- Home

- »

- Advanced Interior Materials

- »

-

Metal Screw Fasteners Market Size, Industry Report, 2033GVR Report cover

![Metal Screw Fasteners Market Size, Share & Trends Report]()

Metal Screw Fasteners Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (Stainless Steel, Carbon Steel), By End Use (Automotive, Construction, Machinery & Equipment, Electrical & Electronics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-674-0

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Metal Screw Fasteners Market Summary

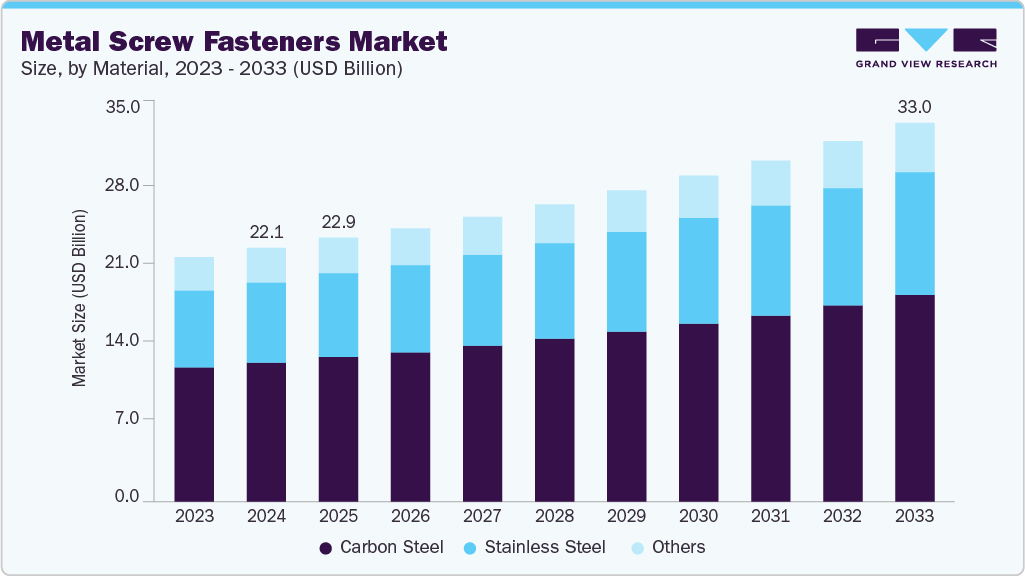

The global metal screw fasteners market size was estimated at USD 22.07 billion in 2024 and is projected to reach USD 33.02 billion by 2033, growing at a CAGR of 4.7% from 2025 to 2033. The demand for metal screw fasteners is witnessing consistent growth due to their essential role in manufacturing, construction, and the automotive industries.

Key Market Trends & Insights

- Asia Pacific dominated the metal screw fasteners market with the largest revenue share of 39.2% in 2024.

- By material, the stainless steel segment is expected to grow at the fastest CAGR of 5.0% over the forecast period.

- By end use, the electrical & electronics segment is expected to grow at the fastest CAGR of 5.3% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 22.07 Billion

- 2033 Projected Market Size: USD 33.02 Billion

- CAGR (2025-2033): 4.7%

- Asia Pacific: Largest market in 2024

Rapid urbanization and infrastructure development across emerging economies have significantly increased their consumption. Moreover, the growing need for product assembly in sectors like electronics, home appliances, and industrial machinery further boosts demand. Metal fasteners offer superior load-bearing capacity and durability, making them preferable over plastic or polymer alternatives. Rising industrial automation also necessitates reliable fastening solutions. E-commerce growth and packaging innovation also contribute to secondary demand. As economies scale up production, the dependence on metal screw fasteners is set to rise steadily.

The Recent trends include the development of anti-corrosive coatings, hybrid materials, and reusable fasteners. Companies are focusing on eco-friendly plating and surface treatments to meet RoHS and REACH regulations. Precision-engineered fasteners for aerospace and electronics are in high demand. Integration with RFID or QR codes for traceability is another emerging trend. Additionally, additive manufacturing (3D printing) of specialized metal fasteners is gradually gaining attention. Automation in assembly lines is increasing the need for fasteners compatible with robotic systems. Supply chain digitalization and smart inventory systems are also shaping the procurement and logistics of fasteners.

