- Home

- »

- Next Generation Technologies

- »

-

U.S. Smart Pole Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Smart Pole Market Size, Share & Trends Report]()

U.S. Smart Pole Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Service), By Hardware, By Installation Type, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-246-3

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Smart Pole Market Size & Trends

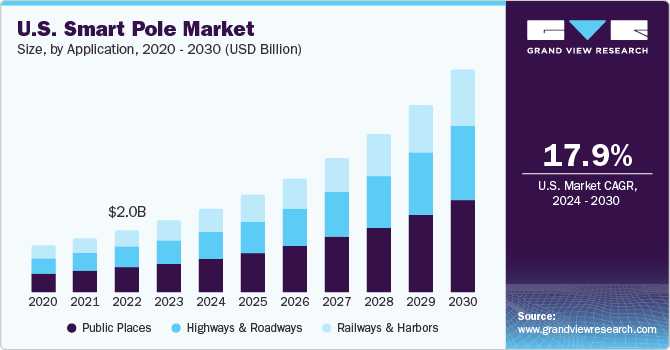

The U.S. smart pole market size was valued at USD 2.35 billion in 2023 and is anticipated to grow at a CAGR of 17.9% from 2024 to 2030. The rapid proliferation of IoT technology indicates a significant demand for wireless sensor networks to improve city infrastructure in the country. The issues of traffic jams and accidents, along with the need to introduce sustainability and energy efficiency in city lighting systems, has created significant market opportunities for smart pole manufacturers. These solutions offer features such as traffic guidance, traffic monitoring, parking guidance, and vehicle monitoring, leading to effective traffic management.

The U.S. accounted for a revenue share of 22.27% in the global smart pole market in 2023. Policymakers in the country have understood current challenges in smart city development and the implementation of scalable and effective offerings, with smart poles considered crucial in revitalizing the Intelligent Transportation Systems (ITS) space. Several notable companies are getting involved, including Nokia and Verizon, to provide the required hardware and software to lighting manufacturers. Over the past few years, cities such as San Jose and Los Angeles have been the beneficiaries of smart pole systems because of such collaborations. Another example is ClearWorld teaming up with Nokia in March 2021, wherein the latter would sell smart poles by ClearWorld to cities and military bases in the United States.

In recent years, there has been a greater awareness regarding the contribution of smart poles in lowering energy consumption as well as emissions, which has propelled market expansion. According to Signify, switching from conventional lighting systems to energy-efficient LEDs leads to a reduction of 50% in energy consumption. However, these savings can reach up to 90% when integrating these lights with presence detection and automatic dimming, making smart poles an appealing option for authorities. They can further offer feedback regarding the operations of the LED panel illuminating an area in real time. Additionally, recent advancements have made it possible to monitor air quality and weather, conduct surveillance of sidewalks, offer contact options with emergency services, and even provide EV charging & Wi-Fi hotspots through smart poles. Thus, their adoption has shown promising growth in the U.S.

The U.S. has witnessed various conventional lighting replacement projects in recent years. Energy providers such as San Diego Gas & Electric (SDG&E) and Central Hudson Gas & Electric are encouraging and focusing on the development of programs to replace traditional light systems with smart poles. The demand for smart poles is expected to be positively impacted by the launch of several initiatives and programs in major cities. For instance, the Bureau of Street Lighting stated that it would reach full LED street lighting across the city of Los Angeles by the end of 2022, improving system efficiency and pushing their energy conservation efforts. Another program, Smart Street Lighting NY, that aimed to replace half a million street lights with smart LED fixtures in New York, was completed in August 2023. Such projects have helped drive substantial market growth.

