- Home

- »

- Consumer F&B

- »

-

U.S. Frozen Dessert Market Size, Trends Report, 2030GVR Report cover

![U.S. Frozen Dessert Market Size, Share & Trends Report]()

U.S. Frozen Dessert Market (2022 - 2030) Size, Share & Trends Analysis Report By Product (Ice Creams, Frozen Yoghurt, Sweet Treats, Tofu), By Distribution Channel (Retail, Food Service), By State, And Segment Forecasts

- Report ID: GVR-1-68038-884-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

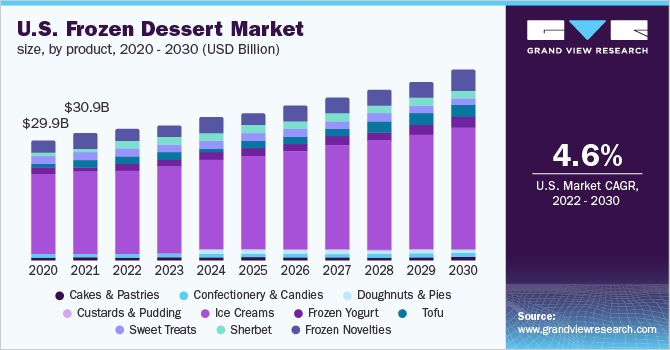

The U.S. frozen dessert market size was valued at USD 30.95 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.6% from 2022 to 2030. Increasing product launches in the frozen dessert segment such as custard, yogurt, gelato, granita, ice cream, and sherbet would further drive the market. For instance, in September 2021, Sara Lee Frozen Bakery launched a collection of ice creams and novelties in various flavors such as mango, passionfruit, chocolate, and vanilla. The initiative was taken to increase product penetration among consumers preferring varied flavors of ice creams. Increasing health and safety concerns over rising COVID-19 cases obliged people to take fewer trips to stores for buying household items including frozen desserts.

This trend resulted in the need for stockpiling eatables in houses that lasted for a longer duration without spoilage, which further increased the sales of frozen food including desserts in the U.S. For instance, Yasso, a U.S.-based frozen food brand, witnessed a double-digit sales growth during the pandemic in the year 2020. Further, consumers seeking to treat themselves with frozen novelties, such as ice cream, would strengthen the market growth over the forecast period.

The increasing number of health-conscious consumers seeking out a low-carb and low sugar diet with nutritional benefits will bode well for the market growth. Manufacturers in response to the trend are introducing protein-rich frozen desserts with various health benefits. For instance, in June 2020, Pro Rich Nutrition LLC, a California-based health and dietetic food stores company, introduced Pro Rich dairy-based frozen dessert, fortified with 10-11 grams of protein, 26 vitamins and minerals, amino acids, organic prebiotic fiber, and probiotic cultures and is available in five flavors including JoJo's Original, Rocket Launch, Chocolate Chunk, Mint Madness, and Strawberry Sundae. It is gluten-free, non-GMO, and contains no artificial colors, flavors, sweeteners, or preservatives.

Many key brands and companies in the U.S. are launching innovative limited edition and seasonal flavors for frozen desserts in collaboration with other small brands in the country, which is likely to gain traction among consumers. For instance, in July 2021, Kraft Macaroni & Cheese launched a limited-edition ice cream in collaboration with Brooklyn-based ice cream brand -Van Leeuwen. Both the brands collaborated to launch Kraft Macaroni & Cheese as a summer treat that claims to have no artificial flavors and preservatives. Kraft Macaroni & Cheese ice cream would be available at Van Leeuwen scoop shops and online.

The COVID-19 pandemic has resulted in digitalizing the process of ordering and shipping for frozen dessert brands through their websites and other e-commerce retailers. For instance, in March 2022, GoodPop frozen pops launched a United States Department of Agriculture (USDA) certified organic pops that are 100% fruit juice-based and made with no added sugar. The pops will be available in a pack of six in three flavors: orange, cherry, and grape. These products will be available at GoodPop’s online shop across the U.S. beginning in April. Hence, initiatives like these will propel market growth in the coming years.

