- Home

- »

- Advanced Interior Materials

- »

-

U.S. Metal Screw Fasteners Market Size, Share Report, 2033GVR Report cover

![U.S. Metal Screw Fasteners Market Size, Share & Trends Report]()

U.S. Metal Screw Fasteners Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Stainless Steel, Carbon Steel), By End Use (Automotive, Construction, Machinery & Equipment, Electrical & Electronics), And Segment Forecasts

- Report ID: GVR-4-68040-673-3

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Metal Screw Fasteners Market Summary

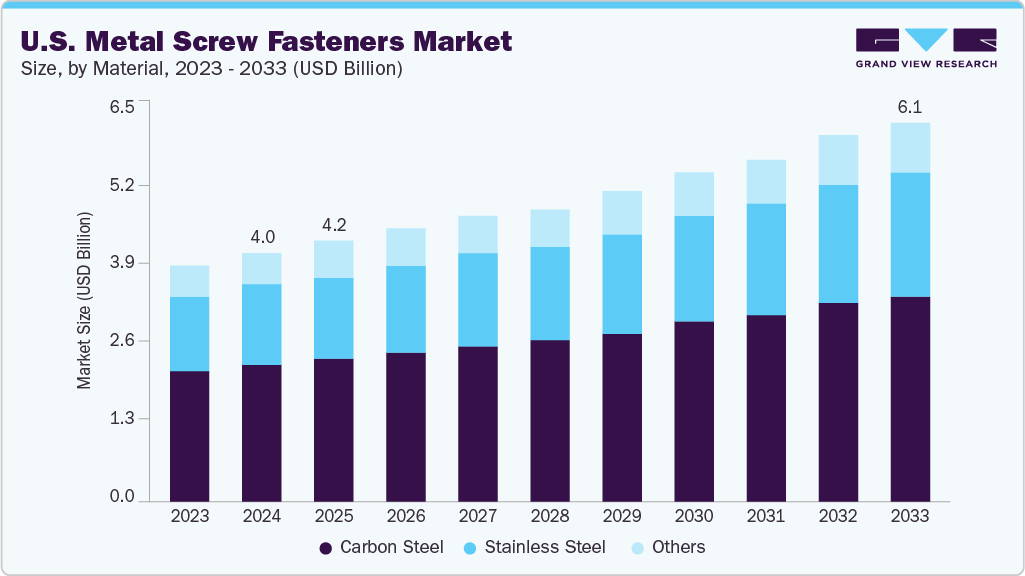

The U.S. metal screw fasteners market size was estimated at USD 4.04 billion in 2024 and is projected to reach USD 6.10 billion by 2033, growing at a CAGR of 4.8% from 2025 to 2033. The expanding construction and automotive sectors, ongoing infrastructure redevelopment, and increased residential and commercial projects are some of the key factors driving the market growth.

Key Market Trends & Insights

- By material, the stainless steel segment is expected to grow at the fastest CAGR of 5.1% from 2025 to 2033.

- By material, the carbon steel segment held the largest revenue share of 54.9% in 2024.

- By end use, the electrical & electronics segment is expected to grow at the fastest CAGR of 5.4% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 4.04 Billion

- 2033 Projected Market Size: USD 6.10 Billion

- CAGR (2025-2033): 4.8%

With more emphasis on durability and high-load bearing materials, metal screw fasteners are preferred over alternatives. Government funding for infrastructure projects, including roadways, airports, and bridges, further stimulates demand. Rapid urbanization and growing consumer demand for high-performance home appliances and electronics also contribute to the growth of the U.S. metal screw fasteners industry. The manufacturing sector’s rebound post-COVID is increasing equipment demand. Moreover, the trend of prefabricated buildings boosts demand for standardized fasteners. Rising e-commerce also fuels growth in logistics, warehousing, and packaging industries using fasteners.

