- Home

- »

- Next Generation Technologies

- »

-

U.S. Enterprise Telecom Services Market Size Report, 2030GVR Report cover

![U.S. Enterprise Telecom Services Market Size, Share & Trends Report]()

U.S. Enterprise Telecom Services Market (2023 - 2030) Size, Share & Trends Analysis Report By Service, By Transmission, By Enterprise Size, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-064-4

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

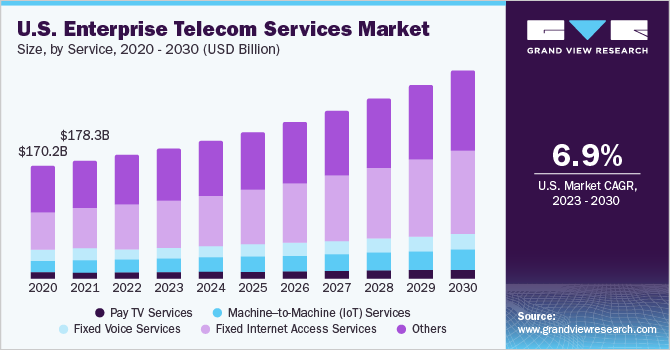

The U.S. enterprise telecom services market size was valued at USD 187.01 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.9% from 2023 to 2030. Enterprises in the U.S. are increasingly embracing telecom services such as voice and data services, as well as other communication tools, to enhance their interactions with clients, associates, and employees. The implementation of these services can help organizations reduce expenses by facilitating remote work and streamlining communication and collaboration processes. The utilization of mobile services allows for increased flexibility and responsiveness among employees, as they can work from any location and at any time. This shift towards adopting telecom services has become a crucial element for enterprises to achieve their business objectives and is driving the growth of the market

The proliferation of digital technology has emerged as a pivotal catalyst for the expansion of telecom services worldwide. Rapid technological advancements and improvements in telecommunication networks have brought about a substantial transformation in the way various industries operate and deliver services. These developments have significantly enhanced the quality of life for consumers.

Additionally, industry stakeholders are investing in technology and interoperability, leading to a substantial shift in the flow of capital and information in the global economy. The increasing need for digitalization and improved connectivity is expected to propel the growth of the enterprise telecom services market in the U.S.

Significant investments are being directed towards the development of telecom infrastructure, driven by multiple factors such as the surge in demand for high-speed internet and wireless services, the necessity to modernize and upgrade existing networks, and government efforts to enhance connectivity in rural regions. Enterprises and government bodies alike are investing in advanced communication technologies such as fiber optic cables and 5G networks, among others, to meet the escalating demand for data-intensive services.

This substantial increase in spending is anticipated to fuel the growth of the market in the foreseeable future. The growing preference for private 5G networks among enterprises is poised to drive the growth of the market for U.S. enterprise telecom services. Several benefits offered by private 5G and LTE networks, such as improved connectivity, increased security, customization, and cost savings, are driving private 5G network adoption.

Many enterprises are deploying private 5G infrastructure to ensure robust security over their network during data exchange operations. Businesses are heavily investing in creating a smart office environment by embracing machine learning, Augmented Reality/Virtual Reality (AR/VR), and edge computing technology. As a result, the growing demand for private 5G networks is expected to create growth opportunities for the enterprise telecom services market in the U.S.

The market's growth is expected to face a hurdle in the form of high initial capital expenditure. The telecom industry is known for its heavy reliance on capital investments to establish and maintain extensive network infrastructure necessary for providing both wireless and fixed-line services. The high costs associated with infrastructure requirements restrict the entry of new market players.

The significant expenses incurred by telecom businesses typically encompass government licensing fees and spectrum costs, expenses for software and hardware deployment, as well as approval costs for developing infrastructure such as BTS installation and fiber cable laying. Despite these challenges, the growing need for telecom services has resulted in a high influx of capital and investment in the market. Consequently, easy access to capital is expected to minimize the impact of this challenge on the industry.

COVID-19 Impact Analysis

The pandemic adversely affected the U.S. telecom services market during the initial phase. However, the rapid adoption of the remote working model as a result of lockdowns and the increased need to cater to such needs in the future propelled organizations to invest in developing their infrastructure to enable a seamless working environment and efficient business functioning.

As a result, the demand for telecommunication services witnessed an increase during the second and third quarters of 2020, wherein companies adopted cloud-based business models for business functioning. Organizations also started making significant investments in the adoption of next-generation technologies such as AI, IoT, and IIoT to facilitate intelligent automated operations.

