- Home

- »

- Advanced Interior Materials

- »

-

U.S. Cold Chain Packaging Market Size, Share, Report 2030GVR Report cover

![U.S. Cold Chain Packaging Market Size, Share & Trends Report]()

U.S. Cold Chain Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Crates, Insulated Containers & Boxes, Cold Packs, Labels), By Material (Insulating Material), By Application (Fruits & Vegetables), And Segment Forecasts

- Report ID: GVR-2-68038-699-8

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Cold Chain Packaging Market Trends

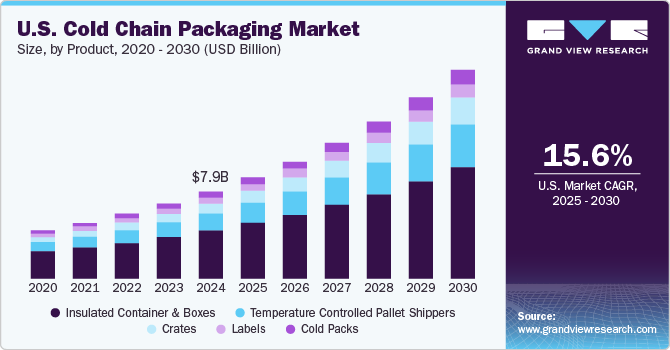

The U.S. cold chain packaging market size was valued at USD 7.97 billion in 2024 and is expected to register a CAGR of 15.6% from 2025 to 2030. This growth is attributed to the increasing demand for processed and frozen foods, fueled by urbanization and changing consumer lifestyles, which necessitates efficient refrigeration solutions. In addition, the rise of e-commerce and online grocery shopping creates new opportunities for cold chain logistics. Furthermore, due to strict temperature control requirements for sensitive products such as vaccines, the pharmaceutical sector contributes significantly to market expansion. Moreover, advancements in smart packaging technologies enhance supply chain efficiency and monitoring capabilities.

Cold chain packaging encompasses a variety of specialized containers, shippers, gel packs, foam bricks, phase change cold storage solutions, and protective materials designed to maintain a stable temperature during transit. These products are tailored to meet the logistics and regulatory requirements of transporting perishable goods through the cold chain, ensuring that items remain at optimal temperatures regardless of external conditions.

The growth of the packaging solutions market can largely be attributed to rising demand from the global food processing industry. Simultaneously, consumers gravitate towards processed and convenient meal options due to changing preferences. This trend has led to significant global demand for processed foods like frozen fruits and vegetables, dairy items, seafood, and meats, all of which require effective packaging for safe storage and transportation.

Cold chain packaging plays a vital role in preserving food quality by slowing down biological degradation and ensuring that products remain safe and high-quality for consumers. The growing population's heightened consumption of preserved foods and beverages further fuels the demand for cold chain solutions. Furthermore, the rise of organized retail reflects consumers' desire for convenient access to nutritious options. For food and beverage companies, maintaining food safety and implementing control measures against food-borne illnesses remain top priorities. To address these challenges, firms are increasingly adopting innovative packaging materials and techniques, such as electro-spun fibers and bio-based polymers, to mitigate the risk of bacterial contamination in food products.

Product Insights

Insulated containers and boxes led the market and accounted for the largest revenue share of 55.2% in 2024 attributed to the increasing demand for temperature-sensitive products across various sectors. In addition, the rise of e-commerce and online grocery delivery has significantly boosted the need for reliable, insulated solutions to maintain food freshness and safety during transit. Furthermore, under strict regulatory standards, the pharmaceutical industry heavily relies on insulated containers for transporting sensitive medications, including vaccines. Moreover, innovations in insulation technology and a growing emphasis on sustainable packaging further contribute to market expansion.

Cold packs are expected to grow at a CAGR of 17.6% over the forecast period, owing to their essential role in maintaining temperature control while transporting perishable goods. In addition, the surge in meal kit delivery services and online grocery shopping has heightened the demand for effective cold packs that ensure food safety and quality. Furthermore, as consumers increasingly prioritize convenience and freshness, cold packs are becoming vital for various applications, including pharmaceuticals and food delivery services. Moreover, the ongoing advancements in cold pack materials and designs enhance their effectiveness, thus driving market growth.

Material Insights

Insulating materials dominated the market and accounted for the largest revenue share of 58.1% in 2024, driven by increasing demand for energy-efficient solutions across various industries. As energy costs rise and environmental concerns become more pressing, there is a heightened focus on advanced insulation materials that enhance temperature control in refrigeration and HVAC systems. In addition, innovations such as polyurethane foams and vacuum-insulated panels are gaining traction for their superior thermal performance. Furthermore, government initiatives promoting energy efficiency and sustainability further support the expansion of this market segment.

Refrigerants are expected to grow at a CAGR of 16.7% over the forecast period attributed to their essential role in maintaining temperature stability for perishable goods. In addition, the rising demand for temperature-sensitive products, particularly in the food and pharmaceutical sectors, necessitates effective refrigerants like gel packs and dry ice. Stringent regulations regarding product safety amplify this need, driving innovation in refrigerant technology. Furthermore, the shift towards sustainable refrigerant options aligns with broader environmental goals, contributing to accelerated market growth as companies seek efficient solutions for cold chain logistics.