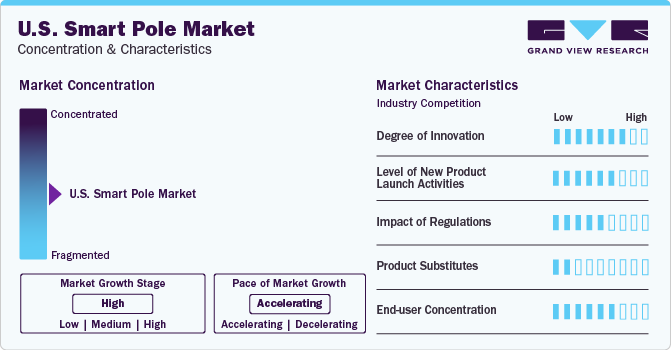

Market Concentration & Characteristics

The market growth stage is high, and the pace of growth is accelerating. There have been significant investments to drive innovations in the smart pole technology to improve its efficiency and reliability. Companies such as Clovity have introduced several advanced functions such as license plate detection, noise & decibel management, crowd monitoring, and gunshot detection, all of which greatly aid in improving the safety of people in a particular location. Other established companies such as Signify, Siemens, and Cree are also undertaking extensive research and development activities to improve upon this technology further.

As government bodies across the U.S. aim to improve traffic management and citywide infrastructure, there has been a steady influx of novel product and service launches in the country’s smart pole market. For instance, in April 2022, Ivedaannounced the launch of Utilus, the company’s smart pole technology that offers AI-based video analytics and video surveillance features, smart power management capabilities, and an advanced energy storage battery setup to operate continuously even during a power outage. Such developments are expected to boost the development of the smart city sector.

The U.S. smart pole market is moderately regulated, with factors such as illumination levels, light distribution, light pollution, and energy efficiency being key for manufacturers launching their products. Additionally, the integration of wireless communication networks in smart poles also calls into action telecom regulations that need to be adhered to.

As constant breakthroughs are being made in the smart pole technology, the risk of substitutes replacing them remains low in the coming years. Moreover, an increasing number of states in the country are looking to install reliable smart poles that can function optimally in the long term, making the prospects of replacement solutions quite low.

Various state and local government bodies in the United States have encouraged the installation of smart poles across cities, making them the primary end-user in this market. These systems are installed across roadways, public spaces, harbors, and highways to offer safety and security to people. Corporate establishments and educational institutions are other important end-users in this market.

Installation Type Insights

The retrofit installation segment accounted for 59.90% of the revenue share in 2023. As retrofitting involves upgrading of the existing system without replacing it completely, it has become a cost-effective solution for concerned authorities. As a majority of the projects require technological modifications to hundreds of lighting systems at a time, retrofit installations result in significant cost savings. States such as New York, California, Texas, and Florida have successfully seen conventional street lighting in different cities being upgraded to address consumer demands for improving city infrastructure, driving substantial demand for this segment.

The new installation segment is expected to account for a significant revenue share in the coming years. New installation involves the complete replacement of conventional lighting systems with advanced infrastructure such as air quality sensors and surveillance cameras. Such an installation allows complete freedom to include features from scratch, while also enabling maximum efficiency that may not be possible in retrofitting systems. Moreover, there is the added advantage of better long-term return on investments since maintenance expenses are greatly reduced, while greater compliance with regulations is also made possible as advanced components are designed for maximum efficiency.

Application Insights

The public place segment accounted for the largest revenue share of 39.57% in 2023. Public areas such as roadways, gardens, parks, and footpaths have seen a sizeable increase in the installation of smart lighting, as they offer benefits such as dynamic lighting for energy efficiency, announcement speakers, and charging points & internet connectivity for the convenience of visitors and tourists. Many smart poles come with digital signages to offer traffic alerts, emergency notifications, and weather updates, which has broadened their appeal. Additionally, brands can also push advertising messages through these systems, giving further impetus to their installation in public spaces.

The highways and roadways segment is a major application sector for smart pole installations. The U.S. government is actively trying to improve road safety and driver convenience through advanced systems for providing traffic updates and reducing the risk of accidents, which is driving the segment’s growth. Additionally, issues such as high energy consumption and emissions that plague conventional lighting due to continued usage are addressed by smart lighting solutions, leading to energy savings and environmental benefits. The extensive presence of fuel stations, hotels, and toll plazas in the country has been another driver for the increased installation of smart poles across highways, proving beneficial for both consumers and authorities.

