- Home

- »

- Consumer F&B

- »

-

U.S. Fruits & Vegetables Market Size & Share Report, 2030GVR Report cover

![U.S. Fruits And Vegetables Market Size, Share & Trend Report]()

U.S. Fruits And Vegetables Market (2024 - 2030) Size, Share & Trend Analysis Report By Product (Fresh Fruits & Vegetables, Dried Fruits & Vegetables, Frozen Fruits & Vegetables), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-363-8

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

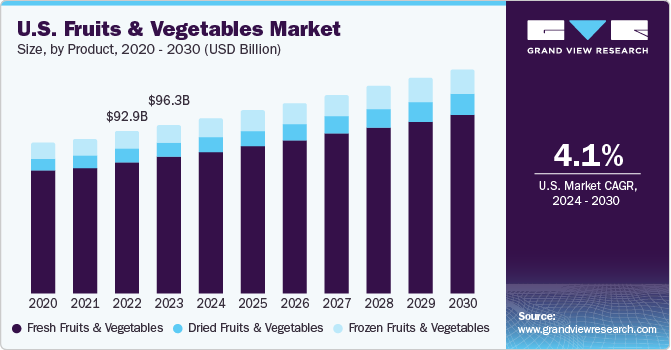

The U.S. fruits and vegetables market size was valued at USD 96.26 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 4.1% from 2024 to 2030. Customers are on the lookout for fresh & exotic fruits and vegetables for a healthy diet as they invest more time and money in their health. Millennials remain the main consumers of fruits and vegetables in the U.S. due to their increased digital presence. Online retailers adopt strategies like offering large discounts and cashback, which are expected to attract this demographic over the forecast period. With more frequent snacking habits among millennials and their concerns about the costs have made online stores an attractive alternative.

The growing popularity of online grocery shopping & delivery services is a key driver of product purchases. Meal kit delivery is another addition to grocery delivery that is gaining popularity among health-conscious consumers, as they provide many combinations of fruits & vegetables based on the personalized requirements of consumers. These meal kits are popular among various groups including millennials, Generation X, and people who do not have time to cook extravagant meals or are single. The U.S. fruits and vegetable business is driven by factors like increasing health awareness, rising disposable incomes, and growing demand for fresh and locally-sourced produce.

Amazon accounts for a major portion of all online sales. However, it has experienced a decline in sales because of brick-and-mortar retailers like Target and Walmart. However, after buying ‘Whole Foods’, the company has seen an increase in its overall sales. Target has improved its online presence; sales are being increased because of the acquisition of the e-commerce service shift, which provides consumers with same-day grocery deliveries. Similarly, Walmart has taken certain steps to keep up with the rising online buying trends. Its online inventory has increased from 10 million items to 67 million items, demonstrating a significant increase in sales.

With the rise in obesity rates in the U.S. and growing awareness of the benefits of healthy diets, consumers are steadily shifting toward fresh foods and healthier options over the past ten years. Younger demographics tend to be drawn to trendy diets like raw food and paleo diets that emphasize the health advantages of fresh produce. Furthermore, elderly people tend to have more cautious eating habits due to health issues. The demographic of baby boomers who buy fresh produce is equally significant. According to the International Food Information Council, around 52% of Americans report that they follow a diet or eating pattern in 2022, up significantly from 2021. Fruits and vegetables are the most popular foods for managing weight loss, energy levels, digestive health, and heart health. Dried fruits, pumpkin seeds, spinach, kale, swiss chard, and collard greens are few iron rich fruits and vegetables.

Fruits are promoted as a healthy option to sweet snacks like cookies and cakes because snacking is a frequent exercise for most Americans across many age groups. It is also one of the main contributors to obesity in the general population, coupled with a sedentary lifestyle. In addition, as a means of maintaining their health, consumers who want to boost their nutrient consumption focus on "superfoods", which boosts the market for fruits and vegetables because items like avocados have high vitamin and fiber content. Berries, citrus fruits, apples and pears are fruits containing high flavonoids content that aid in improvement of heart health and cognitive function. Their hesperidin content in citrus fruits has potential anti-inflammatory properties.

