- Home

- »

- Organic Chemicals

- »

-

U.S. Potassium Sorbate Market Size, Industry Report, 2033GVR Report cover

![U.S. Potassium Sorbate Market Size, Share & Trends Report]()

U.S. Potassium Sorbate Market (2025 - 2033) Size, Share & Trends Analysis Report By Form (Powder, Granular, Liquid), By Application (Food & beverage, Pharmaceuticals, Cosmetics & Personal Care), And Segment Forecasts

- Report ID: GVR-4-68040-639-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Potassium Sorbate Market Summary

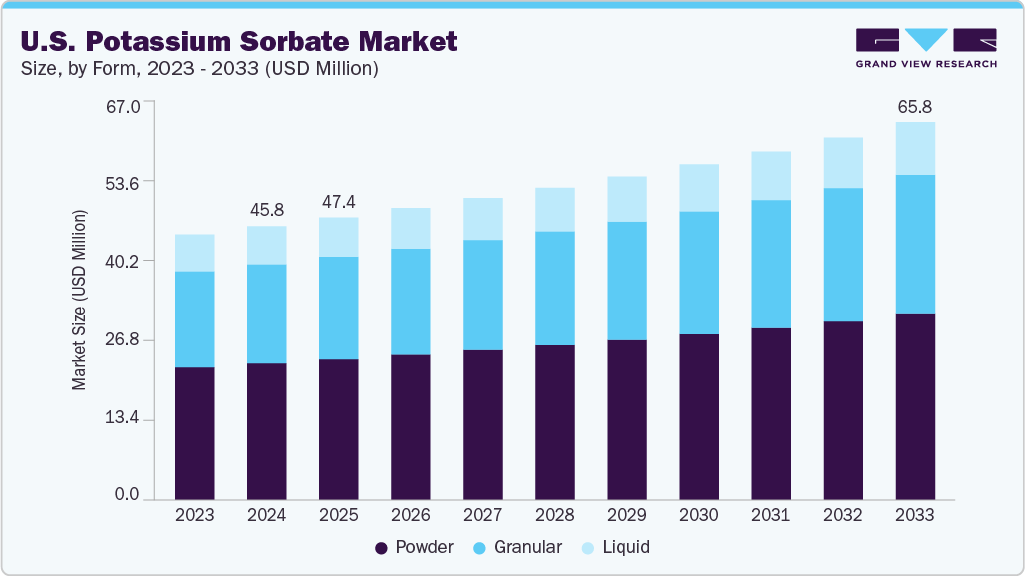

The U.S. potassium sorbate market size was estimated at USD 45.8 million in 2024 and is projected to reach USD 65.8 million by 2033, growing at a CAGR of 4.2% from 2025 to 2033. The market is primarily driven by the rising demand for effective and food-grade preservatives across the food and beverage sector, propelled by the growing consumption of packaged and processed foods.

Key Market Trends & Insights

- By form, the granular segment is expected to grow at the highest CAGR of 4.4% from 2025 to 2033 in terms of revenue.

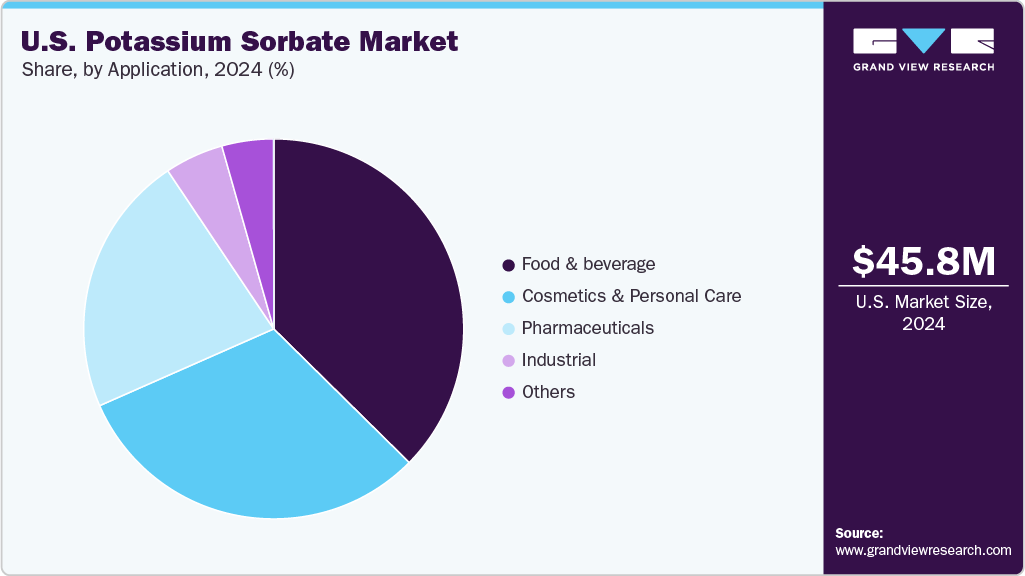

- By application, the food & beverages segment held the largest revenue share of 37.4% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 45.8 Million

- 2033 Projected Market Size: USD 65.8 Million

- CAGR (2025-2033): 4.2%

Additionally, the increasing inclination toward clean-label and shelf-stable products has reinforced the adoption of potassium sorbate due to its low toxicity and broad-spectrum antimicrobial properties. Expanding applications in pharmaceuticals and personal care products further support market growth, as manufacturers seek safe, cost-effective preservatives to meet evolving regulatory and consumer safety standards.The market presents significant growth opportunities driven by the expanding use of natural and minimally processed ingredients in cosmetics, personal care, and clean-label food products. As consumer preferences shift toward safer, preservative-free formulations, potassium sorbate’s favorable regulatory status and compatibility with natural ingredients position it as a preferred solution. Moreover, the growing demand for organic and sustainable preservation methods in pharmaceuticals and pet food offers untapped potential for market players to diversify applications and innovate with advanced delivery systems like microencapsulation.

Despite its widespread usage, the market faces challenges from the rising scrutiny of synthetic preservatives, with consumers increasingly opting for fully natural alternatives. Regulatory pressures surrounding maximum allowable concentrations and labeling transparency further constrain market flexibility. Additionally, potassium sorbate’s limited efficacy against all types of microorganisms, coupled with its potential to degrade in high-temperature or highly acidic environments, may limit its use in certain formulations, compelling manufacturers to explore combination preservatives or reformulations.

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players, such as Merck, Shandong Kunda Biological Technology Co., Ltd, Titan Biotech, TCI, and Hunan Huari Pharmaceutical Co., Ltd, dominating the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

Leading players in the market are adopting strategies focused on product portfolio expansion, strategic partnerships, and capacity enhancements to strengthen their market presence and meet evolving consumer demands. Companies are increasingly investing in clean-label and food-grade preservative innovations, aligning with the shift toward natural and minimally processed products. Additionally, manufacturers are enhancing their supply chain resilience and regional distribution networks to ensure consistent product availability amid fluctuating raw material prices and regulatory changes.

Form Insights

The powder segment held the largest revenue share of 49.75% in 2024, primarily due to its superior stability, longer shelf life, and ease of transportation and storage. Powdered potassium sorbate is widely favored across the food and beverage industry, where it is used in baked goods, dairy products, and packaged foods to prevent mold and yeast growth. Its high concentration and excellent solubility allow for precise dosing in large-scale food processing, making it cost-effective and efficient. Furthermore, the powder form is preferred in industrial applications where bulk handling and extended storage are critical operational requirements.

The granular segment is also gaining traction, particularly in beverage and liquid-based food applications, due to its faster solubility and compatibility with automated mixing systems. Meanwhile, the liquid form of potassium sorbate, though holding a smaller share, is steadily growing in demand within the cosmetics, personal care, and pharmaceutical industries, where it is directly blended into emulsions, creams, and suspensions. Its ease of integration in liquid formulations without requiring additional solubilizing steps makes it an attractive choice for manufacturers focused on streamlined production processes. However, storage limitations and shorter shelf life compared to powder have slightly restrained its wider adoption.

Application Insights

The food & beverage segment accounted for the largest revenue share of 37.4% in 2024, driven by the compound’s widespread use as a preservative in processed foods, baked goods, dairy products, sauces, and beverages. With rising consumer demand for convenient, shelf-stable, and ready-to-eat food products, potassium sorbate remains a preferred choice due to its effectiveness against mold and yeast, regulatory approval (GRAS status), and compatibility with clean-label formulations. The segment continues to benefit from the growing adoption of natural preservatives that ensure product safety without altering taste, color, or nutritional value.

Beyond food and beverage, the pharmaceutical segment utilizes potassium sorbate in oral medications, syrups, and topical formulations due to its antimicrobial properties and safety profile. The cosmetics & personal care segment is also witnessing steady growth, supported by rising consumer interest in paraben-free and low-toxicity preservatives in creams, lotions, shampoos, and makeup products. In the industrial segment, potassium sorbate is used on a smaller scale in adhesives, lubricants, and coatings that require microbial stability. The other category, includes pet food and agricultural applications, is emerging as a niche opportunity as awareness of food safety and preservation expands into non-traditional sectors.

Key U.S. Potassium Sorbate Company Insights

Key players, such as Merck, Shandong Kunda Biological Technology Co., Ltd, Titan Biotech, TCI, and Hunan Huari Pharmaceutical Co., Ltd, are dominating the market.

-

Merck is a recognized player in the potassium sorbate market, offering high-purity, pharmaceutical-grade powders and analytical reference standards. Through its comprehensive Emprove and EMPARTA product lines, Merck provides potassium sorbate manufactured under stringent cGMP guidelines with full documentation to support regulatory compliance and ensure supply chain transparency. Its offerings cater to diverse industries, including food & beverage, pharmaceuticals, and cosmetics, backed by robust R&D and global distribution networks, positioning Merck as both a trusted supplier and an innovation-driven competitor in the preservative space.

Key U.S. Potassium Sorbate Companies:

- Merck

- Shandong Kunda Biological Technology Co., Ltd.

- Titan Biotech

- TCI

- Hunan Huari Pharmaceutical Co., Ltd.

- Jiangsu Mupro Ift Corp.

- Celanese Corporation

- BIMAL PHARMA PVT. LTD.

- FBC Industries

- Conflate Chemtech

- ASTRRA CHEMICALS

U.S. Potassium Sorbate Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 47.4 million

Revenue forecast in 2033

USD 65.8 million

Growth rate

CAGR of 4.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, application

Country Scope

U.S.

Key companies profiled

Merck; Shandong Kunda Biological Technology Co., Ltd; Titan Biotech; TCI; Hunan Huari Pharmaceutical Co., Ltd.; Jiangsu Mupro Ift Corp.; Celanese Corporation; BIMAL PHARMA PVT. LTD.; FBC Industries; Conflate Chemtech; ASTRRA CHEMICALS

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Potassium Sorbate Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. potassium sorbate market report based on application, and form.

-

Form Outlook (Volume, Kilotons, Revenue, USD Million, 2021 - 2033)

-

Powder

-

Granular

-

Liquid

-

-

Application Outlook (Volume, Kilotons, Revenue, USD Million, 2021 - 2033)

-

Food & beverage

-

Pharmaceuticals

-

Cosmetics & Personal Care

-

Industrial

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. potassium sorbate market size was estimated at USD 45.8 million in 2024 and is expected to reach USD 47.4 million in 2025.

b. The U.S. potassium sorbate market is expected to grow at a compound annual growth rate of 4.2% from 2025 to 2033 to reach USD 65.8 million by 2033.

b. The powder segment held the largest revenue share in 2024 due to its superior shelf stability, ease of handling, and broad applicability across food, pharmaceutical, and industrial formulations. Its cost-effectiveness and high solubility in large-scale processing environments further reinforced its dominance in the U.S. market.

b. Some of the key players operating in the U.S. Potassium Sorbate Market include Merck, Shandong Kunda Biological Technology Co.,Ltd., Titan Biotech, TCI, Hunan Huari Pharmaceutical Co.,Ltd., Jiangsu Mupro Ift Corp., Celanese Corporation, BIMAL PHARMA PVT. LTD., FBC Industries, Conflate Chemtech, ASTRRA CHEMICALS.

b. The U.S. potassium sorbate market is driven by the rising demand for effective, food-grade preservatives in processed foods and beverages, supported by growing consumer preference for clean-label products. Its expanding use in pharmaceuticals and personal care formulations due to its low toxicity and regulatory approval is further fueling market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.