- Home

- »

- Biotechnology

- »

-

U.S. Organoids & Spheroids Market, Industry Report, 2030GVR Report cover

![U.S. Organoids And Spheroids Market Size, Share & Trends Report]()

U.S. Organoids And Spheroids Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Spheroids, Organoids), By Application (Developmental Biology, Regenerative Medicine), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-282-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Organoids & Spheroids Market Trends

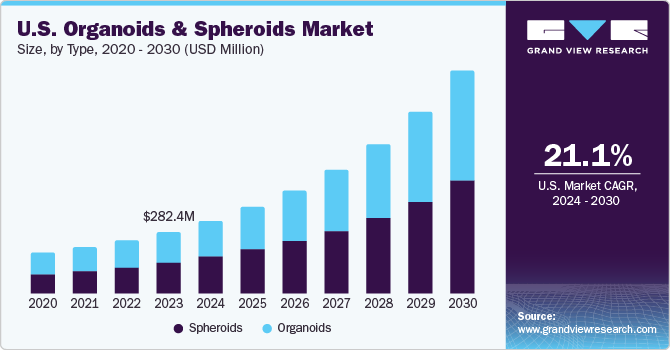

The U.S. organoids and spheroids market size was estimated at USD 282.42 Million in 2023 and is expected to witness growth at a CAGR of 21.15% from 2024 to 2030. The major drivers of this growth include the increasing prevalence of diseases, technological advancements in 3D spheroid technology, the high adoption of organoids and spheroids in drug discovery, and the rise in demand for cell therapy and tissue engineering.

The U.S. organoids & spheroids market accounted for a 42% share of the global organoids & spheroids market in 2023. The potential applications of organoids and spheroids as models for drug screening and analyzing human disorders are anticipated to offer significant growth opportunities to the market in the forecast period. 3D spheroids play a crucial role in tissue engineering and regenerative medicine research as they serve as fundamental building blocks for complex tissues and organs.

The advent of technology revolutionized the development of mini organoids in laboratories, leading to significant growth in the biomedical research sector. This technology enables the creation of specific tumor models for research and screening purposes, offering access to tissue models that hold promise for developing cancer therapies. Organoids provide a more accurate representation of in vivo conditions, offering a valuable tool for studying complex biological processes and diseases like cancer. Such trends are likely to fuel the market growth.

Moreover, the surge in demand for organ transplantation procedures is expected to enhance market growth significantly. For instance, data published by the Human Resources and Services Administration reveals that nearly 113,000 people are on the national transplant waiting list for solid organ transplantation in the United States. This surge in demand is expected to propel growth opportunities for organoids and spheroids in the market.

Market Concentration & Characteristics

The U.S. organoids & spheroids industry is characterized by the presence of both small and large companies, driving intense competition. This dynamic landscape is fostering increased rivalry among companies, leading to a focus on innovation, research and development, and strategic investments to strengthen their market positions and drive growth in this rapidly evolving sector.

Companies are engaging in acquisitions to strengthen their market positions, enhance capabilities, and broaden their product portfolios. This strategic approach allows them to access new technologies, expertise, and market segments, ultimately driving growth and competitiveness within the industry. For instance, in June 2022, CytoSMART Technologies introduced a machine-learning algorithm for organoid analysis on the CytoSMART Omni Systems, enhancing the capabilities for researchers and drug developers using 3D in vitro models like organoids, spheroids, and tumoroids in various fields such as neurology, gastroenterology, and oncology.

Several companies in the U.S. Organoids & Spheroids industry engage in mergers and acquisitions to enhance their industry positions. This strategic approach enables companies to enhance their capabilities, broaden their product offerings, and enhance their expertise, ultimately aiming to fortify their presence and competitiveness in the industry. For instance, in December 2022, Molecular Devices, LLC. announced the acquisition of Cellesce Ltd, a company specializing in contract development and manufacturing of large-scale patient-derived organoids (PDOs) for various applications, notably drug screening.