Vegetarians & vegans primarily rely on the consumption of fruits and vegetables to meet their nutritional requirements. Moreover, non-vegetarians who are more inclined toward meat consumption can be encouraged to eat more vegetables and less meat overall. This strategy would help increase the consumption of fruits and vegetables as this diet can serve the same amount of nutrients as meat. The USDA provides assistance to farmers through loan programs, disaster relief, and technical assistance. They also offer nutrition education programs and resources for consumers. Consumer demand for specialty crops is increasing due to their perceived health benefits, freshness, and unique flavors.

Plant-based diets have become increasingly popular in the U.S. over the past few years, which drives the demand for fruits and vegetables. In the U.S., millions of individuals currently follow a plant-based diet. 9.7 million Americans, one million of whom are vegan, follow a vegetarian diet; according to a Vegetarian Times study in 2022. Moreover, according to an article by Healthshots in 2020, a majority of the people who become vegetarians do so for good health. Apart from this, weight management, environmental concerns, and animal welfare were the other main motivators. California, Florida, Washington, Oregon, Arizona, and Georgia are leading fruits and vegetable producing states in the U.S. California leads the fruits and vegetable production, which is responsible for nearly 70% of the U.S. fruit and vegetable production.

Vegan trends are expected to provide several growth opportunities to the U.S. fruits & vegetables industry. However, plant-based products are gaining traction in the market and competitors are making efforts in meeting the demand of customers who now prefer plant-based food items more often. Veganism could be the biggest opportunity for players in the market. Moreover, the USDA Dietary Guidelines recommend that adults consume 25-35 grams of dietary fiber per day. These guidelines also highlight the importance of consuming a variety of fruits and vegetables to ensure adequate fiber content intake.

According to an article in Modern Restaurant Management in April 2022, the popularity of plant-based foods is rising. This is mainly due to the increase in the vegan population, which totals around 10% in the U.S. Furthermore, due to climate change and due to the aftermath of the COVID-19 pandemic, the popularity of plant-based foods is further expected to rise. Additionally, the published report also states that the total sales of around 17 restaurants that switched to a plant-based menu, increased from 10% to 1,000%. This indicates a significant increase in demand for fresh fruits & vegetables in the U.S.

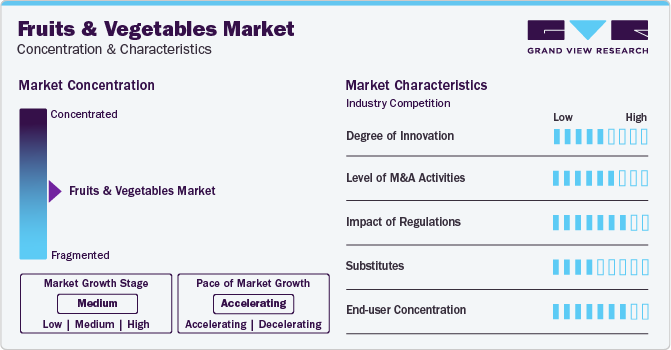

Market Concentration & Characteristics

The growth of this market can be attributed to increasing consumer health-consciousness and spending on healthy snacking options. Consumers are prioritizing fruits and vegetables for their well-being, fueling demand. Adoption of technologies like AI-powered irrigation systems, vertical farming, and robotics is gradually impacting production and distribution processes, offering avenues for future innovation.

Companies focus on strategic acquisitions to expand their presence overseas and reinforce their position in the market. Over the next few years, internationally reputed companies are likely to acquire small-and medium-sized companies operating in the industry in a bid to facilitate regional expansion.Some large players are integrating their operations across the supply chain, potentially increasing efficiencies but also raising concerns about market dominance.

Stringent regulations around food safety and pesticide use can be challenging for smaller farms but ensure consumer protection and drive innovation in safer production methods. Global trade disruptions and transportation challenges can affect the availability and affordability of imported fruits and vegetables, impacting market stability and consumer choices. Furthermore, outbreaks of foodborne illnesses linked to fruits and vegetables can damage consumer confidence and impact market demand, requiring robust safety measures and improved traceability throughout the supply chain.

Product Insights

The fresh fruits & vegetables segment dominated the market with the highest share of 80.82% in 2023. The coronavirus outbreak had a significant impact on the consumption of fresh fruits and vegetables in the U.S. Although the availability of these products took a hit owing to logistical and transport challenges, the demand for fresh fruits and vegetables was high. This was because consumers increased their focus on eating healthy and including more fresh produce in their diets instead of processed or frozen foods.

