- Home

- »

- Sensors & Controls

- »

-

U.S. Fire Safety Equipment Market Size, Share Report, 2030GVR Report cover

![U.S. Fire Safety Equipment Market Size, Share & Trends Report]()

U.S. Fire Safety Equipment Market (2023 - 2030) Size, Share & Trends Analysis Report By Solution (Fire Detection, Fire Suppression), By Application (Commercial, Industrial, Residential), And Segment Forecasts

- Report ID: GVR-4-68040-094-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

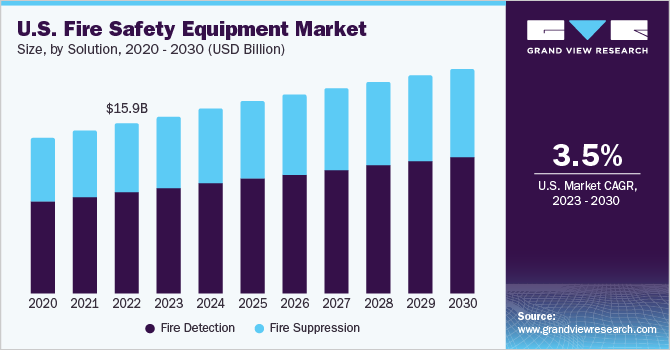

The U.S. fire safety equipment market size was valued at USD 15.96 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.5% from 2023 to 2030. The construction industry is a primary factor driving the market growth, as new buildings are equipped with fire safety systems to comply with building codes and regulations. The industry witnessed a significant boom in recent years, fueled by infrastructure projects, commercial developments, and residential construction. With increased construction activity, the risk of fire incidents also escalates. Flammable materials, electrical wiring, and combustible gases at construction sites pose a considerable fire hazard. This heightened risk necessitates the adoption of robust fire safety measures, driving the demand for fire safety equipment.

Fire safety has become increasingly important in the U.S. in recent years owing to incidents such as the Station nightclub fire in West Warwick and the Ghost Ship warehouse fire in Oakland. For instance, in 2020, according to the National Fire Protection Association (NFPA), an estimated 1,291,500 fire cases were reported in the U.S., which caused 3,420 civilian deaths, 16,720 civilian injuries, and USD 14.8 billion in property damage. This increasing incidence of fire is resulting in the deployment of fire alarms and detectors in commercial and industrial spaces, a major factor expected to drive the growth of the U.S. fire safety equipment market.

Stringent government regulations about installing fire safety equipment such as fire alarms and sprinkler systems in residential and commercial spaces as they aid in protection against fire hazards are another important factor anticipated to impact the target market's growth positively. For instance, the NFPA has established nearly 300 codes and standards for installing and maintaining fire safety equipment, which insurance companies and local governments use to enforce fire safety regulations. These codes provide specific fire safety guidelines, including installing, inspecting, and maintaining fire alarm systems. Compliance with these regulations is mandatory, ensuring that buildings prioritize fire safety.

However, the U.S. fire safety equipment market is highly competitive, with numerous manufacturers and suppliers vying for market share. This intense competition generates price challenges as customers demand cost-effective solutions that do not compromise quality and dependability. As a result, manufacturers encounter the difficulty of achieving a delicate equilibrium between cost-efficiency and upholding stringent product standards and safety attributes. Moreover, escalating expenses for raw materials, labor, and compliance impose additional financial burdens on players within the sector.

As building owners and managers recognize the importance of fire safety, they are increasingly investing in upgrading their facilities to comply with modern safety standards. Integration with building automation systems allows for seamless fire safety system monitoring, control, and coordination. This integration streamlines operations, improves response times, and enhances overall safety. Companies that offer interoperable solutions and facilitate integration with smart building platforms can gain a competitive edge in the market. As a result, retrofitting projects and the rise of smart buildings is expected to provide significant growth opportunity for the U.S. market for fire safety equipment.

Solution Insights

The fire detection segment accounted for the largest market share of over 59.0% in 2022 and is expected to hold the highest CAGR over the forecast period. The segment’s growth is primarily driven by regulations and standards set by government agencies and organizations and technological advancements.

Fire detectors are typically more commonly installed in the U.S. than fire alarms because they can detect smoke or heat early on and alert people before a fire spreads. However, fire alarms are often cheaper than fire detectors, making them more accessible to a wider range of customers. This can be particularly important in residential settings where homeowners may be more cost-sensitive in forthcoming years.

The fire suppression segment is anticipated to register considerable growth over the forecast period. Federal, state, and local governments have regulations and policies in place to help prevent and suppress fires. These policies include building codes that require fire-resistant materials and sprinkler systems, restrictions on burning and other fire-related activities, and regulations on how and where fires can be lit.

Fire sprinkler systems are typically installed in buildings to provide automatic fire protection. They consist of a network of pipes and sprinkler heads that are designed to activate when they detect heat or flames. When activated, the sprinklers spray water or other fire suppression agents onto the fire, helping to extinguish it and prevent it from spreading. Hence, such factors are expected to drive the segment growth over the forecast period.

