- Home

- »

- Power Generation & Storage

- »

-

U.S. Lead Acid Battery Market Size & Share, Report, 2030GVR Report cover

![U.S. Lead Acid Battery Market Size, Share & Trends Report]()

U.S. Lead Acid Battery Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (SLI, Stationary), By Construction (Flooded, VRLA), By Application (Automotive, Telecom, Transport Vehicles), And Segment Forecasts

- Report ID: GVR-4-68038-114-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Lead Acid Battery Market Trends

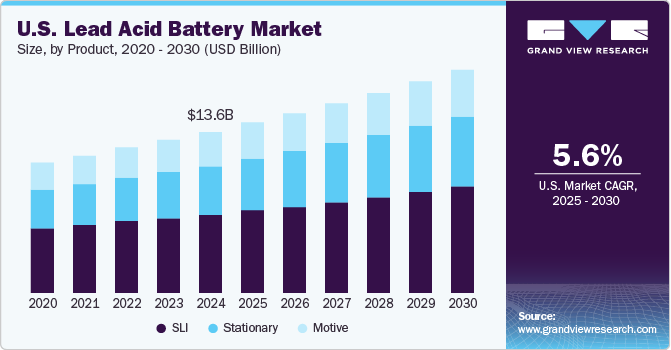

The U.S. lead acid battery market size was valued at USD 13.62 billion in 2024 and is expected to grow at a CAGR of 5.6% from 2025 to 2030. This growth is attributed to the increasing demand for uninterruptible power supply (UPS) systems across various industries enhances the need for reliable energy storage solutions. In addition, the automotive sector's expansion, particularly in electric vehicles and material handling applications, significantly contributes to market growth. Furthermore, the cost-effectiveness and reliability of lead-acid batteries further boost their appeal. Moreover, technological advancements and recycling initiatives support sustainable practices within the industry.

The automotive sector increasingly relies on lead-acid batteries, particularly as electric vehicles (EVs) gain popularity. In the U.S., the market is projected to grow significantly, driven by their demand for energy storage solutions across automotive and electronic industries and data centers. Their robust energy storage capabilities make them essential in various sectors, including wireless telecommunications and automotive equipment supply chains. Despite the advancements in lithium-ion and nickel-metal hydride technologies, lead-acid batteries maintain a significant market share due to their reliability and cost-effectiveness. They are widely used in rechargeable applications, particularly in telecommunications and military operations, where dependable energy storage is crucial.

In addition, the demand for lead-acid batteries is further fueled by ongoing technological innovations that enhance their efficiency and lifespan. These innovations address the needs of the telecom sector, which requires reliable backup power to ensure uninterrupted services. As global communication demands rise, the necessity for lead-acid batteries as a cost-effective energy storage solution becomes more pronounced.

Furthermore, the shift towards renewable energy sources also presents new opportunities for this market. With countries and corporations setting ambitious renewable energy targets, the need for efficient and reliable energy storage solutions is escalating. Lead-acid batteries can provide high surge currents and stability in renewable systems such as solar and wind power installations, thereby supporting grid stability and energy security.

Product Insights

SLI batteries dominated the market and accounted for the largest revenue share of 48.8% in 2024. This growth is attributed to the expanding automotive industry, which demands reliable battery solutions for traditional combustion engines. Increasing vehicle ownership, fueled by rising disposable incomes and urbanization, further propels this demand. In addition, technological advancements, such as enhanced battery efficiency and smart features, also play a crucial role. Furthermore, stringent emissions regulations necessitate improved battery performance, making SLI batteries essential for vehicle compliance and operational efficiency.

The stationary lead-acid battery segment is expected to grow at a CAGR of 6.4% over the forecast period, owing to rising demand for backup power solutions across various sectors, including telecommunications and renewable energy systems. In addition, the increasing reliance on uninterrupted power supply systems in commercial and residential applications drives this trend. Furthermore, advancements in battery technology have improved performance and lifespan, making stationary batteries more appealing. Moreover, government incentives promoting renewable energy storage also contribute to market growth, as businesses and consumers seek reliable energy solutions to support sustainability initiatives.

Construction Insights

The flooded lead-acid battery segment led the market and accounted for the largest revenue share of 58.9% in 2024. This growth is attributed to its cost-effectiveness and reliability, making it a preferred choice for various applications, particularly in the marine and material handling sectors. In addition, flooded batteries account for a significant market share due to their high power output and ability to operate under diverse conditions. Furthermore, the increasing demand for uninterruptible power supply (UPS) systems and electric vehicles further boosts the adoption of flooded batteries, providing dependable performance in critical situations.

The VRLA battery segment is expected to grow at a CAGR of 5.9% from 2025 to 2030. This growth is fueled by its advantages over traditional flooded batteries, including maintenance-free operation and enhanced safety features. In addition, the rising adoption of start-stop technology in vehicles and the growing popularity of hybrid and electric vehicles significantly contribute to this trend. VRLA batteries are favored for their ability to withstand frequent charge-discharge cycles, making them ideal for modern automotive applications. Furthermore, expanding uses in renewable energy storage and backup power systems are creating new opportunities for VRLA battery manufacturers.

