- Home

- »

- Advanced Interior Materials

- »

-

U.S. lithium Market Size And Share, Industry Report, 2030GVR Report cover

![U.S. Lithium Market Size, Share & Trends Report]()

U.S. Lithium Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Carbonate, Hydroxide), By Application (Automotive, Consumer Electronics, Grid Storage, Glass & Ceramics), And Segment Forecasts

- Report ID: GVR-4-68040-275-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. lithium Market Size & Trends

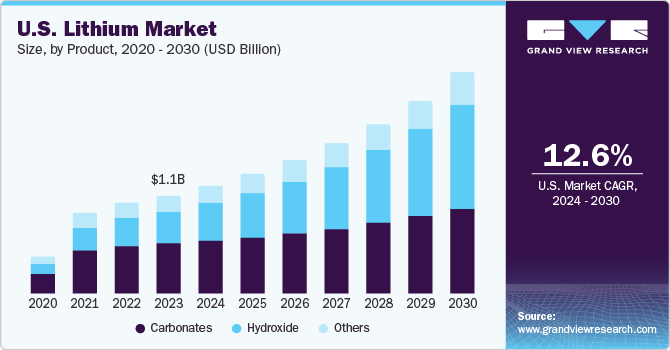

The U.S. lithium market size was valued at USD 1.06 billion in 2023 and is expected to grow at a CAGR of 12.6% from 2024 to 2030. Rising demand for lithium-ion batteries in electric vehicles, consumer goods, and grid storage in the country is seen as one of the major driving factors for the market. The popularity of lithium-ion batteries in electric vehicles (EVs) is due to their high energy per unit mass, compared to other types of EV energy storage systems, including solid-state (SSB), nickel hydride (Hydride), lead acid (LAD) or ultracapacitor (UAC). The exponential growth in the electric vehicles market is estimated to provide a lucrative opportunity to the producers of lithium-ion batteries, which, in turn, is expected to drive the growth of the lithium market.

The prevailing trend of adopting green energy worldwide is driving the usage of lithium in grid storage applications for electrification, further driving the global lithium market. This global growth is positively impacting the U.S. market for lithium. Power system operators harness the stored energy for later usage as it enhances operational flexibility and enables integration of energy distribution and supply. For instance, California (U.S.) is a global leader in terms of balancing renewable energy of grids with the help of utility-scale batteries, thereby driving the demand for lithium in grid storage applications in the state.

With major significance towards li-ion battery production, the U.S. is one of the major consumers of lithium in the world. The country has huge reserves of lithium. Lithium resources from brines and minerals account for 14 million tons in the U.S., as of 2023, as per USGS. However, the country mines only about 1% of lithium used in the world.

The country is expected to boost its lithium mining capabilities in the coming years. The market players in the U.S. are focusing on getting a hold of the battery supply chain owing to the increasing production of EVs in the country and the significant danger of transportation of batteries. The U.S. has a vision to establish secure battery technology and materials within the country. Several goals are set by the country including the growth of material processing base, encouraging cell & electrode manufacturing sectors, material recycling, and supporting R&D.

Market Concentration & Characteristics

The market is consolidated in nature, with production concentrated in the hands of a few key manufacturers. The market players compete against product quality, reliability in terms of supply and customer service, and diversity in product portfolio. Furthermore, mergers & acquisitions, capacity expansions, new product developments, and forming long-term supply agreements with global players are some of the strategic initiatives adopted by the market players to sustain and gain a higher competitive share in the industry.

The innovation in the market is moderate to high with key participants investing in the R&D of new products. For instance, in June 2021, Albemarle announced about opening a Battery Materials Innovation Center at its site in Kings Mountain, North Carolina, U.S. The center aids in supporting the company’s lithium hydroxide, lithium carbonate, and advanced energy storage materials growth platforms. With this center, the company aims at obtaining realistic and relevant cell building capabilities to generate meaningful data for next generation battery material design.

The market is highly regulated since lithium batteries are hazardous in nature and are subject to the Department of Transportation Hazardous Materials Regulations (HMR; 49 CFR Parts 171–180). This includes packaging and standard hazard communication requirements (e.g., markings, labels, shipping papers, emergency response information) and hazmat employee training requirements.

Lithium is majorly used in lithium-ion batteries. Potential alternatives to lithium-ion batteries that are in the exploratory stage are sodium-ion, and solid state batteries. However, these technologies are not yet commercially viable, and the usage of lithium is anticipated to witness moderate threat of substitutes over the forecast period.

Product Insights

The carbonates segment dominated the U.S. lithium market with a revenue share of over 50% in 2023. Lithium Carbonate (Li2CO3) is used for treatment of mental disorders such as bipolar disorder. As per a recent article published on Forbes Health, 6% of the U.S. adult population suffered serious mental health disorders in 2022 such as bipolar disorder and severe anxiety. Li2CO3 is commonly prescribed for treatment of bipolar disorder, wherein it acts as mood stabilizer and reduces the severity of extreme behavior, which may lead to uncertain activities. Rising cases of such disorders are expected to anticipate the usage of Li2CO3 further augmenting the growth of the market in U.S.