A survey commissioned by Nutrisystem and conducted by OnePoll in 2022 revealed that post-pandemic, over 70% of Americans became increasingly concerned about their health since the pandemic, particularly about weight loss and weight gain. This has significantly driven the consumption of fresh fruits and vegetables.

The dried fruits & vegetables segment is anticipated to grow at the fastest CAGR of 5.4% from 2024 to 2030. As Americans search for healthier snack choices, the consumption of dried fruits and vegetables has seen a steady rise in recent years. Dried fruits and vegetables are popular because they are convenient, portable, and have a longer shelf life than fresh produce. The growing popularity of plant-based diets is another element boosting this segment.

According to an article by the Alliance for Science, as of January 2022, 10% of Americans over the age of 18 identified as vegan or vegetarian. Many consumers are now choosing to eat less meat and search for alternative forms of nutrition and protein. The addition of plant-based protein and nutrients to meals can be done quickly and inexpensively using dried vegetables and fruits.

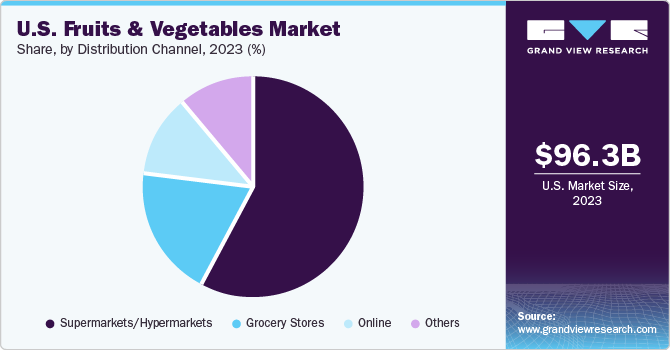

Distribution Channel Insights

The supermarkets/hypermarkets segment led the market with the highest share of over 58% in 2023. Due to the pandemic, consumers adopted new purchasing behaviors, such as buying products online, curbside pickups, and home delivery. The Fresh Trends 2022 study from The Packer, however, indicates that such behaviors have decreased since 2021. Due to the desire of many customers to personally smell and touch the product before making a purchase, online buying of fruits and vegetables has decreased.

Other major reasons attributed to consumer preference to shop for fruits and vegetables from hypermarkets and supermarkets are convenience, price, availability, and brand recognition. Hypermarkets and supermarkets often offer a one-stop shopping experience, where consumers can find a wide variety of products, including fruits and vegetables, in one place. Such establishments often have lower prices on fruits and vegetables compared to other retailers due to their immense purchasing power and subsequently, economies of scale.

The online segment is anticipated to grow at the fastest CAGR of 5.2% over the forecast period. Given the temporary and permanent closures of physical distribution channels in the country due to the viral outbreak, the sale of fruits and veggies through e-commerce portals or online grocery stores saw an increase in and after 2020. One in six consumers (15.8%) claimed to buy groceries online and had them brought to their homes every week, according to the PYMNTS Connected Economy Monthly Report. This segment is still in its early stages of growth but is growing steadily as major players like Walmart and Amazon expand their digital business.

Regional Insights

The Southeast U.S. region dominated the market with a share of nearly 30% in 2023. The subtropical, humid climate of the region coupled with its flat terrain, abundant soil, and long growing season, is ideal for cultivation. According to the 2022 MDPI article on the U.S. fresh fruits and vegetables market, California in the western region of the U.S. and Florida are the major producing states with over half of total fruit and vegetable farms. In the Southeast U.S., most people earn a living through farming, textile manufacturing, coal mining, oil drilling, and farming. Owing to these factors the production and consumption of fruits & vegetables in high in the region thus contributing to the market growth.

The Southwest U.S. region is estimated to grow at the highest CAGR of 5.7% over the forecast period. The region produces all root vegetables, including turnips, carrots, leeks, parsnips, potatoes, radishes, and sweet potatoes. Moreover, vegetables, fruits, nuts, and dairy products are also widely produced in the Southwest U.S., particularly in California. With its proximity to high-producing farming regions, South California is a global trade hub with a diversified population and a workforce interested in adopting healthy lifestyles. California is also home to 4,700 supermarkets and grocery stores, providing a wide selection of products and the convenience of purchasing.

