- Home

- »

- Consumer F&B

- »

-

U.S. Saccharin Market Size & Share, Industry Report, 2033GVR Report cover

![U.S. Saccharin Market Size, Share & Trends Report]()

U.S. Saccharin Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Sodium Saccharin, Calcium Saccharin, Insoluble Saccharin), By Application (Pharmaceuticals, Tabletop Sweetener), By Distribution Channel (Offline, Online), And Segment Forecasts

- Report ID: GVR-4-68040-756-5

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Saccharin Market Summary

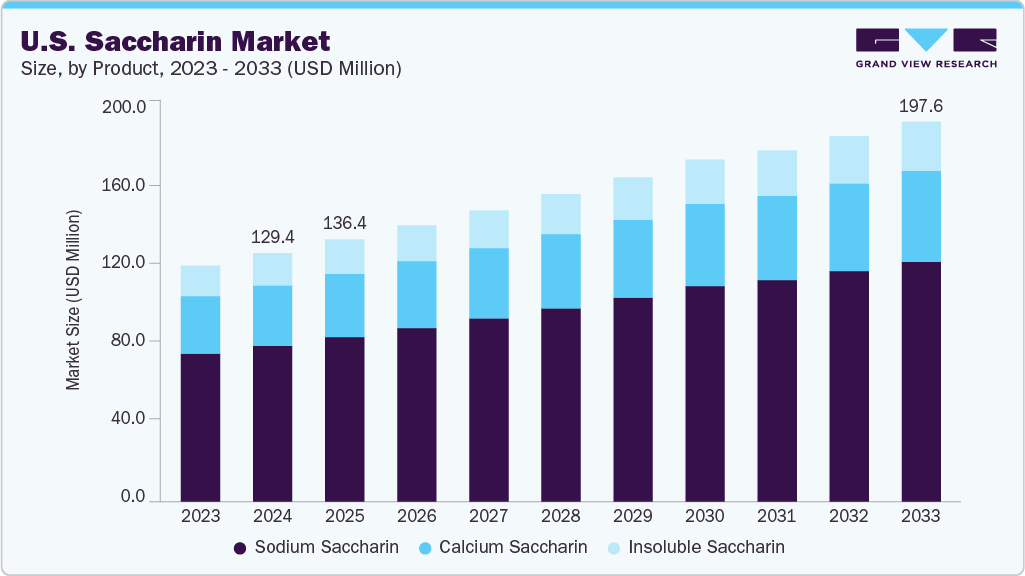

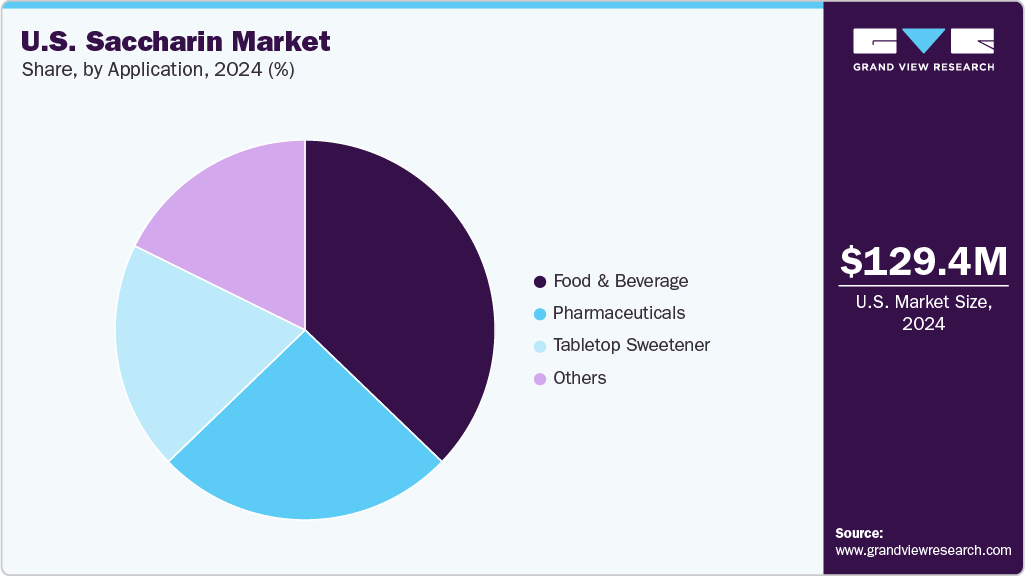

The U.S. saccharin market size was estimated at USD 129.4 million in 2024 and is projected to reach USD 197.6 million by 2033, growing at a CAGR of 4.7% from 2025 to 2033. The growth of the U.S. saccharin industry is primarily driven by increasing health consciousness and a growing preference for low-calorie sweeteners among Americans.

As consumers become more aware of the health risks associated with excessive sugar consumption, including obesity and diabetes, there is a notable shift toward alternatives like saccharin, which offers sweetness without added calories. This shift is especially pronounced among younger generations, such as Gen Z and millennials, who increasingly seek “better-for-you” food and beverage products.

Another key growth factor is the rising prevalence of lifestyle-related diseases, notably diabetes and obesity, in the U.S. With over 37 million Americans managing diabetes as of 2024, there is substantial and sustained demand for sugar substitutes in pharmaceuticals, dietary supplements, and processed foods. The medical and health sector's consistent utilization of saccharin to formulate sugar-free products such as cough syrups, chewable tablets, and various medications further supports market growth.

The dynamic expansion of the food and beverage industry has created new application avenues for saccharin. It is widely used in diet sodas, sugar-free baked goods, confections, jams, and drinks produced by major food manufacturers. The ingredient’s intense sweetness, stability in diverse processing conditions (heat, acids), and cost-effectiveness make it attractive for producers aiming to reduce sugar content without sacrificing product taste.

Supportive regulatory conditions have played a significant role in reinforcing the market's growth trajectory. Continuous approval from the U.S. Food and Drug Administration (FDA) ensures consumer confidence and encourages manufacturers to utilize saccharin in a wide array of products. The robust regulatory environment, combined with routine safety assessments, has contributed to saccharin’s acceptance across food, beverage, pharmaceutical, and personal care categories.

