- Home

- »

- Next Generation Technologies

- »

-

U.S. Engineering Services Outsourcing Market Report, 2030GVR Report cover

![U.S. Engineering Services Outsourcing Market Size, Share & Trends Report]()

U.S. Engineering Services Outsourcing Market (2025 - 2030) Size, Share & Trends Analysis Report By Services (Testing, Designing, Prototyping, System Integration), By Location, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-312-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

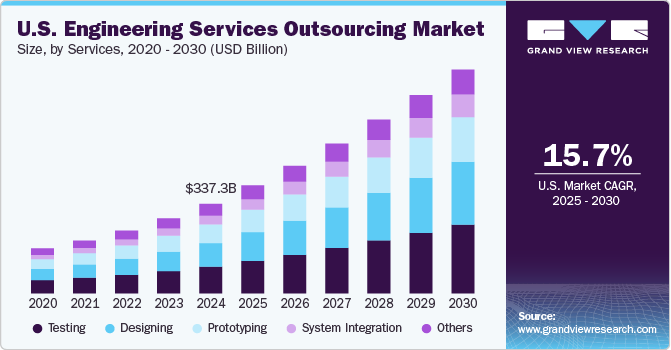

The U.S. engineering services outsourcing market size is estimated at USD 337.28 billion in 2024 and is expected to grow at a CAGR of 15.7% from 2025 to 2030. The market growth can be attributed to several factors, including the increasing complexity of engineering projects that necessitate specialized expertise and advanced technological capabilities. In addition, the demand for cost reduction and operational efficiency is driving businesses to seek external partners who can provide high-quality engineering services at competitive prices, which is further driving the engineering services outsourcing industry growth.

Cost reduction and efficiency gains are significant drivers fueling the market growth. One of the primary reasons for this growth is the ability of ESO to reduce operational costs. By outsourcing engineering services, companies can leverage labor cost arbitrage, particularly by partnering with providers in regions such as India, the Philippines, or Eastern Europe, where engineering talent is available at lower costs. In addition, ESO eliminates the need for companies to invest in costly infrastructure such as advanced software, tools, and research facilities. This reduction in overhead allows organizations to reallocate budgets to other strategic areas, which is further propelling the engineering services outsourcing industry expansion.

Moreover, the growing adoption of Artificial Intelligence (AI), the Internet of Things (IoT), and Digital Twins is driving the U.S. engineering services outsourcing industry growth. These technologies have transformed traditional engineering processes, enabling more accurate simulations, predictive maintenance, and real-time monitoring. ESO providers are often at the forefront of these innovations, investing heavily in advanced software and tools. For instance, Digital Twin technology allows companies to create virtual replicas of physical systems, enabling them to optimize performance and identify potential issues before deployment. By outsourcing these capabilities, businesses gain access to state-of-the-art tools without incurring the high costs of in-house development, thereby driving market growth.

Furthermore, the adoption of Industry 4.0 technologies is significantly driving the growth of the U.S. Engineering Services Outsourcing (ESO) industry. Industry 4.0, often referred to as the Fourth Industrial Revolution, incorporates advanced technologies such as automation, artificial intelligence (AI), the Internet of Things (IoT), digital twins, and big data analytics into industrial processes. This shift is transforming the engineering landscape, creating a surge in demand for specialized expertise that ESO providers are uniquely positioned to deliver.

Moreover, automation and robotics are central to Industry 4.0, enabling businesses to increase productivity and reduce costs. The design, development, and deployment of robotic systems require specialized engineering services, from mechanical design to software programming and integration. ESO providers have the necessary expertise to deliver end-to-end solutions for automation projects, allowing companies to implement robotic systems more quickly and efficiently. This growing demand for robotics-related engineering services is further fueling the expansion of the U.S. engineering services outsourcing industry.