Key Companies & Market Share Insights

The U.S. fruits & vegetables market is characterized by the presence of a few well-established players such as Nestlé, Dole Food Company, Inc., Fresh Del Monte Produce, Inc., Sunkist Growers Inc., Chiquita Brands International Inc., General Mills Inc., Fresh Pro, Sysco Corporation, Tanimura & Antle Fresh Foods, Inc., and C.H. Robinson Worldwide Inc. Key players operating in the market are adopting various steps to increase their presence in the market. These steps include strategies such as partnerships, mergers & acquisitions, global expansion, and others.

Key U.S. Fruits And Vegetables Companies:

The following are the leading companies in the U.S. fruits and vegetables market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these U.S. fruits and vegetables companies are analyzed to map the supply network.

- Nestlé

- Dole Food Company, Inc.

- Fresh Del Monte Produce, Inc.

- Sunkist Growers, Inc.

- Chiquita Brands International, Inc.

- General Mills Inc.

- Fresh Pro

- Sysco Corporation

- Tanimura & Antle Fresh Foods, Inc.

- C.H. Robinson Worldwide, Inc.

Recent Developments

-

In December 2022, Fresh Del Monte Produce, Inc. launched the Del Monte Zero pineapple, its first carbon-neutral certified pineapple. The product is available in North American and selective European markets. It is a product line extension from the Del Monte Gold, HoneyGlow, and Del Monte pineapple varieties.

-

In July 2022, Sunkist Growers, Inc. started The Official Orange of American Summer campaign to promote the Californian orange variety. As a part of the promotional and packaging campaign, the company offered an 8-pound combo bag and matching display bin for Valencia oranges.

-

In January 2021, Robinson Fresh, a new consumer brand launched by C.H. Robinson, marked the company's foray into offering fresh produce under its name. As a leader in the provision and transportation of fresh produce, C.H. Robinson is bringing its expertise directly to consumers through Robinson Fresh.

U.S. Fruits And Vegetables Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 100.07 billion

Revenue forecast in 2030

USD 127.61 billion

Growth rate

CAGR of 4.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

Northeast U.S.; Southeast U.S.; Southwest U.S.; West; Midwest

State scope

Florida; Georgia; Tennessee; North Carolina; Louisiana

Key companies profiled

Nestlé; Dole Food Company, Inc.; Fresh Del Monte Produce, Inc.; Sunkist Growers, Inc.; Chiquita Brands International, Inc.; General Mills Inc.; Fresh Pro; Sysco Corporation; Tanimura & Antle Fresh Foods, Inc.; C.H. Robinson Worldwide, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Fruit And Vegetables Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. fruits and vegetables market report on the basis of product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fresh Fruits & Vegetables

-

Dried Fruits & Vegetables

-

Frozen Fruits & Vegetables

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets/Hypermarkets

-

Grocery Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Northeast

-

Southeast

-

Florida

-

Georgia

-

Tennessee

-

North Carolina

-

Louisiana

-

-

Southwest

-

West

-

Midwest

-

-

Frequently Asked Questions About This Report

b. The U.S. fruit and vegetables market size was estimated at USD 92.88 billion in 2022 and is expected to reach USD 96.26 billion in 2023.

b. The U.S. fruit and vegetables market is expected to grow at a compound annual growth rate of 4.1% from 2023 to 2030 to reach USD 127.61 billion by 2030

b. The fresh fruits & vegetables segment dominated the U.S. fruits & vegetables market with a share of 80.9% in 2022. This is attributable to the high consumption of fresh fruits & vegetables owing to the growing inclination of consumers towards a healthy diet and lifestyle.

b. Some key players operating in the U.S. fruit and vegetables market include Nestlé, Dole Food Company, Inc., Fresh Del Monte Produce, Inc., Sunkist Growers, Inc., Chiquita Brands International, Inc., General Mills Inc., Fresh Pro, Sysco Corporation, Tanimura & Antle Fresh Foods, Inc., and C.H. Robinson Worldwide, Inc.

b. Key factors that are driving the U.S. fruit and vegetables market growth include increasing consumer awareness regarding lifestyle-driven health disorders and the need for increasing nutrition elements in daily diets.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.