- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Electric Vehicle Plastics Market, Industry Report, 2030GVR Report cover

![U.S. Electric Vehicle Plastics Market Size, Share & Trends Report]()

U.S. Electric Vehicle Plastics Market (2024 - 2030) Size, Share & Trends Analysis Report By Resin (PP, PU), By Application (Interior, Exterior), By Vehicle Type (BEV, HEV/PHEV), By Components (Battery, Bumper), And Segment Forecasts

- Report ID: GVR-4-68040-226-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Electric Vehicle Plastics Market Trends

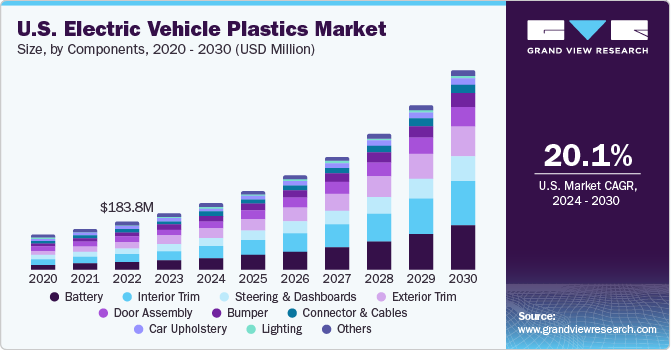

The U.S. electric vehicle plastics market size was estimated at USD 216.22 million in 2023 and is anticipated to grow at a CAGR of 20.1% from 2024 to 2030. The increasing demand for lightweight vehicles is the major driving factor for the market. The automotive industry has undergone significant transformations, with a growing emphasis on reducing the weight of vehicles to enhance fuel efficiency. Plastics play a pivotal role in this evolving trend, offering substantial weight reduction possibilities.The impact of using thermoset polyurethane for automotive component manufacturing was evidently observable as it decreased the overall weight of an automobile to a great extent (by almost 40%).

A lighter vehicle structure serves as a strategic advantage for accommodating technologies for electric automobiles which rely on hefty batteries. Thus, weight reduction is anticipated to play a pivotal role in meeting the stipulated regulations set by the government towards reducing the weight of vehicles and lowering the energy consumptions. In addition, reduced weight helps improve the battery life of electric vehicles (EVs) over the life cycle of the vehicle. Reduction in weight helps boost the overall performance of the vehicle as well in terms of acceleration and handling. Reduction in mass at unhinged points facilitates reduction in noise and vibration, thus contributing to a smoother ride.

EV manufacturers are mainly focusing on components, which are manufactured from various types of thermoplastic elastomers in order to enhance the performance of electric vehicles and follow the trend of lightweight vehicles.Plastics include polymers such as polypropylene, polyurethane, and polyamides. An added advantage of plastics is the property of binding. Plastic parts can be bound together, unlike metals, which require welding. Welding joints contribute to the overall weight of an automobile, whereas reduction in the number of joints helps reduce the weight of an automobile.

Another reason behind rising demand for global vehicle plastics market is the high cost of automotive metals including magnesium & aluminum. Hence, the use of plastics as replacement of metals in certain automotive components is increasing. Vehicles make use of various plastics such as polyurethane, polypropylene, acrylonitrile butadiene styrene (ABS), polyvinyl chloride (PVC), polymethyl methacrylate (PMMA), polycarbonate, polyamides and others. These materials possess different physical properties that lead to lightweight of the vehicles. For example, polypropylene is highly resistant to chemicals and almost completely impervious to water. These features make them suitable to manufacture automotive bumpers, cable insulation, battery boxes, indoor and outdoor carpets and others. The same features are also of use in the manufacture of chemical tanks, bottles, non-automotive carpets, liners, insulation and other such applications. This diversification of electric vehicle plastics provides a new source of revenue for automotive plastic manufacturers and the market could expand further into other manufacturing disciplines.

Market Characteristics & Concentration

The market is moderately consolidated. In the present market scenario, a few multinational companies are catering to all the demands of electric vehicle plastics in the U.S. The market is capital intensive and raw material procurement is a critical challenge. The market is also fairly regulated with stringent norms in terms of product composition and specification.

The innovation in the market is moderate. For instance, in March 2023, BASF entered into a strategic cooperation agreement with Zhejiang REEF Technology Co., Ltd., aiming to pioneer cutting-edge recyclate formulations tailored for applications within the automotive, packaging, and consumer sectors. As per the agreement, BASF is set to provide its recently launched IrgaCycle additive solutions with technical consultation and support for developing recycled polymer formulations at BASF's testing facilities. Through the pooling of resources and knowledge, this partnership will be a catalyst for innovation.

The impact of regulation is moderate to high. The stringent guidelines imposed by REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) on the production of petrochemicals, integral to the manufacturing of plastics, entail a thorough risk assessment within the framework of Council Regulation (EEC) No.793/93 on Existing Substances. This factor poses constraint on the market and have the potential to impede its growth.