Primary drivers include robust growth in the automotive, construction, aerospace, and heavy machinery sectors. Technological advancements in product design (e.g., anti-corrosive coatings, precision threading), increasing usage in electrical and electronic appliances, and higher demand from HVAC systems also contribute. Strict regulations on building safety encourage the use of certified, high-quality fasteners. The U.S. housing renovation market is thriving, pushing demand from DIY and home improvement channels. Increasing demand from renewable energy projects (wind and solar) and offshore platforms also acts as a catalyst.

Recent innovations include self-drilling, corrosion-resistant stainless steel screw fasteners and smart fasteners with embedded sensors for stress detection. There's a growing shift toward eco-friendly coatings like trivalent chromium. Automation and robotics in fastener installation tools enhance efficiency and reduce labor costs. 3D printing is being explored for prototype custom fasteners. Lightweight aluminum alloy screws are gaining popularity in electric vehicles. Some players are focusing on modular fastener kits for fast installation in field conditions. E-commerce is transforming distribution, with players offering custom packaging and instant delivery. There's also a push toward full traceability using QR-coded or laser-marked screws.

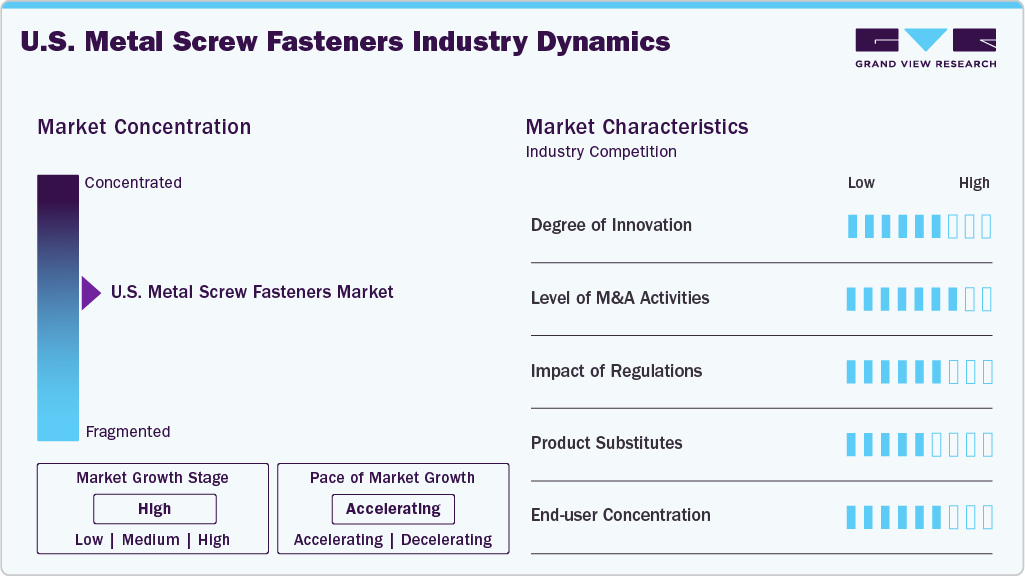

Market Concentration & Characteristics

The U.S. metal screw fasteners market is moderately consolidated, with a few large players such as Illinois Tool Works, Fastenal, and Stanley Black & Decker dominating through extensive distribution networks and diversified product portfolios. However, there is still significant room for regional and niche players serving specialized industrial applications. M&A activity is relatively frequent as companies seek vertical integration and global reach. OEM relationships and long-term contracts limit new entry in some industrial segments, adding to the market’s semi-consolidated nature.

The threat from product substitutes is moderate. Alternatives such as adhesives, welding, rivets, and plastic fasteners are used in certain low-load or specific applications. However, for high-strength, permanent, or semi-permanent connections, especially in construction, automotive, aerospace, and heavy equipment, metal screw fasteners remain irreplaceable. The demand for removable and reusable connections further cements their necessity. Cost-effectiveness and regulatory preferences also reduce substitute threats.

