- Home

- »

- IT Services & Applications

- »

-

U.S. Digital Marketing Software Market Size Report, 2030GVR Report cover

![U.S. Digital Marketing Software Market Size, Share & Trends Report]()

U.S. Digital Marketing Software Market (2023 - 2030) Size, Share & Trends Analysis Report By Solution, By Service, By Deployment, By Enterprise Size, By End-use, And Segment Forecasts

- Report ID: GVR-4-68039-931-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

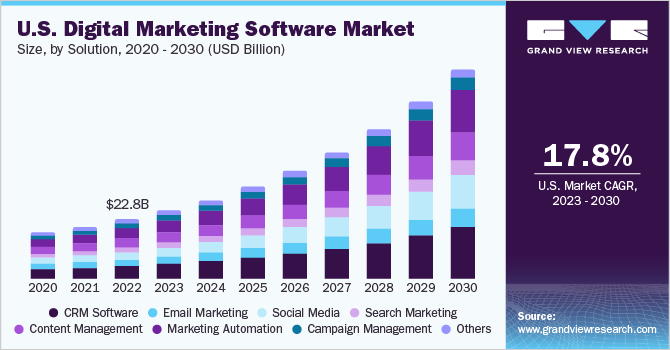

The U.S. digital marketing software market size was estimated at USD 22.78 billion in 2022 and is expected to grow a compound annual growth rate (CAGR) of 17.8% from 2023 to 2030. The industry is expanding due to the rising demand for mobile devices and the ongoing shift from desktop computers to smartphones. As smartphone usage rises and high-speed mobile networks spread out, advertisers increasingly resort to mobile advertising. With the rise of online shopping and customers completing research on existing reviews before purchasing, digital marketing has increasingly become the country's most reliable form of mass communication. In the U.S., digital marketing has emerged as a burgeoning, fast-paced sector.

In many end-use sectors and industry verticals, particularly SMEs, the market has developed over time in response to incumbents' technological improvements and changing needs. Several businesses are forming strategic partnerships with end-users to help them better their digital marketing efforts. For instance, in July 2023, Manta, a digital comics platform, announced the launch of a new Business Management Software service to manage and streamline business operations for small enterprises. The service offers features including online scheduling, automated marketing, billing & payments, and Customer Relationship Management (CRM).

Digital marketing software is leveraging Artificial Intelligence (AI) and Machine Learning (ML) to automate crucial tasks such as customer segmentation, content personalization, and online advertising. This intelligent automation streamlines processes such as data collection and analysis, boosts accuracy, and allows marketers to focus on activities such as e-mail and social media marketing. For instance, in May 2023, WPP plc partnered with NVIDIA Corporation, a technology company,to develop an AI-powered generative content engine for online advertising. The content engine connects with manufacturing, 3D designs, and supply chain tools, enabling artists and designers of WPP plc to integrate 3D content with generative AI.

The COVID-19 pandemic, which prompted a fundamental shift in how people use various apps, positively impacted the U.S. digital marketing software market. The fast-paced technological developments during the pandemic and businesses' dynamic attempts to keep their systems up-to-date on the latest technology to stay ahead of market competitors. Marketing automation software is projected to increase in popularity to facilitate tasks like team communication and lead nurturing to grow a business. As a result, app developers have reviewed their advertising settings during the pandemic and the subsequent economic collapse and improved their abilities to urge further accountability and clarity with clients.

Apart from security and privacy concerns about confidential data that can hamper the digital marketing software market, integration is one factor that characterizes the software's clients and users. The buyer's decision is heavily influenced by the software's ability to integrate with their applications. This connectivity allowed marketers to track customer behavior across several channels and databases. However, key market players such as Oracle Corporation; Salesforce, Inc.; and International Business Machines Corporation are pursuing an organic strategy of acquiring marketing technology startups to create rival all-in-one marketing solutions. As a result, despite suppliers' best efforts, this issue poses a barrier to the industry.

Solution Insights

The CRM software segment accounted for the largest revenue share of over 21% in 2022. The demand for data-driven insights, which provide improved functionality beyond their conventional roles of activity tracking, information gathering, and passive data repository generation, drives the segment’s growth. Small and medium-sized businesses are increasingly demanding these solutions. CRM software based on Software-as-a-Service (SaaS) and on-demand models is projected to give potential growth opportunities in the U.S. market. For instance, in June 2022, Salesforce.com, Inc. announced the launch of Customer 360 innovations that integrate marketing, sales, and service data on a single platform to enable businesses to connect, automate, and customize every interaction and establish reliable relationships at scale.

