- Home

- »

- Power Generation & Storage

- »

-

U.S. Energy Transition Market Size, Industry Report, 2033GVR Report cover

![U.S. Energy Transition Market Size, Share & Trends Report]()

U.S. Energy Transition Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Renewable Energy, Electrification, Energy Efficiency), By Sector (Power & Utility, Transportation), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-661-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Energy Transition Market Summary

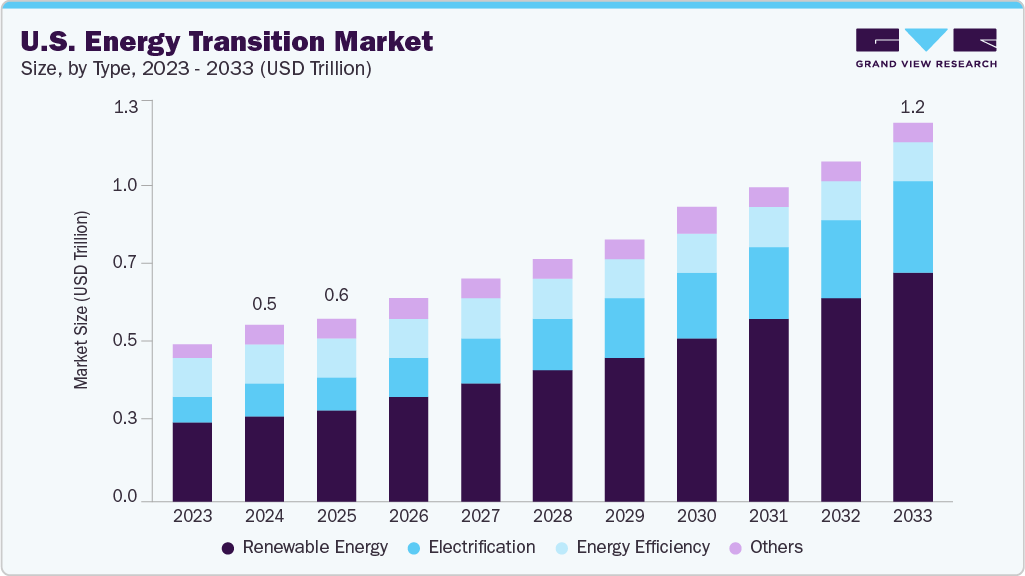

The U.S. energy transition market size was estimated at USD 0.52 trillion in 2024 and is projected to reach USD 1.18 trillion by 2033, growing at a CAGR of 10.1% from 2025 to 2033. The market reflects the nation’s ongoing shift from fossil fuel-based systems to cleaner, more sustainable energy sources.

Key Market Trends & Insights

- The energy transition market in the U.S. is expected to grow significantly over the forecast period.

- By type, the renewable energy segment held the highest revenue share of 49.65% in 2024.

