- Home

- »

- Electronic & Electrical

- »

-

U.S. Portable Consumer Electronics Market Size Report 2033GVR Report cover

![U.S. Portable Consumer Electronics Market Size, Share & Trends Report]()

U.S. Portable Consumer Electronics Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Wearable Devices, Portable Personal Styling & Grooming Devices), By Distribution Channel (Offline, Online), And Segment Forecasts

- Report ID: GVR-4-68040-848-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Portable Consumer Electronics Market Summary

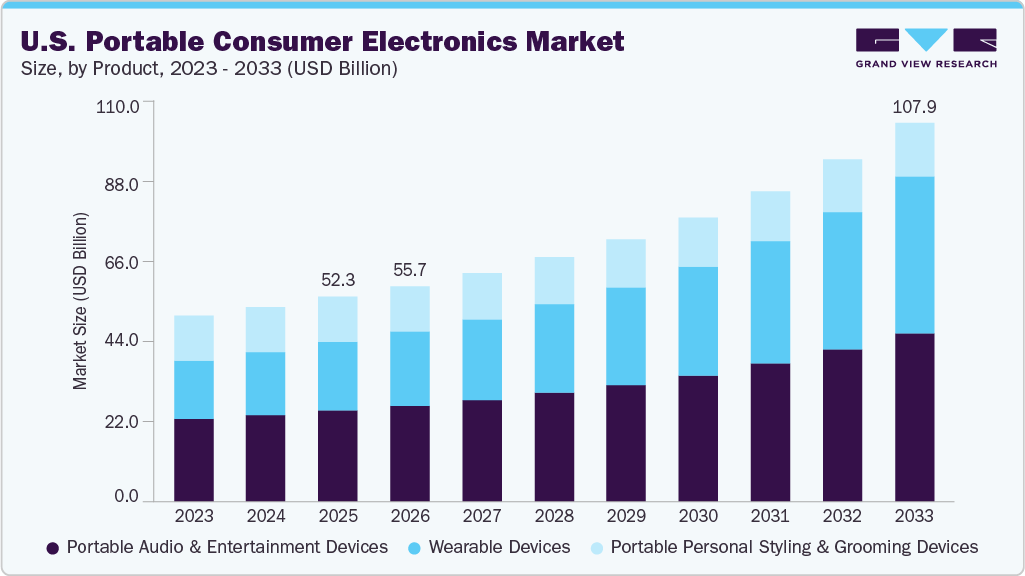

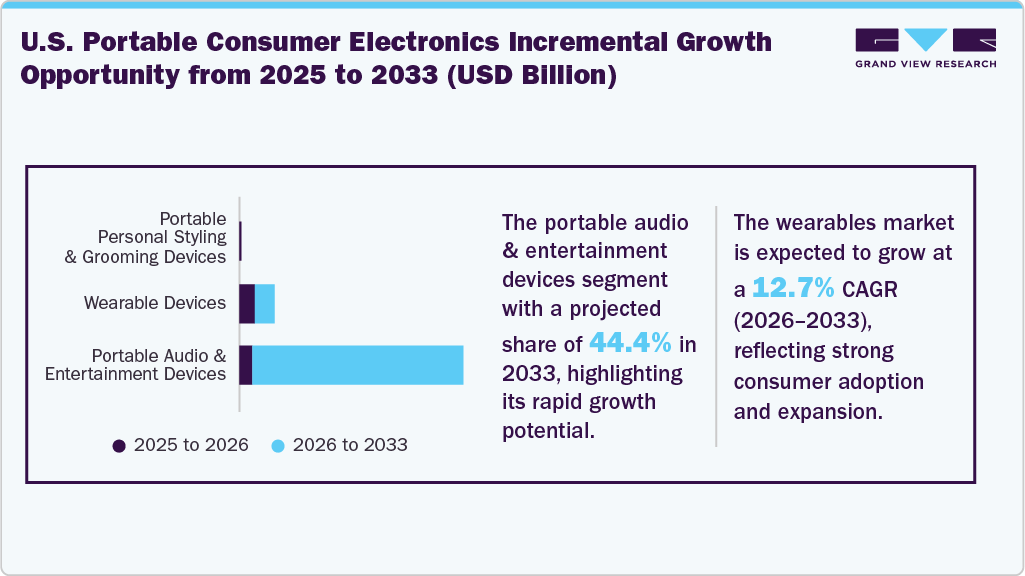

The U.S. portable consumer electronics market size was estimated at USD 52.26 billion in 2025 and is projected to reach USD 107.86 billion by 2033, growing at a CAGR of 9.9% from 2026 to 2033. The market growth is driven by rapid technological advancements, rising disposable incomes, and increasing consumer demand for wearable devices and portable gaming and entertainment devices.

Key Market Trends & Insights

- By product, the portable audio and entertainment devices segment held the largest market share of 44.5% in 2025.

- By distribution channel, the offline segment held the largest market share of 53.9% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 52.26 Billion

- 2033 Projected Market Size: USD 107.86 Billion

- CAGR (2026-2033): 9.9%

The U.S. portable electronic devices industry is expected to grow due to advancements in Artificial Intelligence (AI), the Internet of Things (IoT), and 5G connectivity. This results in rapid innovation in complex and interconnected portable devices. At the same time, digitalization across industries, increasing reliance on electronic devices, and the growth of online streaming platforms are all contributing to this trend. This is increasing the demand for portable devices, including audio products, wearables, and other entertainment gadgets in the U.S.

Wearable and portable audio devices, such as Bluetooth headphones, true wireless earbuds, smartwatches, smart rings, and smart glasses, are gaining traction and attracting more tech-savvy customers in the U.S. compared to traditional devices. An increasing number of users are adopting smart rings for health monitoring. Moreover, the latest smart glasses integrate features such as augmented reality overlays, real-time navigation, language translation, and immersive content directly on the display. For example, in September 2025, Meta introduced the Meta Ray-Ban glasses, featuring advanced AI glasses and a full-color, high-resolution display. These emerging technologies are expected to drive the portable consumer electronics industry in the U.S.

The U.S. portable consumer electronics market is also influenced by gaming trends, including PC gaming on the go, innovations in gaming consoles, handheld gaming, and changing lifestyle trends, as well as rapid technological advancements. Gaming devices with unique console designs, powerful AMD or Intel processors, better OLED and high-refresh-rate screens, and longer battery life attract many young and middle-aged customers. Online gaming and new product launches in this category are also expected to fuel the growth of the U.S. portable consumer electronics industry.

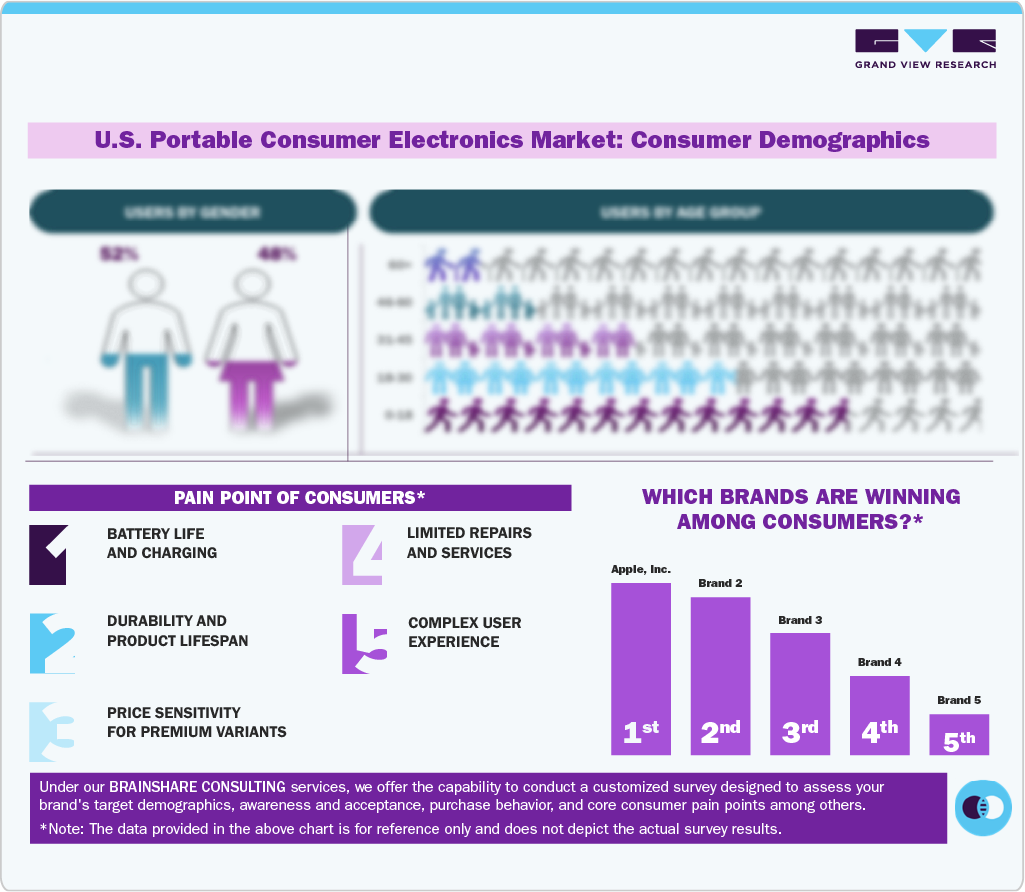

Consumer Insights

In the U.S., portable audio and entertainment devices are more popular among young and middle-aged people aged 15 to 40, especially Gen Z and millennials. Bluetooth speakers, wireless earbuds, headphones, media players, and handheld gaming consoles are gaining demand in the U.S. Teenagers and young adults use these devices primarily for music streaming, mobile gaming, social media, and entertainment. Working professionals often prefer the use of headphones, smartwatches, and True Wireless Earbuds (TWS) for commuting, travel, fitness, and remote work. In the U.S., factors such as the widespread use of smartphones, a strong fitness culture, an increasing number of people working in hybrid settings, interest in premium audio brands, and frequent travel and outdoor activities drive the demand for portable consumer electronics.

In the U.S., adults between 20 and 60 widely use portable grooming and styling devices. These products are especially popular among young adults who prefer regular grooming and among middle-aged consumers who value convenience. Social media influences the younger population, and they prefer following skin care and beauty routines at home. This has increased demand for portable hair tools, trimmers, grooming kits, and skincare devices. Moreover, adults demand quick grooming, hygiene, and portable products to stay groomed, especially during hectic routines and business trips. With the rising popularity of DIY grooming in the U.S., men are increasingly using grooming products and choosing premium and cordless devices. Big stores, pharmacies, and online shops are contributing to the trend by offering a wide variety of portable products and quick delivery services.

Product Insights

The U.S. portable audio and entertainment devices segment accounted for the largest revenue share of 44.5% in 2025, driven by increasing use of smartphones, remote working lifestyles, technological advancements, and rising demand for portable electronic devices for music and entertainment. The portable audio and entertainment devices include Bluetooth speakers, Bluetooth headphones, True Wireless Earbuds (TWS), portable media players, and portable gaming consoles. Demand for audio devices is rising as users travel continuously and adapt to hybrid work routines. Furthermore, the U.S. manufacturers are engaged in innovations to increase their market share in the U.S. For example, in December 2025, JLab introduced the JBuds Open Headphones, the first open-over-ear Bluetooth headphones designed to offer premium sound while allowing the ambient sound to naturally flow in.

The wearable devices segment is expected to grow at the fastest CAGR of 12.7% during the forecast period, owing to an increasing demand for health monitoring, fitness activity, and safety. Users demand shock-resistant, waterproof, and application-integrated devices that are suitable for use during activities such as dance, fitness, traveling, and various indoor or outdoor activities. According to the American Heart Association’s journal, cuffless devices, such as smartwatches, rings, and fingertip monitors, can be used to measure blood pressure as alternatives to traditional arm-cuff monitors. These devices are easy to use, convenient, and capable of continuous monitoring, providing insights into changes in the user’s blood pressure during daily life and sleep cycles. This further contributes to the growth of this segment in the U.S.

Distribution Channel Insights

The offline stores segment led the U.S. portable consumer electronics industry, accounting for the largest share of 53.9% in 2025, driven by hands-on demos, personalized assistance, instant product delivery, and various festival discounts offered by offline stores. This includes specialty stores, hypermarkets & supermarkets, department stores, and multi-brand stores. In the U.S., customers often prefer offline stores, especially for product experience, such as wearable devices and grooming electronics. Specialty stores such as Apple and Samsung showcase their newest smartphones and smartwatches, encouraging customers to visit and try their products in person. Multi-brand stores and supermarkets offer discounts on portable electronics during holidays, festivals, and back-to-school times, which contribute to the segment growth.

The U.S. online distribution channel segment is projected to grow at the fastest CAGR from 2026 to 2033. The growth is driven by technological innovations, increasing use of e-commerce applications and websites, consumer convenience, product variety, and competitive pricing. E-commerce platforms, for instance, enable brands to reach customers easily and quickly. Direct-to-consumer channels help increase profits, build customer loyalty, and give brands more control over pricing and after-sales support. Amazon, Best Buy, Walmart, eBay, and Newegg are the major online distributors in the U.S. Discounts on portable electronics, easy payment methods, fast delivery, reliable shipping, and simple returns make online shopping more popular among customers in the U.S.

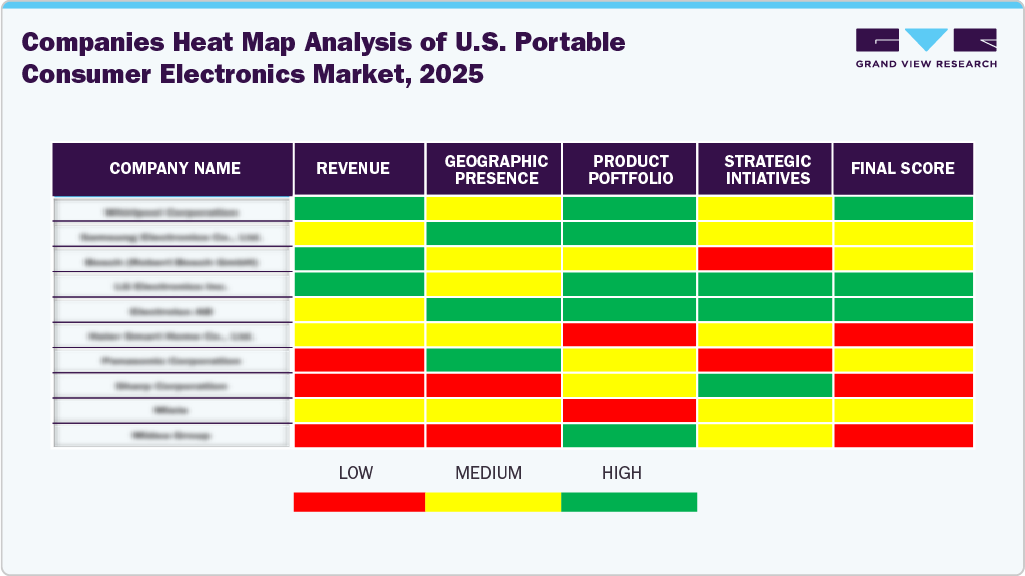

Key U.S. Portable Consumer Electronics Company Insights

Key players operating in the U.S. portable consumer electronics industry include Apple, Samsung Electronics, Sony Corporation, Panasonic, Philips, Bose, Harman International (JBL, AKG), Anker Innovations, Skullcandy, Sennheiser, and Garmin. Market players focus on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

-

In the U.S., Apple’s growth depends on locking users into its ecosystem and making money from services. The company encouraged users to adopt AirPods and Apple Watch for easy integration with iPhones and Macs. Continuous improvements in health and safety features, such as ECG and fall detection, prompted consumers to upgrade their devices. The company used data-driven marketing to customize offerings and keep premium prices in the U.S. portable consumer electronics market.

-

Samsung focuses on a multi-tier product strategy in the U.S. to reach both premium and budget customers in portable audio, wearables, and connected accessories. The company emphasizes making its devices work well together by closely integrating portable devices, such as Galaxy Buds and Galaxy Watch, with Galaxy smartphones and tablets, thereby improving the user experience across devices. The company is also expanding its carrier partnerships and increasing its retail presence to enhance distribution and financing options.

Key U.S. Portable Consumer Electronics Companies:

- Apple, Inc.

- Samsung Electronics

- Sony Corporation

- Panasonic Holdings Corporation

- Koninklijke Philips N.V.

- Bose Corporation

- Harman International (JBL, AKG)

- Anker Innovations

- Skullcandy Inc

- Sennheiser Electronic SE & Co. Ltd.

- Jabra

- LG Electronics, Inc.

- Braun GmbH

- Garmin Ltd.

- Sonos

- GoPro, Inc.

Recent Developments

-

In October 2025, ROG introduced Xbox Ally and Ally X, developed in partnership with ASUS and AMD. These gaming handhelds offer the Xbox experience, allowing users to play more games, including those from leading Windows PC storefronts, all in one place.

-

In August 2025, Google introduced Pixel Watch 4, featuring a first-of-its-kind domed Actua 360 display, standalone satellite communication, on-the-go Gemini assistance, and loss of pulse detection. Other features include the longest-lasting and fastest-charging battery, a durable, serviceable design, and advanced health and fitness capabilities.

-

In May 2025, Philips introduced its Norelco Shaver i9000 Prestige Ultra with the brand's first "Root-Level" shave, for closeness, comfort, and customization. This electric shaver is powered by artificial intelligence (AI), delivering maximum comfort, superior precision, and ultimate personalization while providing a seamless user experience.

U.S. Portable Consumer Electronics Market Report Scope

Report Attribute

Details

Market value size in 2026

USD 55.74 billion

Revenue forecast in 2033

USD 107.86 billion

Growth rate

CAGR of 9.9% from 2026 to 2033

Actuals

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Country scope

U.S.

Key companies profiled

Apple Inc.; Samsung Electronics; Sony Corporation; Panasonic Holdings Corporation; Philips; Bose; Harman International (JBL, AKG); Anker Innovations; Skullcandy Inc.; Sennheiser electronic SE & Co. Ltd.; Jabra; LG Electronics Inc.; Braun GmbH; Garmin Ltd.; Google; Sonos; GoPro.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Portable Consumer Electronics Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. portable consumer electronics market report based on product, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Portable Audio & Entertainment Devices

-

Portable Bluetooth Speakers

-

Portable Media Players

-

Handheld Gaming Consoles

-

True Wireless Earbuds (TWS)

-

Bluetooth Headphones

-

Others

-

-

Wearable Devices

-

Smartwatches & Fitness Bands

-

Smart Rings

-

Smart Glasses

-

Wearable Cameras

-

-

Portable Personal Styling & Grooming Devices

-

Hair Dryers

-

Hair Straightener

-

Curling Irons

-

Crimpers and Wavers

-

Hot Rollers

-

Electric Shavers

-

Electric Toothbrushes

-

Others

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Exclusive Brand Stores

-

Hypermarkets & Supermarkets

-

Multi-Brand Stores

-

Others

-

-

Online

-

E-Commerce Platforms

-

Company Websites

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.