- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Flexitank Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Flexitank Market Size, Share & Trends Report]()

U.S. Flexitank Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Single Trip, Multi-trip), By Application (Foodstuffs, Wine & Spirits, Oils), And Segment Forecasts

- Report ID: GVR-4-68040-233-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Flexitank Market Size & Trends

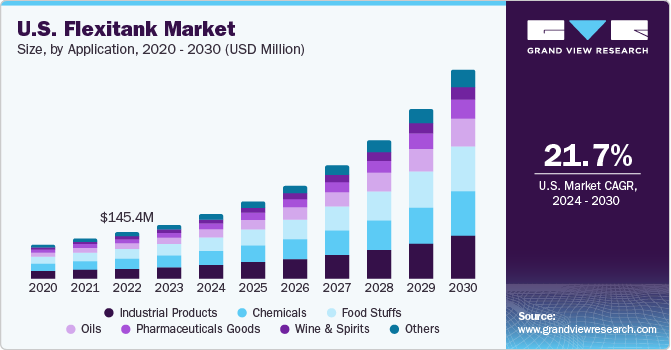

The U.S. flexitank market size was estimated at USD 169.08 million in 2023 and is anticipated to grow at a CAGR of 21.7% from 2024 to 2030. The growth is attributed to presence of flexitank producers in U.S. such as Environmental Packaging Technologies, Inc. and Techno Group USA. In addition, the growing preference for flexitanks over conventional shipping containers for the delivery of liquid orders is driving flexitank market in U.S.

The capacity of flexitanks ranges from 12,000 to 26,000 liters. A broad variety of liquid goods, including wines, concentrates, fruit juices, edible oils, mineral water, malt extracts, lubricants, tallow, non-hazardous chemicals, fertilizers, and medications, are typically sent using them. In addition, Flexitanks are preferred over conventional tanks by U.S. shipping service providers like InterlogUSA when moving liquid cargo across the nation. Flexitanks offer several advantages over conventional liquid transportation methods. Increased shipping capacity, lower costs in comparison to other bulk liquid transportation, and more availability in comparison to alternative shipping containers are a few of the main benefits.

Some of the biggest pharmaceutical businesses in the world, such as Pfizer, Johnson & Johnson, Eli Lilly and Company, and Abbott Laboratories, are based in the U.S. These businesses favor single-trip flexitanks for shipping temperature-sensitive liquids, which means the U.S. industry has a significant opportunity to develop. Furthermore, the U.S. market's need for flexitanks is being supported by growing need for components such as sorbitol, fructose, coconut oils, corn oil, egg liquid, and malt extract in the food and beverage industry for the production of a range of confectionary and bakery items.

Market Concentration & Characteristics

The U.S. flexitank market is characterized by a low degree of innovation. Compared to certain other industries, flexitanks do not experience frequent technical improvements due to their design and functionality being well-established and standardized. Though innovation takes place slowly overall, mostly in areas like improved durability and sustainability through material composition.

Due to the market's small number of significant participants and the level of mergers and acquisitions in the market tends to be low. A lower degree of M&A activity is suggested by the competitive landscape's relative stability and the lack of notable consolidation.

The market is significantly influenced by regulations governing the storage and transit of liquids, including goods fit for human consumption, chemicals, and prescription drugs. Product design and use are impacted by adherence to safety standards, environmental laws, and food safety restrictions.

Since the flexitank offers a specialized and affordable option for transporting bulk liquids, with benefits including simple installation, excellent space management, and compatibility with multiple modes of transportation, there aren't many substitutes for it. Although there are other packaging options, including drums or intermediate bulk containers (IBCs). However, flexitanks' affordability and adaptability provide them a competitive edge over these options.

Application Insights

The industrial products segment dominated the market and accounted for largest revenue share of over 21.0% in 2023. Surfactants, detergents, water-based paints, bleaching agents, disinfectants, and additives for improved oil recovery are all included in the industrial product area. Compared to ISO tank containers, flexitanks are less expensive to position and need less manpower to fill, handle, and empty than drums and IBCs. Additionally, single-trip flexitanks are an affordable solution that offer little to no bulk storage. Due to the aforementioned characteristics as well as their capacity to hold 15% and 40% more cargo than IBC and drums, respectively, flexitank demand is anticipated to rise across a range of industrial applications, including plasticizers, paraffin wax, printing inks, emulsions, fertilizers, and natural and synthetic latex.

The chemical segment held a significant market share in 2023. Flexitanks are becoming more and more popular among chemical businesses as a packaging option because of their affordability, robustness, and lightweight compared to standard corrugated packaging. Furthermore, recycled polypropylene, ethylene vinyl acetate (EVA), and polyethylene can be used to make flexitanks for the chemical sector, negating the requirement for 100% virgin polymers. This promotes sustainability and further reduces the product's price. Therefore, during the forecast period, it is anticipated that the widespread use of multi-trip flexitanks in the chemical sector and the growing popularity of recycled thermoplastic polymers for chemical applications will propel the growth of the flexitanks market as a whole.

Furthermore, the food stuffs segment witnessed significant market growth in 2023 owing to the growing exports and imports of fruit juices, concentrates, vegetable oils, palm oils, fish oils, edible oils, sorbitol, fructose, coconut oils, egg liquid, malt extract, corn oil, sauces, purees.

