- Home

- »

- IT Services & Applications

- »

-

U.S. Enterprise Collaboration Market, Industry Report, 2030GVR Report cover

![U.S. Enterprise Collaboration Market Size, Share & Trends Report]()

U.S. Enterprise Collaboration Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Solution, Services), By Organization Size, By Deployment Mode (On-premises, Cloud-based), By End-use (BFSI, Healthcare, Education), And Segment Forecasts

- Report ID: GVR-4-68040-608-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Enterprise Collaboration Market Trends

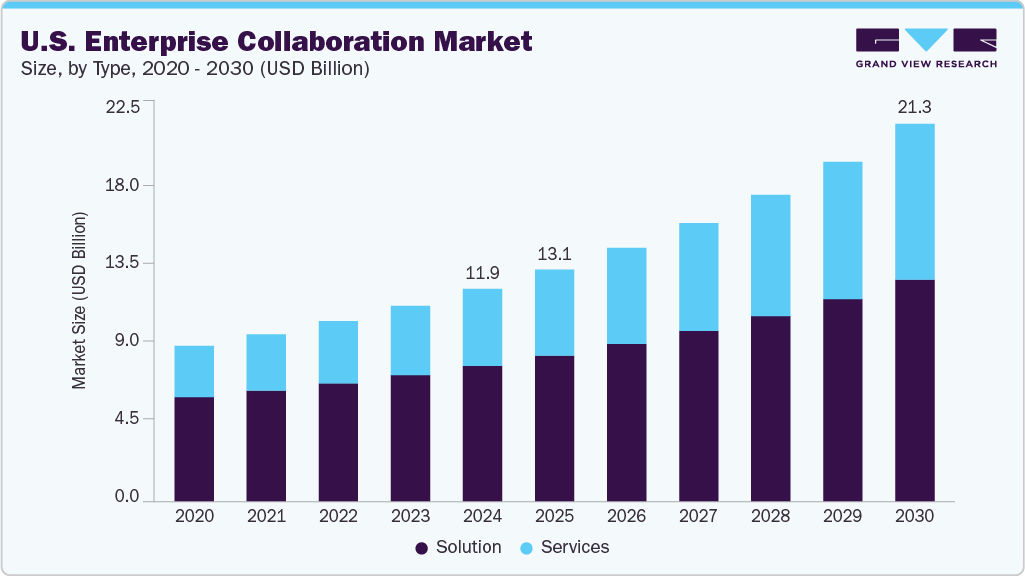

The U.S. enterprise collaboration market size was estimated at USD 11.98 billion in 2024 and is projected to grow at a CAGR of 10.3% from 2025 to 2030. The growing adoption of hybrid and remote work models across organizations is significantly driving the demand for enterprise collaboration tools.

The surge in cloud-based platforms and the integration of collaboration features such as real-time messaging, video conferencing, and document sharing are streamlining workflows and enhancing team efficiency. Integration with AI-driven features like intelligent scheduling, automated transcription, and smart task management is further fueling innovation and competitiveness within the market. The increasing emphasis on employee experience and digital workplace transformation continues to be a major catalyst for market growth.

The U.S. enterprise collaboration industry is being driven by the increasing shift toward remote and hybrid work models, compelling organizations to adopt advanced digital collaboration tools. Businesses prioritize operational agility and employee productivity, there is a growing demand for integrated platforms that support video conferencing, instant messaging, project management, and document sharing. Major enterprises are investing in solutions that foster seamless communication across distributed teams, ensuring business continuity and workforce engagement.

In addition, the rising focus on digital transformation across sectors such as healthcare, education, finance, and government is accelerating the adoption of the enterprise collaboration industry. Initiatives such as cloud migration, cybersecurity enhancements, and data compliance mandated by U.S. regulations like HIPAA and CCPA are pushing companies to deploy secure, scalable, and compliant collaboration tools, thereby increasing demand for the U.S. enterprise collaboration industry.

