- Home

- »

- Communications Infrastructure

- »

-

U.S. Private LTE & 5G Network Market Size Report, 2030GVR Report cover

![U.S. Private LTE & 5G Network Market Size, Share & Trends Report]()

U.S. Private LTE & 5G Network Market (2023 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Services), By Frequency (Sub-6 GHz, mmWave), By Spectrum, By Vertical, And Segment Forecasts

- Report ID: GVR-4-68039-124-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2019 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

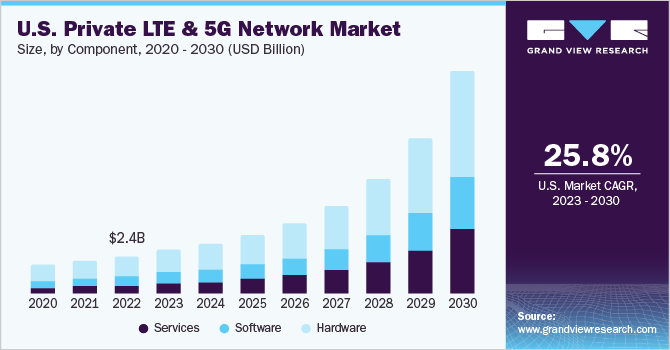

The U.S. private LTE & 5G network market size was estimated at USD 2.42 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 25.8% from 2023 to 2030. The key drivers attributed to the market expansion include the growing adoption of private LTE and 5G networks for the Internet of Things (IoT) and smart city applications. The gradual increase in IoT applications in energy, manufacturing, public safety, and transportation has driven businesses and organizations toward deploying a private network infrastructure. Additionally, the demand for private networks from use cases such as Automated Guided Vehicles (AGV), collaborative robots/ cloud robots, industrial sensors, and heavy machinery automation, among others, is driving market growth.

The growing pace of building smart cities in the U.S. have surged IoT devices' deployment for several application including transport, public safety, security, energy management, and so on. Therefore, the demand for private networks in the U.S. is expected to increase from the businesses that highly utilize the IoT ecosystem. For instance, in January 2023, Verizon launched its private 5G wireless network at The Smart Factory Wichita, an innovative Industry 4.0 experience center developed by Deloitte. The Smart Factory at Wichita would offer features such as enhanced shop floor visibility, material handling automation, reduced defects, and improved quality assurance and workplace safety. Such launches are expected to contribute to the smart cities applications thereby contributing to the market growth.

Private LTE and 5G networks have the capability to operate on three distinct frequency spectrum categories: licensed, unlicensed, and shared. In the U.S., the initial deployment of private LTE and 5G networks relied on two specific frequency spectrums. These included the utilization of the unlicensed 5 GHz spectrum, commonly referred to as MulteFire, and the 3.5 GHz spectrum within the Citizens Broadband Radio Service (CBRS) band. The CBRS bands in the U.S. cover a significant 150MHz of the shared spectrum in the C-band. In recent developments, the Federal Communications Commission (FCC) has taken steps to release additional spectrum bands dedicated to 5G, encompassing various frequency ranges such as high, mid, low, and unlicensed bands. This proactive approach from the government and regulatory authorities is expected to have a positive impact on the private 5G market in the U.S. throughout the anticipated forecast period.

The private networking infrastructure provides complete control over the network and allows customers to modify it as per their specific requirements and the priority of operations. With the introduction of Industry 4.0., the industrial players are actively focused on deploying high-speed networks to deliver uninterrupted connectivity for several industrial applications, including machine connectivity (M2M), AGV, collaborative robots, and ultra-high-speed (UHD) wireless cameras. The manufacturing, energy, and utility sectors are witnessing high adoption of the Industrial Internet of Things (IIoT), which is also an integral part of Industry 4.0 revolutions. Companies from such sectors heavily adopt private networks to provide unified and secure connectivity for these mission-critical applications.

