Home

- »

- Biotechnology

- »

-

U.S. Circulating Tumor Cells Market, Industry Report, 2030GVR Report cover

![U.S. Circulating Tumor Cells Market Size, Share & Trends Report]()

U.S. Circulating Tumor Cells Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Clinical/Liquid Biopsy, Research), By Specimen (Bone Marrow, Blood), By Product, By Technology, And Segment Forecasts

- Report ID: GVR-4-68040-245-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Circulating Tumor Cells Market Trends

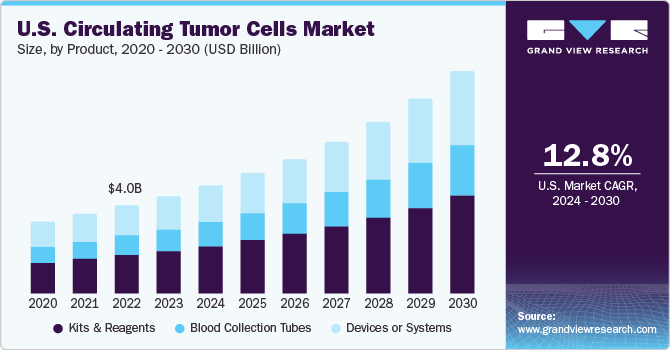

The U.S. circulating tumor cells market size was estimated at USD 4.45 billion in 2023 and is expected to grow at a CAGR of 12.77% from 2024 to 2030. Some key drivers are increased awareness of cancer treatment and improved healthcare facilities. Technological developments, in addition to specific antigens and biomarkers discoveries, are a few crucial factors contributing majorly to the growth of the Circulating Tumor Cells (CTC) market. Other key factors that boost market growth include the rising incidence of cancer, growing demand for rapid and early-stage cancer diagnosis, advanced facilities, and extensive research.

The U.S. accounted for 39.0% of the global circulating tumor cells market in 2023 owing to key factors such as increased incidence of diseases, rise in drug treatment rate, and high diagnostic prices compared to other developed economies. With the well-established infrastructure of care centers, it is anticipated that there will be an increase in sales of CTC diagnostic tests over the forecast period due to the launch of sophisticated prognosis and diagnosis modalities. In addition, prominent players and several research institutions working on CTC testing kit improvements, advancements in associated technologies, such as drug discovery, cancer diagnostics, personalized medicine, and liquid biopsy, and a well-framed reimbursement structure are expected to enhance the market growth.

Moreover, initiatives undertaken by market players, such as Advanced Cell Diagnostics, Apocell, Inc., and other prominent players to enhance their market hold can be attributed to the large share of the U.S. market. For instance, in October 2022, TellBio, Inc. published data from the scientific founders demonstrating the valuable impact of a new antibody targeting numerous cadherins on tumor cell dissemination in mouse pancreatic and breast cancer models. The growth in cancer-related spending for the introduction of companion diagnostics and personalized medicines is also expected to drive the market over the forecast period. Research organizations are constantly engaged in endeavors to develop CTC-based tests, which can prove helpful in cancer diagnosis.

The ongoing advancements in chip technology have positively impacted market growth. The chip technology helps perform precise CTC isolation but also helps overcome the challenges associated with isolation devices developed by key companies. CTC research is anticipated to grow in demand for tailoring preventive medicine for cancer treatment. For instance, in August 2022, researchers at the Cleveland Clinic in Ohio developed new liquid biopsy tests that can help diagnose cancer before the onset of symptoms by using a nanotube-CTC chip. Such advances are expected to boost the U.S. CTC market.

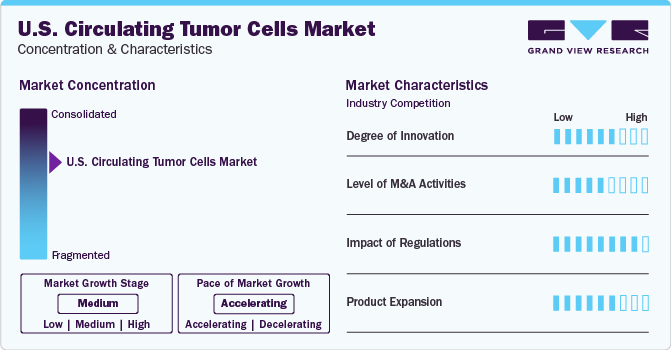

Market Concentration & Characteristics

The CTC industry is characterized by a competitive landscape with multiple companies and research institutions actively working on developing and commercializing CTC-based technologies. It is witnessing a moderate growth rate with an accelerating pace of industry growth. Intense competition exists to innovate, improve sensitivity, and establish clinical validity. Market leaders and early entrants strive to maintain their market share while new entrants seek to disrupt the market with novel approaches.

The market has witnessed many innovations in the past few years. Using imaging techniques for CTC detection and microfluidic chip development for CTC capture are two recent innovations. Several companies are investing in the research & development and launches of products that help in CTC analysis and downstream assays. For instance, in March 2022, Miltenyi Biotec extended its operations in Maryland by widening its facility to accommodate increased manufacturing, R&D, and quality assurance activities.