Furthermore, the expansion of 5G infrastructure across the United States is enabling faster and more reliable access to cloud-based collaboration platforms, particularly benefiting mobile and field-based workers. This improved connectivity supports real-time updates, remote training, and dynamic team coordination, strengthening enterprise agility, further accelerating market growth.

Moreover, the growing emphasis on employee experience and workplace wellness is encouraging the use of platforms that integrate AI-driven features like sentiment analysis, virtual whiteboards, and workflow automation. These technologies enhance team productivity and creativity while reducing digital fatigue. Organizations prioritize flexibility, inclusivity, and sustainability in their communication ecosystems, the U.S. enterprise collaboration industry is expected to experience sustained growth across industries and organizational sizes.

Type Insights

The solution segment led the market with the largest revenue share of 63.8% in 2024, driven by the increasing demand for integrated and secure collaboration tools among U.S. enterprises collaboration industry. Organizations continue to adopt hybrid and remote work models. Advancements in AI-powered features such as real-time transcription, automated task tracking, and smart scheduling are further boosting adoption. The growing emphasis on data security and scalable cloud infrastructure continues to position the solution segment as the backbone of the U.S. enterprise collaboration industry.

The services segment is expected to grow at the fastest CAGR of 12% from 2025 to 2030, driven by the increasing demand for flexible, scalable, and cloud-based collaboration solutions. The growing reliance on managed services and consulting to optimize collaboration platforms, enhance user adoption, and ensure data security is further accelerating segment growth. The U.S. government's emphasis on digital transformation also contributes to the increasing demand for professional and managed services, positioning the services segment as the fastest-growing category in the U.S. enterprise collaboration industry.

Organization Size Insights

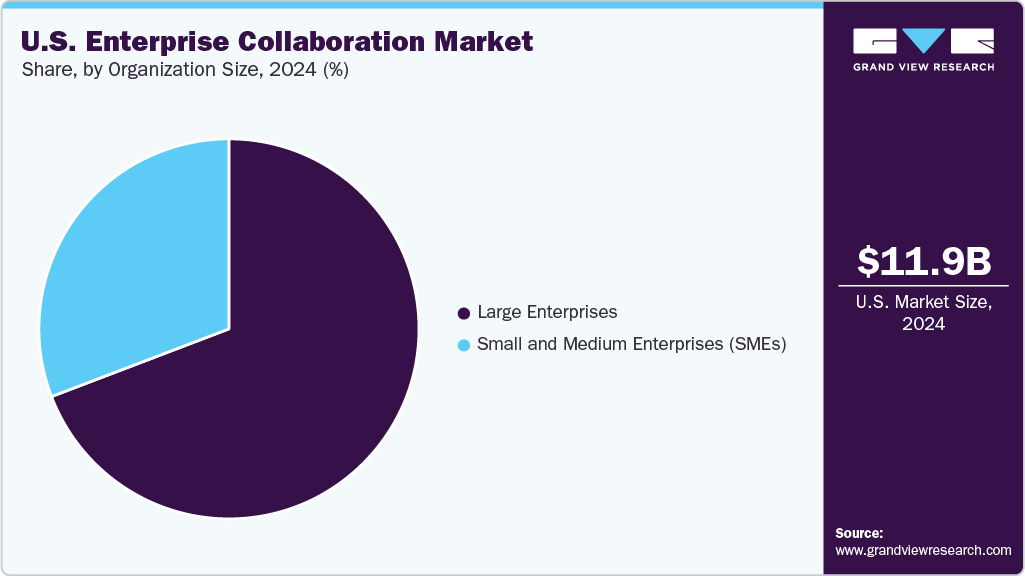

The large enterprises segment accounted for the largest market share in 2024, driven by the growing need to support distributed workforces and ensure secure communication across departments. Large U.S.-based enterprises are increasingly investing in advanced collaboration platforms to improve productivity and decision-making. The increasing integration of AI-driven tools and data security features makes enterprise-grade solutions more attractive to large organizations. These enterprises continue to expand their digital footprints and emphasize operational efficiency, and the demand for a robust market growth.