Most unlicensed and shared spectrum bands used for private LTE connections are suitable for 5G deployment. As a result, several telecom providers are already deploying 5G network infrastructure across major metropolitan cities such as Las Vegas, Los Angeles, Miami, and New York City. The private 5G network provides enhanced data capacity and extremely low latency connectivity compared to the private LTE network. Such benefits of the 5G network allow customers to deploy standalone infrastructure for integrating multi-cloud platforms on a centralized high-speed network in the office and facility locations. The robust deployment of the IIoT, coupled with a growing need for ultra-high and secured bandwidth connectivity, is anticipated to bolster the deployment of private 5G networks during the forecast period.

Numerous automotive, manufacturing, and logistics companies are urging to set up private LTE networks in the U.S. However, the adoption from small- and medium-scale businesses is still very low. Companies in outskirts areas and low-income markets are facing challenges, such as financial budget and alternative networks' availability, in adopting private networks. Many small- and medium-sized companies in the U.S. cannot meet the massive capital investments required to build a dependable private connectivity infrastructure, which in turn is anticipated to be a challenging factor for the steady growth of the market.

COVID-19 Impact

The global economy, including the private LTE & 5G industry, experienced significant impacts from the COVID-19 pandemic, with the U.S. being particularly affected. Governments worldwide implemented stringent lockdown measures, including in major cities, to contain the virus spread. As a result, the deployment and integration of 5G infrastructure faced delays. Additionally, these restrictions led to labor shortages and disruptions in logistics and supply chains on a global scale. Consequently, the initial and second quarters of 2020 observed a slowdown in market growth due to the delayed deployment of 5G and LTE networks caused by the pandemic's effects. However, the U.S. private LTE and 5G network market is anticipated to gain momentum as the world recovers from the adversities of the pandemic.

Component Insights

The hardware segment led the market and accounted for more than 51.0% of the revenue share in 2022. This high share is attributable to the growing deployment of the Radio Access Network (RAN), backhaul, and transport equipment, and the core network for private LTE and 5G networks. The need for improved connectivity to connect a large chain of sensors at industrial premises is anticipated to boost RAN equipment adoption and installation. Furthermore, the increasing development of private 5G networks using RAN technology is expected to fuel the segment's growth. For instance, in April 2023, the Institute for the Wireless Internet of Things (WIoT) at Northeastern University, along with its Open6G R&D Center, unveiled an operational private 5G network. This advanced network is entirely automated using Artificial Intelligence (AI). It has been constructed using open-source components, offering a programmable, fully virtualized, and open-RAN-compliant system designed to serve within a campus environment.

The services segment is expected to expand at a high CAGR from 2023 to 2030 on account of the emerging need for 5G deployment and integration. This segment is categorized based on installation and integration, support, and maintenance, and data services. The installation and integration segment held the largest market share in 2022 on account of the high demand for infrastructure integration, consulting, and application integration services. The market is anticipated to flourish owing to the partnerships between cloud service providers, system integrators, equipment vendors, and application/software developers to integrate and deploy core network infrastructure and complete private virtualized RAN (vRAN/C-RAN) at the customer premises.

Frequency Insights

The sub-6 GHz segment led the market in 2022 with a revenue share of more than 96.0%. The sub-6 GHz frequency encompasses a low band and a mid-band of spectrum ranges, mainly 6 GHz and below. The increasing development of sub-6 GHz frequency-based 5G modules by several market players across the globe is attributed to the segment’s growth. In September 2022, at MWC Las Vegas, Fibocom, an IoT wireless solutions and modules provider, introduced the FX170(W) series, its latest offering in the 5G Sub-6GHz and mmWave module category. These modules are powered by Snapdragon's X65 5G Modem-RF System and are designed to provide users with a seamless and high-speed wireless connectivity experience.