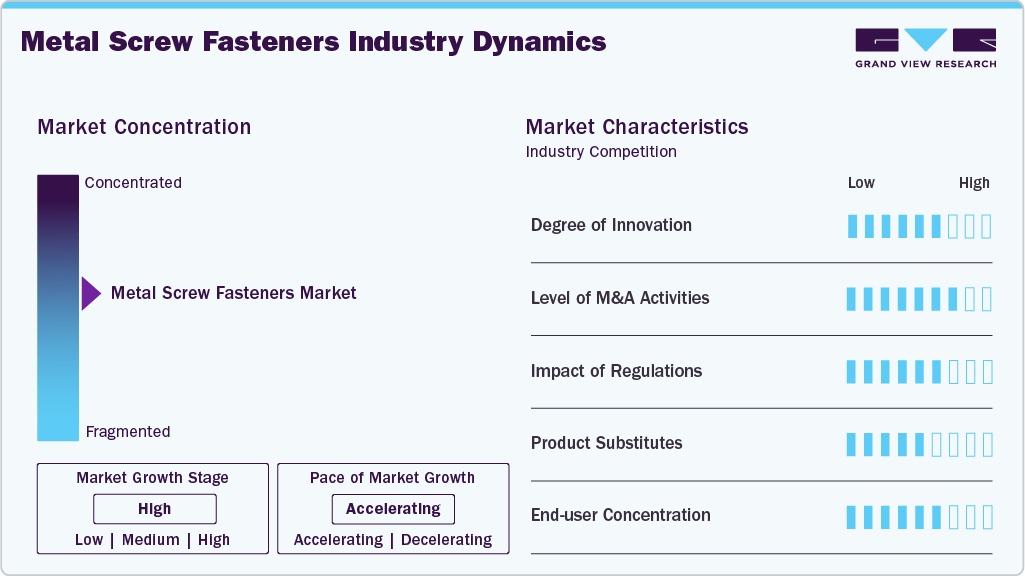

Market Concentration & Characteristics

The metal screw fasteners market is moderately consolidated, with several global players such as Würth Group, Stanley Black & Decker, and Hilti holding significant shares. However, a large number of regional manufacturers cater to specific applications, particularly in Asia-Pacific and Central & South America. The competition is intense in mid and low-end segments, while the premium, application-specific fastener segment remains relatively concentrated among technologically advanced companies. M&A and regional expansion are common strategies for growth and consolidation.

The threat of substitutes is moderate. Alternatives like adhesives, plastic rivets, or welding are used in some applications but lack the strength, reusability, and precision of metal screw fasteners. In certain lightweight or temporary installations, polymer fasteners or snap-fit solutions may be used, but they do not match metal in critical structural applications. Innovations in bonding and composites might pose a future threat, especially in aerospace and electronics. However, for structural integrity and heavy-duty requirements, substitutes are limited.

Material Insights

The carbon steel segment held the highest revenue market share of 54.9% in 2024, primarily due to its cost-effectiveness, versatility, and strength. They are extensively used in general manufacturing, heavy equipment, and automotive industries. As infrastructure projects expand in developing economies, the demand for affordable and durable fasteners is rising rapidly, driving carbon steel usage. Technological improvements in coating and heat treatment have enhanced the corrosion resistance and lifespan of carbon steel fasteners, making them suitable for more diverse applications than before. Their growing adoption in mid-segment industrial and construction projects fuels this rapid growth trajectory.

Stainless steel segment is expected to grow at the fastest CAGR of 5.0% over the forecast period. This dominance is primarily due to their superior corrosion resistance, strength, and longevity. They are widely used in construction, marine, automotive, and food-grade applications where exposure to moisture, chemicals, or extreme conditions is common. Their aesthetic finish also makes them a preferred choice in architectural applications. Despite their higher cost, industries favor stainless steel fasteners for critical, long-lasting installations. Increasing environmental regulations and the demand for sustainable, rust-free materials further support stainless steel’s leadership in the market.