Furthermore, various mergers & acquisitions by key players in the market would integrate well with the upward growth trend. For instance, in December 2021, The Urgent Company, a consumer brand subsidiary of Perfect Day, acquired Coolhaus, a frozen ice-cream brand and a pioneer in dessert innovation and novelties. This initiative was taken in response to expanding the company’s product portfolio, providing a better food system to the consumers in Los Angeles, and stronghold its growing range in the dairy aisle. Similarly, in January 2022, MidOcean Partners acquired Casper’s Ice Cream (Casper’s), a manufacturer and supplier of branded and co-packed frozen novelty products sold in grocery and mass retail outlets throughout the U.S.

Product Insights

The ice-creams segment held the largest revenue share of over 60.0% in 2021. Increasing demand for convenience food products among millennials, coupled with new launches in this segment in different flavors to entice customers, would drive the demand for the segment in the forecast period. For instance, in February 2019, Magnum Ice Cream announced the launch of new Magnum Non-Dairy frozen dessert bars in the U.S., available in two decadent flavors: classic and almond. These products are Certified Vegan by Vegan Action. Apart from these two flavors, there is an increasing trend of cappuccino, rooibos tea, mocha, punch, cocoa, and tropical flavors among consumers in the country.

The frozen yogurt segment is projected to register the fastest CAGR of 5.6% from 2022 to 2030. The growing health awareness and increasing preference for healthy food and diet among consumers are major factors fueling the growth of the segment. Frozen yogurt contains low levels of lactose and can be consumed by lactose-intolerant individuals. This is acting as a key factor propelling the growth of the target market. For instance, Peachwave, LLC offers frozen yogurt that is high in calcium and protein and contains real cultured skim milk and yogurt cultures, with nearly 28 million live and active cultures per ounce, with easily digestible properties.

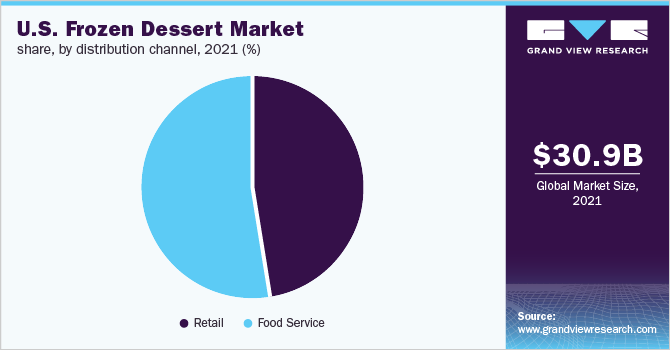

Distribution channel Insights

The foodservice segment led the market in 2021 with a revenue share of over 50.0%. Various initiatives such as mergers & acquisitions and product launches by various food services including restaurants, cafes, and ice-cream parlors operating at convenient and accessible locations in the U.S. are contributing to the segment growth. For instance, in April 2022, Bruster’s, a food and beverages company, re-launched its non-dairy vegan frozen dessert line made with oat milk. These products are available in 14 new frozen dessert flavor recipes including coffee chocolate chip, chocolate raspberry truffle, and mint chocolate chip.

The retail segment is expected to register the fastest growth rate of 5.0% during the forecast period. The convenient shopping experience of having a plethora of food and beverage items including frozen desserts in a single place is the primary driver for consumers to visit their nearby retail stores. Furthermore, to ensure the in-store buying habits of customers are maintained, storeowners are stocking desserts that are high in demand at their stores. For instance, in April 2022, KLIMON launched 5 flavors of its 100% plant-based, almond-based, and dairy-free frozen dessert pints at select Walmart locations throughout the U.S.

State Insights

California held the largest revenue share of over 14.0% in 2021 owing to the growing consumer inclination toward low-sugar and low-calorie desserts in the state. In addition, increasing consumer willingness to spend on healthy snacks has facilitated manufacturers to innovate and produce a variety of products. Key innovation by manufacturers for the product segment will further drive the market in the state. For instance, in January 2022, Cold Stone Creamery in partnership with Danone North America launched a plant-based frozen dessert available at participating Cold Stone Creamery stores in the U.S. The product claims to be dairy-free, vegan, and non-GMO.