In the United States, federal regulations, such as the Common Rule and oversight by Institutional Review Boards (IRBs), play a crucial role in ensuring compliance with ethical standards and the protection of participants' rights. It is essential to verify whether consent is specifically granted for a particular research activity or if it extends to broader research processes. The national rules for research involving the retrieval of tissues for research purposes emphasize the importance of obtaining informed consent from donors and ensuring independent oversight to safeguard the interests of donors/participants and the integrity of the research.

Companies in the U.S. organoids and spheroids industry are expanding products into new geographic areas allowing them to be involved in emerging opportunities, access new markets, and capitalize on the growing demand for organoids and spheroids in drug development. For instance, in July 2023, Molecular Devices, LLC., announced the industrialization of biology through its organoid line expansion services to bolster next-generation drug discovery efforts.

Type Insights

The spheroids segment dominated the market with a share of 52% in 2023. The wide applications of spheroids in cancer research and drug screening drive segment growth. They are 3D cell aggregates that mimic tissues and microtumors, offering a more accurate representation of tumor behavior compared to 2D cell cultures. They play a pivotal role in the study of tumor cell formation, tumor microenvironments, drug screening, and stem cell research. Such features of spheroids are anticipated to expand the segment’s growth over the forecast period.

The organoids segment is projected to grow at the fastest CAGR from 2024 to 2030. They are more complex structures that aim to replicate the functionality of organs and tissues. They offer a more physiological representation of the tumor microenvironment thereby showcasing significance in personalized medicine, drug development, and tissue engineering. Such trends will lead to market expansion in the coming years.

Application Insights

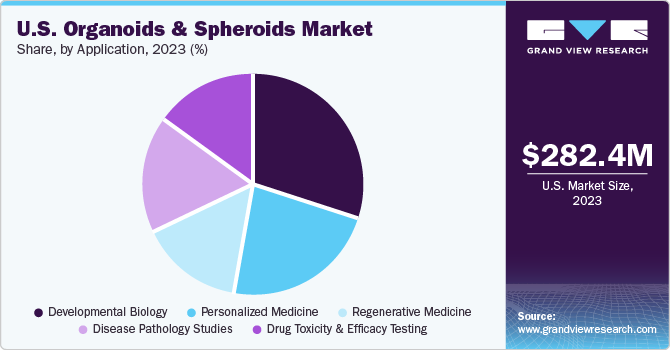

The developmental Biology segment held the largest share of 30% in 2023 due to the growing utilization of organoid and spheroid culture systems development in the field of developmental biology development in the field of developmental biology. Their models provide insights into tissue homeostasis, lineage specification, and embryonic development, and aid in studying organ development. They enable real-time analysis and visualization of developmental processes, facilitating comparisons between animal and human development. Such features contribute to the segment’s expansion.

The regenerative medicine segment is anticipated to witness growth at the largest CAGR from 2024 to 2030. The transplantation of organoids and spheroids derived from adult stem cells aids in replacing diseased tissues or organs. For instance, Sugimoto et al. treated mice with endogenous epithelial colon damage by successfully transplanting colonic epithelial organoids obtained from the human primary tissues. Such kinds of applications are likely to boost the segment’s growth over the forecast period.

End-use Insights

Biotechnology and pharmaceutical industries segment accounted for 47% of revenue share in 2023 as industries focusing on the development and commercialization of organoids and spheroids products due to their high demand. Moreover, several companies implement strategic initiatives such as collaborations and acquisitions which are expected to drive the segment’s growth.

The academic & Research Institutes segment is projected to expand at the CAGR of 24% in the forecast period. The increasing use of organoid models for research and development in institutes expanding the growth of the segment. For instance, as per the article published by PubMed, the 3D tumor models, including spheroids from cervical cancer cell lines and patient-derived organoids, offer a valuable platform to assess novel therapies, especially immunotherapies targeting tumor cells and influencing the tumor microenvironment.