Social media is expected to grow significantly during the forecast period. Every day, the average American interacts with their phone approximately 2,600 times. Swipes, clicks, and taps on social media sites such as Facebook, TikTok, and Instagram account for more than half of swipes, clicks, and taps. Consumers spend a lot of time online, and with so many items available at the touch of a button, there is a lot of demand for social media software. Furthermore, social media and digital marketing demand have increased as artificial intelligence and data-driven marketing expand.

Service Insights

The professional services segment accounted for the largest market share of over 66% in 2022. Professional services are predicted to rise as the demand for trained and accomplished individuals with knowledge in managing, installing, and debugging software grows. Professional services help businesses make better use of their resources, cut down on administrative costs, and increase profits. Professional services also assist businesses in improving resource management by increasing efficiency through enhanced collaboration, integrated knowledge management, and better planning, resulting in the professional services segment's continued expansion.

The managed services segment is anticipated to register significant growth over the forecast period. Emerging technologies like the Internet of Things (IoT), artificial intelligence, and even drones are opening new revenue streams for the managed services segment. There are also challenges, including security threats and persistent concerns about commoditization and margin erosion. Managed IoT is gaining popularity among the newer options. More than half of managed IoT has experienced significant revenue potential in the past few years, which indicates they're generating steady sales and thus, creating growth opportunities for the segment.

Deployment Insights

The cloud segment accounted for the largest revenue share of over 67% in 2022. The versatility of cloud-based deployment of digital marketing software is increased, allowing businesses to tailor products and services on a wide scale. Due to the cloud-based deployment approach, users can access the software from anywhere on any device, including personal PCs, laptops, cell phones, and tablets. When compared to on-premises implementation, the cloud-based deployment strategy offers more flexibility. As a result, cloud-based digital marketing solutions are progressively being adopted by numerous industries, including BFSI, healthcare and life sciences, government, and telecom, among others.

The on-premise deployment segment is expected to register considerable growth over the forecast period. Due to the security benefits, many firms still prefer the on-premise deployment model. End-users in highly regulated areas, such as healthcare and financial services, are more likely to choose an on-premise deployment approach, fueling the on-premise segment's development. The market vendors are now focusing on integrating an on-premise data center with a cloud. For instance, SAS Customer Intelligence 360 Engage offers SAS 360 Engage Direct, which is the platform's direct marketing or database marketing component. Engage Direct connects on-premises consumer data and traditional marketing procedures to online, digital marketing campaigns. Moreover, cloud-specific technologies are hosted on-premises in a data center with many commodity machines running identical system software in a private cloud.

Enterprise Size Insights

The large enterprises segment accounted for the largest revenue share of over 56% in 2022. Large companies use digital marketing to differentiate themselves from the competition. As these organizations have established brand awareness and want to persuade potential customers to convert, large firms want to employ digital marketing to stand out from the competition. Digital marketing software links businesses with their potential customers on social media through social media marketing and email marketing. Large firms in the U.S. increasingly use digital marketing software to handle their vast client databases efficiently, which is expected to fuel demand for the market in the large enterprises sector.

The small and medium enterprises (SMEs) segment is anticipated to register significant growth over the forecast period. SMEs use the digital marketing solution to extend their customer base at a minimal cost, enhance conversion rates, and increase ROI from digital advertising. Since they attempt to break into competitive marketplaces, SMEs employ digital marketing to increase brand awareness. For instance, in May 2023, Mastercard announced updates to the Digital Doors service program, a marketing hub platform. The upgraded platform would assist small businesses in enhancing their online presence and digital marketing capabilities.