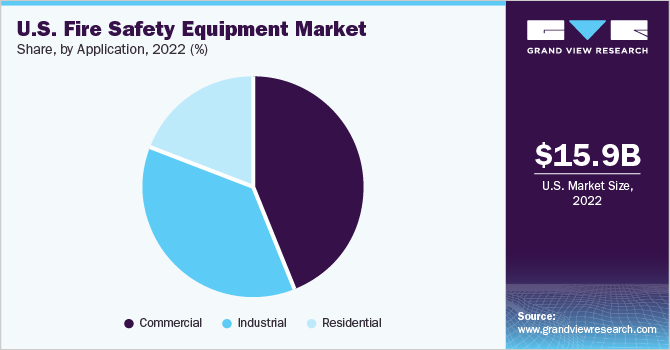

Application Insights

The commercial segment accounted for the largest market share of over 48.0% in 2022. Commercial sectors such as offices, hospitals, and shopping malls are increasing the adoption of fire safety equipment. The commercial sector in the U.S. is experiencing robust growth driven by factors such as economic development, increased consumer spending, and technological advancements.

Effective fire protection systems become essential as businesses expand their operations, construct new facilities, or renovate existing spaces. These systems help prevent fires, detect potential hazards, and enable swift evacuation, minimizing property damage and ensuring occupants' safety. These systems were primarily used in commercial buildings, such as offices, hospitals, and shopping malls. Hence, such factors are anticipated to drive the segment growth.

The residential segment is expected to register the highest CAGR over the forecast period. Homeowners are increasingly aware of the devastating impact that fires can have on their homes and their families, and as a result, they are taking proactive steps to protect themselves and their loved ones.

Another key driver of the market is the increasing demand for connected fire safety systems. These systems integrate smoke detectors, carbon monoxide detectors, and other fire safety equipment with smart home technology, allowing homeowners to monitor and control their fire safety systems remotely. This particularly appeals to busy homeowners who want to protect their homes even when they are away.

Key Companies & Market Share Insights

The competitive landscape is fragmented, featuring many regional and global market players. The major participants are entering into strategic collaborations, mergers & acquisitions, and partnerships to expand their organization’s footprint and survive the competitive environment. For instance, in April 2022, RapidFire Safety & Security announced a strategic partnership with CEP (Concentric Equity Partners). With this partnership, RapidFire Safety & Security is composed to acquire existing businesses in Missouri, Arizona, California, Texas, and other adjacent states led by people-first owners interested in joining customer-centric companies committed to stable growth via streamlined operations as well as expanded services.Some prominent players in the U.S. fire safety equipment market include:

-

Eaton Corp., Inc.

-

Gentex Corp.

-

Halmaplc

-

Hochiki Corp.

-

Honeywell International, Inc.

-

Johnson Controls

-

Napco Security Technologies, Inc.

-

Nittan Company, Ltd.

-

Robert Bosch GmbH

-

Siemens Building Technologies

-

Space Age Electronics

-

United Technologies Corp

U.S. Fire Safety Equipment Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 21.09 billion

Growth rate

CAGR of 3.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, application

Country scope

U.S.

Key companies profiled

Eaton Corp., Inc.; Gentex Corp.; Halmaplc; Hochiki Corp.; Honeywell International, Inc.; Johnson Controls; Napco Security Technologies, Inc.; Nittan Company, Ltd.; Robert Bosch GmbH; Siemens Building Technologies; Space Age Electronics; United Technologies Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Fire Safety Equipment Market Report Segmentation

The report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. fire safety equipment market report based on solution and application:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Fire Detection

-

Detectors

-

Flame

-

Smoke

-

Heat

-

-

Alarms

-

Audible

-

Visual

-

Manual Call-points

-

-

-

Fire Suppression

-

Extinguisher

-

Water

-

Dry Chemical Powder

-

Others

-

-

Sprinkler

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Industrial

-

Residential

-

Frequently Asked Questions About This Report

b. The U.S. fire safety equipment market size was estimated at USD 15.95 billion in 2022 and is expected to reach USD 16.61 billion in 2023.

b. The U.S. fire safety equipment market is expected to grow at a compound annual growth rate of 3.5% from 2023 to 2030 to reach USD 20.08 billion by 2030.

b. The commercial sector dominated the U.S. fire safety equipment market with a share of over 40.0% in 2022. This is attributable to factors such as economic development, increased consumer spending, and technological advancements.

b. Some key players operating in the U.S. fire safety equipment market include Eaton Corp., Inc.; Gentex Corp.; Halmaplc; Hochiki Corp.; Honeywell International, Inc.; Johnson Controls; Napco Security Technologies, Inc.; Nittan Company, Ltd.; Robert Bosch GmbH; Siemens Building Technologies; Space Age Electronics; and United Technologies Corp.

b. Key factors that are driving the U.S. fire safety equipment market growth include stringent government regulations pertaining to installing fire safety equipment and increasing construction activities in the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.