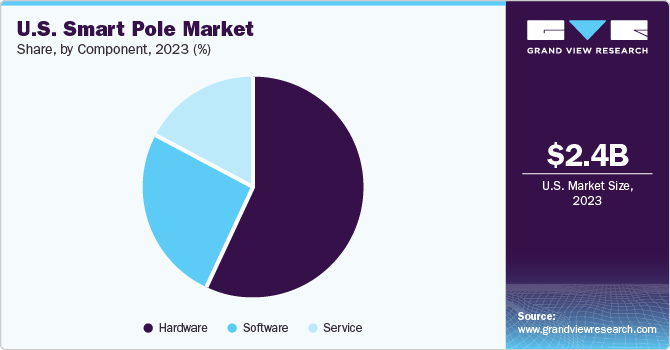

Component Insights

The hardware segment accounted for the largest revenue share of 56.48% in 2023. A leading factor contributing to this segment’s growth is the steady upgrade of lighting infrastructure being witnessed across cities in the nation. Also, a rising demand for energy-efficient lamps has encouraged the need to replace conventional incandescent lamps with energy-efficient LED lighting. Furthermore, the integration of other advanced features such as wireless sensors and security cameras to improve convenience of pedestrians and drivers has resulted in an extensive need for cutting-edge hardware offerings.

The service segment, on the other hand, is projected to witness the fastest CAGR from 2024 to 2030. The U.S. government, along with several state governments, is undertaking collaborations with smart pole manufacturers and network providers to improve infrastructure, which is leading to a consistent demand for services such as installation and maintenance of these systems. As a sizeable number of lighting systems are being currently retrofitted with upgrades and innovative technologies, there is a healthy demand for professional services that are generally offered by manufacturers to maintain their longevity and performance.

Hardware Insights

The controller segment accounted for the highest revenue share of 29.73% in 2023. The extensive usage of control centers and centralized command to aid authorities in monitoring smart solutions across different areas and cities drives segment expansion. Control devices are primarily used for controlling lighting and other advanced features efficiently, based on occupancy, movement, and temperature. Furthermore, they are also used to understand trends in natural lighting via light sensors that would lead to optimum usage of electricity. Manufacturers are launching advanced solutions with intelligent controllers to improve the efficiency of smart poles and drive down costs, thus generating significant revenue.

The communication device segment is expected to advance at the fastest CAGR through 2030. The extensive demand for communication systems has been driven by the need to make roadways and pathways safer and more user-friendly through the integration of advanced features in smart poles. They are comprised of multiple devices such as small cell cellular antennas, IoT network gateways, smart LED lights, public address systems, panic buttons, digital signage, and electronic call boxes, all of which communicate through the IoT gateway with the control center. As these components carry out critical functions, the demand for communication devices is growing exponentially in the market.

Key U.S. Smart Pole Company Insights

Companies involved in this market undertake several growth strategies such as new product development, mergers & acquisitions, and investments in R&D. Major names in the U.S. market for smart poles include Signify Holding, Wipro Limited, and Siemens AG.

-

Signify Holding, a Dutch company, has a U.S. subsidiary, Signify North America Corporation, headquartered in New Jersey. The company specializes in providing lighting solutions for consumers and Internet of Things (IoT) applications. The company’s portfolio includes LED lamps, luminaires, LED tubes, and decorative lighting. These products are used across most industry verticals. Signify also offers services such as consulting for lighting system improvisation, project management, and maintenance services for lighting systems.

-

Siemens AG has its America headquarters located in Washington, D.C. The company is well-known globally as a provider of smart infrastructure for distributed energy systems & buildings, automation & digitalization in the manufacturing & process industries, conventional and renewable power generation and distribution, smart mobility solutions for road & rail, and digital healthcare services & medical technology. The company’s mobility services division provides intelligent lighting solutions, including engineering, installation, programming, and operations.

Wolfspeed, Inc. (formerly Cree, Inc.); Eaton Corporation; and Zumtobel Lighting Inc. are some notable emerging companies establishing their presence in the U.S. market.

