- Home

- »

- Consumer F&B

- »

-

U.S. Packaged Food Market Size & Share Report, 2022-2030GVR Report cover

![U.S. Packaged Food Market Size, Share & Trends Report]()

U.S. Packaged Food Market Size, Share & Trends Analysis Report By Product (Bakery & Confectionary Products, Snacks & Nutritional Bars, Beverages, Sauces, Dressings, & Condiments), By Distribution Channel, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-2-68038-362-1

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Consumer Goods

Report Overview

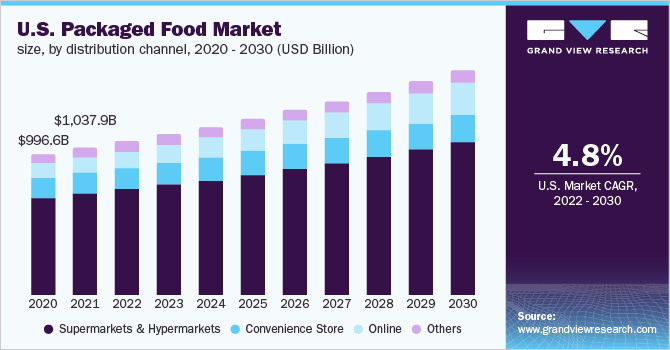

The U.S. packaged food market size was valued at USD 1.03 trillion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.8% from 2022 to 2030. The hectic work and life schedules of consumers across the country and the rising preference for convenience have been driving the market over the years. Furthermore, the escalating expansion of e-commerce in the U.S. boosts the sales of the products over the nation. In addition, increasing innovations in food packaging, plant-based products, bold flavors, and healthy ingredients have contributed to the growth of the U.S. over the next few years.

The COVID-19 pandemic led to significant changes in U.S. consumers’ food-spending patterns. In general, consumers increased their expenditures on food from grocery stores and other retail food establishments, while they decreased food-away-from-home expenditures. At-home consumption of packaged food including snacks, dairy products, prepared meals, as well as bakery items increased, with moderate pantry loading. In addition, sales of beverages through on-trade channels declined slightly during 2020, probably as a result of the loss of business from the temporary closure of restaurants, pubs, and bars. However, preserved and packaged foods have enjoyed revenue growth, although the margin performance of companies has varied.

The rising demand for plant-based products due to the growing vegan population in the country has widened the industry players' opportunity. Many industry players, including Danone S.A, Nestlé, and Unilever, have entered the plant-based market to seize the opportunity. Furthermore, the groundbreaking innovations of vegan companies such as Impossible Foods Inc. and Beyond Meat have accelerated the industry's growth. As per the United States Department of Health and Human Services, as of 2020, around 30 million adults in the U.S. are lactose intolerant. As a result, plant-based dairy alternatives have gained significant traction among the nation's lactose intolerant consumers.

Over the past few years, demand for organic, natural, clean, and whole-food products are surging among the health and environment-conscious consumers who are less price sensitive. With the organic growing trend in the food and beverage industry, the organic product segment is becoming a mainstream food category. In addition, consumers seek more transparency in the sourcing and supply chain of the products they are purchasing. Therefore, the industry players are becoming more transparent by providing more information about the product labels' products. Furthermore, the rising favor for healthy foods made with natural ingredients, low-calorie, low-fat, and free from artificial color, GMO, and sugar drives the growth of packaged food industry in the country.

Packaged food products such as rice, pasta, noodles, snacks, and canned food have extended shelf lives, and consumers stockpile these items, which, in turn, is driving their sales. Moreover, product innovation, the launch of new product flavors from private label brands, and a drastic shift from generic products to premium products such as gluten-free and organic options are driving the consumption of packaged food in the country.

Distribution Channel Insights

The supermarkets and hypermarkets dominated the market for packaged food and accounted for revenue share of more than 68.0% in 2021. A large number of consumers prefer buying groceries from supermarkets and hypermarkets because of the shopping experience offered by these stores. The option of physically verifying a product, along with expert assistance, is a major factor contributing to the dominance of this distribution channel in the market. Furthermore, the steady rise of Walmart Supercenters, which has made Walmart the largest grocery store in the U.S., has contributed to the growth of the supermarket and hypermarket segment over the last decade. Kroger, the largest traditional grocery retailer, has been a major mergers-and-acquisitions player in recent years, purchasing retailers such as Harris Teeter and Roundy's.

On the other hand, the online distribution channel is expected to register the fastest CAGR of 9.1% in the market for packaged food from 2022 to 2030. Prior to the COVID-19 pandemic, the packaged food industry in the U.S. was lagging behind in terms of e-commerce penetration. Customer apprehensions about purchasing fresh food online, as well as costly e-commerce costs and complicated website designs, hampered its adoption. However, after the outbreak of COVID-19, customers turned to e-commerce due to the fear of contracting the virus and strict restrictions and lockdown orders in many states. The hassle-free shopping experience offered by various online platforms is expected to drive the growth of this segment.

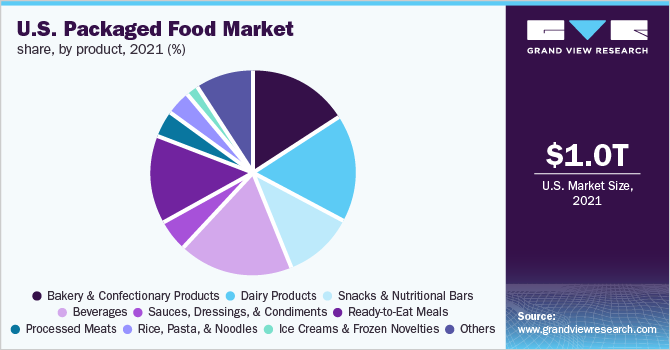

Product Insights

The beverages segment dominated the U.S. packaged food market and accounted for revenue share of more than 17.0% in 2021. This segment includes a wide range of nonalcoholic packaged beverages. Carbonated soft drinks, fruit beverages, and bottled water accounted for the beverage segment's major share. Beverages with exotic flavors and essential nutrients are gaining traction among U.S. consumers. In addition, the increasing demand for functional drinks and sports drinks among the health-conscious consumers and athletes in the country has been driving the growth of the segment. Other than beverage, bakery and confectionery products, dairy products, and snacks and nutritional bars contribute to a significant industry's significant revenue share.

The ready-to-eat meals are expected to register the fastest CAGR of 6.1% in the market for packaged food from 2022 to 2030. Consumers in the nation increasingly prefer ready meals. The changing lifestyle has been boosting the demand for ready-to-eat meals that save the consumers' time and efforts. Prepared or ready meals are an extremely convenient alternative for dual-earning households and students across the country. Furthermore, consumers are willing to pay a premium price for higher-quality convenient foods. Ready-to-eat stew, soup, sandwiches, burgers, and salads are gaining traction among U.S. consumers, especially among the millennials.

Key Companies & Market Share Insights

The market for packaged food is characterized by a few well-established players and several small and medium players. As of 2021, large companies such as Nestlé, The Coca-Cola Company, PepsiCo, Tyson Foods, Inc., Mars, Incorporated, and Cargill, Incorporated holds the majority share of the U.S. However, over the past few years, private label brands are growing over the nation. Large retail chains, including Costco, Whole Foods Market, and Wegmans Food Markets, are increasingly offering their private label food brands. The improving quality, better packaging, and lower cost are key factors boosting private label food products' sales in the U.S.

-

In March 2021, Nestlé acquired Essentia Water, a premium functional water brand. The acquisition was aimed at further expanding its presence in the premium functional water segment.

-

In January 2020, Keurig Dr Pepper Inc. acquired Limitless, a U.S.-based caffeinated sparkling water company. This acquisition helped Keurig Dr Pepper expand its beverages portfolio to meet the growing demand for healthy packaged beverages across the U.S.

-

In October 2021, Tyson Foods, Inc. launched air-fried chicken bites that are 75% less fat and contain 35% fewer calories. The products include Spicy Chicken Bites and Parmesan Chicken Bites. With this, the company was able to expand its packaged food product portfolio in the U.S. market.

Some of the prominent players in the U.S. packaged food market include: -

-

Nestlé

-

The Coca-Cola Company

-

PepsiCo

-

Tyson Foods, Inc.

-

Mars, Incorporated

-

Cargill, Incorporated

-

The Kraft Heinz Company

-

General Mills Inc.

-

Conagra Brands, Inc.

-

Kellogg Co.

U.S. Packaged Food Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.08 trillion

Revenue forecast in 2030

USD 1.58 trillion

Growth Rate

CAGR of 4.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD trillion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Key companies profiled

Nestlé; The Coca-Cola Company; PepsiCo; Tyson Foods, Inc.; Mars Incorporated; Cargill, Incorporated; The Kraft Heinz Company; General Mills Inc.; Conagra Brands, Inc.; Kellogg Co

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Packaged Food Market Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. packaged food market report based on product and distribution channels.

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Bakery & Confectionary Products

-

Dairy Products

-

Snacks & Nutritional Bars

-

Beverages

-

Sauces, Dressings, & Condiments

-

Ready-to-Eat Meals

-

Breakfast Cereals

-

Processed Meats

-

Rice, Pasta, & Noodles

-

Ice Creams & Frozen Novelties

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Store

-

Online

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. packaged food market size was estimated at USD 1,037.9 billion in 2021 and is expected to reach USD 1,084.7 billion in 2022.

b. The U.S. packaged food market is expected to grow at a compound annual growth rate of 4.8% from 2022 to 2030 to reach USD 1,588.9 billion by 2030.

b. Beverages dominated the U.S. packaged food market with a share of 18.0% in 2021. This is attributable to the availability of a wide range of non-alcoholic packaged beverages coupled with increasing demand for functional drinks.

b. Some key players operating in the U.S. packaged food market include Nestlé, The Coca-Cola Company, PepsiCo, Tyson Foods, Inc., Mars, Incorporated, Cargill, Incorporated, The Kraft Heinz Company, General Mills Inc., Conagra Brands, Inc., and Kellogg Co.

b. Key factors that are driving the U.S. packaged food market growth include hectic work schedules, changing lifestyles, rising preference for convenience, escalating expansion of e-commerce, and increasing product innovations across the country.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."