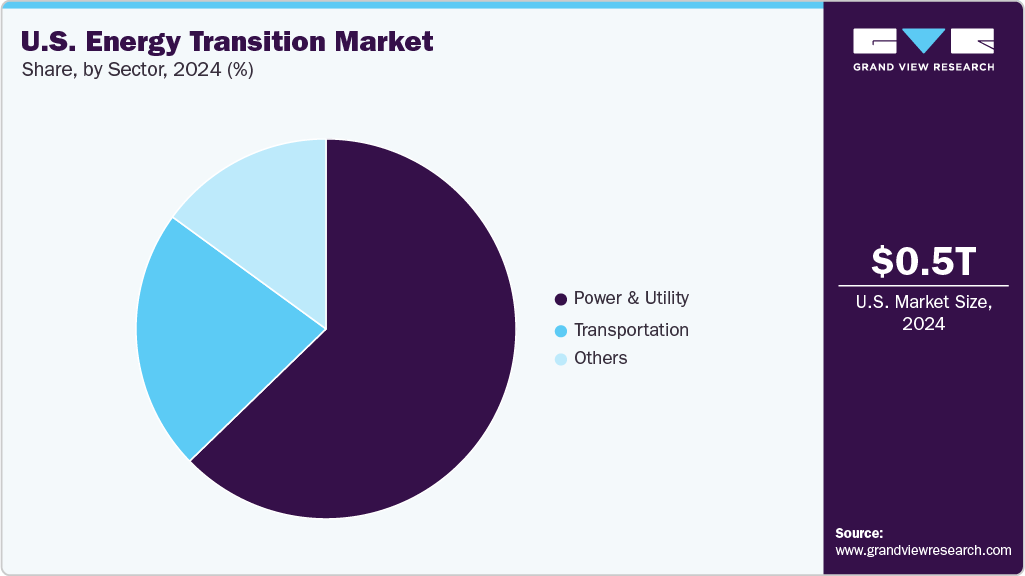

- By sector, the power & utility segment held the highest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 0.52 Trillion

- 2033 Projected Market Size: USD 1.18 Trillion

- CAGR (2025-2033): 10.1%

Key drivers include federal decarbonization targets, the Inflation Reduction Act (IRA), and growing investor and consumer demand for green energy. Utility-scale solar and wind installations, grid modernization programs, and electric vehicle (EV) infrastructure deployment are accelerating the domestic transition. In addition, state-level mandates, tax incentives, and carbon-reduction initiatives create a supportive environment for clean energy investment and adoption.

The U.S. energy transition market spans sectors such as power generation, transportation, manufacturing, and buildings, with growing adoption of renewables, battery storage, hydrogen, and carbon capture solutions. Although fossil fuels still account for a significant share of energy supply, market momentum is shifting due to climate resilience efforts and the pursuit of energy independence. Key regions, including California, Texas, and the Northeast, are leading with aggressive clean energy goals and infrastructure buildouts. With active participation from federal agencies, utilities, startups, and industrial players, the U.S. is becoming a central player in advancing energy innovation and decarbonization. The combination of policy support, financial incentives, and market readiness positions the U.S. energy transition market for sustained growth over the coming decade.

Drivers, Opportunities & Restraints

The U.S. energy transition market is primarily driven by the nation’s commitment to achieving net-zero emissions, reducing reliance on imported fossil fuels, and adhering to climate goals under international and federal frameworks. The Inflation Reduction Act and state-level clean energy mandates are accelerating the adoption of technologies such as utility-scale solar, onshore and offshore wind, battery storage, and green hydrogen. Public and private investments in clean infrastructure, coupled with national grid resilience initiatives and the electrification of vehicles, buildings, and industrial operations, significantly boost market growth across the country.

Opportunities continue to expand as the U.S. integrates advanced digital grid systems, vehicle-to-grid (V2G) solutions, and scalable energy storage to enhance system flexibility and efficiency. The growth of community solar programs, distributed energy resources (DERs), and energy-as-a-service (EaaS) models are reshaping how energy is produced and consumed. Additionally, increasing corporate procurement of renewable energy and rising demand for localized energy generation present further potential for market penetration. However, the transition also faces challenges, including aging grid infrastructure, regional disparities in policy and incentive frameworks, and the intermittency of renewables. High capital expenditure for grid upgrades and slow permitting processes for clean energy projects continue to pose barriers to rapid nationwide deployment.

Type Insights

The renewable energy sub-segment led the U.S. energy transition market with a revenue share of over 49.65% in 2024. It is expected to retain its position as the largest contributor through 2033. Renewable energy has become the foundation of clean energy deployment across power generation, transportation, and buildings as the U.S. accelerates toward national decarbonization goals. Utility-scale solar and wind farms and expanding hydropower and bioenergy projects are replacing aging fossil fuel assets and driving emissions reductions while enhancing energy security and grid resilience.

Renewable energy delivers zero-carbon electricity and enables deep electrification across other sectors. Integrating renewables with energy storage, digital controls, and distributed generation platforms supports real-time grid balancing and broader system optimization. Federal and state policies-such as investment tax credits (ITC), renewable portfolio standards, and incentives under the Inflation Reduction Act-are accelerating deployment across the country. Public and private sector investments in clean energy infrastructure, community solar, and green hydrogen production further expand the segment. As costs continue to fall and technologies improve, renewable energy is poised to play a central role in helping the U.S. meet its long-term climate goals, modernize the power grid, and ensure affordable, sustainable energy access nationwide.

