U.S. Premium Bottled Water Market Summary

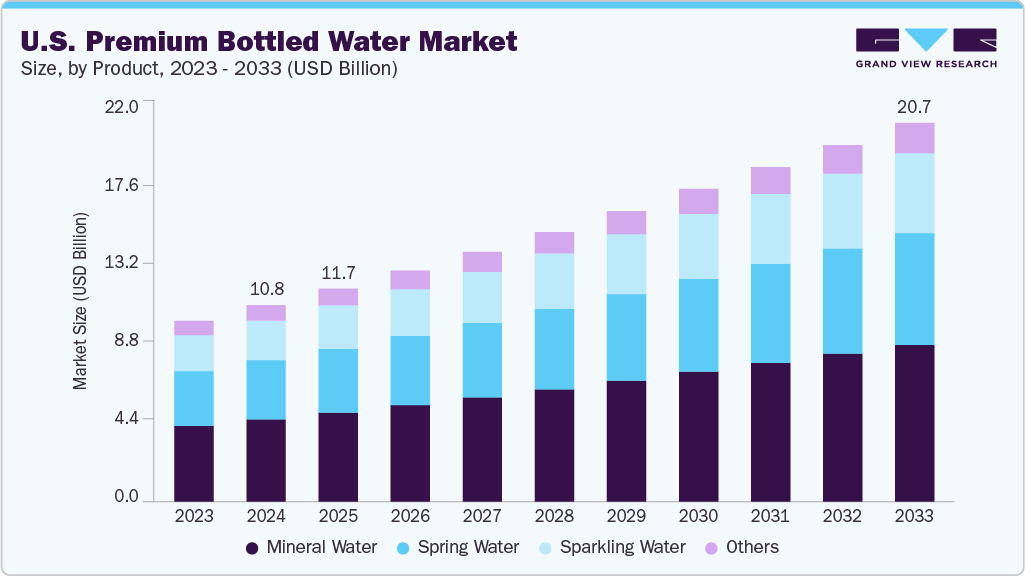

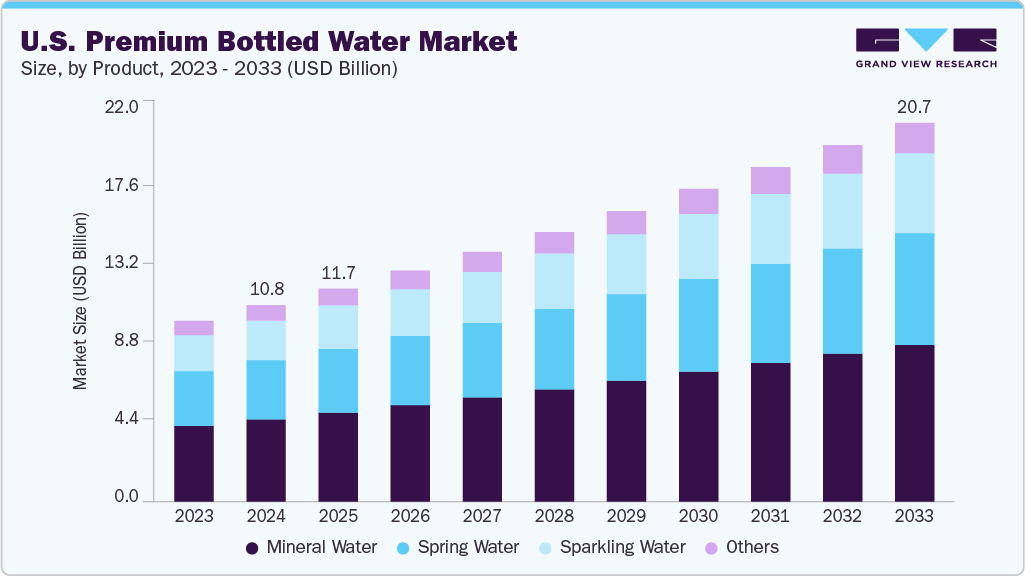

The U.S. premium bottled water market size was estimated at USD 10.76 billion in 2024 and is projected to reach USD 20.75 billion by 2033, growing at a CAGR of 7.5% from 2025 to 2033. The market growth is attributed to the growing health consciousness among Americans.