Service Insights

The fixed internet access services segment dominated the market in 2022 and accounted for a revenue share of more than 34.0%. Fixed internet access services utilize several high-speed transmission technologies such as fiber, Digital Subscriber Line (DSL), wireless, satellite, cable modem, and Broadband over Power Line (BPL). These services are being increasingly adopted by enterprises to achieve more robust and stable connectivity.

Among the available options, Fixed Wireless Access (FWA) services have emerged as a popular choice for businesses due to their quick and cost-effective installation process, as they do not require ground-based cables. Their growing demand has spurred key market players to launch innovative solutions to cater to the specific needs of businesses. For example, in March 2021, AT&T announced its plans to enhance its FWA product for business customers by incorporating 5G technology. Such initiatives are expected to drive segment growth over the forecast period.

The machine-to-machine (IoT) services segment is anticipated to expand significantly over the forecast period. Machine-to-machine (IoT) refers to the communication between two machines, which enables network devices to exchange information and perform actions without manual assistance from humans. Machine-to-machine services leverage Artificial Intelligence (AI) and Machine Learning (ML) to facilitate communication between systems.

Businesses are adopting M2M/IoT services to reduce costs by minimizing maintenance and downtime, boost revenue by leveraging new business opportunities, and improve customer services by proactively monitoring and servicing equipment before it faces failure, which is driving the segment’s growth.

Transmission Insights

The wireless segment dominated the market in 2022 and accounted for a revenue share of more than 59.0%. The growth of the wireless transmission segment can be attributed to several advantageous features, such as reliable connectivity, flexibility, strong coverage, lower costs, and easier installation. Wireless transmission technology eliminates unexpected errors such as construction errors or power outages, making it more reliable for ensuring improved connectivity.

Key market players are taking strategic initiatives to cater to the growing demand for wireless solutions. For instance, in February 2022, Nokia announced its partnership with Kyndryl Inc., a spin-off of the International Business Machines (IBM) Corporation’s IT infrastructure services. This partnership is aimed at providing businesses with private wireless transmission. Such initiatives are anticipated to drive the growth of the wireless transmission segment over the forecast period.

The wireline segment is anticipated to register significant growth over the forecast period. Wireline telecom services are adopted in harsh environments where wireless connectivity might be insufficient. For instance, large open areas such as factories or manufacturing plants require a large amount of data that is not supported by wireless connectivity. In such instances, traditional wireline connectivity provides reliable coverage. Reliability and strong coverage are driving the adoption of the wireline segment, thus contributing to its projected growth.

Enterprise Size Insights

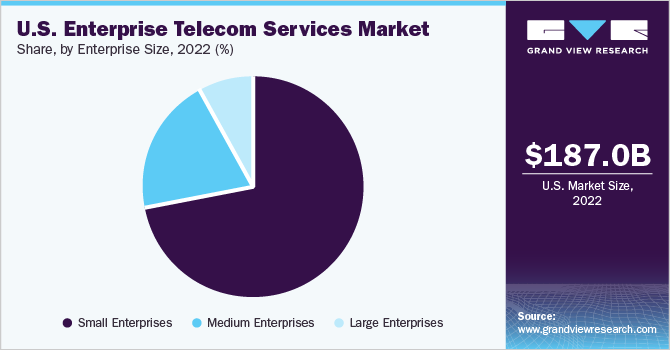

The small enterprises segment dominated the market in 2022 and accounted for a revenue share of more than 72.0%. Favorable government initiatives and increasing access to capital due to a rising number of investments are contributing to the proliferation of small businesses in the United States. As per the 2021 Small Business Profile report published by the U.S. Small Business Administration, there are over 32.5 million small businesses in the country, accounting for almost 99.9% of all businesses in the U.S.

This growth in the number of small enterprises is creating a potential market for telecom service providers. Small businesses are adopting telecom services to enhance cross-team collaboration, boost employee productivity and satisfaction, and expand their customer reach, among other benefits. As a result, this trend is driving the growth of the telecom services segment.

The medium enterprises segment is anticipated to grow significantly over the forecast period. Large enterprises are in constant need to update their offerings and improve their work environment to sustain the growing competition in almost every field. To gain a competitive edge, large enterprises are undergoing digital transformation, wherein AI, ML, cloud computing, and automation are playing a crucial role.

Additionally, large enterprises across industries such as healthcare, automotive, and manufacturing are seeking improved speed and efficiency through connectivity. At this juncture, telecom service providers are targeting large enterprises to yield more profits. This is creating significant opportunities for the adoption of telecom services.

End-use Insights

Based on end-use, the IT & telecom segment dominated the market in 2022 and accounted for a revenue share of more than 22.0%. The widespread implementation of 5G cellular networks worldwide and the rapid uptake of 5G communications due to significant benefits such as high-speed connectivity and increased bandwidth are critical factors contributing to the adoption of enterprise telecom services in the IT and telecom sector.