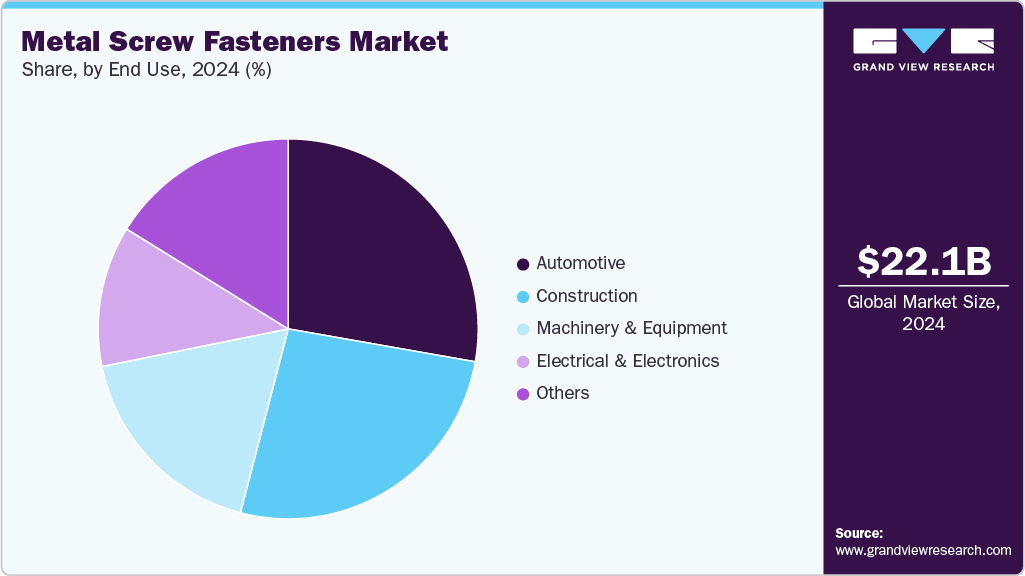

End Use Insights

The automotive segment held the highest revenue market share of 27.8% in 2024. These fasteners are essential for assembling various vehicle components, including chassis, engines, body frames, and interior systems. As vehicle production volumes remain high and electric vehicle (EV) manufacturing accelerates, the need for high-precision, durable, and vibration-resistant fasteners continues to rise. Moreover, the trend toward lightweight vehicles has led to the use of specialized fasteners that support weight reduction without compromising structural integrity. Automotive OEMs and Tier 1 suppliers maintain long-term contracts with fastener manufacturers, further reinforcing this segment’s dominance.

The electrical & electronics segment is expected to grow at the fastest CAGR of 5.3% over the forecast period, driven by the rapid proliferation of consumer electronics, wearable devices, home automation systems, and industrial IoT equipment. These devices require compact, lightweight, and high-precision fastening solutions to ensure structural stability and safety in miniaturized assemblies. Additionally, as the global demand for smartphones, laptops, and smart appliances rises-particularly in Asia-Pacific-OEMs are increasing production, leading to higher consumption of micro and specialty screw fasteners. The trend toward 5G infrastructure, electric circuit miniaturization, and PCB fastening further amplifies the demand for advanced metal screw fasteners in this segment.

Regional Insights

Asia Pacific dominated the global metal screw fasteners market and accounted for the largest revenue share of about 39.2% in 2024, due to large-scale manufacturing, construction, and automotive production in China, India, Japan, and South Korea. The region benefits from low labor costs, abundant raw materials, and strong export capacity. Rapid urbanization and industrialization continue to drive demand for fasteners in building, infrastructure, and machinery. Major automotive hubs like India and China rely heavily on localized fastener supply chains. Governments are also investing in smart cities and industrial corridors, further supporting growth. The growing electronics and appliance manufacturing sectors create additional demand. Asia Pacific remains the backbone of global fastener supply and consumption.

China Metal Screw Fasteners Market Trends

China is the largest single market for metal screw fasteners, driven by its vast industrial base and strong export orientation. It leads in both production and consumption, supplying fasteners for construction, automotive, rail, shipbuilding, and consumer electronics. Government-led infrastructure projects, such as the Belt and Road Initiative, support steady domestic demand. Local manufacturers are increasingly investing in automation and precision fasteners for high-end applications. China is also expanding its EV production, generating new fastener requirements. The presence of specialized clusters in Zhejiang and Jiangsu provinces supports economies of scale. Environmental regulations are pushing a shift toward eco-friendly coatings and materials

North America Metal Screw Fasteners Market Trends

The North American metal screw fasteners market is supported by its robust automotive, aerospace, and construction industries. The U.S. drives most of the demand, with a focus on advanced materials and high-performance fasteners. Reshoring efforts and infrastructure stimulus packages are revitalizing local manufacturing. Demand is rising for stainless and coated fasteners that meet strict quality and environmental standards. Precision fastening solutions for aerospace, EVs, and electronics are gaining traction. Canada and Mexico contribute through cross-border supply chains under the USMCA agreement. Technological innovation and digital procurement systems shape the competitive landscape in the region.

U.S. Metal Screw Fasteners Market Trends

The U.S. market is driven by high-value sectors like defense, aerospace, construction, and EV production. The ongoing push to rebuild infrastructure and increase domestic manufacturing is boosting demand for reliable fasteners. Public investments in roads, bridges, and renewable energy projects further support market expansion. Manufacturers are focusing on corrosion-resistant and high-torque fasteners that comply with stringent ASTM and SAE standards. Lightweight and high-strength fasteners are increasingly used in automotive and aerospace applications. Labor shortages are encouraging automation in fastener production. Import competition remains, but trade policies support local sourcing and domestic supplier partnerships.

Europe Metal Screw Fasteners Market Trends

Europe is a mature market with stable demand from the automotive, construction, and industrial machinery sectors. Sustainability is a key driver, with the growing use of recyclable and corrosion-free fasteners to meet EU regulations. Countries like Germany, France, and Italy are hubs for high-precision and specialty fasteners. The construction of energy-efficient buildings and renewable energy infrastructure is fueling demand. Europe’s shift toward EVs is also increasing the need for lightweight, high-strength fasteners. Supply chain disruptions have encouraged regional sourcing strategies. Innovation and quality assurance remain top priorities for European manufacturers and buyers.

Germany plays a central role in the European fastener market, known for its engineering excellence and precision manufacturing. It is a key supplier of fasteners to the automotive, industrial, and construction sectors. The country is investing heavily in green infrastructure and EV production, increasing the demand for advanced fastening systems. German firms focus on research-driven innovations, especially in anti-corrosive and torque-optimized designs. Quality and compliance with DIN standards remain crucial. As global supply chains diversify, Germany strengthens its position as a premium exporter. Local SMEs and mid-sized firms dominate the market with specialized product lines.

Central & South America Metal Screw Fasteners Market Trends

Central & South America show moderate but steady growth, primarily driven by construction, mining, and automotive industries. Brazil and Mexico are key markets with emerging demand for both standard and specialty fasteners. Economic recovery and investment in housing and infrastructure are boosting consumption. The automotive sector, especially in Mexico, is tightly integrated with U.S. supply chains. Local production is limited, with most high-performance fasteners being imported. Currency fluctuations and supply disruptions affect pricing and availability. Government-backed industrialization and trade incentives may accelerate demand in the coming years.

Middle East & Africa Metal Screw Fasteners Market Trends

The Middle East and Africa region is gradually growing, supported by urban development, oil & gas infrastructure, and the construction of mega projects. Countries like the UAE, Saudi Arabia, and South Africa are key contributors. Fasteners are in high demand for commercial buildings, pipelines, and transportation networks. Imports dominate the market due to limited domestic manufacturing. Projects like NEOM and African economic corridors are creating fresh opportunities. Harsh climatic conditions increase the need for stainless and coated fasteners. Market potential is high, but logistics and political instability can pose challenges in certain subregions.