The hydroxides segment is expected to witness the fastest CAGR of 18.2% during the forecast period. Lithium hydroxide (LiOH) is a white hygroscopic crystalline material and an inorganic compound. It is commercially available as anhydrous and monohydrate and is usually used by Li-on battery manufacturers. The inclination of major key players toward adopting LiOH for battery manufacturing is expected to benefit market growth positively. For instance, in February 2022, Piedmont Lithium announced that it is in the process of expanding its production capacity of LiOH to 30,000 metric tons per annum in its newly upcoming Tennessee plant by 2025.

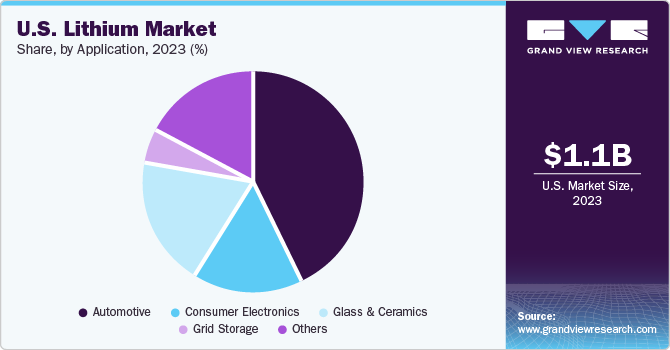

Application Insights

The automotive segment dominated the market with a revenue share of over 42% in 2023. Lithium finds its widest application in the manufacturing of batteries. Rising concern regarding climate irregularities has accelerated the adoption of EVs as they reduce the carbon footprint and greenhouse gas impact. Technological advancement and stringent government regulations have also led to a massive demand for EVs, which is expected to drive the lithium demand for use in battery cells. Key automotive companies, such as BMW, Audi, Volkswagen, and General Motors, have already announced that by 2030, more than 50% vehicles sold will be fully electrical to achieve carbon neutrality. This decision has explicitly propelled the demand for lithium so that EV manufacturers do not face any shortage in the supply of automotive components.

Consumer electronics is expected to witness the fastest CAGR during the forecast period. The segment growth is attributed to rising demand for electronic devices, such as mobile phones, laptops, and MP3 players, which make use of lithium batteries. Characteristics such as lightweight, large energy storage, and small size are driving the demand for lithium batteries, thus positively influencing the lithium market growth in the U.S.

Remote controllers, smoke detectors, portable games, and cameras are made of single-use lithium batteries that cannot be charged. Rechargeable lithium polymer cells find applications in products such as digital cameras, toys, mobile phones, small and large appliances, laptops, tablets e-readers, and power tools. Thus, rising investment for the expansion of consumer electronics production is expected to augment the growth of the U.S. market for lithium over the forecast period.

Key U.S. lithium Company Insights

The market is characterized as highly competitive in nature with existing or experienced suppliers constantly seeking opportunities to develop, innovate, and improve new production technologies. In addition, with the high demand for lithium from the EV industry, the competition for a larger market share has intensified. The market is also characterized by the presence of well-established players with a strong financial base and experience in the field. Large investments are required to operate in the industry. Thus, new entrants face competition from key players.

-

Albemarle Corporation completed the construction of a new lithium plant worth USD 500 million in Chile. This plant has increased the production capacity of battery-grade lithium in the country from 44,000 tons to 80,000 tons per year.

-

American Lithium Corp., one of the leading lithium company in the U.S. has one of the world’s largest lithium processing base.

-

Piedmont Lithium aims to become the only integrated producer of lithium hydroxide from spodumene deposits in the U.S.

Key U.S. lithium Companies:

- Albemarle Corp.

- American Lithium Corp.

- Atlas Lithium Corp

- Lithium Americas Corp.

- Livent Corp.

- Piedmont Lithium

- Sigma Lithium Corp

Recent Developments

-

In February 2024, Albemarle Corp. has partnered with BMW group to deliver battery-grade lithium to BMW. This partnership is not only limited to raw material supply but also to innovations in the market.

-

In September 2023, American Lithium Corp.announced a new lithium discovery from the initial drill hole completed at one of the key discovery targets previously identified from 2021 field work conducted near the Community of Quelcaya. This discovery is expected to impact the company’s abilities to refine and process lithium.

U.S. Lithium Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.16 billion

Revenue forecast in 2030

USD 2.38 billion

Growth rate

CAGR of 12.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons; revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

Albemarle Corp.; Livent Corp.; Lithium Americas Corp.; Piedmont Lithium; American Lithium Corp; Atlas Lithium Corp; Sigma Lithium Corp

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Lithium Market Report Segmentation

This report forecasts revenue and volume growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. lithium market report on the basis of product and application:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Carbonates

-

Hydroxide

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Grid Storage

-

Glass & Ceramics

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. lithium market was valued at USD 1.06 billion in the year 2023 and is expected to reach USD 1.16 billion in 2024.

b. The U.S. lithium market market is expected to grow at a compound annual growth rate of 12.6% from 2024 to 2030 to reach USD 2.38 billion by 2030.

b. Based on product segment, carbonates emerged as a dominating segment in the market with a share of over 50% in 2023 due to the inclination toward rising usage of Li2CO3 in the healthcare industry.

b. The key market players in the U.S. lithium market includes Albemarle Corp.; Livent Corp.; Lithium Americas Corp.; Piedmont Lithium; American Lithium Corp; Atlas Lithium Corp; Sigma Lithium Corp.

b. The key factor driving the U.S. lithium market is the rising demand for lithium-ion batteries in electric vehicles, consumer goods, and grid storage in the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.