- Home

- »

- Advanced Interior Materials

- »

-

U.S. Nanomaterials Market Size, Industry Report, 2030GVR Report cover

![U.S. Nanomaterials Market Size, Share & Trends Report]()

U.S. Nanomaterials Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Gold, Silver, Iron, Copper), By Application (Aerospace, Automotive, Medical), And Segment Forecasts

- Report ID: GVR-4-68040-223-1

- Number of Report Pages: 162

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Nanomaterials Market Size & Trends

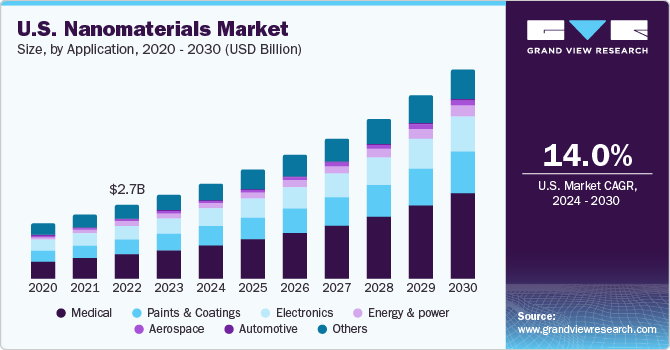

The U.S. nanomaterials market size was estimated at USD 3.03 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 14.0% from 2024 to 2030. The market is primarily driven by the rising demand for nanomaterials in the medical industry. A rapidly aging population, technological advancements, and increasing occurrence of chronic illnesses and surgical procedures aid the market demand. For instance, developments in electrocardiographic technology and rising cases of cardiovascular ailments are fuelling the use of cardiology equipment.

Nanomaterials have enabled the development of a variety of drug carriers for the controlled therapeutic agent delivery in chronic diseases including diabetes, atherosclerosis, pulmonary tuberculosis, and asthma. Medical equipment uses nanoparticles for diagnosis of several illnesses. Magnetite nanoparticles are used for scanning in Magnetic Resonance Imaging (MRI). Nanomaterials offer high functionality in nanomedicine applications as they allow efficient and targeted drug delivery, thus effectively addressing the shortcomings of conventional therapy.

The technological advancements in nanomaterials will revolutionize various industries owing to its wide range of applications such as the aerospace industry, which, in turn, is anticipated to augment the market growth over the forecast period. For instance, in February 2024, Penn State's College of Engineering broke a barrier in communication and power transmission by using acoustic metamaterial; a derivate of discrete nanoparticles, for the transmission of messages in enclosed metal spaces, such as metal containers carrying outer space samples back to Earth. Such technological innovations can revolutionize the aerospace industry.

Toxicity assessment of nanomaterials hinders the commercialization of nanotechnology. For instance, inert elements such as gold can become highly reactive at nanometre dimensions, leading to pro-pulmonary effects in lung tissues. An international standard has been developed for labelling consumer products containing manufactured nano-objects, which allows informed choices when purchasing and for the use of consumers. The U.S. federal government formed the National Nanotechnology Initiative (NNI) to establish a framework for shared goals, priorities, and strategies that help each participating company in the innovations related to R&D in nanotechnology.

Market Characteristics & Concentration

The level of innovation is high. This is factored due to an influx of investments by the National Nanotechnology Initiative (NNI) and the National Aeronautics and Space Administration (NASA). Furthermore, COVID-19 nanoscale vaccines in the United States were developed using nanoparticles.

The market has a high level of mergers and acquisitions, and collaborations. For instance, in June 2021, Nano One Materials Corp. partnered with Johnson Matthey to develop cost-effective nanomaterials lithium-ion batteries.

The threat of substitutes is low as nanoparticles possess superior properties over the existing scarce metals and has a widespread use case in biomedicine. For instance, nanomaterials when used for cancer treatment, can destroy only the cancer cells without causing harm to the healthy cells and tissues. Hence, the threat of substitutes is considered to be low as nanoparticles possess superior properties over the existing products.

The market is highly competitive as companies strive to increase the product's application scope Companies are investing significantly in research & development activities to introduce new products into the market. Nanomaterials with varied properties and content allow manufacturers to charge a premium for the product.

Application Insights

The medical segment dominated the market by accounting for the highest revenue share of 32.49% in 2023. This is due to the rising use in biomedical applications such as cancer and brain tumour diagnosis and treatment. In addition, nanoparticles are used for gene therapy and body detoxification. The increasing adoption of nanoparticles in the research of efficient biomedical devices is anticipated to drive the segment growth during the forecast period.

The paints & coatings segment is projected to grow at the fastest CAGR during the forecast period owing to its use as coloring pigments as well as synthetic amorphous silica. New nano-based coatings have numerous applications in surface protection. This is expected to drive market growth in the upcoming years.

