- Home

- »

- Advanced Interior Materials

- »

-

U.S. Prefabricated Panels Market Size, Industry Report 2030GVR Report cover

![U.S. Prefabricated Panels Market Size, Share & Trends Report]()

U.S. Prefabricated Panels Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Modular, Panelized), By End-use (Residential, Non-residential), And Segment Forecasts, Consumer Behavior And Competitive Analysis

- Report ID: GVR-4-68040-620-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Prefabricated Panels Market Trends

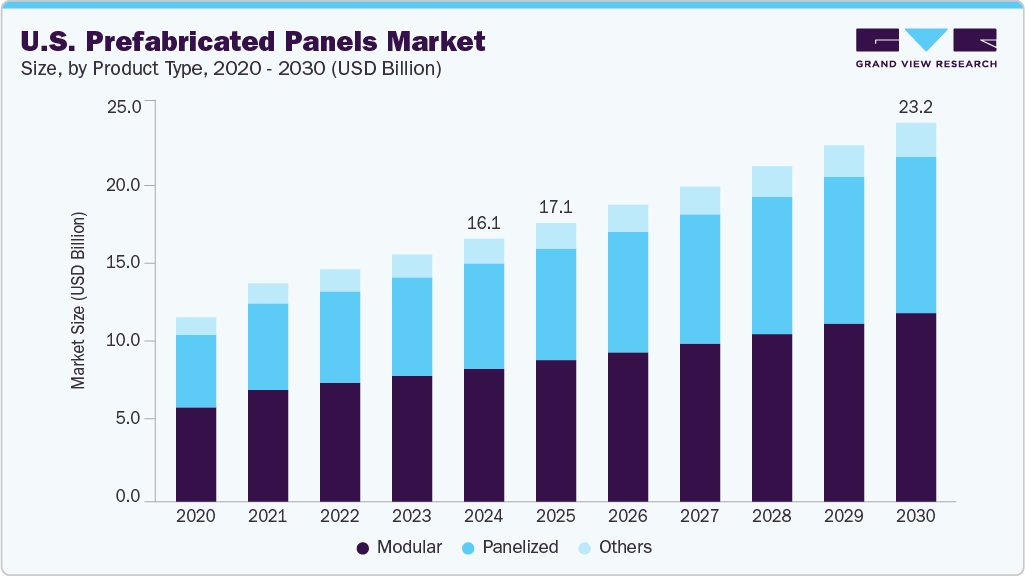

The U.S. prefabricated panels market size was valued at USD 16.06 billion in 2024 and is projected to grow at a CAGR of 6.3% from 2025 to 2030. The U.S. prefabricated panels market is growing steadily, driven by rising demand in residential and non-residential sectors, especially in healthcare and multi-family housing segments. Modular and panelized products offer cost-effective and faster construction solutions amid high real estate costs.

The U.S. prefabricated panel market is experiencing robust growth, driven by supportive government policies and strategic investments. For example, Colorado’s Innovative Housing Incentive Program, launched in January 2023, offers a 20% reimbursement on monthly operating costs for manufacturers of modular and kit homes, aiming to deliver 5,000 affordable housing units over five years. In addition, companies like Mighty Buildings have secured significant funding, such as a USD 5 million grant from the California Energy Commission, to support the development of sustainable modular housing. These developments reflect a rapidly expanding and maturing market where prefabricated panels are becoming a mainstream construction solution in the U.S.

The market primarily comprises two product segments, namely modular and panelized panels. Modular panels are fully pre-built and self-contained units transported and assembled on site, requiring less on-site labor and construction time. Panelized systems involve transporting individual prefabricated panels (roofs, walls, floors) and assembling them on-site. Though construction involving the use of panelized panels requires more on-site labor and can be cost-intensive compared to modular panels, these panels are preferred for their design flexibility, especially in projects requiring customization and large-scale developments.

The prefabricated panels industry is particularly strong in the Western U.S., driven by rapid urbanization and infrastructure needs. However, challenges such as high transportation expenses, especially for modular units, limit wider national adoption. Industry players are responding by investing in technological innovations, including automation and AI, and pursuing mergers to enhance capabilities and expand market reach. Prefabricated panels are reshaping the U.S. construction industry with improved efficiency, sustainability, and scalability.

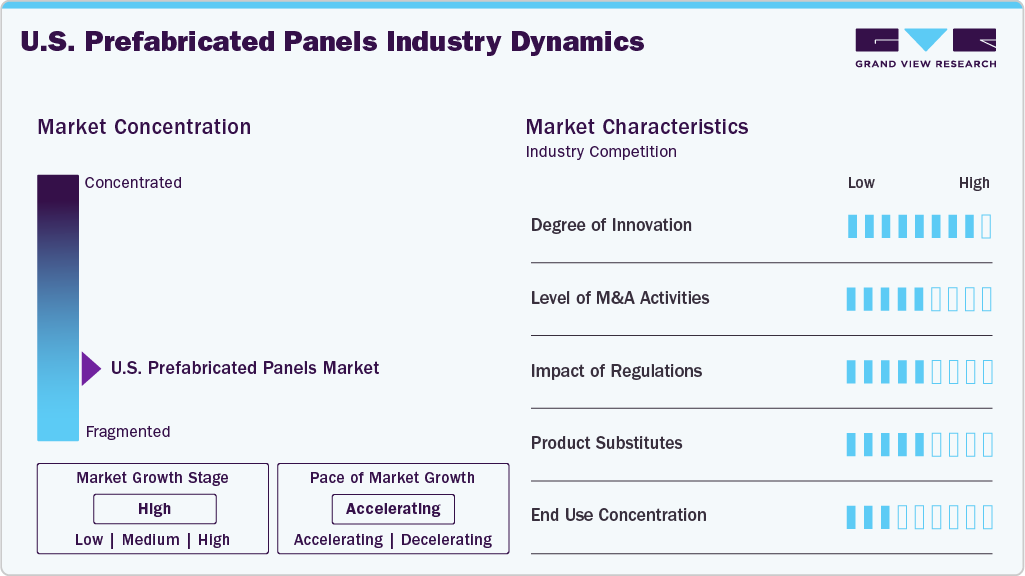

Market Concentration & Characteristics

The pace of growth in the prefabricated panel market is accelerating due to advanced technologies and urgent demand in specific regions. AI-powered micro factories and 3D printing are enhancing the speed and scalability of panel production, significantly improving manufacturing efficiency. Furthermore, natural disasters like the 2023 Maui wildfires have increased the need for fast-deploying modular structures. In response, over 100 modular construction companies entered the Hawaiian market to build temporary housing, underlining the sector’s capacity to respond quickly to urgent housing needs.

Innovation in the U.S. prefabricated panel market is driving rapid advances in both product design and manufacturing processes. For example, modular panels are increasingly integrated with energy-efficient technologies like rooftop solar grids and battery storage, as shown by companies offering fully off-grid modular homes. In addition, modular wiring solutions embedded within panels improve installation speed and safety, significantly reducing onsite labor and errors. These technological advances enhance the appeal of prefabricated panels by making buildings smarter, greener, and quicker to construct.

While the prefabricated panel market is not experiencing significant merger and acquisition activities, consistent strategic acquisitions help companies broaden geographic coverage and product capabilities. Builders FirstSource’s acquisitions of California TrusFrame and Trussway in recent years underscore this trend. These moves improve supply chain efficiency and scale manufacturing, positioning companies to meet growing demand. However, the market remains fragmented without a dominant consolidation wave.

Regulations influence the U.S. prefabricated panels market, especially through building codes, zoning laws, and energy standards. These rules affect design, approval time, and costs. The growing focus of the government on sustainability and affordable housing is expected to boost support for modular construction. In 2024, the state of Massachusetts proposed updates to its building codes to streamline the permitting process for modular construction. These changes are aimed at reducing bureaucratic delays and make it easier for developers to meet housing demand using prefabricated methods. This move also reflects a broader trend among the U.S. states to revise outdated codes in favor of faster, more efficient construction alternatives.

Product Type Insights

The modular segment held the largest revenue share of 50.7% in 2024 in the U.S. prefabricated panel market. Modular panels are complete, factory-built units that are transported and assembled on-site, enabling faster project completion and reduced labor costs. They are widely used in residential projects, including multi-family housing, and increasingly preferred in non-residential sectors like healthcare and education due to their quality control and speed of delivery. The ongoing housing shortage and increased need for affordable multi-family units is driving the adoption of modular panels. Modular panels allow better waste management and use of sustainable materials, aligning with green building certifications and stricter environmental regulations. S2A Modular’s GreenLuxHome series offers luxury, self-sustaining modular homes with rooftop solar and Tesla Powerwall batteries, allowing off-grid living or selling energy back to the grid. These homes can be built in six weeks with over 35 floor plans or custom designs.

The panelized segment in the U.S. prefabricated panel industry is expected to grow over the forecast period. Panelized systems include factory-manufactured walls, floor, and roof panels that are shipped and assembled on-site. This offers more flexibility in design and easier transportation compared to complete modules. Technological advancements, especially in insulated panels, fire-resistant materials, energy-efficient designs, and diverse application scopes, are key factors driving the adoption of panelized systems in residential and commercial sectors. As sustainability and customization become top priorities in the construction sector, the panelized segment is expected to witness growth over the coming years.

End Use Insights

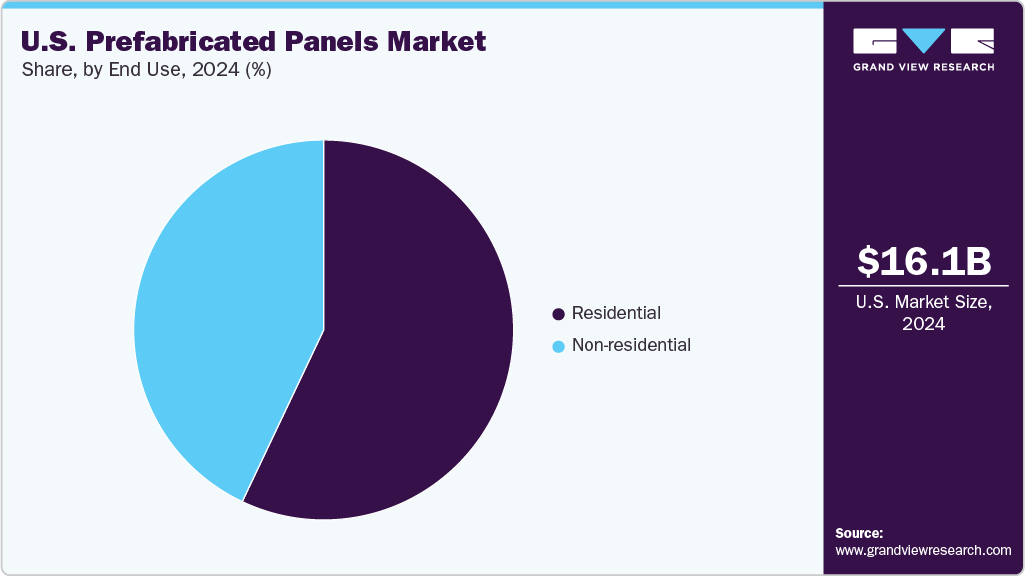

The residential segment held the largest revenue share in 2024. The segment witnessed the highest demand due to the increasing housing needs and the benefits of faster construction offered by prefabricated panels. These panels help reduce build times and lower costs, making them popular for single-family homes, multi-family units, and luxury residences. Energy efficiency and sustainability features also contributed to the surging demand for prefabricated panels in this segment, as homeowners seek greener and affordable living options.

The non-residential segment is expected to grow over the forecast period, with rising demand for panels in commercial buildings, educational facilities, healthcare centers, military installations, and telecommunications infrastructure. Prefabricated panels are preferred in these spaces owing to their quick and easy installation, cost-effectiveness, and flexibility to meet specialized requirements. Public infrastructure projects, such as schools and offices, increasingly rely on prefabricated solutions to speed up construction and manage budgets efficiently.

Key U.S. Prefabricated Panels Market Company Insights

The U.S. prefabricated panels market is intensely competitive. Some of the major companies in the market are S2A Modular, WillScot, and Panel Built, Inc. Key players in the market focus on quick installation, energy efficiency, and scalability to meet diverse construction needs while emphasizing quality, durability, and integration of advanced technology. The market is supported by a mix of manufacturers and industry associations promoting the growth of modular construction and related standards.

Key U.S. Prefabricated Panels Companies:

- Panel Built, Inc.

- S2A Modular

- WillScot

- Builders FirstSource, Inc. (BFS)

- Modular Building Institute (MBI)

- Oldcastle BuildingEnvelope

- PortaFab Corporation

Recent Developments

-

In December 2024, Panel Built acquired PAC Systems, rebranding it as Power Built. This move positions Panel Built as the only modular building provider to manufacture and integrate its own modular wiring systems, enhancing installation efficiency and safety.

-

In October 2024, Panel Built announced the provision of prefabricated buildings for disaster relief. These structures offer rapid deployment, flexibility, and durability, serving as emergency clinics, supply stations, and sanitation facilities.

-

In June 2024, Panel Built introduced "white rooms," cost-effective alternatives to traditional cleanrooms. These rooms maintain positive internal pressure to prevent contamination, catering to industries requiring controlled environments without stringent certifications.

-

In April 2023, Hapi Homes introduced a lineup of contemporary home models tailored for residential, hospitality, and disaster relief applications. The company has donated 10 fully furnished homes to the City of Odesa and the Ukrainian Red Cross, demonstrating its commitment to providing shelter in crises.

U.S. Prefabricated Panels Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 23.18 billion

Growth rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, end use

Key companies profiled

Panel Built, Inc.; S2A Modular; WillScot; Builders FirstSource, Inc. (BFS); Modular Building Institute (MBI); Oldcastle BuildingEnvelope;PortaFab Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Prefabricated Panels Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. prefabricated panels market report based on product type, and end use:

-

Product type Outlook (Revenue, USD Million, 2018 - 2030)

-

Modular

-

Panelized

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Non- Residential

-

Frequently Asked Questions About This Report

b. The global prefabricated panels market size was estimated at USD 16.06 billion in 2024 and is expected to reach USD 17.07 billion in 2025.

b. The U.S. prefabricated panels market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2030 to reach USD 23.18 billion by 2030.

b. The modular segment led the market and accounted for the largest revenue share of 50.7% in 2024, due to its ability to deliver fully integrated, ready-to-install structures with reduced construction time and labor costs.

b. Some of the key players operating in the U.S. prefabricated panels market include Kingspan Group, Tata Steel, Atco Ltd., Butler Manufacturing, Metecno Group, NCI Building Systems, Algeco, Ritz-Craft Corporation, EPACK Prefab, and Lindab Group

b. Key factors driving the U.S. prefabricated panels market include rising demand for fast and cost-efficient construction, growing urbanization, sustainability initiatives, and advancements in building technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.