The prominent players are adopting strategies such as mergers and acquisitions (M&A), collaborations, and partnerships to strengthen their product portfolio and keep the market competitive. For instance, in July 2022, Bio-Techne Corporation acquired Namocell, Inc., aiming to add Namocell's technology to Bio-Techne's existing offerings, providing researchers with a more comprehensive toolbox for studying single cells.

The regulatory framework for the CTC market falls under the U.S. FDA to determine the safety and efficacy of these products and services. The FDA regulates medical devices, including those related to cancer diagnostics and monitoring, to ensure their safety and efficacy. Furthermore, adherence to the Clinical Laboratory Improvement Amendments (CLIA) is crucial for CTC testing laboratories.

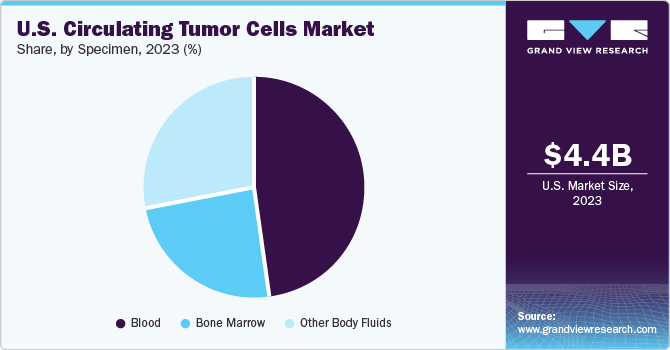

Specimen Insights

The blood segment held the largest market share of 47.6% in 2023. CTC detection using blood samples assists in prognosis prediction and determines systemic chemotherapy response. Hence, it is crucial for CTC identification in blood samples and is considered significant in cancer research. Moreover, using untreated whole blood samples is beneficial in enriching CTCs. Technological development for addressing challenges associated with CTC detection in blood samples is expected to drive segment growth further.

The other body fluids segment is expected to witness the fastest CAGR from 2024 to 2030. Several big companies provide blood collection tubes containing preservatives for blood stabilization. Proprietary storage tubes called Cell-Free DNA are available, and CTCs are stable for at least four days at room temperature in these tubes. The most widely used anticoagulant agent in these tubes is EDTA, which stabilizes blood samples by protecting cell viability and allows the study at a genetic and proteomic level, thus enabling biomarker analysis.

Technology Insights

The CTC enrichment methods segment held the largest market share of 66.4% in 2023 owing to the wide range of available methods for enriching CTCs in cancer detection. Different techniques for CTC detection include filtration, centrifugal force, magnetic beads-based enrichment, and other physical properties such as size, density, deformity, & electric charges. Positive or negative enrichment of CTC based on biological properties is projected to significantly boost the market growth during the forecast period. Furthermore, a successful enrichment process contributes to sensitivity, selectivity, and yield enhancement while also ensuring positive clinical translation of CTCs.

The CTC analysis segment is expected to witness the fastest CAGR from 2024 to 2030 as it can help clinicians detect underlying reasons for unresponsiveness among patients subjected to targeted therapy. CTC analysis is a minimally invasive method in repetitive analysis and validated technology for tumor study & clinical decision-making. Moreover, technological advancements such as next-generation sequencing (NGS) and immunofluorescence are projected to significantly enhance CTC analyses, further boosting the segment’s growth.

Application Insights

The research segment held the largest market share of 74.7% in 2023 and is expected to register the fastest CAGR during the forecast period. CTCs are a crucial aspect of cancer metastasis and serve as a valuable liquid biopsy material. The enumeration of CTCs is a reliable predictive and prognostic biomarker that can effectively monitor treatment efficacy, detect early metastasis development, and assess therapeutic responses more accurately than traditional imaging methods.

There is a growing focus on characterizing and isolating CTCs, presenting promising opportunities for predictive testing research. Repeated tissue biopsies can get expensive and invasive and are not always feasible. This makes the characterization of CTCs in liquid biopsy an attractive choice to minimize invasiveness and cost. Therefore, the genomic and molecular characterization of CTCs contributes to treatment selection and more personalized treatments.

Product Insights

The kits & reagents segment held the largest market share of 44.2% in 2023. Owing to frequent purchases of these products and their wide usage rates. For instance, the U.S. witnesses a wide usage and production of the CellSearch Circulating Tumour Cell Kit, making it the most popular CTC kit in the country. Several cancer cell lines have been tested by researchers using this kit due to ease of use, and the resultant product of label-free viable cells subsequently used in downstream analysis. In addition, rich product portfolio accessibility coupled with microfluid technological advancements technology is projected to boost further market growth.

The devices or systems segment is expected to witness the fastest CAGR from 2024 to 2030, owing to several advances in microfluidics technology and a wide product portfolio. The fabricated glass microchip’s introduction aiming to overcome challenges and expand technical completeness for mass production is projected to propel segment growth in the upcoming years.