The threat of substitute is low to moderate. The most common substitute materials for automotive plastics are natural and synthetic rubbers and their respective hybrid of rubber and plastics such as copolymers. These materials have made inroads into the electric vehicle plastics market and are thriving owing to their versatility and slightly better properties.

Resin Insights

Polyurethane (PU) segment dominated the market with a revenue share of over 29% in 2023.Owing to its ability to infuse the characteristics of both plastics and rubber at a lower weight compared to metal & other plastic materials, the demand of this segment is propelling. Increasing product demand from electric vehicle industry for use in refrigeration insulation, interior trims, and seat cushioning has greatly influenced the segment growth over the past few years and is expected to continue over the forecast period. It used for manufacturing various automotive components, such as bumpers, interior trims, and seals. Furthermore, PU offers lightweight durability, excellent resistance to abrasion, and enhanced flexibility to the end product. Its ability to be molded into intricate shapes, coupled with superior insulation properties, makes it an ideal choice for the latest requirements of the market. Furthermore, the growing emphasis on light weight vehicles has led to an increased adoption of lightweight materials like PU.

Polypropylene (PP) segment is expected witness the fastest growth during the forecast period. PP offers excellent chemical and electrical resistance at very high temperatures thus, making it an ideal choice for the electric vehicles. It is semi-rigid, translucent, and provides integral hinge property. It is also quite light weighted as compared to other plastics further reducing the overall weight of vehicles, which, in turn, helps reduce tire wear & tear and energy consumptions. PP LGF 30 Y have excellent resistance to heat aging, chemical coupling, low warp, high strength and creep & fatigue resistance for a longer duration. Thus, owing to their lightweight and better aesthetic value, LGF composites are commonly used as alternatives to traditional reinforced thermoplastics and metals for a variety of automotive applications such as wheel covers, battery holders, engine insulation, electronic accelerator pedals, gear shift sticks, and instrument panels.

Components Insights

The batteries segment dominated the market with the largest revenue share in 2023. The segment is also expected to witness the fastest CAGR of 25.1% during the forecast period. According to a Reuters’ survey, the global automotive industry will have invested around USD 1.2 trillion in projects connected to EVs by 2030, marking the beginning of a revolutionary period in the sector and the U.S. emerges as a focal point with more than 10% of these investments. The U.S. is expected to play a crucial role in the global electric vehicle industry due to its commitment to a substantial battery production capacity, which is expected to support the assembly of 13 million electric vehicles by 2030. As the U.S. positions itself to lead in battery production, the electric vehicle plastics market is positioned for a comparable surge in demand in the country. Strong and lightweight automotive plastics play a crucial role in the development and production of electric vehicles, enhancing both their overall performance and energy efficiency.

The International Energy Agency has forecasted that EV sales globally is estimated at 60% of the total vehicles sold by 2030. This underscores the expanding market for electric vehicles. This surge in EV adoption, coupled with the U.S. becoming a prominent player in battery production, amplifies the importance of the electric vehicle plastics industry in providing innovative solutions to meet the evolving needs of the electric vehicle market. The automotive plastics market and the rapidly growing electric vehicle sector have a mutually beneficial relationship that highlights their collaborative contribution to leading the automotive sector toward an electrified and sustainable future.

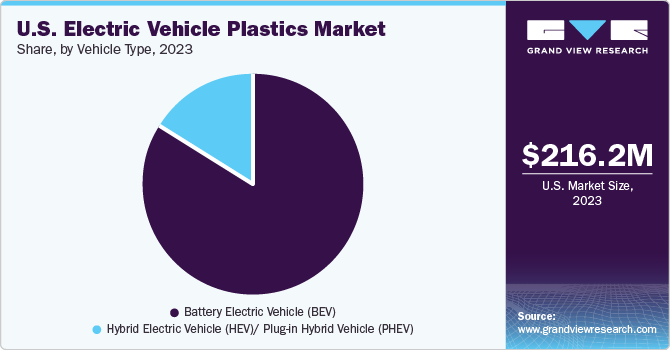

Vehicle Type Insights

The battery electric vehicle (BEV) segment dominated the market with a revenue share of 84% in 2023. It is also anticipated to be the fastest growing segment. Rising awareness among the general public about the benefits of battery-powered vehicles and rising fossil fuel prices, especially in the U.S., are expected to aid the growth of the BEVs segment over the forecast period further boosting the U.S. market for electric vehicle plastics. Another reason for this high demand of plastic in the BEV segment can be attributed to the stringent government regulations towards the reduction of CO2 emissions and aiding the adoption of electric vehicles. BEVs are expected to significantly lower vehicular emissions and reduce the cost of owning the vehicle in the long run.