Application Insights

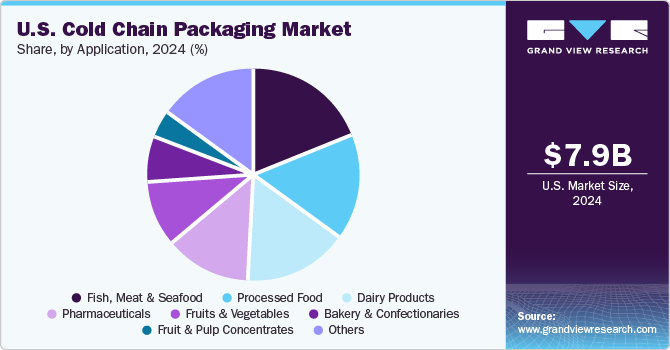

The fish, meat, and seafood segment dominated the market and accounted for the largest revenue share in 2024, attributed to the rising consumption of meat and seafood and the need for stringent temperature control during transportation necessitates effective cold-chain solutions. In addition, biological changes in these products can lead to spoilage if not properly managed, making cold-chain packaging essential for maintaining freshness and safety. Furthermore, expanding e-commerce and online grocery shopping further amplifies this sector's demand for reliable cold chain logistics.

Processed food application is expected to grow at a CAGR of 18.0% over the forecast period, owing to the changing consumer lifestyles and preferences for convenience. As more consumers seek ready-to-eat and packaged food options, there is a heightened need for effective cold chain solutions to ensure product quality during storage and transport. In addition, the increasing production volumes of processed foods, alongside rising disposable incomes, contribute to this trend. Furthermore, advancements in packaging technology enhance the efficiency of cold chain systems, enabling better preservation of food quality and safety throughout the supply chain.

Key U.S. Cold Chain Packaging Company Insights

Some of the key companies in the market include Cold Chain Technologies, Cryopak, Sonoco Thermosafe, and others. These companies adopted various strategies, such as strategic partnerships, mergers, and acquisitions, to strengthen supply chain capabilities. Furthermore, new product launches and technological investments are pivotal for improving operational efficiency and sustainability.

-

Cryopak specializes in temperature-controlled pharmaceutical, biotech, and life sciences packaging. The company manufactures diverse products, including insulated shipping containers, gel packs, phase change materials, and temperature monitoring devices. Beyond cold chain packaging, Cryopak also serves industries such as food and beverage, blood shipping, and electronics, ensuring the safe transport of temperature-sensitive goods across various sectors.

-

Sonoco Thermosafe manufactures insulated containers and packaging systems that ensure the integrity of products during transit. The company also operates in other segments, such as consumer packaging and industrial products, providing a comprehensive portfolio that includes protective packaging solutions for various industries.

Key U.S. Cold Chain Packaging Companies:

- Cold chain Technologies

- Cryopak

- Sonoco Thermosafe

- SOFRIGAM

- Softbox Systems Ltd

- Pelican Products, Inc.

- CSafe

- TOWER Cold Chain Solutions

- Sealed Air Corporation

- CoolPac

- Nordic Cold Chain Solutions

- Global Cooling Inc.

- Inmark LLC

- Envirotainer AB

- DGP Intelsius LLC

Recent Developments

-

In August 2024, Cold Chain Technologies (CCT) partnered strategically with VPL Rx. This collaboration aims to enhance cold chain packaging solutions for specialty pharmacies by integrating CCT’s thermal packaging into VPL Rx’s shipping workflow. The partnership offers real-time tracking, seasonal pack-out guidance, and tailored packaging recommendations, ensuring safe and efficient delivery of temperature-sensitive medications. This initiative is designed to improve operational efficiency and patient care in the specialty pharmacy sector.

U.S. Cold Chain Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.25 billion

Revenue forecast in 2030

USD 19.06 billion

Growth rate

CAGR of 15.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, application

Key companies profiled

Cold Chain Technologies; Cryopak; Sonoco Thermosafe; SOFRIGAM; Softbox Systems Ltd; Pelican Products, Inc.; CSafe; TOWER Cold Chain Solutions; Sealed Air Corporation; CoolPac; Nordic Cold Chain Solutions; Global Cooling Inc.; Inmark LLC; Envirotainer AB; DGP Intelsius LLC.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Cold Chain Packaging Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. cold chain packaging market report based on product, material, and application.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Crates

-

Dairy

-

Pharmaceutical

-

Fisheries

-

Horticulture

-

-

Insulated Container & Boxes

-

Large

-

Medium

-

Small

-

X-Small

-

Petite

-

-

Cold Packs

-

Labels

-

Temperature Controlled Pallet Shippers

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

InsulatingMaterial

-

Expanded Polystyrene (EPS)

-

Polyurethane Rigid Foam (PUR)

-

Vacuum Insulated Panel (VIP)

-

Cryogenic Tanks

-

Others

-

-

Refrigerants

-

Fluorocarbons

-

Inorganics

-

Ammonia

-

CO2

-

-

-

Hydrocarbon

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Fruits & Vegetables

-

Fruit & Pulp Concentrates

-

Dairy Products

-

Milk

-

Butter

-

Cheese

-

Ice Cream

-

-

Fish, Meat & Seafood

-

Processed Food

-

Pharmaceuticals

-

Vaccines

-

Blood Banking

-

-

Bakery & Confectionaries

-

Others

-

Frequently Asked Questions About This Report

b. Product segment dominated the U.S. cold chain packaging market with a share of 67.89% in 2019. This is attributable to increasing demand for processed and frozen foods due to growing population in metro and changing lifestyle and habits of consumers.

b. Key factors that are driving the U.S. cold chain packaging market growth include expanding organized retail sectors in emerging economies, which will create opportunities for U.S.-based cold chain service providers in the coming years.

b. The U.S. cold chain packaging market size was estimated at USD 3,906.0 million in 2019 and is expected to reach USD 4,477.0 million in 2020.

b. The U.S. cold chain packaging market is expected to grow at a compound annual growth rate of 15.7% from 2020 to 2027 to reach USD 12,428.6 million by 2027.

b. Some key players operating in the U.S. cold chain packaging market include Sonoco Thermosafe; Sofrigam; Softbox Systems, Inc.; Va-q-tec AG; and Creopack.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.