Key U.S. Organoids And Spheroids Company Insights

The competition in the Organoids & spheroids market is accompanied by technological advancements and expanding potential applications in drug discovery. Moreover, key companies are actively engaged in mergers, acquisitions, collaborative partnerships, and various agreements to drive research initiatives, enhance their market shares, and contribute significantly to the overall market revenue.

Key U.S. Organoids And Spheroids Companies:

- Thermo Fisher Scientific, Inc

- Sigma-Aldrich Co. LLC

- 3D Biomatrix

- Corning Incorporated

- 3D Biotek LLC

- Perkin Elmer, Inc.

- Prellis Biologics

- Danaher

- Aragen Bioscience

- Cell Microsystems

Recent Developments

-

In February 2024, Cell Microsystems partnered with OMNI Life Science to introduce innovative cellular analysis solutions to North America. This partnership seeks to launch three innovative products - CERO, CASY, and TIGR - in the markets of the United States and Canada.

-

In February 2024, Danaher announced a collaboration with Cincinnati Children's Hospital Medical Center to enhance patient safety in early drug development. This partnership aims to develop innovative technologies focusing on liver organoid technology for drug toxicity screening to accelerate the development of new therapies and potentially save significant research costs.

U.S. Organoids And Spheroids Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 282.42 million

Revenue Forecast in 2030

USD 1.06 billion

Growth rate

CAGR of 21.15% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end-user

Country scope

U.S.

Key companies profiled

Thermo Fisher Scientific, Inc; Sigma-Aldrich Co. LLC; 3D Biomatrix; Corning Incorporated; 3D Biotek LLC; Perkin Elmer, Inc.; Danaher; Prellis Biologics; Aragen Bioscience; Cell Microsystems

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Organoids And Spheroids Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. Organoids and Spheroids market based on type, application, and end-use:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

By Type

-

Organoids

-

By Type

-

Neural Organoids

-

Hepatic Organoids

-

Intestinal Organoids

-

Other Organoids

-

-

By Method

-

General Submerged Method for Organoid Culture

-

Crypt Organoid Culture Techniques

-

Air Liquid Interface (ALI) Method for Organoid Culture

-

Clonal Organoids from Lgr5+ Cells

-

Brain and Retina Organoid Formation Protocol

-

Other

-

-

By Source

-

Primary Tissues

-

Stem Cells

-

-

-

Spheroids

-

By Type

-

Multicellular tumor spheroids (MCTS)

-

Neurospheres

-

Mammospheres

-

Hepatospheres

-

Embryoid bodies

-

-

By Method

-

Micropatterned Plates

-

Low Cell Attachment Plates

-

Hanging Drop Method

-

Others

-

-

By Source

-

Cell Line

-

Primary Cell

-

iPSCs Derived Cells

-

-

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Developmental Biology

-

Personalized Medicine

-

Regenerative Medicine

-

Disease Pathology Studies

-

Drug Toxicity & Efficacy Testing

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotechnology and pharmaceutical industries

-

Academic & Research Institutes

-

Hospitals and Diagnostic centers

-

Frequently Asked Questions About This Report

b. The U.S. organoids and spheroids market size was estimated at USD 282.42 million in 2023 and is expected to reach USD 335.90 million in 2024.

b. The U.S. organoids and spheroids market is expected to witness a compound annual growth rate of 21.15% from 2024 to 2030 to reach USD 1.06 billion by 2030.

b. Based on application, the developmental biology segment led the market with the largest revenue share in 2023, owing to the rising usage of organoid and spheroid culture systems for developmental biology.

b. Some of the key players operating in the market include 3D Biomatrix; 3D Biotek LLC; AMS Biotechnology (Europe) Limited; Cellesce Ltd; Corning Incorporated; Greiner Bio-One; Hubrecht Organoid Technology (HUB); InSphero, Lonza; Merck KGaA; Prellis Biologics; STEMCELL Technologies Inc.; Thermo Fisher Scientific, Inc.

b. Usage of organoid models to reveal how the COVID-19 virus affects several intestinal cells is expected to drive the adoption of organoids in research. Moreover, technological developments in the 3D spheroid technologies are expected to drive the market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.