Changing consumer dietary habits, including the increased popularity of packaged and convenience foods, have also accelerated market expansion. Many of these products previously relied heavily on sugar but are now reformulated with saccharin to cater to health-conscious consumers. This trend extends to personal care and oral hygiene products, expanding saccharin’s market base beyond food alone.

Digitalization in retail and marketing, including the rapid growth of online sales channels, has made saccharin-containing products more accessible to consumers across the U.S. Online platforms facilitate the promotion and distribution of sugar-free and diet products, broadening consumer reach and driving sustained demand. With these combined factors, the U.S. saccharin industry is poised for continued robust growth in the years ahead.

The U.S. saccharin industry faces several significant challenges, primarily revolving around lingering health concerns and negative public perception. Despite regulatory approvals confirming saccharin’s safety for human consumption at approved levels, historical studies linking saccharin to cancer in laboratory animals still influence consumer skepticism and occasionally foster regulatory scrutiny. Such controversies have led consumers, especially those favoring clean-label and “natural” products, to avoid artificial sweeteners like saccharin in favor of alternatives perceived as safer.

Intense competition from natural and plant-based sweeteners is a major restraint for the market. Stevia, monk fruit, and even newer non-nutritive sweeteners are increasingly preferred by health-conscious consumers and food manufacturers aiming for “natural ingredients” labelling. This trend is reinforced by the growing influence of the clean-label movement, causing a market shift away from traditional artificial sweeteners and reducing overall demand for saccharin in certain segments.

Product Insights

The sodium saccharin segment led the market with the largest revenue share of 62.70% in 2024. The growth of sodium saccharin in the U.S. is driven by its versatile functionality, cost-effectiveness, and favorable regulatory status, and increased consumer demand for low-calorie, sugar-free products, especially in beverages, diet foods, and medications, fuels market expansion. The convenience of its rapid solubility, stability under heat and acidic conditions, and intense sweetness ensures that it meets the technical requirements for mass-market products, further catalyzing widespread adoption across processed foods, drinks, and pharmaceuticals.