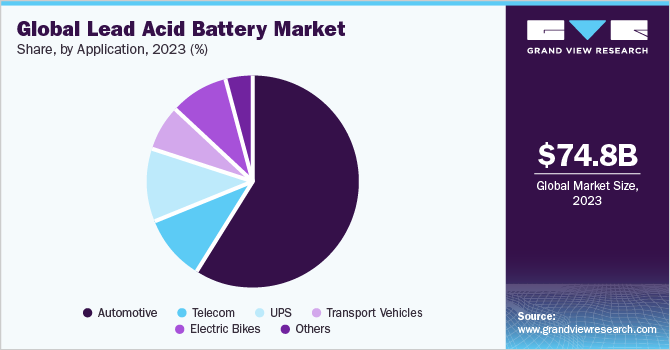

Application Insights

The automotive applications dominated the market and accounted for the largest revenue share of 56.1% in 2024, owing to the increasing demand for vehicles, particularly in the internal combustion engine segment, where lead-acid batteries are essential for starting, lighting, and ignition (SLI) systems. In addition, the rise of electric vehicles (EVs) also contributes to this growth, as lead-acid batteries are used in auxiliary systems. Furthermore, advancements in battery technology and the need for reliable power sources in various automotive applications further enhance market demand, supported by government incentives promoting sustainable transportation solutions.

The UPS applications segment is expected to grow at a CAGR of 7.3% over the forecast period. This growth is attributed to the rising need for reliable backup power solutions across critical industries such as telecommunications, healthcare, and data centers. As businesses increasingly rely on uninterrupted power to safeguard sensitive equipment and operations, lead-acid batteries provide a cost-effective and dependable energy storage solution. Furthermore, the growing focus on renewable energy sources and the integration of lead-acid batteries for energy storage in solar and wind applications also contribute to their expanding role in UPS systems.

Key U.S. Lead Acid Battery Company Insights

Some of the key players in the market include C&D Technologies, East Penn Manufacturing, Crown Battery, and others. These companies are adopting various strategies, including new product launches that focus on integrating advanced technologies for improved performance and efficiency, strategic collaborations, and partnerships that aim to expand manufacturing capabilities and market reach. Furthermore, companies also focus on mergers and acquisitions to consolidate resources and enhance product offerings.

-

EnerSys produces many products, including flooded lead-acid batteries, valve-regulated lead-acid (VRLA) batteries, and Thin-Plate Pure Lead (TPPL) batteries. The company operates across multiple segments, such as motive power, which serves material handling, electric vehicles, and stationary power applications for telecommunications and renewable energy storage. Their innovative technologies enhance battery performance and efficiency to meet diverse customer needs.

-

Johnson Controls manufactures a variety of lead-acid batteries, including SLI (Starting, Lighting, and Ignition) batteries for conventional vehicles and advanced VRLA batteries for hybrid and electric vehicles. The company operates in several segments, including automotive batteries for passenger cars and commercial vehicles and energy storage solutions for industrial applications. Their commitment to innovation and sustainability drives the development of high-performance battery technologies that cater to evolving market demands.

Key U.S. Lead Acid Battery Companies:

- EnerSys

- C&D Technologies

- East Penn Manufacturing

- Crown Battery

- NorthStar

- Johnson Controls

- B.B. Battery

- Panasonic Corporation

- Exide Technologies

- CSB Battery Co., Ltd.

Recent Developments

-

In April 2024, Hyundai Motor and Kia entered into a strategic collaboration with Exide Energy Solutions Ltd. to localize electric vehicle (EV) battery production in India. This collaboration aims to manufacture lithium-iron-phosphate (LFP) cells, enhancing their regional EV expansion plans. Exide Industries, known for its lead-acid batteries, will leverage its extensive experience in battery manufacturing. This initiative positions Hyundai and Kia to utilize domestically produced batteries in future EV models, aligning with India's carbon neutrality goals.

-

In May 2023, EnerSys introduced the ODYSSEY Connect battery monitoring system, designed to enhance the performance of its lead-acid batteries. This innovative system allows users to monitor battery health and performance data via Bluetooth on their smart devices. Key features include tracking the State of Health (SOH) and State of Charge (SOC) as well as providing voltage and temperature data. This advancement aims to improve operational efficiency and give users real-time insights into their lead-acid battery systems.

U.S. Lead Acid Battery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 14.36 billion

Revenue forecast in 2030

USD 18.89 billion

Growth rate

CAGR of 5.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, construction, application

Key companies profiled

EnerSys; C&D Technologies; East Penn Manufacturing; Crown Battery; NorthStar; Johnson Controls; B.B. Battery; Panasonic Corporation; Exide Technologies; CSB Battery Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Lead Acid Battery Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. lead acid battery market report based on product, construction, and application:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

SLI

-

Stationary

-

Motive

-

-

Construction Outlook (Revenue, USD Million, 2018 - 2030)

-

Flooded

-

VRLA

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

UPS

-

Telecom

-

Electric bikes

-

Transport vehicles

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.