-

Wolfspeed, Inc., headquartered in North Carolina, provides semiconductor solutions for lighting-class LED products, and radio frequency & power applications. The company operates through two business segments, namely LED Products and Wolfspeed. Under the former segment, the company offers LED components and chips required to develop LED-based products for specialty lighting applications, video screens, lighting, and automotive applications.

Key U.S. Smart Pole Companies:

- Wolfspeed, Inc. (formerly Cree, Inc.)

- ClearWorld LLC

- Clovity

- Comptek Technologies

- Eaton

- Echelon

- General Electric

- Iveda

- Siemens

- Signify Holding

- Silver Spring Networks, Inc. (subsidiary of Itron)

- Telensa

- Wipro Limited

- Zumtobel Group

Recent Developments

-

In May 2023, Clovity launched its City Smart Pole solution, debuting it at the Cities Summit of the Americas in Denver, Colorado. The product integrates IoT (Internet of Things) and AI software with AI cameras, smart devices, digital signage, private 5G networks, and similar smart capabilities. Its benefits as stated by the company include bike lane monitoring, pedestrian tracking, dynamic streaming content, vehicle tracking, smart lighting, and theft prevention, among others

-

In March 2023, Valmont Industries announced its partnership with ClearWorld, which specializes in providing alternative energy systems. Through this deal, Valmont would offer ClearWorld smart solar poles to its customers. These solar poles offer a sustainable and resilient power source to keep critical infrastructure running even during natural disasters and power outages, while also having inbuilt IoT capabilities and reduced maintenance and operating costs

-

In January 2023, Iveda, an Arizona-based provider of smart city technologies, launched a USD 1.5 million project for its Utilus Smart Pole technology in Taiwan’s largest harbor city Kaohsiung, through the provision of vital IoT infrastructure for smart city deployment. Utilus smart poles integrate AI-based video analytics, video surveillance, the ‘IvedaSPS’ smart power system, and the ‘IvedaPinpoint’ location-based trackers and smart sensors, which would solve challenges such as traffic and parking management in the city

U.S. Smart Pole Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 7.31 billion

Growth rate

CAGR of 17.9% from 2024 to 2030

Historical data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Component, hardware, installation type, application

Key companies profiled

Wolfspeed, Inc. (formerly Cree, Inc.); ClearWorld LLC; Clovity; Comptek Technologies; Eaton; Echelon; General Electric; Iveda; Siemens; Signify Holding; Silver Spring Networks, Inc. (subsidiary of Itron); Telensa; Wipro Limited; Zumtobel Group

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Smart Pole Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. smart pole market report based on component, hardware, installation type, and application:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Service

-

-

Hardware Outlook (Revenue, USD Million, 2017 - 2030)

-

Lighting Lamp

-

Pole Bracket & Pole Body

-

Communication Device

-

Controller

-

Others

-

-

Installation Type Outlook (Revenue, USD Million, 2017 - 2030)

-

New Installation

-

Retrofit Installation

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Highways & Roadways

-

Public Places

-

Railways & Harbors

-

Frequently Asked Questions About This Report

b. The U.S. smart pole market size was estimated at USD 2.35 billion in 2023 and is expected to reach USD 2.73 billion in 2024.

b. The U.S. smart pole market is expected to grow at a compound annual growth rate of 17.6% from 2024 to 2030 to reach USD 7.31 billion by 2030.

b. The hardware segment dominated the U.S. smart pole market with a share of 56.48% in 2023. A leading factor contributing to this segment’s growth is the steady upgrade of lighting infrastructure being witnessed across cities in the U.S.

b. Some key players operating in the U.S. smart pole market include Wolfspeed, Inc. (formerly Cree, Inc.); ClearWorld LLC; Clovity; Comptek Technologies; Eaton; Echelon; General Electric; Iveda; Siemens; Signify Holding; Silver Spring Networks, Inc. (subsidiary of Itron); Telensa; Wipro Limited; Zumtobel Group.

b. Key factors that are driving the market growth include the need for energy-efficient pole lighting systems and increasing government initiatives for smart cities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.