Key U.S. Circulating Tumor Cells Company Insights

Some prominent U.S. circulating tumor cells market companies include QIAGEN; Bio-Techne Corp.; AVIVA Biosciences; BIOCEPT, Inc.; BioCEP Ltd.; Fluxion Biosciences, Inc.; Greiner Bio-One International GmbH; Ikonisys Inc.; and Sysmex Corporation; STEMCELL Technologies, Inc. These companies are undertaking strategic initiatives, such as market expansions, acquisitions, and mergers, which are anticipated to fuel market growth over the forecast period.

Established players with patented technologies and strong research capabilities have a competitive advantage. The presence of these well-established market players limits the growth opportunities of emerging players in the market. However, innovative startups and research institutions still enter the market with novel approaches.

Key U.S. Circulating Tumor Cells Companies:

- QIAGEN

- Bio-Techne Corporation

- Precision for Medicine

- AVIVA Biosciences

- BIOCEPT, Inc.

- BioCEP Ltd.

- Fluxion Biosciences, Inc.

- Greiner Bio-One International GmbH

- Ikonisys, Inc.

- Miltenyi Biotec

- IVDiagnostics, Inc.

- BioFluidica

- Canopus Bioscience Ltd.

- Biolidics Limited

- Creativ MicroTech, Inc.

- LungLife AI, Inc.

- Epic Sciences

- Rarecells Diagnostics

- ScreenCell

- Menarini Silicon Biosystems

- LineaRx, Inc. (Vitatex, Inc.)

- Sysmex Corporation

- STEMCELL Technologies, Inc.

Recent Developments

-

In February 2024, BioXcel Therapeutics, Inc. received U.S. FDA Fast Track Designation for BXCL701, an investigational, oral innate immune activator designed to initiate inflammation in the tumor microenvironment.

-

In August 2023, Cell Microsystems announced the acquisition of Fluxion Biosciences, Inc., which complements the company's CellRaft technology-based platforms and applications to build various innovative cell analysis solutions.

-

In February 2022, Epic Sciences announced a collaboration with Fulgent Genetics to integrate DefineMBC results into Fulgent's existing testing portfolio, making it more accessible to healthcare providers and MBC patients.

U.S. Circulating Tumor Cells Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 4.45 billion

Revenue forecast in 2030

USD 10.16 billion

Growth rate

CAGR of 12.77% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, product, specimen

Country scope

U.S.

Key companies profiled

QIAGEN; Bio-Techne Corp.; Precision for Medicine; AVIVA Biosciences; BIOCEPT, Inc.; BioCEP Ltd.; Fluxion Biosciences, Inc.; Greiner Bio-One International GmbH; Ikonisys, Inc.; Miltenyi Biotec; IVDiagnostics; BioFluidica; Canopus Bioscience Ltd.; Biolidics Limited; Creativ MicroTech, Inc.; LungLife AI, Inc.; Epic Sciences; Rarecells Diagnostics; ScreenCell; Menarini Silicon Biosystems; LineaRx, Inc. (Vitatex, Inc.); Sysmex Corporation; STEMCELL Technologies, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Circulating Tumor Cells Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. circulating tumor cells market report based on technology, application, product, and specimen:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

CTC Detection & Enrichment Methods

-

Immunocapture (Label-based)

-

Positive Selection

-

Negative Selection

-

-

Size-based Separation (Label-free)

-

Membrane-based

-

Microfluidic-based

-

-

Density-based Separation (Label-free)

-

Combined Methods

-

-

CTC Direct Detection Methods

-

SERS

-

Microscopy

-

Others

-

-

CTC Analysis

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Clinical/ Liquid Biopsy

-

Risk Assessment

-

Screening and Monitoring

-

-

Research

-

Cancer Stem Cell & Tumorogenesis Research

-

Drug/Therapy Development

-

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Kits & Reagents

-

Blood Collection Tubes

-

Devices or Systems

-

-

Specimen Outlook (Revenue, USD Billion, 2018 - 2030)

-

Blood

-

Bone Marrow

-

Other Body Fluids

-

Frequently Asked Questions About This Report

b. The U.S. circulating tumor cells market size was estimated at USD 4.45 billion in 2023.

b. The U.S. circulating tumor cells market is expected to grow at a compound annual growth rate (CAGR) of 12.77% from 2024 to 2030 to reach USD 10.16 billion by 2030.

b. The CTC enrichment methods segment held the largest market share of 66.4% in 2023 owing to the wide range of available methods for enriching CTCs in cancer detection.

b. Some prominent U.S. circulating tumor cells market companies include QIAGEN; Bio-Techne Corp.; AVIVA Biosciences; BIOCEPT, Inc.; BioCEP Ltd.; Fluxion Biosciences, Inc.; Greiner Bio-One International GmbH; Ikonisys Inc.; and Sysmex Corporation; STEMCELL Technologies, Inc.

b. Some key drivers are increased awareness of cancer treatment and improved healthcare facilities. Technological developments, in addition to specific antigens and biomarkers discoveries, are a few crucial factors contributing majorly to the growth of the Circulating Tumor Cells (CTC) market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.