U.S. Package Boilers Market Summary

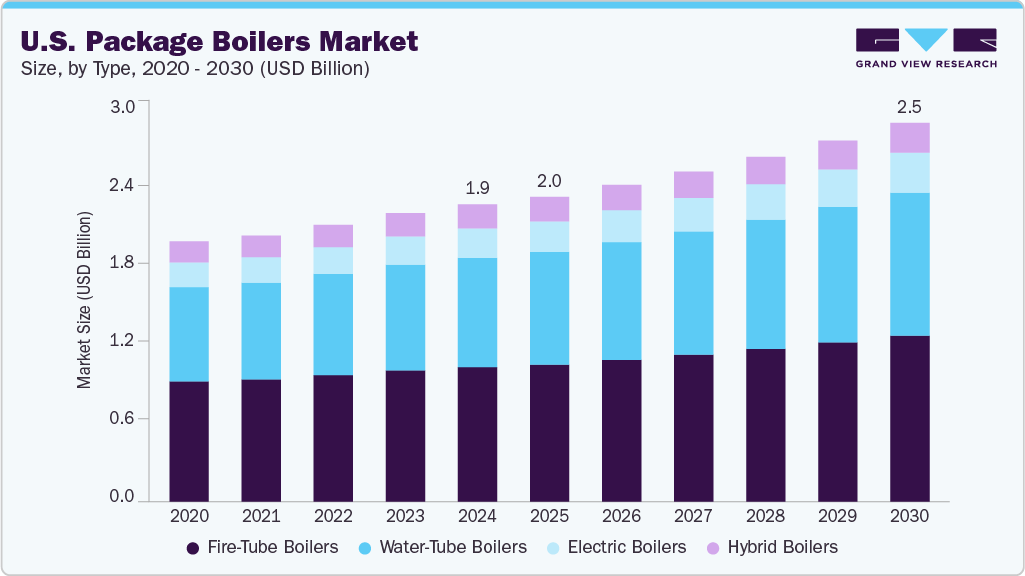

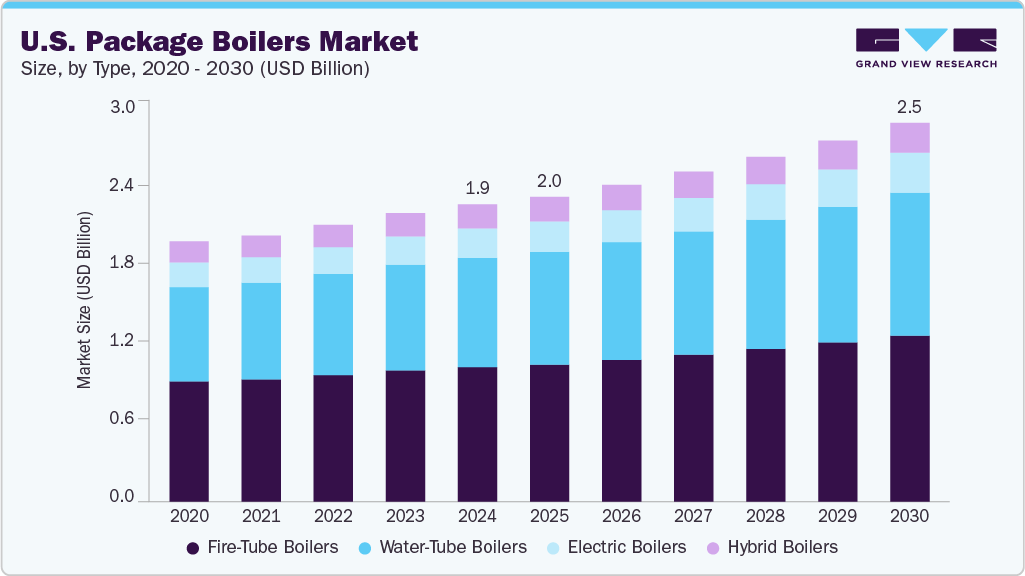

The U.S. package boiler market size was estimated at USD 1.99 billion in 2024 and is projected to reach USD 2.54 billion by 2030, growing at a CAGR of 4.5% from 2025 to 2030. The market is expected to grow owing to rising industrial demand for efficient steam generation systems in the chemicals, food processing, energy, and pharmaceuticals sectors.

Key Market Trends & Insights

- By type, the fire-tube boilers segment held the highest market share of 45.2% in 2024.

- By design, the D-type segment held the highest market share in 2024.

- By fuel type, the gas segment held the highest market share in 2024.