Services Insights

Based on services, the testing segment led the market with the largest revenue share of 29.96% in 2024. This dominance can be attributed to the increasing complexity of automotive systems and the need for rigorous testing to ensure safety, compliance, and performance standards. As vehicles integrate more advanced technologies, such as electric and autonomous features, the demand for specialized testing services has surged. Outsourcing these services allows manufacturers to leverage external expertise and resources, enhancing efficiency while managing costs effectively. The trend towards outsourcing also reflects a broader industry shift where companies focus on core competencies while relying on third-party providers for essential testing functions

The designing segment is expected to witness at the fastest CAGR of 17% from 2025 to 2030. This rapid growth is driven by several factors, including the increasing emphasis on innovative design solutions that cater to evolving consumer preferences and regulatory requirements. As automotive manufacturers strive to differentiate their products in a competitive market, there is a heightened focus on design capabilities that enhance functionality and aesthetics. Moreover, advancements in design technologies, such as computer-aided design (CAD) and simulation tools, are enabling faster and more efficient design processes. The growing trend towards electric vehicles (EVs) and smart mobility solutions further amplifies the need for innovative design approaches that integrate sustainability and user-centric features.

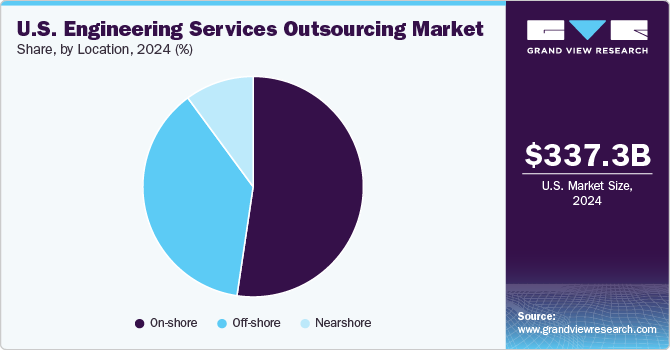

Location Insights

Based on location, the on-shore segment accounted for the largest market revenue share in 2024. The on-shore segment focuses on contracting engineering services to providers within the United States, instead of offshoring work to other countries. This market has grown significantly as businesses seek localized expertise, faster communication, and adherence to U.S. regulations and standards, particularly in high-tech, aerospace, automotive, healthcare, and energy industries. Industries such as healthcare, aerospace, and defense require strict compliance with U.S. standards such as FDA, FAA, and DoD.

The near shore segment is expected to witness at the fastest CAGR from 2025 to 2030. The near-shore U.S. engineering services outsourcing industry refers to outsourcing engineering services to neighboring or geographically close countries, such as Mexico, Canada, and some parts of Central and South America. This model combines the benefits of proximity with cost efficiencies, making it an attractive option for U.S. companies. Near-shore locations allow for quick site visits and in-person meetings, fostering stronger relationships.

Application Insights

Based on application, the aerospace segment accounted for the largest market revenue share in 2024, driven by increasing demand for advanced technologies, cost optimization, and the need for faster innovation. Aerospace projects involve significant research and development, which can be outsourced to reduce internal costs. Outsourcing engineering services to off-shore and near-shore locations such as India, and Mexico provides access to skilled talent at lower labor costs. There is a shortage of specialized aerospace engineers in the U.S., leading companies to outsource tasks such as structural analysis, avionics, and testing, which is further driving segmental growth.

The manufacturing segment is expected to register at the fastest CAGR from 2025 to 2030. The U.S. manufacturing sector is increasingly leveraging engineering outsourcing services to remain competitive, drive innovation, and address challenges such as labor shortages, rising costs, and the demand for digital transformation. Companies outsource engineering tasks to avoid the high costs of establishing in-house R&D teams and infrastructure. Specialized manufacturing sectors, such as medical devices, electronics, and industrial machinery, are increasingly outsourcing engineering services for compliance and innovation. Such trends are expected to support the growth of this segment.

Key U.S. Engineering Services Outsourcing Company Insights

Some of the key players operating in the market are Accenture, plc, and Siemens AG, among others.

-

Accenture plc is a global professional services company specializing in consulting, technology, and outsourcing. The company provides cutting-edge solutions across industries by leveraging advanced technologies such as artificial intelligence, cloud computing, and digital twin systems. Its ESO services focus on product design, development, testing, and system integration to help clients enhance efficiency and innovation while reducing operational costs.