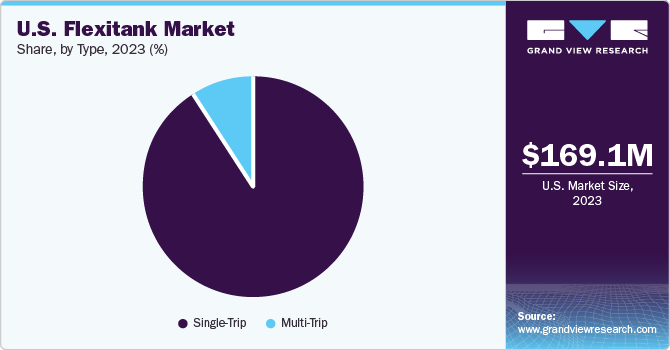

Type Insights

The single-trip segment led flexitank market in U.S. and registered largest market share of over 91.0% in 2023. This growth is attributed to the reduced danger of product contamination linked to single-trip flexitanks. Furthermore, their one-time use avoids the inconveniences of cleaning and return logistics, simplifying operations and reducing costs—factors that are expected to further propel market growth and sector demand. The low cost and extensive availability of single-trip products are expected to keep the category-leading throughout the projected period.

The multi-trip segment maintained a substantial market share in 2023, owing to its high ranking on the sustainability front and ability to be reused multiple times, which optimizes the Total Cost of Ownership (TCO). As a result, these bulk packages are more effective overall in the logistical chain.

Key U.S. Flexitank Company Insights

The U.S. flexitank market is characterized by a few dominant players who control a large portion of the market. These businesses compete based on things like pricing, product quality, and service dependability, and they hold a sizable market share. The market has a consolidated structure with low competition from smaller businesses and few new entrants.

Key players in the market include TechnoGroupUSA; Environmental Packaging Technologies, Inc.; and UWL Inc.

-

TechnoGroupUSA is the designer, producer, and distributor of Techno-Tanks Flexitanks. In addition, it also offers bulk liquid storage and logistics solutions. The company serves a diverse range of businesses and sectors in Miami, Florida, offering them the newest methods for moving their bulk liquids. The company regularly exports and imports water, wine, juice, concentrates, glycerin, additives, and much more using the Flexitanks available for purchase from TechnoGroupUSA.

-

Environmental Packaging Technologies, Inc. produces and supplies flexitanks, which are utilized in the bulk liquid freight transportation industry. It provides packaging options for bulk product storage and transportation. The organization serves a broad spectrum of industries, including shippers of agrochemicals, wine, culinary oils, pharmaceuticals, and premium beverages. In addition, it offers logistic services, product stewardship, product transfer, loading and unloading, packaging supply and installation, and removal, disposal, and recycling.

SIA Flexitanks; are the other participants operating in the U.S. flexitank market

- SIA Flexitanks provides a customized set of premium products to its wide variety of customers who wish to export their goods globally. The company's bulk liquid tanks are free-flowing, non-hazardous, and have undergone quality testing to guarantee they satisfy international regulations for contact with food. The company places a great value on safety, which is why it complies with regulatory bodies such as the US FDA, German BGA, and Japanese Canning Authority.

Key U.S. Flexitank Companies:

- Environmental Packaging Technologies, Inc.

- TechnoGroupUSA

- Trans Ocean Bulk Logistics

- SIA Flexitanks

- UWL Inc.

- ASF Logistics

- TSC Container Freight

- Transolve global

- ECU Worldwide

Recent Developments

- In November 2023, ASF Logistics announced the expansion of its Flexitanks unit, which is dedicated to promoting the use of this incredibly effective and eco-friendly mode of transportation for non-hazardous bulk liquid cargo. ASF Logistics is the human standard in global logistics. The bulk liquids sector will now benefit from ASF's dependable, constant high standards thanks to the development of the Flexitank product line.

U.S. Flexitank Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 202.05 million

Revenue forecast in 2030

USD 656.06 million

Growth rate

CAGR of 21.7% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in thousand units, Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Type, application.

Key companies profiled

Environmental Packaging Technologies, Inc.; TechnoGroupUSA; Trans Ocean Bulk Logistics; SIA Flexitanks; UWL Inc.; ASF Logistics; TSC Container Freight; Transolve global; ECU Worldwide.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Flexitank Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of latest industry trends in each sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. flexitank market report based on type and application.

-

Type Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Single-Trip

-

Multi-Trip

-

-

Application Outlook (Volume, Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Food Stuffs

-

Wine & Spirits

-

Chemicals

-

Oils

-

Industrial Products

-

Pharmaceuticals Goods

- Others

-

Frequently Asked Questions About This Report

b. The U.S. flexitank market was valued at USD 169.08 million in the year 2023 and is expected to reach USD 202.05 million in 2024

b. The U.S. flexitank market is expected to grow at a compound annual growth rate of 21.7% from 2024 to 2030 to reach USD 656.06 million by 2030.

b. The single-trip segment led the market and registered the largest market share of over 91.0% in 2023. This growth is attributed to the reduced danger of product contamination linked to single-trip flexitank.

b. The key market player in the U.S. flexitank market includes Environmental Packaging Technologies, Inc.; TechnoGroupUSA; Trans Ocean Bulk Logistics; SIA Flexitanks; UWL Inc.; ASF Logistics; TSC Container Freight; Transolve global; ECU Worldwide

b. The key factors that are driving the U.S. flexitank market include, the growing preference for flexitanks over conventional shipping containers for the delivery of bulk liquid products and growing import and exports of liquid products from U.S

b. The industrial products segment dominated the market and accounted for the largest revenue share of over 21.0% in 2023 due the high demand of flexitank across a range of industrial applications to pack bulk products such as paraffin wax, printing inks, emulsions, fertilizers, and natural and synthetic latex.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.