In addition, the rising prevalence of diabetes, obesity, and lifestyle-related diseases in the U.S. bolsters demand for sugar substitutes, with sodium saccharin remaining a preferred ingredient owing to its long safety track record and broad regulatory approval. Manufacturers continue to select sodium saccharin for its predictable performance, scalability in formulations, and affordability compared to newer sweetener options, supporting steady growth across the consumer packaged goods and healthcare industries.

The calcium saccharin segment is expected to grow at the fastest CAGR of 4.6% from 2025 to 2033. Calcium saccharin’s growth is linked to its suitability for products targeting consumers with sodium restrictions or those seeking low-sodium diets. As public health initiatives and consumer awareness about sodium reduction continue to rise, particularly among individuals managing hypertension, cardiovascular disease, or on physician-recommended sodium-restricted diets, food and beverage producers increasingly turn to calcium saccharin as an alternative sweetener. Its adoption is further encouraged in pharmaceutical and personal care products, where minimal sodium content is critical.

The expansion of the calcium saccharin market is also facilitated by its stable and neutral flavor profile in formulations that could be sensitive to sodium-induced flavors or aftertastes. Manufacturers value its compatibility with diverse product categories, from oral hygiene products to “sodium-free” tabletop sweeteners. With growing segments of the U.S. population seeking sodium-free alternatives, especially in health-centric and specialty food markets, calcium saccharin’s role continues to strengthen.

Application Insights

The food and beverage segment led the market with the largest revenue share of 37.2% in 2024. The primary reason for growth in the food and beverage application of saccharin is the substantial consumer shift toward healthier, low-calorie, and sugar-free options. With rising awareness about the adverse health effects of excessive sugar intake, especially the linkage to diabetes and obesity, both manufacturers and consumers are increasingly turning to artificial sweeteners like saccharin as alternatives to traditional sugar. Saccharin's key advantages for food and beverage producers include its intense sweetness at very low concentrations, zero-calorie profile, stability under heat and acidic conditions, and competitive cost compared to other sweeteners, all making it invaluable for use in diet sodas, sugar-free baked goods, jams, confections, yogurts, and sauces.

Changes in government policies and regulatory frameworks, such as FDA approval and regulatory support for low-calorie sweeteners, have further catalyzed its adoption in this sector. The dynamic expansion of processed foods and beverages, rising urbanization, higher disposable incomes, and evolving consumer dietary preferences in the U.S. all support continuous growth in saccharin’s use. The ongoing trend of food manufacturers reformulating products to reduce sugar content-driven by public health recommendations and consumer pressure, ensures that saccharin remains a popular sugar substitute in both legacy and new product development across the growing food and beverage landscape.

The pharmaceutical application of saccharin is primarily in masking the bitter or unpleasant taste of oral medications, syrups, chewable tablets, and vitamins, thereby improving patient compliance, especially in pediatric and geriatric populations. Saccharin is highly valued as a pharmacologically inactive excipient: its powerful sweetening ability (being several hundred times sweeter than sugar) allows minute quantities to impart pleasant flavors without adding calories or interfering with the drug's therapeutic action. This makes it an ideal ingredient not just for taste masking, but also for use in specialized medicine formulations such as dissolvable, effervescent, and orally disintegrating tablets.

Rising chronic diseases and medication use in the U.S. generate greater demand for palatable oral medicines, while aging populations and pediatric care require taste-masked formulations to maintain medication adherence. Innovations in drug delivery, expansion of chewable and flavored medication markets, and strict regulatory demands for palatable excipients further accelerate this trend. In addition, the relatively low cost and established safety of saccharin, combined with its versatile use in both human and veterinary pharmaceuticals, drive sustained growth and make this segment the most dynamic within the saccharin industry.

Distribution Channel Insights

The offline segment led the market with the largest revenue share of 77% in 2024. The growth is driven by sustained consumer preference for physical retail experiences where trust, product verification, and immediate availability are prioritized. Traditional retail outlets such as supermarkets, pharmacies, specialty stores, and wholesalers have well-established supply chains and long-standing relationships with manufacturers and end consumers, facilitating consistent product accessibility. Many food and pharmaceutical manufacturers also prefer offline channels to ensure large volume orders and reliable, regulated storage and handling conditions, which are critical for saccharin products used in sensitive manufacturing processes.