The small and medium enterprises (SMEs) segment is expected to grow at the fastest CAGR from 2025 to 2030, fueled by the increasing adoption of hybrid work models and digital transformation initiatives. U.S.-based SMEs are prioritizing cost-effective and scalable collaboration tools to enhance productivity and maintain operational continuity across distributed teams. The growing reliance on remote teams, project-based workflows, and the need for seamless document sharing and real-time communication are accelerating the demand for the U.S. enterprise collaboration industry over the forecast period.

Deployment Mode Insights

The cloud-based segment accounted for the largest market revenue share in 2024. The accelerated adoption of remote and hybrid work models across the U.S. has significantly driven demand for collaboration tools. Cloud-based platforms enable real-time communication and seamless integration with other enterprise applications, making them highly adaptable. The strong presence of cloud infrastructure providers in AI-driven collaboration tools further fuels the rapid expansion of this segment, positioning it as the largest deployment mode in the U.S. enterprise collaboration industry.

The on-premises segment is expected to grow at the fastest CAGR from 2025 to 2030, fueled by heightened data security concerns and regulatory compliance requirements. On-premises deployment allows organizations to customize their systems, meet strict compliance standards, and mitigate risks associated with third-party data breaches. The rising incidence of cyberattacks has reinforced the demand for in-house data management and secure communication tools. These factors, combined with the ability to integrate seamlessly with existing enterprise IT ecosystems, sustain on-premises solutions in the U.S. industry.

End-use Insights

The IT & telecom segment accounted for the largest market share in 2024, driven by the sector's accelerated adoption of remote work solutions, and unified communication tools. The rapid digital transformation within IT and telecom enterprises has necessitated robust collaboration frameworks. U.S.-based companies are heavily investing in secure, scalable, and integrated collaboration tools to maintain productivity and ensure data protection in compliance with federal regulations. The demand for flexible, hybrid work environments across the U.S. tech landscape has reinforced the IT & telecom sector's leadership in leveraging enterprise collaboration solutions, solidifying its dominance in the market.

The healthcare segment is expected to grow at the fastest CAGR from 2025 to 2030, driven by growing emphasis on integrated patient care. The U.S. healthcare system is rapidly adopting advanced collaboration tools to support telemedicine, secure patient data exchange, and streamline workflows among providers, patients, and insurers. These evolving requirements continue to push healthcare providers to adopt robust, cloud-based, and AI-powered solutions, making the healthcare sector one of the fastest-growing segments in the U.S. industry.

Key U.S. Enterprise Collaboration Company Insights

Some of the key players operating in the market include Microsoft and Google LLC, among others.

-

Microsoft Corporation is a global technology leader and a dominant force in the U.S. enterprise collaboration industry. Through its Microsoft 365 suite, which includes Teams, SharePoint, Outlook, and OneDrive, Microsoft enables seamless communication, document sharing, and real-time collaboration across enterprises. The company's deep integration of AI-powered features, advanced security, and cross-platform accessibility makes it a preferred choice for organizations seeking comprehensive and scalable collaboration tools.

-

Google LLC offers a robust portfolio of cloud-based collaboration tools under Google Workspace, including Gmail, Google Meet, Docs, Sheets, and Drive. Designed for simplicity and productivity, Google’s tools are widely used by businesses, educational institutions, and government agencies across the U.S. The company focuses heavily on real-time editing, smart suggestions via AI, and seamless mobile access, making it one of the top players in the U.S. enterprise collaboration industry.

Some of the emerging market players in the market include Notion Labs, Inc., and Smartsheet Inc. among others.

-

Notion Labs, Inc. is an emerging player in the U.S. enterprise collaboration industry, offering a unified workspace that combines notes, documents, project management, and databases. Known for its flexibility and user-friendly interface, Notion is particularly popular among startups, remote teams, and creative professionals. The company emphasizes customization and integration, enabling users to build tailored workflows and collaborate in real-time with ease.

