- Home

- »

- Next Generation Technologies

- »

-

U.S. Smart Meter Market Size, Share, Industry Report, 2033GVR Report cover

![U.S. Smart Meter Market Size, Share & Trends Report]()

U.S. Smart Meter Market (2025 - 2033) Size, Share & Trends Analysis Report By Component (Hardware, Software), By Type (Smart Electric Meter, Smart Water Meter), By Technology, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-635-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Smart Meter Market Size & Trends

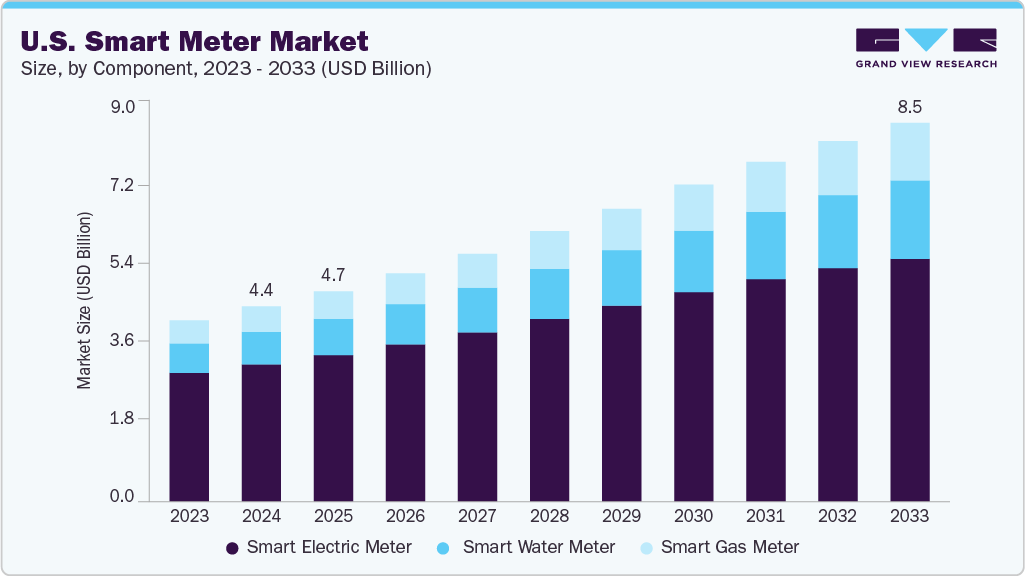

The U.S. smart meter market size was estimated at USD 4.37 billion in 2024 and is projected to reach USD 8.50 billion by 2033, growing at a CAGR of 7.6% from 2025 to 2033. The market growth is primarily driven by the increasing adoption of renewable energy sources and the global push for energy efficiency and decarbonization. Utilities are deploying smart meters to better integrate solar, wind, and other renewables into the grid, reducing non-technical losses and improving overall grid resilience. This transition supports government mandates and sustainability goals worldwide as well as innovation in smart metering technologies, which is further fueling the expansion of the smart meter industry.

Advanced metering infrastructure (AMI) systems are a gaining trend in the smart meter industry, offering two-way communication between utilities and consumers. AMI enables real-time data collection, dynamic load management, and enhanced analytics, empowering utilities to optimize grid operations and consumers to manage their energy use more effectively. The expansion of AMI is closely linked with IoT and AI integration, which enhances data processing, predictive maintenance, and demand response capabilities.

Additionally, cybersecurity and data privacy have emerged as critical drivers in the smart meter industry, prompting the implementation of robust security measures to protect sensitive consumer data and grid infrastructure. As smart meters become more interconnected through IoT platforms, utilities and manufacturers are investing in secure communication protocols and advanced software solutions to mitigate cyber risks, ensuring trust and regulatory compliance, and thereby driving market growth.

Furthermore, consumer-centric software platforms and analytics tools transform the smart meter industry by enabling real-time monitoring, detailed consumption insights, and personalized energy management. These software advancements facilitate better customer engagement, support demand response programs, and help utilities optimize grid performance. Integration with cloud computing and AI further enhances the value of smart metering systems by providing actionable intelligence for both consumers and utilities.

Moreover, key companies are adopting innovative strategies to integrate advanced technologies such as IoT, artificial intelligence, and edge computing to enhance data accuracy, grid-edge capabilities, and real-time analytics. They are expanding their advanced metering infrastructure (AMI) offerings to improve predictive maintenance, support electric vehicle integration, and enable comprehensive energy monitoring and optimization. Such strategies by key companies are expected to drive the market growth in the coming years.

Component Insights

The hardware segment dominated the market with a share of over 76% in 2024, driven by continuous innovations to enhance accuracy, durability, and communication capabilities. Key advancements include integration with IoT devices, multi-utility support for electricity, gas, and water, and improved display functionalities. Moreover, the increasing demand for secure, tamper-resistant meters that meet stringent and evolving regulatory standards is accelerating growth in this segment.