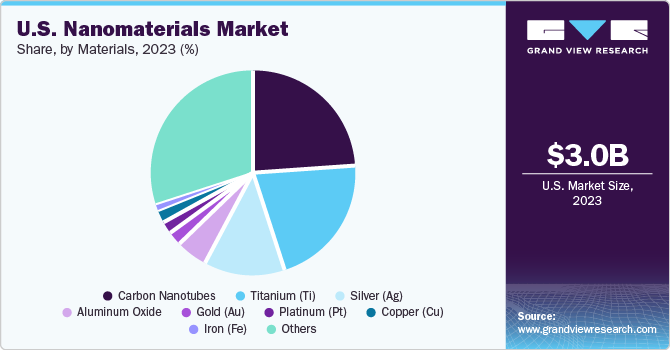

Material Insights

Carbon nanotubes held the second-largest revenue share of 24.5% in 2023. Nanotubes are commonly used as agents in targeted drug delivery applications. Furthermore, they are extensively used for gene therapies, biosensor diagnosis, and tissue generation applications. Their large surface area, ability to conjugate, and high absorption capability has driven its use as diagnostic and therapeutic agents, such as drugs, vaccines, genes, biosensors, and antibodies.

Titanium is the fastest-growing segment and is expected to register the highest CAGR from 2024 to 2030. Titanium has corrosion resistance, high strength-to-weight ratio, and biological compatibility. Aerospace, petrochemicals, medical, architectural, and chemicals applications are the top end users of the segment. These nanomaterials exhibit biocompatibility, excellent UV radiation resistance, mechanical strength, and corrosion resistance.

Key U.S. Nanomaterials Company Insights

The U.S. nanomaterials market has been observing continuous research & development activities over the recent years. Key market players such as Strem Chemicals, Inc., American Elements, US Research Nanomaterials, Inc., Nanoshel LLC, and Nanocomposix, Inc. are continuously engaged in R&D activities and the implementation of new technologies to have a competitive edge.

Key U.S. Nanomaterials Companies:

- Nanocomposix

- Nanoshel LLC

- Strem Chemicals, Inc.

- American Elements

- US Research Nanomaterials, Inc.

- Nanocomposix, Inc.

- SkySpring Nanomaterials, Inc.

- Alcoa

- Quantum Materials Corporation

- Advanced Material Development

Recent Developments

-

In February 2024, John Hopkins Whiting School of Engineering and the Applied Physics Laboratory announced the ongoing development of a groundbreaking biocompatible nanocomposite material that can treat Retinitis pigmentosa by the brain’s visual cortex.

-

In April 2023, Advanced Material Development received a U.S. patent for Liquid Phase Exfoliation for manufacturing 2D nanomaterials. Its primary application includes producing graphene-based materials such as few-layer graphene and graphene nanoplatelets.

-

In April 2023, Penn State developed a rapid test for Monkeypox using nanomaterials heterostructures including two-dimensional hafnium disulfide nanoplatelets and zero-dimensional spherical gold nanoparticles.

U.S. Nanomaterials Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.44 billion

Revenue forecast in 2030

USD 7.54 billion

Growth rate

CAGR of 14.0% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, application

Key companies profiled

Strem Chemicals, Inc.; American Elements; US Research Nanomaterials, Inc.; Nanocomposix, Inc.; SkySpring Nanomaterials, Inc.;

Quantum Materials Corporation; Nanoshel LLC; Nanocomposix; Alcoa

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Nanomaterials Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. nanomaterials market report based on material and application:

-

Material Outlook (Revenue, USD Million, 2017 - 2030)

-

Gold (Au)

-

Silver (Ag)

-

Iron (Fe)

-

Copper (Cu)

-

Platinum (Pt)

-

Titanium (Ti)

-

Nickel (Ni)

-

Aluminum Oxide

-

Antimony Tin Oxide

-

Bismuth Oxide

-

Carbon Nanotubes

-

Other Nanomaterials

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Aerospace

-

Automotive

-

Medical

-

Energy & power

-

Electronics

-

Paints & Coatings

-

Other

-

Frequently Asked Questions About This Report

b. The U.S.nanomaterials market size was estimated at USD 3.03 billion in 2023 and is expected to reach USD 3.44 billion in 2024.

b. The U.S. nanomaterials market is expected to grow at a compound annual growth rate of 14.0% from 2024 to 2030 to reach USD 7.54 billion by 2030.

b. The carbon nanotubes material segment dominated the market with a revenue share of 24% in 2023 and is expected to grow at a CAGR of 13.8% owing to their extensive usage in different applications on account of their ability to inhibit bacterial growth and prevent the formulation of further cell structures.

b. Some of the key players operating in the nanomaterials market include Strem Chemicals, Inc., American Elements, US Research Nanomaterials, Inc., Nanocomposix, Inc., Frontier Carbon Corporation, Nanoshel LLC and SkySpring Nanomaterials, Inc.

b. The key factors that are driving the nanomaterials include rapidly growing usage of product in an increasing number of potential as well as existing applications such as cosmetics, electronics, healthcare, defense, agriculture, and energy.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.