The mmWave frequency segment is expected to register a high CAGR over the forecast period. mmWave frequencies are high band frequencies that provide significantly high connectivity with very low latency. These frequency bands are highly beneficial for public safety and industrial infrastructure connectivity applications that require highly reliable networks. Additionally, the FCC has released several mmWave frequencies, including 38.6 to 40.0 GHz, 24.75 to 25.25 GHz, 24.25 to 24.45 GHz, and 47.20 to 48.20 GHz, among others, for 5G use cases. Thus, the high focus on releasing mmWave frequencies for mission-critical applications is expected to boost the growth of the mmWave segment over the forecast period.

Spectrum Insights

The unlicensed/ shared spectrum segment dominated the market with a revenue share of more than 87.0% in 2022 and is expected to continue leading over the forecast period. The high revenue share is attributed to the substantial focus on releasing shared and unlicensed spectrums by FCC and MultiFire Alliance bodies for the private LTE and 5G use cases. Additionally, with the affordable costs and open access benefits, the unlicensed spectrum bandwidth is highly preferred and easily accessible during massive machine-type communications (mMTC).

The licensed spectrum for private LTE and 5G network services involves higher costs than the unlicensed/ shared spectrum. Customers need to purchase and procure a license for a particular spectrum bandwidth to deliver enhanced and secured wireless connectivity for its private use cases. Also, access to a licensed spectrum can be achieved from Communication Service Providers (CSP) and direct bidding through the federal government auctions. The demand for licensed spectrums is expected to significantly grow in industrial, government, and defense sectors that require highly secured connectivity.

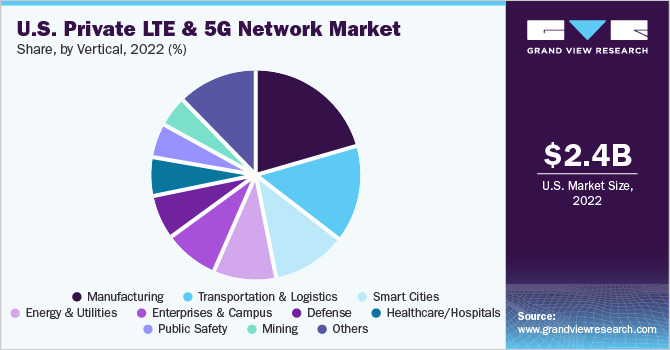

Vertical Insights

The manufacturing segment held the largest market share of around 20.0% in 2022 and is expected to continue leading over the forecast period. The high revenue share is attributable to the growing demand for private network infrastructure across various factories/manufacturing facilities in the U.S. to improve their overall productivity and operational efficiency. The deployment of private LTE and 5G networks primarily caters to the need for high-speed bandwidth for critical use cases, including AGV, UHD wireless cameras, machine-to-machine communications, collaborative/cloud robots, predictive maintenance, and process monitoring, among others. Furthermore, the AGV applications in the industries are expected to portray a remarkable demand for private LTE and 5G networks. The segment is further bifurcated into automotive, electrical, and electronics, food and beverages, pharmaceuticals, heavy machinery, and clothing and accessories.

The transportation and logistics segment is expected to experience substantial growth throughout the forecast period. This segment is further bifurcated into warehouses, vehicle-to-everything (V2X) connectivity, ports, airports, and rail. The segment’s growth can be attributed to the increasing need for enhanced and secure network connectivity to support various applications, such as autonomous forklifts, warehouse robots, and private connectivity solutions at railway stations and airports. These advancements in connectivity solutions are driving the growth of the market.

Key Companies & Market Share Insights

Market players have been consistently engaged in developing new services, upgrading their product portfolios, and implementing business expansion strategies. Additionally, they have pursued partnership and collaboration strategies to facilitate the development of private 5G networks. For instance, in February 2022, Qualcomm Technologies, Inc. and Microsoft Corporation joined forces to offer comprehensive chip-to-cloud solutions, enabling the successful implementation of private 5G networks.