Material Insights

The carbon steel segment held the highest revenue share of 54.9% in 2024, due to its cost-effectiveness, increasing strength-to-weight innovations, and improved protective coatings. Their rising use in the automotive sector, particularly for EV chassis and assembly components, is driving volume growth. The material is also gaining popularity in general machinery, heavy equipment, and commercial fixtures due to its affordability and evolving corrosion resistance properties through galvanization and coating technologies. Carbon steel is increasingly chosen in mid-scale construction and OEM markets, where high strength and competitive pricing are key priorities, making it the most dynamic material segment.

The stainless-steel segment is expected to grow at a significant CAGR of 5.1% over the forecast period, due to their superior corrosion resistance, high tensile strength, and long-term durability. They are widely used across infrastructure, marine, food processing, and HVAC applications where exposure to moisture, chemicals, or fluctuating temperatures is common. Their compliance with stringent safety and environmental regulations makes them the preferred choice in public infrastructure and high-risk environments. Ongoing commercial construction, hospital and school renovations, and energy sector expansion further support demand. Stainless steel's compatibility with automated installation systems also supports its dominance in industrial-scale applications.

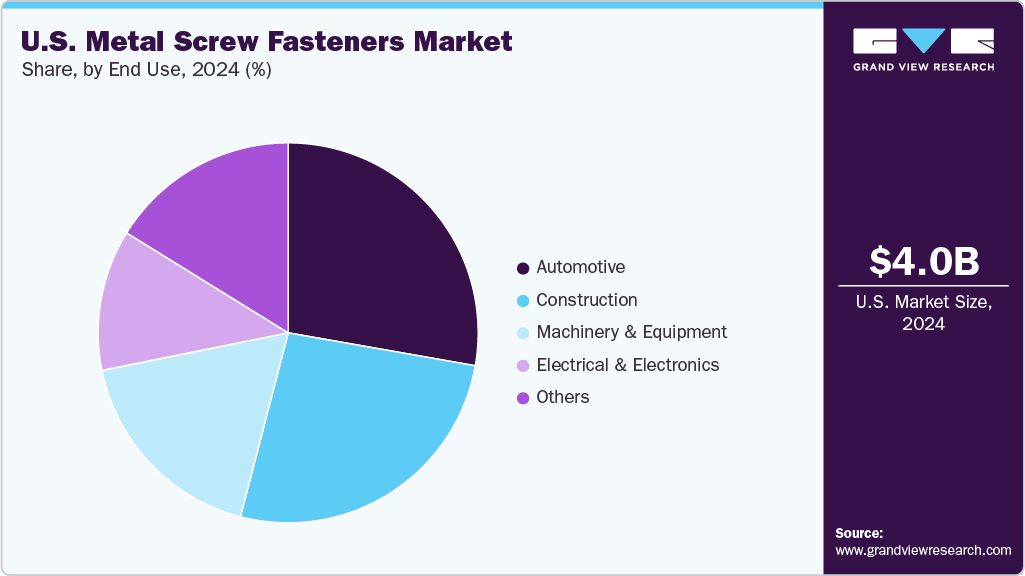

End Use Insights

The automotive segment led the U.S. metal screw fasteners industry with the largest revenue share of 27.8% in 2024, driven by high-volume vehicle production and strict safety and performance standards. Fasteners are critical in assembling engine components, chassis, interiors, electronics, and body panels. Stainless steel and carbon steel variants are widely used for their strength, vibration resistance, and reliability under extreme conditions. As automakers increasingly shift toward electric vehicles (EVs), the demand for precision fasteners suited to lightweight materials and high-voltage components is rising. Long-standing OEM relationships and standardized fastener specifications further solidify automotive as the leading consumer segment.