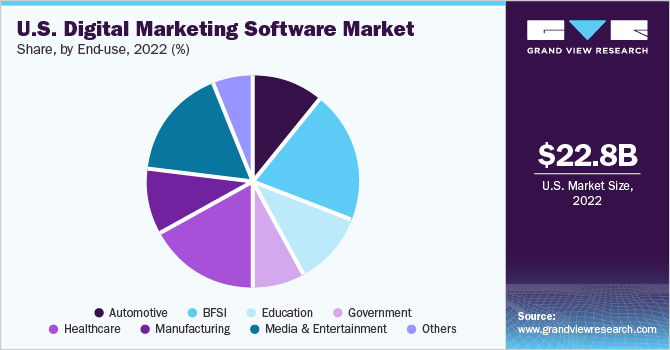

End-use Insights

The BFSI segment accounted for the largest revenue share of over 19% in 2022. The BFSI sector is attracting younger, harder-to-reach consumers through digital marketing platforms, which can help raise brand awareness and promote financial education. The demand for digital marketing software has increased as banks and credit unions are using such software to explore new markets, raise awareness, and reinforce corporate culture messaging. For instance, in April 2023, Pulsate announced the integration with the digital banking platform of Q2 Holdings, Inc. The Pulsate platform enables community banks and credit unions to strengthen member engagement and expand wallet share through mobile channels.

Media and entertainment will continue to evolve quickly in reaction to industry-wide changes and pandemic-driven demographic shifts. As part of their efforts to cash in on the ubiquity of smartphones and the continuous installation of high-speed data networks, media & entertainment corporations are now focusing on establishing online advertising techniques. The sector is adopting digital marketing software to increase interaction which has increased connection with the audience and has reduced various administrative costs compared to traditional marketing methods. Digital marketing software has helped businesses enhance content, video marketing, and other essential details that have helped increase profits for organizations; thus, the country's demand for digital marketing has increased.

Key Companies & Market Share Insights

Several market players are active in the market, including both established players with worldwide operations and regional and local market players catering to a limited number of clients. Hence, the U.S. digital marketing software industry can be described as a highly fragmented market characterized by intense competitive rivalry. In response to the intensifying competition, some players are upgrading their existing products and launching new products. For instance, in June 2023, The Trade Desk, an advertising technology provider, announced the launch of Kokai, a media buying platform. Kokai will incorporate advances in partner integration, distributed AI, user experience, and measurement.

Market incumbents are tweaking their business strategies in line with the proliferation of smartphones and the growing preference for personalized advertising. They are also pursuing various initiatives, such as strategic partnerships and acquisitions, to remain competitive in the market. For instance, in June 2023, Harris, a marketing software provider, acquired Questline Digital, a content marketing agency to offer digital marketing solutions for utility profiles. Some prominent players in the U.S. digital marketing software market include:

-

Adobe, Inc.

-

Hewlett Packard Enterprise Company

-

Hibu Inc.

-

Hubspot, Inc.

-

International Business Machines Corporation

-

Marketo, Inc.

-

Microsoft Corporation

-

Oracle Corporation

-

Salesforce.com, Inc.

-

SAS Institute, Inc.

U.S. Digital Marketing Software Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 82.62 billion

Growth rate

CAGR of 17.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, service, deployment, enterprise size, end-use

Country scope

U.S.

Key companies profiled

Adobe, Inc.; Hewlett Packard Enterprise Company; Hubspot, Inc.; International Business Machines Corporation; Marketo, Inc.; Microsoft Corporation; Oracle Corporation; Salesforce.com, Inc.; Hibu Inc.and SAS Institute, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Digital Marketing Software Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. digital marketing software market report based on solution, service, deployment, enterprise size, and end-use:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

CRM Software

-

Email Marketing

-

Social Media

-

Search Marketing

-

Content Management

-

Marketing Automation

-

Campaign Management

-

Others

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Professional Services

-

Managed Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

BFSI

-

Education

-

Government

-

Healthcare

-

Manufacturing

-

Media & Entertainment

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. digital marketing software market size was estimated at USD 22.78 billion in 2022.

b. The U.S. digital marketing software market is expected to grow at a compound annual growth rate of 17.8% from 2023 to 2030 to reach USD 82.62 billion by 2030.

b. The professional services segment accounted for the largest market share of over 66%% in 2022. Professional services are predicted to rise as the demand for trained and accomplished individuals with knowledge in managing, installing, and debugging software grows.

b. Some key players operating in the U.S. digital marketing software market include Adobe, Inc.; Hewlett Packard Enterprise Company; Hubspot, Inc.; International Business Machines Corporation; Marketo, Inc.; Microsoft Corporation; Oracle Corporation; Salesforce.com, Inc.; Hibu Inc. and SAS Institute, Inc.

b. Key factors that are driving the U.S. digital marketing software market growth include technological advancements and the changing needs of end-user industries and industry verticals, particularly SMEs, the digital marketing software market has been expanding. The rapid growth of cloud computing platforms in the region is also expected to boost the usage of content management, marketing automation, and CRM solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.