- Home

- »

- Medical Devices

- »

-

U.S. Diabetes Devices Market Size, Industry Report, 2030GVR Report cover

![U.S. Diabetes Devices Market Size, Share & Trends Report]()

U.S. Diabetes Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Blood Glucose Monitoring Devices, Insulin Delivery Devices), By Distribution Channel, By End-use (Hospitals, Homecare), And Segment Forecasts

- Report ID: GVR-4-68040-207-8

- Number of Report Pages: 195

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Diabetes Devices Market Size & Trends

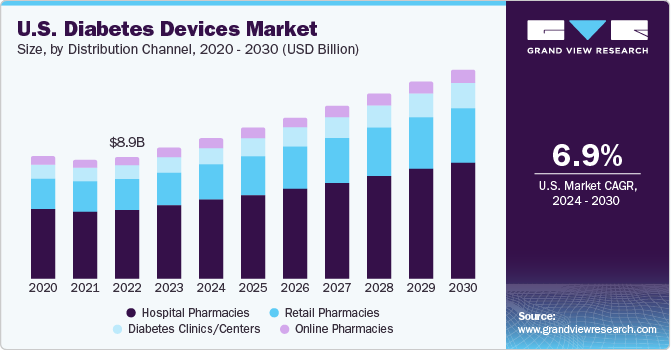

The U.S. diabetes devices market was valued at USD 9.53 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 6.91% from 2024 to 2030. Major factors contributing to the growth of this region include the increasing geriatric population, growing burden of diabetes due to lifestyle changes, increasing prevalence of obesity, and high cost of treatment. Furthermore, the adoption of smart diabetes devices and technologically advanced devices such as the use of Artificial Intelligence (AI) & data analytics are driving the market.

The favorable reimbursement scenario provides access to healthcare services to a large portion of the population. Subsequently, it creates a demand for cost-effective and efficient diabetes devices. This also increases the need for cost-effective diabetes devices and the integration of digital health in the care delivery system. Hence, many companies are seeking U.S. FDA approval to launch their products in the U.S. market. For instance, in January 2022, Insulet Corporation announced that it received clearance from the U.S. FDA for its Omnipod 5 Automated Insulin Delivery System for people with type 1 diabetes aged 6 and above. This system integrates with the Dexcom G6 Continuous Glucose Monitoring (CGM) System and smartphone to automatically regulate insulin & help protect against highs and lows.

The Centers for Disease Control and Prevention (CDC) reports that in the U.S., approximately 34.2 million people, or 10.5% of the population, have diabetes. This includes both diagnosed and undiagnosed cases. Furthermore, there are also a significant number of people who are undiagnosed or have prediabetes, which is a condition where blood glucose levels are higher than normal but not yet high enough to be classified as diabetes. The rise in obesity and diabetes is attributed to factors such as unhealthy diets, sedentary lifestyles, and heredity. These conditions can increase the risk of several other health problems, including heart disease, stroke, and certain types of cancers.

The increasing number of initiatives being undertaken by governments and nonprofit organizations to increase diabetes awareness is expected to boost the adoption of diabetes devices. For instance, the WHO Diabetes Program is aimed at preventing type 2 diabetes, reducing complications, and improving the quality of life for people with diabetes. Several NGOs and governments are creating norms and standards, raising awareness about diabetes prevention, and promoting surveillance to strengthen prevention & control of diabetes. Therefore, a growing number of awareness programs is expected to aid in the diagnosis of diabetes, thus boosting the adoption of diabetic devices.

Market Concentration & Characteristics

The overall U.S. diabetes devices market growth is high as it comprises several innovations, merging and acquisitions, partnerships, and collaborations. Although the market is under several regulations, it is expected to be in favor. In addition, several product and regional expansion strategies are also being adopted by the key market players.

The degree of innovation in the U.S. market for diabetes devices is high. Technological innovation and new product launches are key factors driving changes in the healthcare industry in the country at a significant rate. The country is focusing on the digitalization of healthcare by leveraging innovative technologies, such as AI, big data, and cloud computing. Several market players are launching various products to strengthen their product portfolio. This strategy enables companies to increase their customer reach, expand their product portfolios, and improve their offerings. For instance, in July 2021, Ascensia Diabetes Care y launched a Patient Assistance Program in the U.S. to reduce out-of-pocket costs associated with the Eversense CGM System.