The software segment is expected to witness the fastest CAGR of over 13% from 2025 to 2033, fueled by the growing emphasis on data analytics, real-time monitoring, and predictive maintenance. Advanced software platforms empower utilities to analyze consumption trends, identify anomalies, and optimize grid operations. Integrating cloud computing and artificial intelligence enhances decision-making processes, while intuitive user interfaces boost customer engagement and energy management, collectively driving robust growth in the software segment.

Type Insights

The smart electric meter segment dominated the market in 2024, propelled by strong government initiatives for energy efficiency, grid modernization, and decarbonization efforts. These meters facilitate two-way communication, enable accurate billing, and support remote monitoring, which is essential for integrating renewable energy sources and minimizing non-technical losses. The widespread adoption is further encouraged by regulatory mandates and technological advancements such as IoT integration and edge computing, helping utilities enhance grid reliability and consumer energy management.

The smart water meters segment is expected to witness the fastest CAGR from 2025 to 2033, driven by increasing concerns over water conservation and leak detection. These meters provide real-time usage data to utilities and consumers, promoting efficient water management and accurate billing. Integrating IoT and advanced data analytics enables early anomaly detection and optimized resource distribution, aligning with the U.S. sustainability goals and regulatory pressures to reduce water waste.

Technology Insights

The AMR (Automated Meter Reading) segment accounted for the largest market share in 2024, due to its ability to automate data collection, significantly reducing the costs and errors associated with manual meter readings. AMR systems provide utilities with timely and accurate consumption data, enhancing billing precision and operational efficiency.

The AMI (Advanced Metering Infrastructure) segment is expected to witness the fastest CAGR from 2025 to 2033, driven by its capability to enable real-time, two-way communication between utilities and consumers. AMI supports dynamic load management, integration with renewable energy sources, and demand response programs, all of which are critical for modernizing the grid and advancing sustainability initiatives. These features position AMI as a cornerstone technology for smart grid development and are expected to fuel strong growth in this segment.

End Use Insights

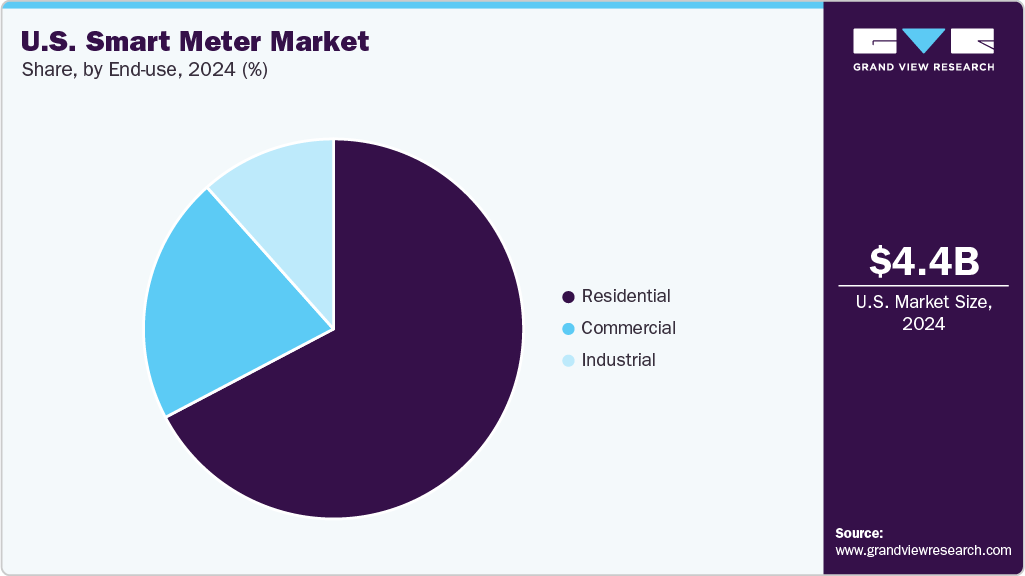

The residential segment accounted for the largest market share in 2024, driven by increasing consumer demand for energy efficiency, cost savings, and real-time energy usage feedback. Regulatory mandates and government incentives promote widespread adoption, while technological advancements such as IoT integration and advanced communication technologies enhance functionality. Consumers benefit from dynamic pricing and demand response programs, which encourage responsible energy consumption and support smart home development.

The industrial segment is expected to witness the fastest CAGR from 2025 to 2033. In the industrial segment, smart meters are adopted to improve operational efficiency, reduce energy costs, and ensure compliance with environmental regulations. Integration with advanced analytics and IoT platforms enables real-time monitoring, predictive maintenance, and optimized energy management. The growing focus on sustainability and renewable energy integration further drives smart meter deployment in industrial facilities.

Key U.S. Smart Meter Company Insights

Some of the key players operating in the market are Siemens AG and Honeywell International, Inc., among others.

-

Siemens AG is a key player in the U.S. smart meter market, driving growth through its advanced metering infrastructure and integration of IoT and AI technologies. The company provides smart meters with grid-edge capabilities that support renewable energy integration, electric vehicle charging management, and predictive maintenance. Siemens’ smart meter solutions contribute to energy efficiency, grid modernization, and enhanced consumer energy management.