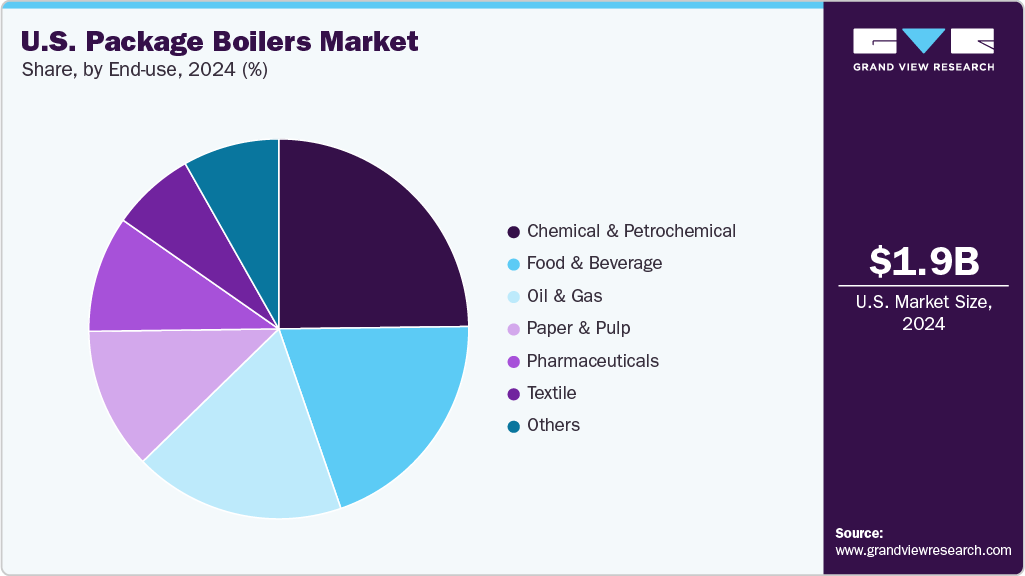

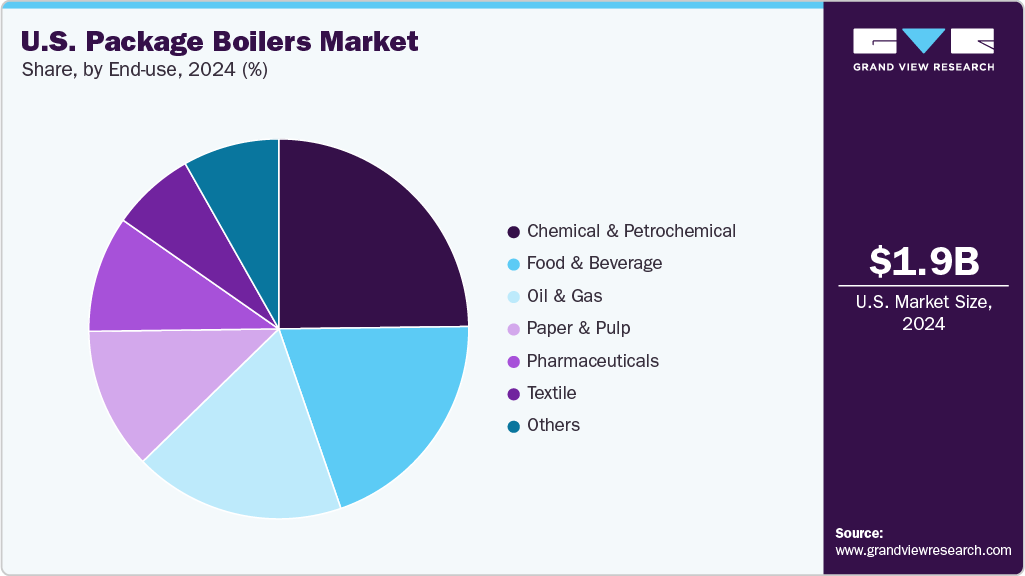

- By end use, the chemical & petrochemical segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.99 Billion

- 2030 Projected Market Size: USD 2.54 Billion

- CAGR (2025-2030): 4.5%

Technological advancements is playing a critical role in boosting the performance and adoption of package boilers in the U.S. market. Innovations such as low-emission combustion systems and intelligent automation controls are making boilers more efficient, safer, and compliant with environmental regulations. These technologies help industries optimize fuel usage, reduce emissions, and lower operational costs. At the same time, the integration of renewable energy sources like biomass and solar into hybrid boiler systems is aligning with sustainability goals. This shift is supported by rising industrial demand, particularly from sectors such as oil and gas, where reliable and high-performance steam generation is essential. Together, these factors are accelerating the growth of the package boilers market.