In addition, key industry players are strategically forming partnerships with industrial manufacturers which is anticipated to drive the market’s growth over the forecast period. For instance, in February 2023, Deutsche Telekom AG, a telecommunications company announced a collaboration with Microsoft Corporation for 5G campus networks, a private 5G network. Such initiatives are expected to fuel the industry’s growth. Some prominent players in the U.S. private LTE & 5G network market include:

-

AT&T Inc.

-

Broadcom Inc.

-

Cisco Systems, Inc.

-

Nokia Corporation

-

Qualcomm Technologies, Inc.

-

Samsung Electronics Co., Ltd.

-

Telefonaktiebolaget LM Ericsson

-

T-Systems International GmbH

-

Verizon Communications Inc.

-

Vodafone Group Plc

U.S. Private LTE & 5G Network Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 14.13 billion

Growth rate

CAGR of 25.8% from 2023 to 2030

Base year for estimation

2022

Historic Period

2019 - 2021

Forecast Period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, frequency, spectrum, vertical

Country scope

U.S.

Key companies profiled

AT&T Inc.; Broadcom Inc.; Cisco Systems, Inc.; Nokia Corporation; Qualcomm Technologies, Inc.; Samsung Electronics Co., Ltd.; Telefonaktiebolaget LM Ericsson; T-Systems International GmbH; Verizon Communications Inc.; Vodafone Group Plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Private LTE & 5G Network Market Report Segmentation

This report forecasts revenue growth at country levels and analyzes the industry trends in each sub-segment from 2019 to 2030. For this study, Grand View Research has segmented the U.S. private LTE & 5G network market report based on component, frequency, spectrum, and vertical:

-

Component Outlook (Revenue, USD Million, 2019 - 2030)

-

Hardware

-

Radio Access Network (RAN)

-

Core Network

-

Backhaul & Transport

-

-

Software

-

Services

-

Installation & Integration

-

Data Services

-

Support & Maintenance

-

-

-

Frequency Outlook (Revenue, USD Million, 2019 - 2030)

-

Sub-6 GHz

-

mmWave

-

-

Spectrum Outlook (Revenue, USD Million, 2019 - 2030)

-

Licensed

-

Unlicensed/Shared

-

-

Vertical Outlook (Revenue, USD Million, 2019 - 2030)

-

Manufacturing

-

Automotive

-

Electrical & Electronics

-

Food & Beverages

-

Pharmaceuticals

-

Heavy Machinery

-

Clothing & Accessories

-

Others (Medical Devices and Consumer Goods)

-

-

Transportation & Logistics

-

Warehouses

-

Vehicle to Everything (V2X) Connectivity

-

Ports

-

Airports

-

Rail

-

-

Energy & Utilities

-

Defense

-

Public Safety

-

Enterprises & Campus

-

Public Venues

-

Mining

-

Healthcare/Hospitals

-

Oil & Gas

-

Retail

-

Agriculture

-

Smart Cities

-

Others (Construction Sites and Real Estate)

-

Frequently Asked Questions About This Report

b. The U.S. private LTE & 5G network market size was estimated at USD 2.42 billion in 2022 and is expected to reach USD 2,833.3 million in 2023.

b. The U.S. private LTE & 5G network market is expected to grow at a compound annual growth rate of 25.8% from 2023 to 2030 to reach USD 14.13 billion by 2030.

b. The hardware segment dominated the component segment in 2022. Increasing deployment of the core network, Radio Access Network (RAN), backhaul, and transport equipment for private 5G networks across various verticals, including enterprises, manufacturing, energy & utilities, smart cities, and others are driving the growth of the segment.

b. Some key players operating in the U.S. private LTE & 5G network market include AT&T Inc., Broadcom Inc., Cisco Systems, Inc., Nokia Corporation, Qualcomm Technologies, Inc., Samsung Electronics Co., Ltd., Telefonaktiebolaget LM Ericsson, T-Systems International GmbH, Verizon Communications Inc., Vodafone Group Plc.

b. The key drivers attributed to the market expansion include the growing adoption of private LTE and 5G networks for the Internet of Things (IoT) and smart city applications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.