Moreover, the demographic segments that still rely heavily on in-person shopping, such as older consumers and institutional buyers, bolster offline channel growth. In addition, offline retail supports impulse purchases, bulk buying, and direct engagement for new product launches through in-store marketing and promotions. The offline channel also caters to regions with limited internet penetration or logistical challenges, making online delivery less feasible. These factors collectively sustain and expand the growth, despite the increasing penetration of online retail.

The online distribution segment is anticipated to grow at the fastest CAGR of 5.1% from 2025 to 2033, due to several converging factors that align with evolving consumer behavior and digital transformation in retail. Increasing internet penetration and smartphone usage have empowered consumers to browse, compare conveniently, and purchase products from home, driving higher online sales volumes. Online platforms also offer a wider variety of products, including niche and specialty saccharin products tailored to specific dietary needs, which are often not available in offline stores. Enhanced digital marketing, personalized promotions, and customer reviews further boost consumer confidence and purchasing frequency online.

The COVID-19 pandemic accelerated a shift toward e-commerce by emphasizing contactless shopping, home delivery, and subscription models. Manufacturers and distributors have invested heavily in digital supply chain integration and online marketplaces to expand geographical reach and reduce distribution costs. B2B buyers also leverage online procurement platforms for efficiency and real-time inventory management. These dynamics, combined with growing consumer preference for health-conscious and sugar-free products that can be researched online before purchase, underpin the rapid expansion of saccharin’s online distribution segment.

Key U.S. Saccharin Company Insights

The competitive landscape of the U.S. saccharin industry is marked by a mix of multinational corporations, regional manufacturers, and specialized producers competing to capture market share across food, beverage, pharmaceutical, and personal care sectors. Leading companies include PMC Specialties Group, Cumberland Farms, Merck KGaA, and Sigma-Aldrich, which leverage strong R&D capabilities, regulatory compliance, and integrated supply chains to maintain competitive advantages. These players focus on product innovation, cost efficiency, and expanding application areas, such as low-calorie foods and pharmaceuticals, to cater to the rising consumer health consciousness and sugar reduction trends.

Key U.S. Saccharin Companies:

- NS Chemicals

- PMC Specialties Group

- Joshi Agrochem Pharma Pvt Ltd

- JMC Corporation

- Sarin Industries

- HENAN KAIFENG PINGMEI SHENMA XINGHUA FINE CHEMICAL CO., LTD.

- Radiant International

- FUJIFILM Wako Pure Chemical Corporation

- Anhui Sinotech Industrial Co., Ltd.

- Hangzhou Focus Corporation

- Cumberland Farms

- Sigma-Aldrich

- Superior Supplement Manufacturing

- Jedwards International

- Merck KGaA

U.S. Saccharin Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 136.4 million

Revenue forecast in 2030

USD 197.6 million

Growth rate

CAGR of 4.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel

Country scope

U.S

Key companies profiled

NS Chemicals; PMC Specialties Group; Joshi Agrochem Pharma Pvt Ltd; JMC Corporation; Sarin Industries; HENAN KAIFENG PINGMEI SHENMA XINGHUA FINE CHEMICAL CO., LTD.; Radiant International; FUJIFILM Wako Pure Chemical Corporation; Anhui Sinotech Industrial Co., Ltd.; Hangzhou Focus Corporation; Cumberland Farms; Sigma-Aldrich; Superior Supplement Manufacturing; Jedwards International; Merck KGaA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Saccharin Market Report Segmentation

This report forecasts revenue growth country-wide and analyzes the latest industry trends and opportunities in each sub-segment from 2021 to 2033. Grand View Research has segmented the U.S. saccharin market report based on the product, application, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Sodium Saccharin

-

Calcium Saccharin

-

Insoluble Saccharin

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Online

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Food & Beverage

-

Pharmaceuticals

-

Tabletop Sweetener

-

Others

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.