Type Insights

The fire-tube boiler segment held the largest share, 45.2%, in 2024. This is due to their robust design and suitability for operations requiring consistent load profiles and lower-pressure steam. They are especially favored in textile manufacturing, food processing, and small-scale chemical production sectors, where compact footprint and simplified maintenance are critical.

Electric boilers are expected to grow at the fastest CAGR over the forecast period. The growth is driven by the rising availability of renewable electricity and growing regulatory pressure to decarbonize industrial operations.

Design Insights

The D-Type design segment dominated the U.S. package boilers market in 2024 and is expected to grow at the fastest CAGR over the forecast period. This is due to its compact structure, which reduces installation time and cost while offering high efficiency. These boilers handle high pressure and capacity, making them ideal for heavy industrial applications like power plants and manufacturing. Their energy-efficient operation and compliance with strict emission standards align with sustainability and regulatory goals.

The A-Type design segment is expected to grow significantly during the forecast period. This segment is driven by its compact structure and suitability for space-constrained industrial environments. Featuring a top-mounted steam drum and dual lower water drums, the A-shaped configuration supports high-capacity and high-pressure operations, making it ideal for sectors like petrochemicals, chemicals, and large-scale manufacturing. Its design allows for easier maintenance and quicker tube replacement, which improves operational reliability and reduces downtime.

Fuel Type Insights

The gas segment accounted for the largest market revenue share of 42.8% in 2024. The gas fuel type segment in the U.S. package boilers market is growing rapidly due to natural gas's widespread availability and cost-effectiveness. As a cleaner alternative to coal and oil, gas-fired boilers help industries comply with strict environmental regulations to reduce emissions.

The biomass segment is expected to register the fastest CAGR of 5.4% over the forecast period. The biomass fuel type segment in the U.S. package boilers market is gaining momentum due to its alignment with sustainability goals and carbon reduction initiatives. Biomass boilers use renewable organic materials such as wood chips, pellets, and agricultural waste, offering a carbon-neutral alternative to fossil fuels. Wood pellets, known for their high energy density and consistent quality, are emerging as a leading fuel choice. Additionally, the use of biomass supports waste reduction and boosts rural economies by utilizing forestry and agricultural residues.

End-use Insights

The chemical and petrochemical end-use segment dominated the U.S. package boilers market in 2024. This dominance is primarily driven by the high thermal energy demands of processes like distillation and cracking, which require reliable and efficient steam generation. Stricter environmental regulations push facilities to adopt low-emission boiler technologies that reduce their carbon footprint. Advances in smart controls and automation enhance operational efficiency and safety, while high thermal efficiency lowers fuel consumption and costs.

The pharmaceutical segment is expected to register the fastest CAGR over the forecast period. The pharmaceutical segment in the U.S. package boilers market is driven by the industry's strict need for high-purity, reliable steam used in sterilization, process heating, and clean steam generation. These boilers ensure product safety and meet stringent regulatory standards such as FDA and cGMP requirements.

Key U.S. Package Boilers Company Insights

Some of the key companies in the U.S. package boilers market include Babcock & Wilcox Enterprises, Inc., Hurst Boiler & Welding Co., Inc., and others.

-

Babcock & Wilcox Enterprises, Inc. is a key player in the U.S. package boilers market, with a longstanding reputation for delivering advanced steam generation technologies. The company stands out for its engineering expertise, global installation base, and ability to meet stringent environmental and operational standards.

Key U.S. Package Boilers Companies:

- Babcock & Wilcox Enterprises, Inc.

- Hurst Boiler & Welding Co., Inc.

- Miura America Co., Ltd.

- Superior Boiler Works, Inc.

Recent Developments

-

In May 2024, Cleaver-Brooks was acquired by Miura Co., Ltd., a prominent Japanese industrial boiler manufacturer. This strategic acquisition is expected to manufacture and engineer sustainable boiler room solutions for the customers.

Blow Molding Plastic Market Report Scope

|

Report Attribute

|

Details

|

|

Revenue forecast in 2030

|

USD 2.54 billion

|

|

Growth rate

|

CAGR of 4.5% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion, and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, design, fuel type, end-use

|

|

Key companies profiled

|

Babcock & Wilcox Enterprises, Inc., Hurst Boiler & Welding Co., Inc., Miura America Co., Ltd., Superior Boiler Works, Inc.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Package Boilers Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. package boilers market report based on type, design, fuel type, and end-use.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fire-tube Boilers

-

Water-tube Boilers

-

Electric Boilers

-

Hybrid Boilers

-

Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Fuel Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil

-

Gas

-

Coal

-

Biomass

-

Electric

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Chemical & Petrochemical

-

Oil & Gas

-

Paper & Pulp

-

Pharmaceuticals

-

Textile

-

Others