-

Smartsheet Inc. is gaining rapid traction as the enterprise collaboration and work management platform that bridges traditional spreadsheet functionalities with modern project tracking and automation. It supports teams in planning, capturing, managing, and reporting on work on a scale. Strong adoption across sectors like IT, healthcare, and finance, Smartsheet is emerging as a key player focused on driving operational efficiency and enterprise collaboration through intuitive, scalable solutions in the U.S. enterprise collaboration industry.

Key U.S. Enterprise Collaboration Companies:

- Microsoft

- Google LLC

- Cisco Systems, Inc.

- Slack Technologies, LLC

- Zoom Communications, Inc.

- Salesforce, Inc.

- Asana, Inc.

- RingCentral, Inc.

- Notion Labs, Inc.

- Smartsheet Inc.

Recent Developments

-

In May 2025, Zoom announced a strategic partnership with Google Cloud to adopt and contribute to the Agent2Agent (A2A) protocol, marking a major advancement in multi-agent AI collaboration for the U.S. enterprise collaboration industry. Integrating with Google Cloud’s Agentspace enables AI-driven scheduling capabilities, allowing Zoom and Gmail users to automatically coordinate meetings, update Google Calendar, and launch Zoom sessions efficiently, enhancing productivity and streamlining U.S. enterprise collaboration industry workflows.

-

In May 2025, Microsoft introduced the Microsoft 365 Agents SDK. This launch aims to enhance the U.S. enterprise collaboration industry by enabling developers to create scalable, multichannel AI agents with advanced integration capabilities, fostering more seamless and intelligent workplace communication.

-

In March 2025, Cisco unveiled its latest AI-powered collaboration solutions, marking a significant advancement in the U.S. enterprise collaboration industry. The company announced the general availability of the Webex AI Agent to enhance customer experiences, alongside updates to the Cisco AI Assistant for Webex Contact Center. These innovations aim to transform contact centers into comprehensive customer experience hubs and improve the U.S. enterprise collaboration industry.

U.S. Enterprise Collaboration Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.06 billion

Revenue forecast in 2030

USD 21.28 billion

Growth rate

CAGR of 10.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Types, organization size, deployment mode, end-use

Country scope

U.S.

Key companies profiled

Microsoft; Google LLC; Cisco Systems, Inc.; Slack Technologies, LLC; Zoom Communications, Inc.; Salesforce, Inc.; Asana, Inc.; RingCentral, Inc.; Notion Labs, Inc.; Smartsheet Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Enterprise Collaboration Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. enterprise collaboration market report based on types, organization size, deployment mode, and end-use:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Solution

-

Services

-

-

Organization Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Large Enterprises

-

Small and Medium Enterprises (SMEs)

-

-

Deployment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premises

-

Cloud-based

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030

-

IT & Telecom

-

BFSI

-

Healthcare

-

Retail & Consumer Goods

-

Manufacturing

-

Education

-

Travel & Hospitality

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. enterprise collaboration market size was estimated at USD 11.98 billion in 2024 and is expected to reach USD 13.06 billion in 2025.

b. The U.S. enterprise collaboration market is expected to grow at a compound annual growth rate of 10.3% from 2025 to 2030 to reach USD 21.28 billion by 2030.

b. The solution segment accounted for the largest market share of over 63% in 2024, driven by the increasing demand for integrated and secure collaboration tools among U.S. enterprises collaboration industry.

b. Some key players operating in the U.S. enterprise collaboration market include Microsoft, Google LLC, Cisco Systems, Inc., Slack Technologies, LLC, Zoom Communications, Inc., Salesforce, Inc., Asana, Inc., RingCentral, Inc., Notion Labs, Inc., Smartsheet Inc.

b. The key factors driving the U.S. enterprise collaboration market include growing adoption of hybrid and remote work models, a surge in cloud-based platforms, and the integration of collaboration features such as real-time messaging, video conferencing, and document sharing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.