IT and telecom industries are utilizing telecom services to provide their customers with advanced transmission and network services. The rising adoption of advanced technologies by telecom companies for providing sophisticated networking solutions and enhancing customer experience is projected to drive the growth of this segment in the foreseeable future.

The healthcare segment is anticipated to register significant growth over the forecast period. Telecommunications has a far more significant role to play in the healthcare industry beyond merely facilitating telephonic medical consultations.

Predictive analysis, healthcare monitoring, remote patient monitoring & virtual care, wearable devices, organ care technology, bioprinting, and cancer immunotherapy are some technological trends in the healthcare industry, where solutions based on the latest technologies, such as AI, AR, and VR, have a niche role to play. Enterprise telecom services would be of paramount importance if all these technological trends were to be realized, which is anticipated to drive segment growth.

Key Companies & Market Share Insights

The market is highly consolidated, characterized by the presence of a few prominent players. These players are driving competition by pursuing various strategies aimed at long-term sustenance, including geographical expansions, product innovations, R&D activities, strategic partnership agreements, and joint ventures. The growing demand for telecom services such as fixed voice services, fixed internet access services, pay TV services, and machine-to-machine IoT services from enterprises is fueling the market growth.

Vendors are focusing on launching innovative products and are engaging in partnerships to strengthen their market position. For instance, in February 2023, Dell Technologies, Inc. unveiled the Telecom Infrastructure Blocks for Red Hat, a cloud-native solution designed in collaboration with Red Hat to cater to the needs of network operators dealing with 5G radio access network (RAN) and 5G core workloads.

This offering aims to aid the telecommunications industry in expediting the integration of open, cloud-native technologies. Dell's services and support will back this solution launch. Such initiatives are anticipated to propel the market's growth over the forecast period. Some of the prominent players in the U.S. enterprise telecom services market include:

-

AT&T Inc.

-

Charter Communications Inc.

-

Comcast

-

T-Mobile USA, Inc.

-

Verizon Communications Inc.

-

Lumen Technologies

-

Cox Communications, Inc.

-

Altice USA, Inc.

-

Frontier Communications Parent, Inc.

-

Windstream Intellectual Property Services, LLC.

U.S. Enterprise Telecom Services Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 313.95 billion

Growth rate

CAGR of 6.9% from 2023 to 2030

Base year of estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Service, transmission, enterprise size, end-use

Key companies profiled

AT&T Inc.; Charter Communications Inc.; Comcast; T-Mobile USA, Inc.; Verizon Communications Inc.; Lumen Technologies; Cox Communications, Inc.; Altice USA, Inc.; Frontier Communications Parent, Inc.; Windstream Intellectual Property Services, LLC.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Enterprise Telecom Services Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. enterprise telecom services market report based on service, transmission, enterprise size, and end-use:

-

Service Outlook (Revenue, USD Billion, 2017 - 2030)

-

Fixed Voice Services

-

Fixed Internet Access Services

-

Pay TV Services

-

Machine-to-Machine (IoT) Services

-

Others (Mobile Voice & Data Services)

-

-

Transmission Outlook (Revenue, USD Billion, 2017 - 2030)

-

Wireline

-

Wireless

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Small Enterprises

-

Medium Enterprises

-

Large Enterprises

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

IT & Telecom

-

Manufacturing

-

Healthcare

-

Retail

-

Media & Entertainment

-

Government & Defense

-

Education

-

BFSI

-

Energy & Utilities

-

Transportation & Logistics

-

Travel & Hospitality

-

O&G and Mining

-

Others (Aviation, Marine, Agriculture, Environmental Monitoring, Construction)

-

Frequently Asked Questions About This Report

b. The U.S. enterprise telecom services market size was estimated at USD 187.01 billion in 2022 and is expected to reach USD 196.59 billion in 2023.

b. The U.S. enterprise telecom services market is expected to grow at a compound annual growth rate of 6.9% from 2023 to 2030 to reach USD 313.95 billion by 2030.

b. The fixed internet access services segment dominated the market in 2022 owing to its increasing adoption by enterprises to achieve more robust and stable connectivity. Additionally, among the available options, Fixed Wireless Access (FWA) services have emerged as a popular choice for businesses due to their quick and cost-effective installation process.

b. Some key players operating in the U.S. enterprise telecom services market include AT&T Inc., Charter Communications Inc., Comcast, T-Mobile USA, Inc., Verizon Communications Inc., Lumen Technologies, Cox Communications, Inc., Altice USA, Inc., Frontier Communications Parent, Inc., and Windstream Intellectual Property Services, LLC.

b. The increasing need for digitalization and improved connectivity is expected to propel the growth of the U.S. enterprise telecom services market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.