The proliferation of EVs has increased reliance on plastics in the automotive industry. This is due to the fact that EV batteries are significantly heavier than their internal combustion engine counterparts, necessitating the use of plastic in various vehicle components, such as the chassis and battery casings to offset the additional battery weight.

Application Insights

The exterior furnishing segment dominated the market with a revenue share of 32% in 2023. Exterior efficiency represent a crucial aspect where plastics, such as polycarbonate and polypropylene, play a significant role in improving the visual appeal and functionality of vehicles. Plastics offer a lightweight alternative to traditional materials, such as metals, contributing to improved overall vehicle performance. From sleek body panels to durable bumpers, plastics are pivotal in creating exterior components that not only enhance the aesthetic appeal of automobiles but also provide crucial impact resistance and durability in various weather conditions. The versatility of plastics allows for innovative designs and intricate detailing in exterior furnishings, contributing to the dynamic and ever-evolving landscape of automotive aesthetics.

The interior furnishing segment is anticipated to grow at the fastest CAGR of 22.9% during the forecast period. Electric vehicle plastics find extensive use in car interiors, encompassing body and light panels, seat covers, steering wheels, and fascia systems. High-performance plastics like GMT and ABS composites are increasingly replacing traditional rubber, metal, and other materials in the construction of internal components such as load floors, seat bases, rear package shelves, and headliners. Plastics help in producing robust, comfortable, and visually pleasing components, simultaneously reducing noise, minimizing harshness, and dampening vibrations. Design flexibility enables the fabrication of integral, inventive, single-piece lightweight parts, resulting in cost and lead time reductions, while also addressing issues linked to vehicle redesign.

Key U.S. Electric Vehicle Plastics Company Insights

Manufacturers of electric vehicle plastics aim to achieve optimum business growth and strong market positioning through production capacity expansions, development of production technologies, acquisitions, collaborations & partnerships, and investments in research & development. The manufacturers compete on the grounds of manufacturing better products with respect to their competitors and developing technologies used for the manufacturing of electric vehicle plastics. Furthermore, the shift of the automotive industry toward the manufacturing of electric vehicles by using low-weight components such as thermoplastics and thermoplastic composites to improve efficiency is anticipated to create more opportunities for the manufacturers.

Key U.S. Electric Vehicle Plastics Companies:

- BASF

- SABIC

- LyondellBasell Industries Holdings B.V.

- Evonik Industries

- Covestro AG

- Dupont

- LANXESS

U.S. Electric Vehicle Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 255.70 million

Revenue forecast in 2030

USD 766.49 million

Growth Rate

CAGR of 20.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kiloton; revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Resin, component, vehicle type, application

Country scope

U.S.

Key companies profiled

BASF; SABIC; LyondellBasell Industries Holdings B.V.; Evonik Industries; Covestro AG; Dupont; LANXESS

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Electric Vehicle Plastics Market Report Segmentation

This report forecasts volume & revenue growth at country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the electric vehicle plastics market report based on resin, components, vehicle type, and application:

-

Resin Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polypropylene (PP)

-

Polyamide (PA)

-

Polycarbonate (PC)

-

Polyethylene (PE)

-

Polyurethane (PU)

-

Polyvinyl Chloride (PVC)

-

Polyvinyl Butyral (PVB)

-

Polybutylene Terephthalate (PBT)

-

Acrylonitrile Butadiene Styrene (ABS)

-

Polyethylene Terephthalate (PET)

-

Others

-

-

Components Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Steering & Dashboards

-

Car Upholstery

-

Bumper

-

Door Assembly

-

Exterior Trim

-

Interior Trim

-

Connector and Cables

-

Battery

-

Lighting

-

Electric Wiring

-

Others

-

-

Vehicle Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Battery Electric Vehicle (BEV)

-

Hybrid Electric Vehicle (HEV)/ Plug-in Hybrid Vehicle (PHEV)

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Interior

-

Exterior

-

Powertrain System/Under Bonnet

-

Lighting & Electric Wiring

-

Frequently Asked Questions About This Report

b. The U.S. electric vehicle plastics market was valued at USD 216.22 million in the year 2023 and is expected to reach USD 255.70 million in 2024.

b. The U.S. electric vehicle plastics market is expected to grow at a compound annual growth rate of 20.1% from 2024 to 2030 to reach USD 766.49 million by 2030.

b. The BEVs segmented accounted for the largest revenue share of over 84% in 2023 owing to the high demand for battery operated electric vehicles in the market.

b. The key market player in the U.S. electric vehicle plastics market includes BASF; SABIC; LyondellBasell Industries Holdings B.V.; Evonik Industries; Covestro AG; Dupont; and LANXESS.

b. The key factors that are driving the U.S. electric vehicle plastics market include, shift towards light weight vehicles, conscious choice of EVs over ICE and the presence of stringent environmental regulations in the U.S.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.