Sector Insights

The power & utility sub-segment accounted for the largest revenue share of approximately 62.76% in 2024 within the U.S. energy transition market. This leadership is fueled by substantial federal and state-level investments in renewable generation capacity, transmission upgrades, and emissions reduction initiatives led by major utility companies. Across the U.S., utilities are spearheading the transition by replacing coal and natural gas facilities with solar farms, wind projects, and utility-scale battery storage. These shifts are supported by decarbonization mandates, Renewable Portfolio Standards (RPS), and integrated resource planning that prioritize low-carbon infrastructure.

Looking ahead, the power & utility segment is expected to witness sustained growth, driven by favorable tax incentives, declining costs of solar PV, wind turbines, and energy storage technologies, along with multi-decade power purchase agreements (PPAs). Federal programs under the Infrastructure Investment and Jobs Act and the Inflation Reduction Act are accelerating transmission grid modernization, interconnection capacity, and resilience against extreme weather events. While intermittency and grid congestion remain pressing, utilities increasingly adopt advanced demand response tools, smart grid networks, and hybrid renewable systems to ensure stability and flexibility. Although other sectors like transportation and industry are also undergoing electrification, the utility sector will continue to anchor the U.S. energy transition by enabling large-scale renewable integration and supporting national clean energy objectives.

Key U.S. Energy Transition Company Insights

Some key players operating in the U.S. energy transition market include NextEra Energy, Inc., Tesla, Inc., First Solar, Inc., Enphase Energy, Inc., and Fluence Energy, Inc., among others. These companies are at the forefront of deploying clean technologies across solar, wind, battery storage, and electric mobility to support the nation’s shift toward a low-carbon economy.

Key U.S. Energy Transition Companies:

- NextEra Energy, Inc.

- Tesla, Inc.

- First Solar, Inc.

- Enphase Energy, Inc.

- Fluence Energy, Inc.

- Plug Power Inc.

- Air Products & Chemicals, Inc.

- GE Vernova

- Constellation Energy

- Brookfield Renewable Partners

Recent Developments

-

In March 2025, NextEra Energy, Inc. announced a USD 2 trillion investment to expand its renewable energy and battery storage portfolio across the United States. The initiative includes the development of new utility-scale solar farms in Texas and Florida, as well as the deployment of advanced energy storage systems to enhance grid reliability. This strategic move aligns with the company's commitment to decarbonization and accelerating the nation's shift toward clean electricity, while supporting growing demand from utilities and corporate buyers for sustainable, cost-effective power solutions.

U.S. Energy Transition Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 0.56 trillion

Revenue forecast in 2033

USD 1.18 trillion

Growth rate

CAGR of 10.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD trillion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, sector, region

Country scope

U.S.

Key companies profiled

NextEra Energy, Inc.; Tesla, Inc.; First Solar, Inc.; Enphase Energy, Inc.; Fluence Energy, Inc.; Plug Power Inc.; Air Products & Chemicals, Inc.; General Electric Company (GE Vernova); Constellation Energy; Brookfield Renewable Partners

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Energy Transition Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. energy transition market report based on the type, sector and country:

-

Type Outlook (Revenue, USD Trillion, 2021 - 2033)

-

Renewable Energy

-

Electrification

-

Energy Efficiency

-

Others

-

-

Sector Outlook (Revenue, USD Trillion, 2021 - 2033)

-

Power & Utility

-

Transportation

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. energy transition market size was estimated at USD 0.52 trillion in 2024 and is expected to reach USD 0.56 trillion in 2025.

b. The U.S. energy transition market is expected to grow at a compound annual growth rate of 10.1% from 2025 to 2033 to reach USD 1.18 trillion by 2033.

b. Based on the type segment, Renewable Energy held the largest revenue share of more than 49.65% in 2024.

b. Some of the key players in the U.S. Energy Transition market include NextEra Energy, Inc., Tesla, Inc., First Solar, Inc., Enphase Energy, Inc., and Fluence Energy, Inc., among others.

b. The key factors driving the U.S. Energy Transition market include ambitious climate targets, growing private sector participation, and advancements in clean energy technologies. The push for net-zero emissions by 2050 is prompting utilities, states, and industries to scale renewable energy, electrify end-use sectors, and modernize energy infrastructure.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.