Key Market Trends & Insights

- By product, the mineral water segment held the highest market share of 41.8% in 2024.

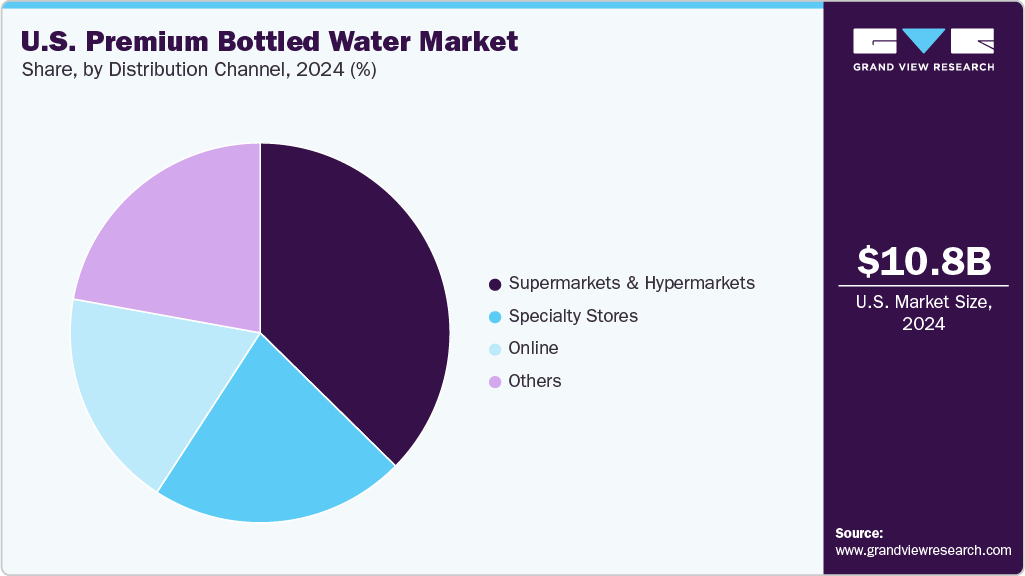

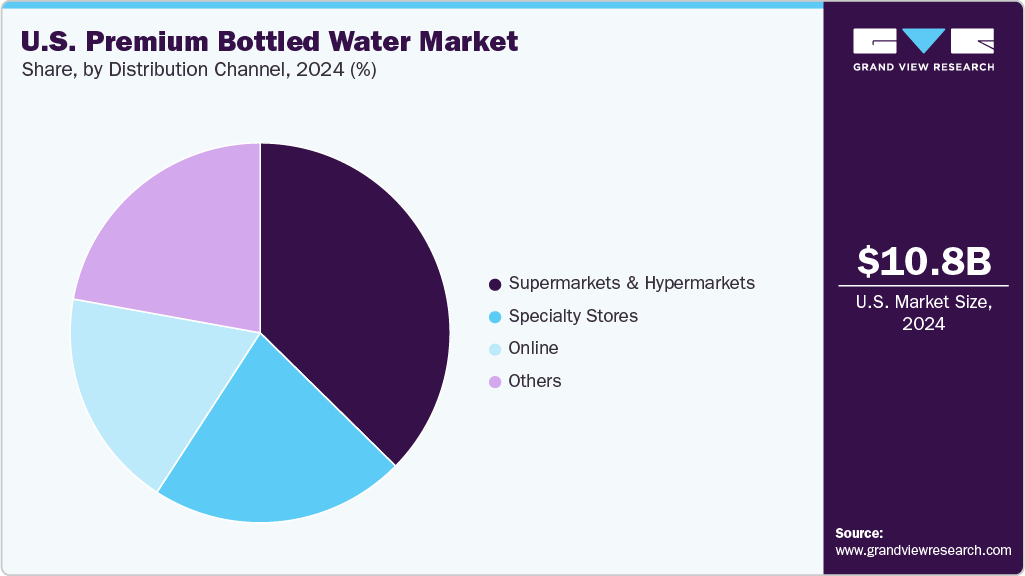

- Based on distribution channel, the supermarkets & hypermarkets segment accounted for a share of around 37.4% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.76 Billion

- 2030 Projected Market Size: USD 20.75 Billion

- CAGR (2025-2030): 7.5%

As more consumers shift away from sugary beverages, they are gravitating toward hydration options that offer perceived purity and wellness benefits. Premium bottled water brands often highlight their mineral content, alkaline pH levels, and natural sourcing, which appeals to individuals seeking functional beverages that support digestion, energy, and overall well-being.

