- Home

- »

- Biotechnology

- »

-

U.S. Stem Cells Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Stem Cells Market Size, Share & Trends Report]()

U.S. Stem Cells Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Adult Stem Cells, HESCs), By Application (Regenerative Medicine, Drug Discovery and Development), By Therapy, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-238-3

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Stem Cells Market Size & Trends

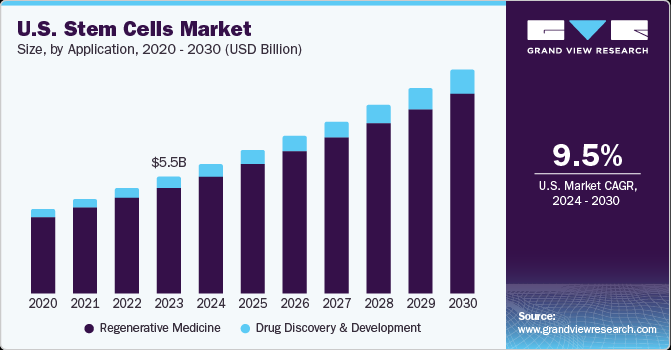

The U.S. stem cells market size was estimated at USD 5.46 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 9.46% from 2024 to 2030. Increase in acceptance of regenerative medicine and rise in number of regulatory approvals of stem cell therapies are expected to drive the market. Growing demand for regenerative medicines, increase in healthcare expenditure, an increase in the incidence of genetic disorder and cancer are the major factors driving the market. Moreover, preservation of stem cells for future treatment with the help of public & private umbilical cord & tissue banking has proved to be profitable in the past; this practice has already gained immense acceptance offering significant momentum to the stem cells market.

The U.S. accounted for over 32.4% of the global stem cells market in 2023. The market is anticipated to be propelled by the escalating progress in precision medicine, the expansion of cell therapy production facilities, and an increasing count of clinical trials. The recent breakthroughs in stem cell therapeutics and tissue engineering have the potential to become a focal point for treating numerous diseases. In addition, the growing demand for stem cell banking and the surge in research activities related to the production, storage, and characterization of stem cells are predicted to boost the market’s revenue growth. The technological advancements in the primary and ancillary markets for stem cell usage further strengthen the anticipated demand growth for stem cells in the forecast period.

The COVID-19 pandemic positively impacted the market, sparking increased interest in clinical trials for products used in treating the virus. Regenerative medicine, particularly stem cell therapies, emerged as potential treatments, reducing mortality and infection rates. For instance, in 2020, COVID-19 patients received stem cell infusions, proving safe and reliable. This has fueled the growing demand for regenerative medicines, which are widely used in treating various diseases and are increasingly sought after for early disease detection and prevention, especially among the aging population.

Regenerative medicines, with their wide-ranging applications in treating various diseases, including neurology, oncology, hepatology, diabetes, injuries, hematology, and orthopedics, are seeing increased demand, particularly for early disease detection and prevention among the aging population. These medicines aid in cell function restoration and are expected to offer effective therapies for chronic conditions due to rapid advancements in the field. A notable development is the March 2022 partnership between Wipro Ltd and Pandorum Technologies, aimed at developing technologies to expedite time-to-market and improve patient outcomes in clinical trials and regenerative medicine R&D. Pandorum will leverage Wipro’s AI capabilities to enhance patient outcomes in regenerative medicine and advanced therapeutics.

Stem cells are increasingly recognized for their role in regenerative medicine, offering the potential to heal and replace damaged tissues and organs. As a promising source for these therapies, stem cells are attracting the attention of researchers, clinicians, and scientists. Market growth is largely driven by significant R&D investments and the growing need for effective treatments to lessen the disease burden. For instance, Celavie Biosciences advanced its 5-year exploratory study on Parkinson’s disease in May 2020, focusing on regenerative stem cell therapies for Parkinson’s and other central nervous system disorders. The company reported successful preliminary trials using OK99 stem cells for Parkinson’s disease.

Market Concentration & Characteristics

The industry is in a moderate growth stage, with an accelerating rate of growth and is highly competitive, leading to competitive pricing for high-quality stem cell products. Government initiatives are also a major factor fueling industrial growth. Companies are actively participating in several initiatives such as increased collaborations, strong funding, and extensive research & development. For instance, in May 2020, the CiRA Foundation and CGT Catapult initiated a collaborative research project focused on characterizing induced pluripotent stem cells. The companies will leverage their expertise to explore new methods for characterizing pluripotent stem cells, which could be used in the production of regenerative medicine products.

Market innovations are enhancing the accuracy, scalability, and therapeutic possibilities of stem cells. Groundbreaking advancements like CRISPR-based gene editing are expanding the scope of stem cell therapies for a variety of diseases, including cancer and cardiovascular disease, offering a growth perspective for the market. The production of autologous cells aimed at transplantation is one of the most significant technological breakthroughs in regenerative medicine which is fueling the market growth. This technology includes alarm systems and automated tracking of the transplantation of autologous cells.

Market forces that boost the demand for stem cells have witnessed significant growth over the years; this can be attributed to an increase in the number of mergers & acquisitions in the market and can lead to an increase in adoption of research and development activities. For instance, in February 2022, Calidi Biotherapeutics merged with Edoc Acquisition Corp. to leverage Edoc’s network of 400+ physicians across various disciplines and increase its market share of stem cell-based delivery platforms.

Strict regulations oversee research and clinical practices in the stem cell market, and adhering to these rules may result in extra procedural expenses and extended R&D timelines, potentially limiting market expansion. Companies and research institutes are partnering to create innovative disease treatments. For instance, in April 2020, the Infectious Disease Research Institute and Celularity announced that the US FDA had approved a clinical trial application to develop a cell-based therapy for COVID-19. Therefore, the increasing use of clinical trials is expected to stimulate stem cell demand in the future.

The growing acceptance of precision medicines is leading to a broader range of products. Companies are exploring innovative procurement methods to advance the creation of personalized medicines. For example, therapies using induced pluripotent stem cells (iPSCs) are created from a small patient’s skin or blood cell sample, which is then reprogrammed to generate new tissues and cells for transplantation. In September 2022, Century Therapeutics and Bristol Myers Squibb entered into a licensing agreement and research partnership for the development and commercialization of iPSC-derived allogeneic cell therapies. