- Home

- »

- Medical Devices

- »

-

U.S. Minimally Invasive Surgery Market Size Report, 2033GVR Report cover

![U.S. Minimally Invasive Surgery Market Size, Share & Trends Report]()

U.S. Minimally Invasive Surgery Market (2025 - 2033) Size, Share & Trends Analysis Report By Surgical Specialty (General Surgery, Gynecological Surgery), By Method (Laparoscopic, Robotic-assisted), By End-use, By Payer Type, And Segment Forecasts

- Report ID: GVR-4-68040-733-3

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

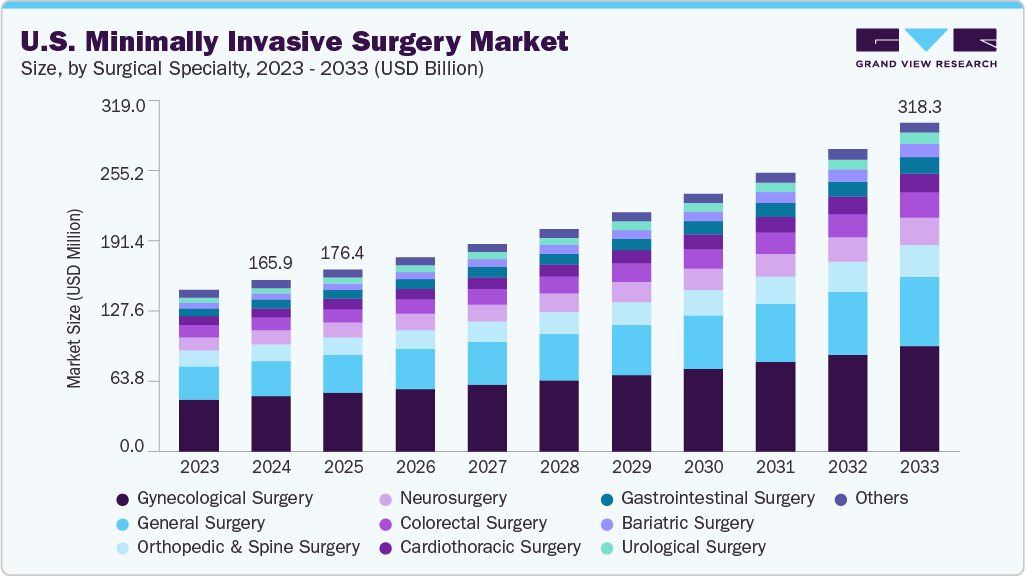

The U.S. minimally invasive surgery (MIS) market size was valued at USD 165.89 billion in 2024 and is expected to reach USD 318.27 billion by 2033, growing at a CAGR of 7.66% from 2025 to 2033. A key factor driving market expansion is the rising prevalence of chronic conditions such as obesity, cardiovascular diseases, and cancer. These conditions often require surgery but benefit from approaches that shorten recovery times and lower complications. Additionally, ongoing innovations in surgical technology-like robotics, high-definition imaging, laparoscopic instruments, and navigation systems-enable surgeons to perform complex procedures more accurately while minimizing patient trauma. Increasing patient awareness about the advantages of minimally invasive techniques has further propelled the demand for these procedures.

Advances in surgical robotics have revolutionized minimally invasive surgery (MIS) by enhancing surgeons’ dexterity, improving visualization (often with 3D imaging), and facilitating more precise movements through small incisions. These benefits lower the barrier of complexity for certain procedures, enabling operations that may have required open surgery to now be performed less invasively. According to the American Hospital Association (AHA), as of 2024, the da Vinci robotic surgical system facilitated around 2.68 million procedures globally, and 2.63 million were carried out in the U.S. As a result, implants such as the da Vinci robot have contributed to an expanded scope of MIS across specialties, including urology, gynecology, general surgery, and more.

Furthermore, evidence from hospital data shows this trend in action. Facilities that introduce robotic-assisted surgery (RAS) capabilities tend to increase their rate of MIS, not merely replacing one minimally invasive method with another but expanding overall usage of less invasive approaches across patient groups. This indicates that RAS does not replace laparoscopic methods for robotic ones; it enables more patients who previously might have undergone open surgery to access the benefits of MIS.

Endoscopic procedures are critical in U.S. healthcare, especially for gastrointestinal diagnosis and treatment. According to several sources, approximately 2.13 million endoscopies were performed in the U.S. in 2023. These high procedure volumes reflect how deeply endoscopy intertwines minimally invasive diagnostic and therapeutic strategies. Colonoscopy remains the cornerstone of cancer prevention programs, with more than 15 million individuals undergoing the procedure annually.

Average Cost of Upper GI Endoscopy, By State (In USD)

State

Outpatient Hospitals

Surgery Centers

Alabama

1,490

1,036

Alaska

2,016

1,401

Arizona

1,686

1,172

Arkansas

1,477

1,027

California

1,850

1,286

Colorado

1,628

1,132

Connecticut

1,782

1,239

Delaware

1,731

1,204

District of Columbia

1,716

1,193

Florida

1,636

1,137

Georgia

1,533

1,066

Hawaii

1,551

1,078

Idaho

1,507

1,047

Illinois

1,710

1,189

Indiana

1,560

1,084

Iowa

1,418

986

Kansas

1,468

1,021

Kentucky

1,502

1,044

Louisiana

1,667

1,159

Maine

1,506

1,047

Maryland

1,773

1,233

Massachusetts

1,827

1,270

Michigan

1,683

1,170

Minnesota

1,894

1,317

Mississippi

1,515

1,053

Missouri

1,497

1,041

Montana

1,558

1,083

Nebraska

1,522

1,058

Nevada

1,608

1,118

New Hampshire

1,613

1,122

New Jersey

1,954

1,359

New Mexico

1,485

1,032

New York

1,839

1,278

North Carolina

1,476

1,026

North Dakota

1,640

1,140

Ohio

1,535

1,067

Oklahoma

1,642

1,142

Oregon

1,675

1,165

Pennsylvania

1,729

1,202

Rhode Island

1,843

1,281

South Carolina

1,573

1,093

South Dakota

1,465

1,019

Tennessee

1,478

1,028

Texas

1,597

1,110

Utah

1,665

1,157

Vermont

1,634

1,136

Virginia

1,590

1,105

Washington

1,773

1,233

West Virginia

1,591

1,106

Wisconsin

1,679

1,167

Wyoming

1,635

1,136

Simultaneously, the growing frequency of upper endoscopies (EGDs) supports more accurate detection of conditions like GERD, Barett’s esophagus, and early-stage GI cancers. Together, these practices illustrate how endoscopic methods have become indispensable tools in delivering efficient, effective, and minimally invasive care nationwide by offering direct visualization, tissue sampling, and treatment options through small openings.

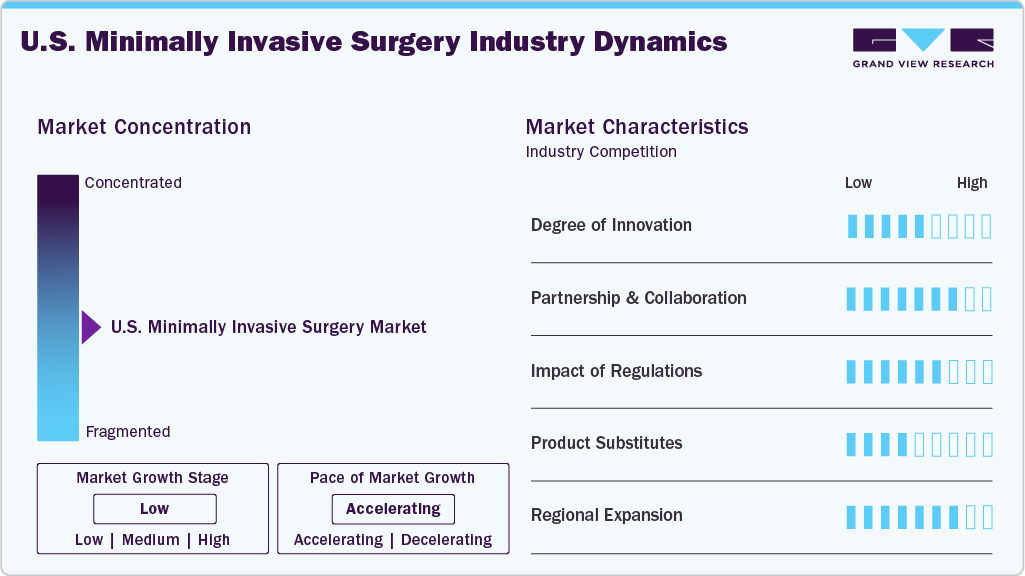

Market Concentration & Characteristics

The industry witnesses significant concentration, with key players focusing on expansion and product differentiation. Medtronic plc, Intuitive Surgical, CMR Surgical, and Smith & Nephew plc hold significant market share. The market is characterized by steady growth driven by increasing surgical procedures, technological advancements, and a focus on patient safety.

The degree of innovation in the industry is high and steadily advancing, driven by advancements spanning surgical robotics, high-definition and 3D imaging, single-incision techniques, and AI-enabled navigation systems. Innovation, such as robotic-assisted platforms (e.g., Intuitive Surgical’s da Vinci System) and newer flexible robotic endoscopes, is broadening the types of procedures that can be performed minimally invasively. Enhanced imaging modalities-like fluorescence-guided surgery and intraoperative CT/MRI integration also improve surgical precision. Moreover, innovation extends beyond devices: integration with digital platforms, machine learning for preoperative planning, and virtual reality training modules reshape the surgical workflow.

The industry has seen a significant increase in partnerships and collaborations, driven by enhanced product innovation, safety integration, and market reach. Medical device companies frequently collaborate with hospitals, academic institutions, and technology firms to test and refine new systems. For example, robotics companies often partner with surgical training centers to accelerate surgeon adoption, while device manufacturers work with imaging firms to integrate advanced visualization technologies. For instance, in August 2024, Tampa General Hospital (TGH) and USF Health formalized an agreement with Medical Microinstruments, Inc. (MMI) to bring the Symani Surgical System, a cutting-edge robotic platform for lymphatic microsurgery to Florida. This marks the first deployment of its kind in the Southeastern U.S. This collaboration was a part of a trade mission to Italy, supported by Florida state leadership, and positions these institutions at the forefront of advanced MIS in the region.

The industry is significantly influenced by regulatory frameworks that govern healthcare delivery and medical surgery practices. Regulation plays a pivotal role in shaping the MIS landscape in the U.S. The FDA requires rigorous premarket approval (PMA) or 510(k) clearance for surgical devices, which ensures patient safety but can also slow time-to-market for innovations. Recent initiatives like the FDA’s Digital Health Center of Excellence have streamlined pathways for AI-driven surgical tools, signaling a growing regulatory adaptability to emerging technologies.

The industry faces a significant threat of substitution, as surgeons and hospitals often weigh different approaches to achieve minimally invasive outcomes. For example, laparoscopic and robotic-assisted surgery can be substitutes for many procedures, with laparoscopic methods usually favored for cost-efficiency. At the same time, robotics may be chosen for precision and complex cases. Similarly, endoscopic techniques (such as colonoscopy or therapeutic endoscopy) can replace certain surgical interventions altogether by enabling diagnosis and treatment without incisions. These substitutes mean that companies must continuously justify the clinical and economic value of their MIS technologies against both established and emerging alternatives.

Surgical Specialty Insights

The gynecological surgery segment accounted for the largest market share in 2024, due to the growing incidence of gynecological disorders and their procedures, such as hysterectomy, myomectomy, oophorectomy, and endometriosis excision. These are highly amenable to laparoscopic, robotic-assisted, and endoscopic techniques. Hysterectomy alone is one of the most frequently performed surgeries for women in the U.S., with over 400,000 procedures carried out annually. Most of these procedures are performed using minimally invasive methods. These approaches reduce postoperative pain, shorten hospital stays, and improve recovery times compared to open abdominal surgery—factors especially important for reproductive-age and working-aged women who need a quicker return to daily activities.

The bariatric surgery segment is expected to grow at the fastest CAGR during the forecast period. This growth is primarily due to the rising prevalence of obesity, increasing use of minimally invasive methods for bariatric procedures such as sleeve gastrectomy and Roux-en-Y gastric bypass, and better long-term outcomes. According to the Centers for Disease Control and Prevention (CDC), nearly 42% adults are classified as obese, which creates an expanding pool of eligible patients. Additionally, growing insurance coverage and favorable reimbursement for metabolic surgery have lowered financial barriers. These factors drive the growth of this market.

Method Insights

The robotic-assisted surgery segment dominated the market in 2024, accounting for the largest revenue share. This is primarily due to the high volume and complexity of surgical procedures performed using this technique. Systems such as the da Vinci Surgical System are now widely integrated into gynecology, urology, general surgery, and thoracic surgery. This allows for enhanced dexterity, three-dimensional visualization, and improved precision compared with conventional laparoscopy. Hospitals have increasingly invested in robotic platforms as patient demand for advanced technology grows, and as clinical evidence highlights benefits such as smaller incisions, reduced blood loss, and shorter recovery times.

The thoracoscopic or video-assisted thoracoscopic surgery (VATS) segment is expected to experience a notable compound annual growth rate (CAGR) during the forecast period. This growth is propelled by the shift away from traditional open thoracotomy for lung and mediastinal conditions. The growing burden of lung cancer, still the leading cause of cancer-related deaths in the U.S., has driven demand for minimally invasive lobectomies and resections that offer patients faster recovery and fewer complications. Advances in imaging, stapling devices, and instrumentation have broadened the feasibility of VATS for complex thoracic procedures. At the same time, outcomes research has consistently shown reduced postoperative pain, and shorter hospital stays compared to open approaches.

Payer Type Insights

The private health insurance segment dominated the market in 2024, accounting for the largest revenue share. This is mainly due to the dominant role of employer-sponsored and individual insurance plans in covering the country’s working-age population. According to the U.S. Census Bureau, nearly 66% of Americans were covered by private insurance in 2023, making it the primary payer for elective and semi-elective MIS procedures such as hysterectomies, hernia repairs, gallbladder surgeries, and orthopedic interventions. Moreover, commercial plans often reimburse hospitals and physicians at higher rates than public payers, reinforcing private insurance as the largest financial driver of MIS utilization.

The Medicare segment is expected to experience a notable compound annual growth rate (CAGR) during the forecast period, fueled by the aging population and the rising incidence of conditions requiring surgical intervention among older adults. As of 2024, more than 65 million Americans are enrolled in Medicare. Many MIS procedures, such as cardiovascular interventions, joint replacements, and thoracic or gastrointestinal surgeries, are highly relevant to older patients, and minimally invasive techniques offer clear benefits in reducing surgical risk, accelerating recovery, and minimizing hospital readmissions in this population.

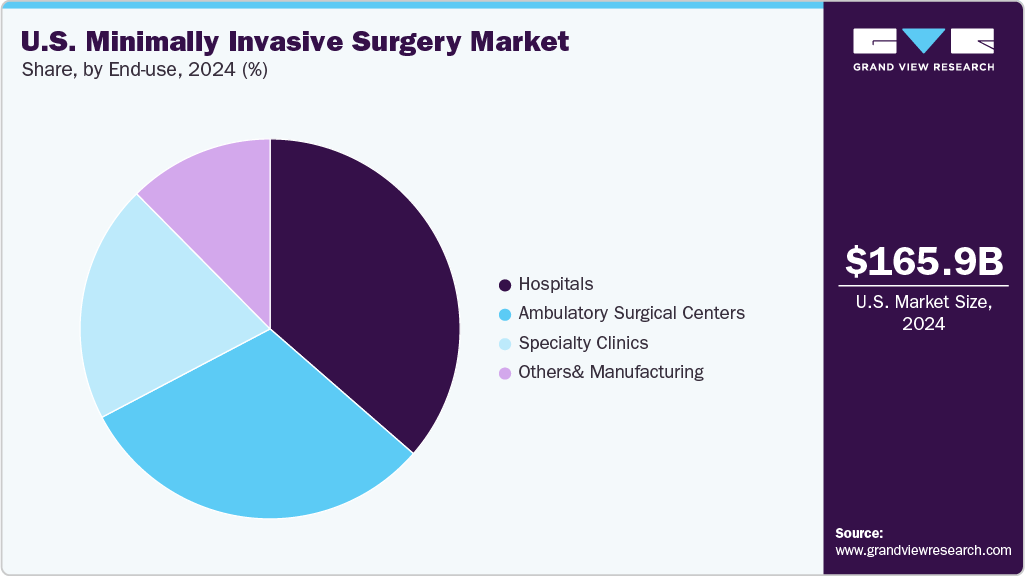

End-use Insights

Hospitals dominated the market in 2024, accounting for the largest revenue share, owing to their broad infrastructure, access to advanced technologies, and ability to handle complex procedures. Most tertiary and community hospitals have specialized surgical suites, robotic systems, and multidisciplinary teams that allow them to perform high-volume MIS procedures across gynecology, urology, cardiothoracic surgery, and general surgery. Hospitals also serve as referral centers for complicated cases that cannot be managed in outpatient settings. Moreover, private and teaching hospitals often lead in adopting new MIS technologies, supported by residency and fellowship training programs that expand surgeon expertise.

The ambulatory surgical centers (ASCs) segment is expected to experience a notable compound annual growth rate (CAGR) during the forecast period. This is attributed to the push toward cost efficiency, patient convenience, and policy incentives to shift care to outpatient environments. Many common MIS procedures, such as laparoscopic cholecystectomy, hernia repair, hysteroscopy, and arthroscopy, can be safely performed in ASCs, where patients benefit from shorter wait times and same-day discharge. According to the Ambulatory Surgery Center Association, ASCs already perform more than 60% of outpatient surgeries in the U.S., and this share continues to rise as insurers and CMS expand reimbursement for outpatient MIS.

Key U.S. Minimally Invasive Surgery Companies Insights

Key players operating in the U.S. minimally invasive surgery (MIS) market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key U.S. Minimally Invasive Surgery Companies:

- Medtronic plc

- Intuitive Surgical

- CMR Surgical

- Smith & Nephew plc

- Renishaw

- Monteris Medical

- PROCEPT BioRobotics

- EndoQuest Robotics

- Moon Surgical

- Asensus Surgical US, Inc.

- Olympus Corporation

Recent Development

-

In October 2024, Stryker Corporation completed the acquisition of Vertos Medical, a company specializing in minimally invasive lumbar decompression (MILD) devices for spinal stenosis.

-

In June 2024, Moon Surgical obtained FDA clearance for the commercial version of its Maestro surgical system, featuring AI-driven real-time assistance powered by NVIDIA’s Holoscan platform.

-

In March 2024, Intuitive Surgical received FDA clearance for its next-gen da Vinci 5 robotic surgery system. Featuring advanced imaging, haptic feedback, enhanced computing power, and ergonomic improvements, this system is being rolled out to select U.S. surgeons before wider commercialization.

-

In February 2024, Virtual Incision received FDA authorization through the De Novo pathway for the MIRA System, a miniaturized robotic-assisted platform designed specifically for colectomy procedures in adult patients. Its compact form aims to make robotic surgery more accessible without major operating room reconfiguration.

U.S. Minimally Invasive Surgery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 176.38 billion

Revenue forecast in 2033

USD 318.27 billion

Growth rate

CAGR of 7.66% from 2025 to 2033

Actual period

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Surgical specialty, method, payer type, end-use

Key companies profiled

Medtronic plc; Intuitive Surgical; CMR Surgical; Smith & Nephew plc; Renishaw; Monteris Medical; PROCEPT BioRobotics; EndoQuest Robotics; Moon Surgical; Asensus Surgical US, Inc.; Olympus Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Minimally Invasive Surgery Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. minimally invasive surgery (MIS) market report based on surgical specialty, method, payer type, and end-use:

-

Surgical Specialty Outlook (Revenue, USD Million, 2021 - 2033)

-

General Surgery

-

Gastrointestinal Surgery

-

Gynecological Surgery

-

Urological Surgery

-

Cardiothoracic Surgery

-

Orthopedic & Spine Surgery

-

Neurosurgery

-

Colorectal Surgery

-

Bariatric Surgery

-

Vascular & Endoscopic Surgery

-

Plastic & Reconstructive Surgery

-

-

Method Outlook (Revenue, USD Million, 2021 - 2033)

-

Laparoscopic Surgery

-

Thoracoscopic Surgery/VATS

-

Robotic-assisted Surgery

-

Endoscopic Surgery

-

Catheter-based/ Interventional Procedures

-

Others

-

-

Payer Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Private Health Insurance

-

Medicare

-

Medicaid

-

Out-of-Pocket/ Self-pay

-

Other Payers

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Public Hospitals

-

Private Hospitals

-

Private Hospitals-for profit

-

Private Hospitals-non-profit

-

-

-

Ambulatory Surgical Centers

-

Specialty Clinics

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. minimally invasive surgery market size was valued at USD 165.89 billion in 2024 and is expected to reach a value of USD 176.38 billion in 2025.

b. The U.S. minimally invasive surgery market is expected to grow at a compound annual growth rate of 7.66% from 2025 to 2033 to reach USD 318.27 billion by 2033.

b. The gynecological surgery segment accounted for the largest revenue share in 2024, due to the growing incidence of gynecological disorders and their procedures, such as hysterectomy, myomectomy, oophorectomy, and endometriosis excision.

b. Some key players operating in the U.S. minimally invasive surgery (MIS) market include Medtronic plc, Intuitive Surgical, CMR Surgical, Smith & Nephew plc, Renishaw, Monteris Medical, PROCEPT BioRobotics, EndoQuest Robotics, Moon Surgical, Asensus Surgical US, Inc., and Olympus Corporation.

b. Key factors driving the growth of the U.S. minimally invasive surgery (MIS) market include the rising prevalence of chronic conditions such as obesity, cardiovascular diseases, and cancer, technological advancements, and the growing shift toward outpatient care.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.