The rise in wellness tourism and luxury consumption is also driving market growth. Premium bottled water is increasingly viewed as a lifestyle product, not just a hydration source. Upscale hotels, spas, and restaurants incorporate high-end water brands into their offerings to enhance the customer experience. This trend is reinforced by elegant packaging, especially glass bottles, which elevate the product’s image and align with the aesthetic expectations of affluent consumers.

The expansion of e-commerce and direct-to-consumer models has made premium bottled water more accessible than ever. Subscription services and online platforms allow consumers to customize their purchases and receive regular deliveries, enhancing convenience and brand loyalty. This digital shift also enables companies to gather insights into consumer behavior, refine their marketing strategies, and introduce innovative products like vitamin-infused or antioxidant-rich waters.

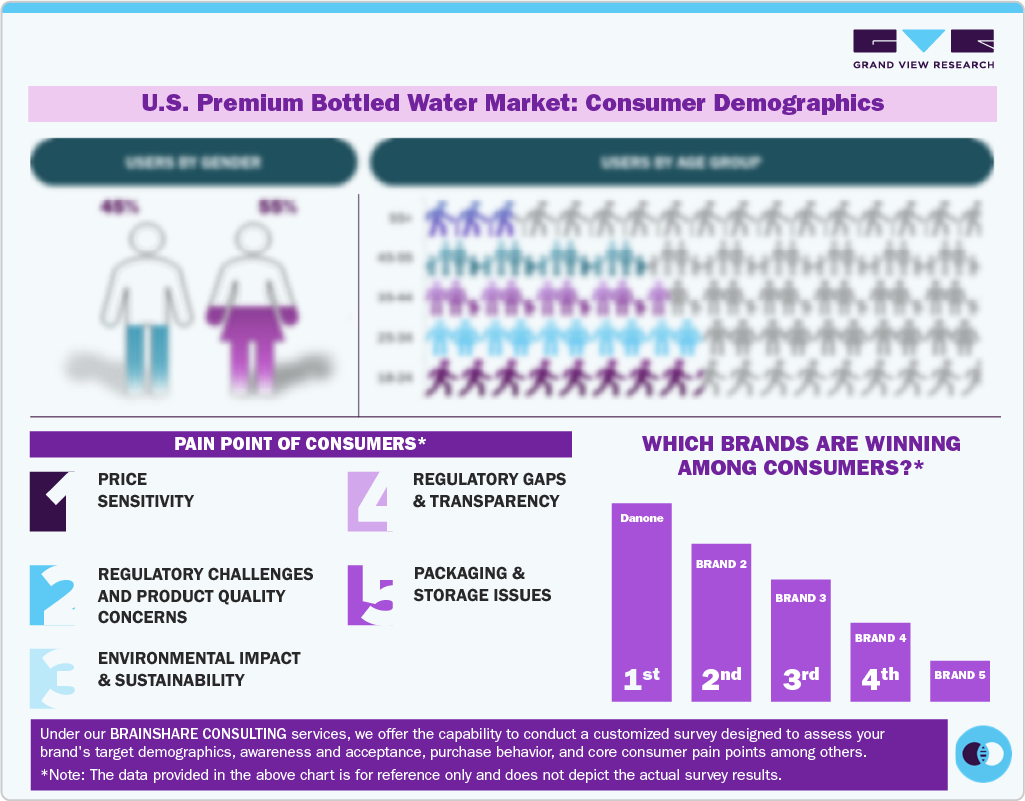

Consumer Insights

Consumption of premium bottled water in the U.S. varies across age groups due to health awareness, lifestyle preferences, and brand perception. Gen Z seeks eco-conscious, trendy brands influenced by social media. Millennials are top consumers, drawn to wellness-focused options and convenience.

Across all demographics, drivers include purity, distrust of tap systems, sustainability, and convenience-solidifying premium water’s appeal as a functional and lifestyle choice.

Product Insights

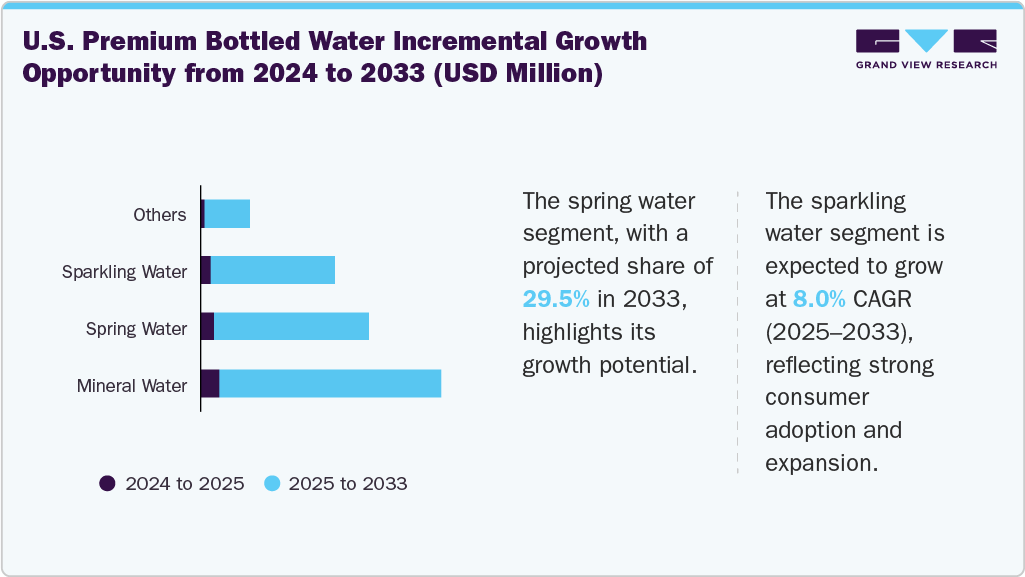

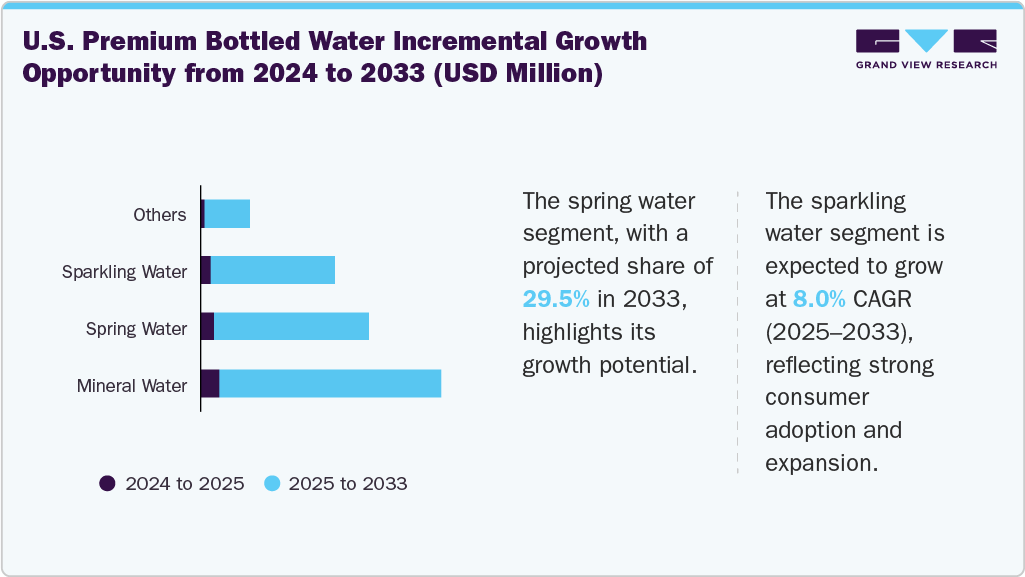

Mineral water dominated the U.S. premium bottled water market. It accounted for a revenue share of 41.8% in 2024, due to its association with natural purity, essential mineral content, and growing consumer preference for health-oriented hydration options. U.S. consumers increasingly view mineral water as a premium alternative to regular bottled water, especially as awareness around wellness and clean-label products continues to rise. Its dominance is further supported by strong retail presence, upscale branding, and demand from hospitality and travel sectors, where mineral water is often considered a luxury.

Spring water held a considerable share in 2024. Its strong association with purity, natural sourcing, and health benefits drives the segment growth. Consumers increasingly favor spring water as it’s sourced from underground aquifers and typically bottled at the source, enhancing its image as clean and mineral-rich. This perception aligns with the broader wellness movement, where buyers seek beverages that support hydration without additives or artificial ingredients. Additionally, spring water brands often emphasize transparency about their sourcing and mineral content, which resonates with health-conscious consumers.

The sparkling water segment is expected to grow at the fastest CAGR of 8.0% from 2025 to 2033. This surge is largely fueled by the growing rejection of sugary sodas in favor of calorie-free, refreshing alternatives. Sparkling water offers the same fizzy satisfaction without the guilt, making it a go-to choice for wellness-minded individuals. Flavor innovation and premium positioning also drive the segment’s momentum. Brands are introducing natural fruit infusions, botanical blends, and functional enhancements like added vitamins or probiotics. These upgrades transform sparkling water from a basic beverage into a lifestyle product catering to taste and health.

In February 2025, Mineragua launched its new 12-pack glass bottle packaging, offering a convenient and sustainable option for sparkling water consumption. Designed for home use and on-the-go hydration, the pack responded to growing consumer demand for multipack formats.

Distribution Channel Insights

The supermarkets & hypermarkets segment accounted for a share of 37.4% in 2024. This dominance is attributed to their ability to offer wide product assortments, competitive pricing, and convenient access-all under one roof. These retail giants serve as one-stop destinations where consumers can explore premium water brands, compare mineral content or packaging features, and make informed choices during routine grocery runs. Their expansive shelf space allows for strategic product placement, often featuring premium bottled water near health foods or checkout counters to encourage impulse purchases.

The online channel is expected to grow at the fastest CAGR of 9.1% from 2025 to 2033. This growth is largely driven by the rise of e-commerce platforms and subscription-based models, which offer unmatched convenience and personalization. Consumers can now explore a wide array of premium brands, compare ingredients and sourcing, and schedule recurring deliveries-all from their smartphones.