The electrical and electronics segment is expected to grow significantly at a CAGR of 5.4% over the forecast period, fueled by rising investments in advanced manufacturing, data centers, and smart infrastructure. The country’s strong base of consumer electronics production, coupled with growing demand for EV components, industrial control systems, and renewable energy installations, is driving the use of precision-engineered fasteners. Increasing adoption of smart homes, IoT-enabled devices, and defense electronics further supports this trend. Additionally, the reshoring of electronics manufacturing and favorable policies like the CHIPS and Science Act are boosting local production, leading to higher demand for specialized screw fasteners across printed circuit boards (PCBs), connectors, enclosures, and heat sinks.

Key U.S. Metal Screw Fasteners Company Insights

Some of the key players operating in the U.S. market include Fastenal Company and Illinois Tool Works Inc.

-

Fastenal is one of the largest industrial fastener distributors in North America, offering a vast range of metal screw fasteners for construction, automotive, and industrial use. It also provides on-site inventory management and custom fastener solutions..

-

ITW is a diversified manufacturer known for its high-performance engineered fasteners and components. It serves automotive, construction, and industrial markets with innovative screw fastener solutions and proprietary technologies.

Dale Fastener Supply and Wilson Garner are some of the emerging participants in the U.S. metal screw fasteners market.

-

Dale Fastener specializes in custom and non-standard fasteners, including U-bolts, J-bolts, and various metal screw fasteners. Based in Texas, it caters to the petrochemical, construction, and heavy equipment sectors.

-

Wilson-Garner is a U.S.-based manufacturer of special bolts, screws, and cold-headed fasteners, primarily supplying the automotive, military, and industrial equipment markets. It focuses on small production runs and customized products.

Key U.S. Metal Screw Fasteners Companies:

- Fastenal Company

- Illinois Tool Works Inc.

- Stanley Black & Decker

- National Bolt & Nut Corporation

- Dale Fastener Supply

- ABC Fasteners

- Wilson Garner

- AFT Fasteners

- MW Components

- US Bolt Manufacturing Inc.

Recent Developments

- In April 2025, Stanley Black & Decker announced a streamlined brand architecture to unify its global fastening portfolio.

U.S. Metal Screw Fasteners Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.20 billion

Revenue forecast in 2033

USD 6.10 billion

Growth rate

CAGR of 4.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material and end use

Country scope

U.S

Key companies profiled

Fastenal Company; Illinois Tool Works Inc.; Stanley Black & Decker; National Bolt & Nut Corporation; Dale Fastener Supply; ABC Fasteners; Wilson Garner; AFT Fasteners; MW Components; US Bolt Manufacturing Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Metal Screw Fasteners Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. metal screw fasteners market report based on material and end use:

-

Material Outlook (Revenue, USD Billion; 2021 - 2033)

-

Stainless Steel

-

Carbon Steel

-

Others

-

-

End Use Outlook (Revenue, USD Billion; 2021 - 2033)

-

Automotive

-

Construction

-

Machinery & Equipment

-

Electrical & Electronics

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. metal screw fasteners market size was estimated at USD 4.04 billion in 2024 and is expected to reach USD 4.20 billion in 2025.

b. The U.S. metal screw fasteners market is expected to grow at a compound annual growth rate of 4.8% from 2025 to 2033 to reach USD 6.10 billion by 2033.

b. Carbon Steel segment held the highest revenue market share of 54.9% in 2024, due to their cost-effectiveness, increasing strength-to-weight innovations, and improved protective coatings.

b. Some of the prominent companies in the metal screw fasteners market include Fastenal Company, Illinois Tool Works Inc., Stanley Black & Decker, National Bolt & Nut Corporation, Dale Fastener Supply, ABC Fasteners, Wilson Garner, AFT Fasteners, MW Components, US Bolt Manufacturing Inc.

b. Key factors driving the U.S. metal screw fasteners market include rising infrastructure spending, growth in EV and electronics manufacturing, and increased demand for durable, high-performance fastening solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.