The market is witnessing high merger and acquisition (M&A) activities. Various prominent market players are acquiring smaller players to strengthen their market position. Through this strategy, companies increase their capabilities and expand their product portfolios. Hence, major players in the market are adopting several strategies like mergers & acquisitions and partnerships & collaborations to stay competitive in the market. In February 2023, Insulet Corporation acquired the patents for insulin pumps from Bigfoot Biomedical (Bigfoot), a company specializing in insulin delivery technologies.

Favorable government policies coupled with an increase in funding for R&D for the concerned market are expected to bring innovative products. Stringent regulations are present for marketing devices like insulin pumps and pens. This is going to slow the introduction of new devices in the market. Governments are planning to regulate devices, such as test strips and diabetic needles, which are the major part of insulin pens. Through this regularization, the costs of the products will be controlled to make them affordable for the rural patient pool.

The increasing prevalence of obesity and the high cost of treatment are also expected to drive the region, along with technological advancements and new product launches and expansion. Leading manufacturers are focusing on the expansion of advanced products in rural areas to gain a substantial marketplace and share. The launches of advanced and innovative products are projected to boost the market growth. For instance, in September 2022, Cardiff University and GlucoRx Limited launched the first-ever non-invasive continuous glucose monitor for needle-free monitoring of blood glucose in patients suffering from diabetes.

Governments in developing countries are increasingly recognizing the need to address the growing burden of diabetes and are investing in diabetes prevention, screening, and management. This presents opportunities for companies to partner with government agencies and healthcare providers to develop and implement diabetes care solutions. Furthermore, companies are also focusing on launching their products and other strategies to a wider population in several regions. For instance, in November 2022, Ascensia Diabetes Care launched GlucoContro.online, an analytics and online diabetes management platform, in the U.S., and now it is available in more than 15 countries.

Type Insights

The insulin delivery devices market held the largest revenue share of 54.19% in 2023. This segment includes pens, pumps, syringes, and jet injections. While insulin pumps have risk factors such as causing diabetic ketoacidosis if the catheter kinks or clogs, the pens segment offers benefits such as portability, and being kid friendly. Insulin syringes are expected to be replaced by other convenient alternatives such as pumps and pens. The jet injectors may cause pain and skin bruises if used incorrectly. In addition, they are more expensive than other devices and take a lot of time to prepare the insulin dose. Thus, adoption of these devices is less and is expected to remain low over the forecast period.

The BGM devices market is expected to witness a faster CAGR over the forecast period. This is due to the availability of low-cost blood glucose monitoring devices and their accuracy in reading glucose levels in the body. Moreover, with the advancements in technology and launches of innovative and integrated solutions, companies are launching cost-effective, technologically advanced, easy-to-use products. This is expected to boost the demand for the blood glucose monitoring devices market.

Distribution Channel Insights

The hospital pharmacies segment held the largest revenue share of 54.13% in 2023. In hospitals, continuous glucose monitoring is vital in diabetes patients in ICU, undergoing cardiothoracic surgery and insulin therapy, which is expected to boost the demand for CGM devices. Furthermore, recently, the FDA has approved the use of self-monitoring glucose meters in hospitals to check blood glucose levels owing to the COVID-19 outbreak. Thereby, the inventory levels for self-monitoring glucose meters have increased significantly, propelling the segment's growth.

The retail pharmacies segment is expected to witness the fastest CAGR over the forecast period as they are considered the most accessible buying option for patients. Retail pharmacies are one of the largest contributors to the total diabetes device distribution volume. The products offered by retail pharmacies include self-monitoring glucose supplies insulin delivery equipment, and OTC products, based on factors such as physician preference, patient preference, profit margin, and insurance coverage.

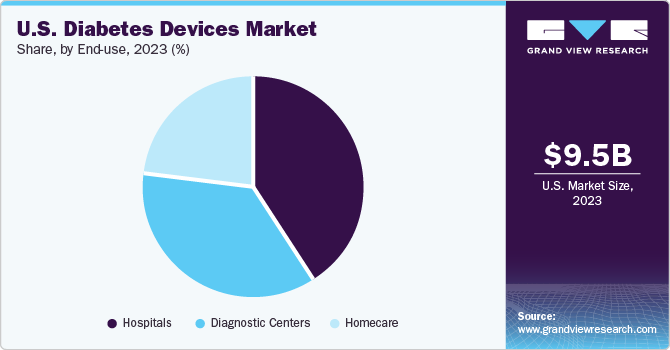

End-use Insights

The hospital segment held the largest revenue share of 40.80% in 2023. Many hospitals and healthcare settings have increased the use of CGM devices for identification of blood sugar levels in patients suffering from diabetes mellitus. CGM devices have been shown to perform considerably better compared to Self-monitoring Blood Glucose (SMBG) devices during clinical studies involving gestational diabetes mellitus, according to National Center for Biotechnology Information (NCBI). The adoption of blood glucose monitoring devices is expected to increase in hospitals owing to the introduction of technologically advanced devices for the management of diabetes mellitus.