-

Siemens AG is a global technology company specializing in electrification, automation, and digitalization across various industries. The company operates through several key business units, including Digital Industries, Smart Infrastructure, Mobility, and Siemens Healthineers, which offers medical technology and healthcare solutions.

Emerson Electric Co. and HCL Technologies Limited are some of the emerging participants in the U.S. engineering services outsourcing industry.

-

Emerson Electric Co. is a global technology and engineering company that was established as a manufacturer of electric motors and fans. The company delivers automation solutions, providing innovative products and services across various sectors, including industrial, commercial, and residential markets. The company specializes in measurement and analytical instrumentation, process control systems, and fluid control technologies, among others.

-

HCL Technologies Limited is a global IT services and consulting company that specializes in a wide range of services, including IT and business services, engineering and R&D services, and products and platforms, catering to diverse industries such as finance, healthcare, and telecommunications. The company has established a strong presence in over 60 countries, focusing on innovation and client-centric solutions to drive digital transformation and operational efficiency for its clients.

Key U.S. Engineering Services Outsourcing Companies:

- ABB Group

- Accenture plc

- Akka Technologies

- ALTEN Group

- Capgemini Engineering

- Cognizant Technology Solutions Corporation

- Emerson Electric Co.

- HCL Technologies Limited

- Hitachi Group

- Infosys Limited

- Siemens AG

- Tata Consultancy Services

- Wipro Limited

Recent Developments

-

In January 2025, Accenture plc announced the completion of its acquisition of AOX, a German company specializing in embedded software for automotive manufacturers and suppliers. This acquisition enhances Accenture's capabilities in addressing the challenges faced by automotive clients as they transition to software-defined vehicles. By integrating AOX's expertise in high-performance computing and real-time operating systems, Accenture aims to strengthen its software architecture and improve project execution across the entire product lifecycle.

-

In January 2025, ABB Group announced its acquisition of Sensorfact, a move aimed at enhancing its digital energy management capabilities. This acquisition will allow ABB to integrate Sensorfact's innovative solutions into its portfolio, thereby expanding its offerings in energy efficiency and sustainability.

-

In December 2024, HCL Technologies announced the acquisition of assets from HPE's Communications Technology Group. This acquisition will expand HCL's portfolio of service offerings, including Business Support Systems (BSS) and network applications, while integrating advanced technologies like AI and IoT into its services.

U.S. Engineering Services Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 407.42 billion

Revenue forecast in 2030

USD 843.97 billion

Growth rate

CAGR of 15.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, location, application

Key companies profiled

Axon Park; Immerse Inc.; Inspirit AI, Inc.; Talespin Reality Labs, Inc.; Ascent XR LLC; G-Cube; HoloPundits, Inc.; Crane Company; Labster, Inc.; Mursion, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

U.S. Engineering Services Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. engineering services outsourcing market report based on services, location, and application:

-

Services Outlook (Revenue, USD Billion, 2018 - 2030)

-

Testing

-

Designing

-

Prototyping

-

System Integration

-

Others

-

-

Location Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-shore

-

Off-shore

-

Near-shore

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aerospace

-

Automotive

-

Manufacturing

-

Consumer Electronics

-

Telecom

-

Construction & Infrastructure

-

Semiconductors

-

Healthcare

-

Energy & Utilities

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. engineering services outsourcing market size was valued at USD 337.28 billion in 2024 and is expected to reach USD 407.42 billion by 2025.

b. The U.S. engineering services outsourcing market is expected to grow at a compound annual growth rate of 15.7% from 2025 to 2030 to reach USD 843.97 billion by 2030

b. The testing segment dominated the market in 2024 of over 29%, driven by the the increasing complexity of automotive systems and the need for rigorous testing to ensure safety, compliance, and performance standards.

b. Some key players operating in the engineering services outsourcing market include ABB Group, Accenture plc, and Capgemini Engineering.

b. The increasing complexity of engineering projects that necessitate specialized expertise and advanced technological capabilities and the growing demand for cost reduction and operational efficiency is driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.