New York is expected to register the fastest CAGR of 6.1% from 2022 to 2030. Growing affinity towards frigid/chilled food including dessert among consumers, especially millennials, due to single-serving options and ease of availability is expected to drive the market during the forecast period. For instance, in May 2021, Whipped Urban Dessert Lab, a New York-based ice-cream parlor, launched ‘Taste of Freedom’ vegan ice cream. The variety sells for USD 13 per 14oz and features an oat milk base, cinnamon spice, and chewy ginger cookie, which will be available at the company’s flagship store and through Goldbelly.com.

Key Companies & Market Share Insights

The U.S. market for frozen desserts is highly fragmented with the presence of a large number of regional players. Some of the key players in the industry are Unilever; Nestlé.; Froneri International Limited; Blue Bell Ice Cream; Wells Enterprises, Inc.; Winward Brands LLC; Tofutti Brands, Inc.; MTY Food Group (Cold Stone Creamery); Dairy Farmers of America, Inc.; and Conagra Brands. Companies have been implementing various expansion strategies, such as partnerships and new product launches, to stay ahead in the game.

-

For instance, in January 2022, Mondelez International, Inc. launched a line of frozen desserts, which is sold under the Oreo brand.

-

In March 2022, So Delicious Dairy Free introduced a new line of frozen desserts, which are made with the company’s Wondermilk and come in both pints and cones.

-

In February 2020, ZoCal, a California-based frozen desserts company released its premier line of frozen treats, including the first-ever zero-calorie popsicle and sorbet bars.

Some prominent players in the U.S. frozen dessert market include:

-

Unilever

-

Nestlé

-

Froneri International Limited

-

Blue Bell Ice Cream

-

Wells Enterprises, Inc.

-

Winward Brands LLC

-

Tofutti Brands, Inc.

-

MTY Food Group (Cold Stone Creamery)

-

Dairy Farmers of America, Inc.

-

Conagra Brands

U.S. Frozen Dessert Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 32.11 billion

Revenue forecast in 2030

USD 46.39 billion

Growth Rate

CAGR of 4.6% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, state

State scope

California; Texas; New York; Florida; New Jersey; Indian

Key companies profiled

Unilever; Nestlé; Froneri International Limited; Blue Bell Ice Cream; Wells Enterprises, Inc.; Winward Brands LLC; Tofutti Brands, Inc.; MTY Food Group (Cold Stone Creamery); Dairy Farmers of America, Inc.; Conagra Brands

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at the state level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. frozen dessert market report on the basis of product, distribution channel, and state:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cakes & Pastries

-

Confectionery & Candies

-

Doughnuts & Pies

-

Custards & Pudding

-

Ice Creams

-

Frozen Yogurt

-

Tofu

-

Sweet Treats

-

Sherbet

-

Frozen Novelties

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Retail

-

Hypermarkets/Supermarkets

-

Online

-

Others

-

-

Food Service

-

-

State Outlook (Revenue, USD Billion, 2017 - 2030)

-

California

-

Texas

-

New York

-

Florida

-

New Jersey

-

Indiana

-

Frequently Asked Questions About This Report

b. The U.S. frozen dessert market size was estimated at USD 30.95 billion in 2021 and is expected to reach USD 32.11 billion in 2022.

b. The U.S. frozen dessert market is expected to grow at a compound annual growth rate of 4.6% from 2022 to 2030 to reach USD 46.39 billion by 2030.

b. Ice Cream dominated the U.S. market with a share of 61.1% in 2021. This is attributed to the wide penetration of ice creams owing to their first-mover advantage.

b. Some key players operating in the U.S. frozen dessert market include Unilever; Nestlé.; Froneri International Limited; Blue Bell Ice Cream; Wells Enterprises, Inc.; Winward Brands LLC; Tofutti Brands, Inc.; MTY Food Group (Cold Stone Creamery); Dairy Farmers of America, Inc.; and Conagra Brands.

b. The key factor that is driving the U.S. frozen dessert market growth includes rising demand for low-sugar and low-calorie desserts on a domestic level, increasing spending among consumers towards trying out new delicacies, and new product launches.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.