The diagnostics centers segment is expected to witness the fastest CAGR over the forecast period. Diagnostic centers use glucose monitoring devices as patients suffering from diabetes prefer examining glucose levels in diagnostic centers due to their effectiveness in providing instant results without long waiting times. Thus, increasing demand for BGM devices is expected to propel segment growth.

Key U.S. Diabetes Devices Company Insights

Some of the most prominent companies in the U.S. diabetes devices market include Medtronic plc, Abbott Laboratories, Bayer AG, and F. Hoffman-La-Ltd. These players have strong product portfolios with the presence of advanced products and focus more on R&D activities and investments.

These players are adopting various strategic initiatives such as product launches, collaboration, partnerships, new product approvals to sustain their position in the market. Some of the emerging players such as Insulet Corporation, and Ypsomed Holdings are collaborating with other major and local players to gain a competitive edge.

U.S. Diabetes Devices Companies:

- Medtronic plc

- Abbott Laboratories

- F.Hoffmann-La-Ltd.

- Bayer AG

- Lifescan, Inc.

- B Braun Melsungen AG

- Lifescan, Inc.

- Dexcom Inc.

- Insulet Corporation

- Ypsomed Holdings

- Companion Medical

- Sanofi

- Valeritas Holding Inc.

- Novo Nordisk

Recent Developments

-

In February 2023, Insulet Corporation acquired the assets of a California-based company, Automated Glucose Control LLC (AGC), specializing in automated insulin delivery technology

-

In November 2022, Ypsomed Holding AG launched YpsoMate 5.5, a new autoinjector platform dedicated to liquid medications of around 1.5 to 5.5 ml volumes

-

In November 2022, Ascensia Diabetes Care launched GlucoContro.online, an analytics and online diabetes management platform in the U.S.

U.S. Diabetes Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.22 billion

Revenue forecast in 2030

USD 15.21 billion

Growth rate

CAGR of 6.91% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, end-use

Country scope

U.S.

Key companies profiled

Medtronic plc, Abbott Laboratories; F.Hoffmann-La-Ltd.; Bayer AG; Lifescan, Inc.; B Braun Melsungen AG; Lifescan, Inc.; Dexcom Inc.; Insulet Corporation; Ypsomed Holdings; Companion Medical; Sanofi; Valeritas Holding Inc.; Novo Nordisk; and Arkray, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Diabetes Devices Market Report Segmentation

This report forecasts revenue growth at country levels as well as provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. diabetes devices market report on the basis of type, distribution channel, and end-use:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

BGM Devices

-

Self-Monitoring Devices

-

Blood Glucose Meters

-

Testing Strips

-

Lancets

-

-

Continuous Glucose Monitoring Devices

-

Sensors

-

Transmitters

-

Receiver

-

-

Insulin Delivery Devices

-

Pumps

-

Pens

-

Syringes

-

Jet Injectors

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital pharmacies

-

Retail Pharmacies

-

Diabetes Clinics/Centers

-

Online Pharmacies

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Centers

-

Homecare

-

Frequently Asked Questions About This Report

b. The U.S. diabetes devices market size was estimated at USD 9.53 billion in 2023 and is expected to reach USD 10.22 billion in 2024.

b. The U.S. diabetes devices market is expected to grow at a compound annual growth rate of 6.91% from 2024 to 2030 to reach USD 15.21 billion by 2030.

b. Hospital pharmacies segment dominated the U.S. diabetes devices market with a share of over 50% in 2024 owing to high footfall and availability of products.

b. Some key players operating in the U.S. diabetes devices market include Abbott Laboratories; F.Hoffmann-La-Ltd.; Bayer AG; Lifescan, Inc.; B Braun Melsungen AG; Lifescan, Inc.; Dexcom Inc.; Insulet Corporation; Ypsomed Holdings; Companion Medical; Sanofi; Valeritas Holding Inc.; Novo Nordisk; and Arkray, Inc.

b. Key factors that are driving the market growth include its well-established healthcare sector, the increasing prevalence of obesity, and the high cost of treatment, along with technological advancements and new product launches.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.