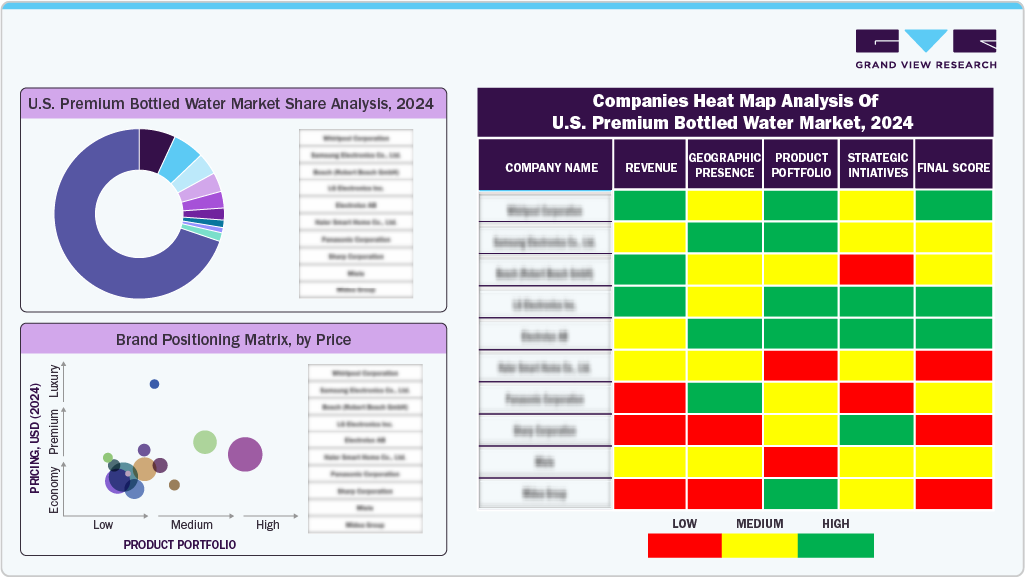

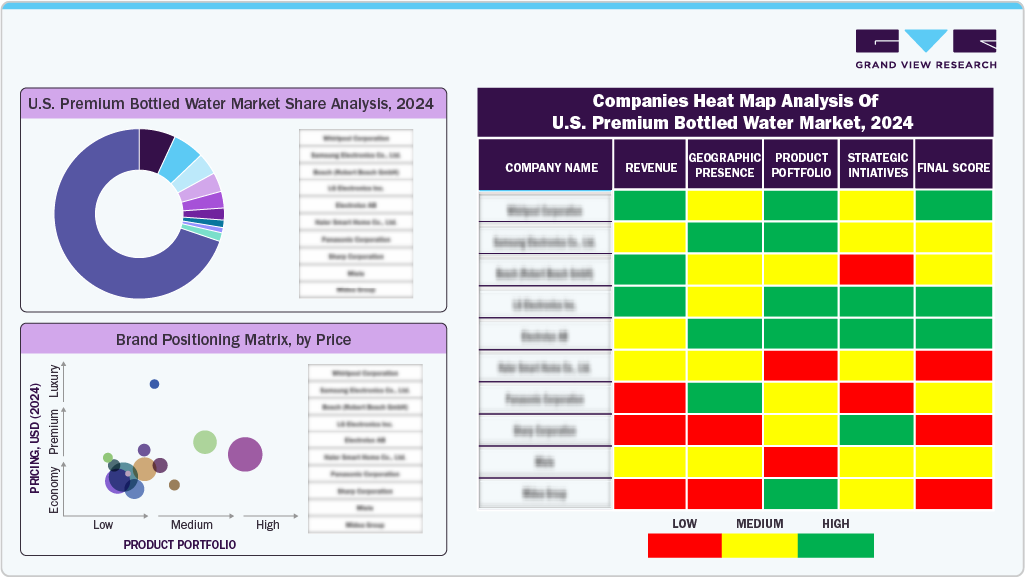

Key U.S. Premium Bottled Water Company Insights

Some of the key players in the U.S. premium bottled water market include Saratoga, Mountain Valley Spring Water, Voss of Norway AS, Beverly Hills Drink Company, and others.

Key U.S. Premium Bottled Water Companies:

- Saratoga

- Mountain Valley Spring Water

- Voss of Norway AS

- Beverly Hills Drink Company

Recent Developments

- In October 2024, Evian solidified its premium positioning in the U.S. market by entering a multi-year official partnership with the MICHELIN Guide. As the exclusive still and sparkling water served at MICHELIN award ceremonies, Evian's presence reinforces its association with fine dining and luxury experiences. The collaboration showcases Evian's glass-format sparkling offerings at high-end culinary venues, aligning the brand with excellence, refinement, and sustainability in the upscale hospitality sector.

U.S. Premium Bottled Water Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 11.67 billion

|

|

Revenue forecast in 2033

|

USD 20.75 billion

|

|

Growth rate

|

CAGR of 7.5% from 2025 to 2033

|

|

Actual data

|

2021 - 2024

|

|

Forecast period

|

2025 - 2033

|

|

Quantitative units

|

Revenue in USD million/billion, and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, trends

|

|

Segments covered

|

Product, distribution channel

|

|

Key companies profiled

|

Saratoga, Mountain Valley Spring Water

Voss of Norway AS, Beverly Hills Drink Company

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Premium Bottled Water Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. premium bottled water market report based on product, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Spring Water

-

Sparkling Water

-

Mineral Water

-

Others

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)