-

Honeywell International Inc. is a prominent player in the smart meter market, offering comprehensive solutions that enable two-way communication between utilities and consumers for real-time data collection, accurate billing, and remote monitoring. Honeywell integrates IoT and AI technologies into its smart metering systems to enhance grid resilience, energy optimization, and customer engagement. The company’s smart meters support the transition to renewable energy sources and the digitalization of energy infrastructure.

Landis+Gyr Limited and Wasion Holdings Limited are some of the emerging market participants in the smart meter market.

-

Badger Meter Inc. is a growing player in the U.S. smart meter market, particularly known for its innovative water metering solutions. The company focuses on smart water meters with advanced data analytics capabilities, enabling utilities and consumers to monitor water usage accurately and optimize resource management. Badger Meter is gaining traction due to increasing demand for water conservation and smart infrastructure modernization in the U.S.

-

Mueller Systems LLC is an emerging company specializing in smart water metering technologies. It offers smart meters and related communication systems that provide real-time data and analytics to utilities and end-users. Mueller Systems is expanding its market presence by addressing the growing need for efficient water management solutions amid rising regulatory and environmental pressures in the U.S. smart meter market.

Key U.S. Smart Meter Companies:

- ABB Group

- Badger Meter Inc.

- Diehl Metering U.S.

- Elster Group GmbH (Honeywell International Inc.)

- General Electric Company

- Honeywell International Inc.

- Itron Inc.

- Kamstrup A/S

- Landis+Gyr Group AG

- Mueller Systems LLC

- Neptune Technology Group Inc.

- Sensus USA Inc. (Xylem Inc.)

- Siemens AG

Recent Developments

-

In May 2025, ABB Group signed a supply frame agreement with RMG, a German manufacturer specializing in ultrasonic gas meters, to provide high-precision gas measurement solutions for the U.S. energy market. This partnership strengthens ABB’s instrumentation portfolio for custody transfer and midstream applications, enhancing its offering for oil and gas customers in the U.S. with advanced ultrasonic gas meters.

-

In October 2024, Diehl Metering significantly boosted production of its HYDRUS 2.0 ultrasonic smart water meter for the U.S. market to address critical local challenges such as water scarcity, rising maintenance costs, and Non-Revenue Water.

-

In December 2023, Xylem, Inc., which includes Sensus USA Inc., introduced the Stratus IQ+ meter equipped with grid-edge capabilities designed for the U.S. market. This smart meter uses edge computing algorithms to detect electric vehicle (EV) charging. It provides utilities with advanced data analytics for better capacity planning and off-peak program management, addressing growing EV integration challenges.

U.S. Smart Meter Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.72 billion

Revenue forecast in 2033

USD 8.50 billion

Growth rate

CAGR of 7.6% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD Million/Billion and CAGR from 2025 to 2033

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, type, technology, end use

Country scope

U.S.

Key companies profiled

ABB Group; Badger Meter Inc.; Diehl Metering U.S.; Elster Group GmbH (Honeywell International Inc.); General Electric Company; Honeywell International Inc.; Itron Inc.; Kamstrup A/S; Landis+Gyr Group AG; Mueller Systems LLC; Neptune Technology Group Inc.; Sensus USA Inc. (Xylem Inc.); Siemens AG.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet you exact research needs. Explore purchase options

U.S. Smart Meter Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest technological trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. smart meter report based on component, technology, type, and end use:

-

U.S. Smart Meter Component (Revenue, USD Billion, 2021 - 2033)

-

Hardware

-

Software

-

-

U.S. Smart Meter Type (Revenue, USD Billion, 2021 - 2033)

-

Smart Electric Meter

-

Smart Water Meter

-

Smart Gas Meter

-

-

U.S. Smart Meter Technology Outlook (Revenue, USD Billion, 2021 - 2033)

-

Automatic Meter Reading (AMR)

-

Advanced Meter Infrastructure (AMI)

-

-

U.S. Smart Meter End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

Residential

-

Commercial

-

Industrial

-

Frequently Asked Questions About This Report

b. The U.S. smart meter market size was estimated at USD 4.37 billion in 2024 and is expected to reach USD 4.72 billion in 2025.

b. The U.S. smart meter market is expected to grow at a compound annual growth rate of 7.6% from 2025 to 2033 to reach USD 8.50 billion by 2033.

b. The hardware segment dominated the market with a market share of over 76% in 2024, driven by continuous innovations aimed at enhancing accuracy, durability, and communication capabilities.

b. Some of the key players in the U.S. smart meter market include ABB Group, Badger Meter Inc., Diehl Metering U.S., Elster Group GmbH (Honeywell International Inc.), General Electric Company, Honeywell International Inc., Itron Inc., Kamstrup A/S, Landis+Gyr Group AG, Mueller Systems LLC, Neptune Technology Group Inc., Sensus USA Inc. (Xylem Inc.), and Siemens AG.

b. Key factors driving the U.S. smart meter market include the growing adoption of renewable energy and electric vehicles, growing demand for smart meters equipped with advanced analytics and grid-edge capabilities, and the growing advancements in technologies such as AI, machine learning, blockchain, and edge computing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.