- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Pharmaceutical Cold Chain Packaging Market Report, 2030GVR Report cover

![U.S. Pharmaceutical Cold Chain Packaging Market Size, Share & Trends Report]()

U.S. Pharmaceutical Cold Chain Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Packaging Format (Active, Passive), By Substrate (Polyethylene), By Temperature Requirement, By Product, By Component, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-548-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The U.S. pharmaceutical cold chain packaging market size was valued at USD 1.23 billion in 2024 and is projected to grow at a CAGR of 14.6% from 2025 to 2030. One of the primary reasons for the growth in pharmaceutical cold chain packaging is the increasing reliance on biologics, vaccines, and gene therapies. These advanced medicines are highly sensitive to temperature fluctuations and require strict temperature control throughout storage and transportation.

For instance, mRNA-based vaccines, such as those developed for COVID-19, require ultra-cold storage at temperatures as low as -70°C. In addition, monoclonal antibodies, insulin, and certain cancer therapies must be kept within specific temperature ranges to maintain their efficacy. As pharmaceutical companies continue to develop more biologics and personalized medicine, the demand for reliable cold chain packaging solutions has significantly increased.

The U.S. biopharmaceutical industry is witnessing substantial growth due to advancements in biotechnology and increased investment in research and development. Companies are shifting toward the production of biologics, cell and gene therapies, and other specialized drugs that are temperature-sensitive. With this shift, the need for sophisticated cold chain packaging has become more critical to ensure the safe and effective delivery of these products. Furthermore, as clinical trials expand across different regions, pharmaceutical firms require robust cold chain solutions to transport investigational drugs while maintaining their integrity.

The U.S. Food and Drug Administration (FDA), along with global regulatory bodies such as the International Council for Harmonisation (ICH) and the U.S. Pharmacopeia (USP), has implemented stringent regulations for the transportation and storage of temperature-sensitive pharmaceuticals. Good Distribution Practices (GDP) and Good Manufacturing Practices (GMP) mandate that pharmaceutical companies maintain strict temperature controls throughout the supply chain. Failure to comply with these regulations can result in drug degradation, financial losses, and regulatory penalties. Consequently, pharmaceutical companies are investing heavily in high-quality cold chain packaging solutions that provide insulation, monitoring, and temperature control to ensure compliance with these regulations.

The pharmaceutical cold chain packaging sector has seen significant technological advancements, including the development of smart packaging solutions with real-time temperature monitoring, phase change materials (PCMs) for improved insulation, and vacuum-insulated panels (VIPs) that offer superior thermal protection. In addition, companies are incorporating data loggers, RFID tracking, and Internet of Things (IoT)-)-)-enabled sensors into packaging solutions to ensure real-time visibility and control of temperature-sensitive shipments. These innovations have improved the reliability of cold chain logistics, making it easier to transport pharmaceuticals safely across long distances and under varying environmental conditions.

The rise of online pharmacies and direct-to-patient drug delivery models has further fueled the demand for pharmaceutical cold chain packaging. Patients now expect home delivery of temperature-sensitive medications, including insulin, specialty biologics, and hormone treatments. This has increased the need for last-mile cold chain solutions that can maintain temperature stability during transportation. Pharmaceutical companies and logistics providers are investing in advanced cold chain packaging that includes insulated shipping containers, refrigerated transport options, and advanced cooling technologies to meet these new demands.

The COVID-19 pandemic highlighted the critical role of pharmaceutical cold chain logistics in delivering vaccines and biologics across the U.S. at an unprecedented scale. The massive rollout of COVID-19 vaccines required extensive cold storage capabilities and robust packaging solutions to maintain efficacy. As a result, pharmaceutical companies and logistics providers have expanded their cold chain infrastructure, investing in high-performance packaging materials, temperature-controlled shipping solutions, and advanced tracking technologies. The lessons learned from the pandemic continue to drive long-term improvements in cold chain logistics, further boosting demand for specialized packaging.

The U.S. pharmaceutical market is highly interconnected with global supply chains, as many drugs, raw materials, and active pharmaceutical ingredients (APIs) are manufactured overseas. The import and export of temperature-sensitive medications require advanced cold chain packaging solutions to ensure safe transportation across different climates and regulatory environments. With growing international trade in pharmaceuticals, companies are focusing on developing packaging that meets both domestic and global cold chain requirements.

Substrate Insights

The Expanded Polystyrene (EPS) substrate segment recorded the largest market revenue share of over 15.2% in 2024. Expanded Polystyrene (EPS) substrate is dominating the pharmaceutical cold chain packaging market due to its superior insulating properties, lightweight structure, cost-effectiveness, and ease of customization.

EPS is widely preferred in cold chain packaging because of its exceptional thermal insulation properties. It effectively maintains the required temperature range for sensitive pharmaceuticals, ensuring that drugs remain stable during transportation and storage. Its ability to provide consistent thermal protection, even under extreme external temperature conditions, makes it a popular choice for pharmaceutical shipments, especially in last-mile delivery and long-haul transportation. EPS packaging is highly durable and impact-resistant, providing a protective barrier for delicate pharmaceutical products. During transit, pharmaceuticals may be subjected to rough handling, pressure changes, and mechanical shocks. The structural integrity of EPS ensures that medications, especially vaccines and biologics stored in vials or pre-filled syringes, remain intact and undamaged throughout the supply chain. This durability enhances the reliability of cold chain packaging, ensuring the safe delivery of critical medications.

Product Insights

The boxes product segment recorded the largest market revenue share of over 51.6% in 2024, due to its superior ability to provide reliable thermal insulation, ease of handling, cost-effectiveness, and widespread use across the pharmaceutical supply chain. As the demand for temperature-sensitive drugs, biologics, and vaccines grows, pharmaceutical companies are increasingly relying on insulated boxes to ensure the safe transportation and storage of these critical products.

The rise of e-commerce in pharmaceuticals and direct-to-patient (DTP) drug delivery has further driven the demand for insulated boxes. With an increasing number of patients receiving temperature-sensitive medications at home, pharmaceutical companies and logistics providers require efficient packaging solutions to ensure safe last-mile delivery. Insulated boxes, combined with gel packs, phase change materials (PCMs), or dry ice, provide a reliable way to transport medications while maintaining their stability throughout the delivery process.

As the pharmaceutical industry moves toward sustainable packaging solutions, manufacturers are developing eco-friendly insulated boxes made from biodegradable materials, recycled EPS, or reusable components. Many companies are investing in returnable cold chain packaging systems, where insulated boxes can be reused multiple times, reducing waste and overall packaging costs. These sustainability efforts are further enhancing the appeal of the boxes segment in the cold chain market.

Components Insights

The insulation components segment recorded the largest market revenue share of over 73.9% in 2024. Insulation materials play a critical role in maintaining the required temperature range for temperature-sensitive pharmaceuticals such as vaccines, biologics, insulin, and specialty drugs during transportation and storage. With the rise of personalized medicine, gene therapies, and mRNA-based vaccines, the demand for high-performance insulation solutions has significantly increased.

Temperature-sensitive pharmaceuticals must be stored and transported within strict temperature thresholds to maintain their potency and efficacy. Any exposure to temperature fluctuations can cause drug degradation, making effective insulation a non-negotiable component of cold chain packaging. Insulation helps minimize heat transfer, ensuring that pharmaceuticals remain within regulated temperature ranges. This is especially critical for drugs that require ultra-cold storage, such as mRNA vaccines, which need -70°C conditions for long-term stability.

Regulatory bodies such as the FDA (Food and Drug Administration), the U.S. Pharmacopeia (USP), and the International Safe Transit Association (ISTA) enforce strict guidelines for pharmaceutical cold chain packaging. Compliance with Good Distribution Practices (GDP) and Good Manufacturing Practices (GMP) requires pharmaceutical companies to validate that their insulation materials maintain temperature stability under real-world shipping conditions. High-performance insulation solutions help pharmaceutical companies meet these regulatory requirements, ensuring product integrity and reducing the risk of drug spoilage.

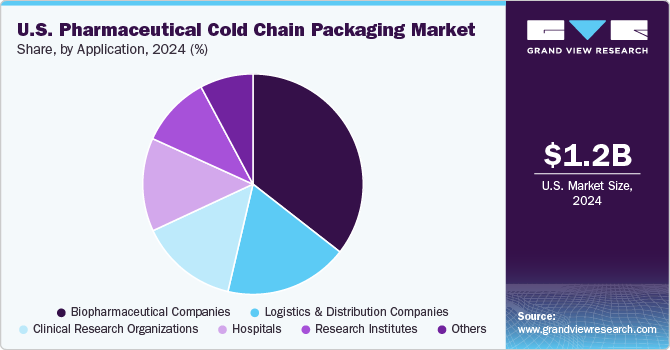

Application Insights

Biopharmaceutical companies are dominating the market due to their growing reliance on temperature-sensitive biologics, cell and gene therapies, and advanced vaccines. The increasing need for regulatory compliance, global distribution, and smart packaging technologies has driven the demand for high-performance insulation, active cooling systems, and real-time monitoring solutions. As the industry continues to evolve, sustainability and innovative temperature-controlled packaging will play a critical role in shaping the future of cold chain logistics for biopharmaceutical companies.

The biopharmaceutical companies segment is a key driver of growth in the market due to the increasing demand for temperature-sensitive biologics, cell and gene therapies, and mRNA-based vaccines. As biopharmaceutical companies continue to develop innovative therapies that require strict temperature control, the need for high-performance cold chain packaging solutions has grown exponentially.

Unlike traditional small-molecule drugs, biologics are derived from living organisms and are highly sensitive to temperature fluctuations. These products, including monoclonal antibodies, recombinant proteins, and vaccines, must be stored and transported within specific temperature ranges, typically 2°C to 8°C for refrigerated biologics and -20°C to -80°C for frozen and ultra-cold biologics. Any deviation from these temperatures can degrade the product, rendering it ineffective or even harmful.

Key U.S. Pharmaceutical Cold Chain Packaging Company Insights

The U.S. pharmaceutical cold chain packaging industry is highly competitive, with key players continuously innovating to meet the growing demand for temperature-sensitive drug transportation. Competition is driven by factors such as regulatory compliance, cost-effectiveness, performance reliability, and eco-friendly packaging solutions, as pharmaceutical companies seek partners that can provide validated, GDP-compliant, and cost-efficient cold chain packaging. In addition, the increasing demand for biologics, personalized medicine, and mRNA-based therapies has pushed companies to develop high-performance temperature-controlled packaging solutions capable of handling ultra-cold storage and long-haul shipments.

To maintain a competitive edge, market players are focusing on strategic partnerships, mergers, and acquisitions to expand their global footprint and strengthen their product portfolios. Companies are also integrating IoT-enabled tracking systems, RFID sensors, and AI-driven analytics to offer real-time monitoring and predictive insights for pharmaceutical shipments, improving supply chain visibility and reducing product loss risks.

-

On March 31, 2025, DHL announced its intention to acquire U.S.-based pharmaceutical logistics firm CryoPDP, a subsidiary of Cryoport Systems. This strategic move aims to bolster DHL's presence in the pharmaceutical logistics sector.

-

In October 2024, Peli BioThermal introduced Crēdo Vault, an advanced bulk shipper designed to enhance thermal reliability and provide real-time monitoring for pharmaceutical shipments.

Key U.S. Pharmaceutical Cold Chain Packaging Companies:

- Sealed Air

- Peli BioThermal Limited

- CSafe

- Intelsius

- Sonoco ThermoSafe

- Cryoport Systems, LLC

- SkyCell AG

- Inmark Global Holdings, LLC

- Smurfit Kappa

- Insulated Products Corporation

U.S. Pharmaceutical Cold Chain Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.41 billion

Revenue forecast in 2030

USD 2.78 billion

Growth Rate

CAGR of 14.6% from 2025 to 2030

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Packaging Format, temperature requirement, substrate, product, component, application, region

Regional scope

North America

Key companies profiled

Sealed Air; Peli BioThermal Limited; CSafe; Intelsius; Sonoco ThermoSafe; Cryoport Systems, LLC; SkyCell AG; Inmark Global Holdings, LLC; Smurfit Kappa; Insulated Products Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Pharmaceutical Cold Chain Packaging Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. pharmaceutical cold chain packaging market report based on packaging format, temperature requirement, substrate, product, component, and application.

-

Packaging Format Outlook (Revenue, USD Million, 2018 - 2030)

-

Active

-

Passive

-

-

Temperature Requirement Outlook (Revenue, USD Million, 2018 - 2030)

-

Controlled Room Temperature (15°C - 25°C)

-

Refrigerated (2°C - 8°C)

-

Frozen (0°C and below)

-

Deep-Frozen (-20°C to -40°C)-

-

Cryogenic (-150°C and below)

-

-

Substrate Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyethylene Terephthalate (PET)

-

Expanded Polystyrene (EPS)

-

Polyurethane (PU)

-

Vacuum Insulated Panel (VIP)

-

Temperature Insulated Packaging (TIP)

-

Metal

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Boxes

-

Mailers

-

Pallets

-

Others

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Coolant

-

Insulation

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biopharmaceutical Companies

-

Clinical Research Organizations

-

Hospitals

-

Research Institutes

-

Logistics and Distribution Companies

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. pharmaceutical cold chain packaging market size was valued at USD 1.23 billion in 2024 and is expected to reach USD 1.41 Billion by 2025.

b. The U.S. pharmaceutical cold chain packaging market is expected to expand at a compound annual growth rate (CAGR) of 14.6% from 2025 to 2030 to reach USD 2.78 Billion.

b. The insulation components segment recorded the largest market revenue share of over 73.9% in 2024 as Insulation materials play a critical role in maintaining the required temperature range for temperature-sensitive pharmaceuticals such as vaccines, biologics, insulin, and specialty drugs during transportation and storage

b. Some of teh key players operating in the market include Sealed Air, Peli BioThermal Limited, CSafe, Intelsius, Sonoco ThermoSafe, Cryoport Systems, LLC, SkyCell AG, Inmark Global Holdings, LLC, Smurfit Kappa, and Insulated Products Corporation

b. One of the primary reasons for the growth in pharmaceutical cold chain packaging is the increasing reliance on biologics, vaccines, and gene therapies. These advanced medicines are highly sensitive to temperature fluctuations and require strict temperature control throughout storage and transportation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.