Key Metal Screw Fasteners Company Insights

Some of the key players operating in the market include Würth Group, Hilti Corporation.

-

Würth Group is the global leader in metal screw fasteners, offering a vast portfolio across automotive, construction, and industrial sectors. Its dominance stems from strong distribution networks, robust logistics, and a focus on high-quality, standardized and specialty fasteners. The company caters to both B2B and retail markets, supporting a wide range of professional applications.

-

Hilti Corporation is a major force in the construction fasteners market, known for its high-performance anchors, screws, and fastening systems. With a direct sales model and on-site engineering services, Hilti caters to infrastructure, energy, and industrial construction projects globally. Its premium product range ensures durability in demanding environments.

Bossard Group and Bulten AB are some of the emerging market participants in the metal screw fasteners market.

-

Bossard Group is a Swiss-based leader in smart fastening and assembly solutions, focused heavily on automation, IoT integration, and supply chain efficiency. It serves high-end industries like electronics, aerospace, and machinery. Bossard is well-positioned in the precision fasteners segment, with strong aftermarket and logistics support.

-

Bulten AB is a key European manufacturer specializing in high-performance fasteners for the automotive industry. Known for its lightweight, sustainable fastening solutions, Bulten plays a strategic role in the shift toward electric vehicles. Its vertically integrated model-from R&D to logistics-gives it a competitive edge in OEM supply.

Key Metal Screw Fasteners Companies:

The following are the leading companies in the metal screw fasteners market. These companies collectively hold the largest market share and dictate industry trends.

- Würth Group

- Illinois Tool Works

- Bossard Group

- Hilti Corporation

- Fastenal

- LISI Group

- Bulten AB

- rconic Fastening Systems

- TR Fastenings

- KAMAX Holding

Recent Developments

-

In December 2024, Bulten and ZJK Vietnam Precision Components Co., Ltd, a part of the Chinese fastener company ZJK Precision Parts (ZJK), signed a letter of intent to establish operations in Vietnam through a joint venture.

-

In January 2025, Bossard Group acquired the German Ferdinand Gross Group. Ferdinand Gross is one of the leading distributors of fastening technology in the important German market. In addition to Germany, Ferdinand Gross also had locations in Hungary and Poland.

Metal Screw Fasteners Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 22.90 billion

Revenue forecast in 2033

USD 33.02 billion

Growth rate

CAGR of 4.7% from 2025 to 2033

Base year for estimation

2024

Actual data

2018 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; Japan; India; South Korea

Key companies profiled

Würth Group; Illinois Tool Works; Bossard Group; Hilti Corporation; Fastenal; LISI Group; Bulten AB; Arconic Fastening Systems; TR Fastenings; KAMAX Holding

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Metal Screw Fasteners Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the global metal screw fasteners market on the basis of product, end use, and region:

-

Material Outlook (Revenue, USD Billion, 2021 - 2033)

-

Stainless Steel

-

Carbon Steel

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Automotive

-

Construction

-

Machinery & Equipment

-

Electrical & Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global metal screw fasteners market size was estimated at USD 22.07 billion in 2024 and is expected to reach USD 22.90 billion in 2025.

b. The global metal screw fasteners market is expected to grow at a compound annual growth rate of 4.7% from 2025 to 2033 to reach USD 33.02 billion by 2033.

b. The carbon steel segment held the highest revenue market share of 54.9% in 2024, primarily due to its cost-effectiveness, versatility, and strength.

b. Some of the key players operating in the metal screw fasteners market include Würth Group, Illinois Tool Works, Bossard Group, Hilti Corporation, Fastenal, LISI Group, Bulten AB, Arconic Fastening Systems, TR Fastenings, and KAMAX Holding

b. Key factors driving the metal screw fasteners market include rapid infrastructure development, rising automotive and industrial manufacturing, and growing demand for corrosion-resistant, high-performance fastening solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.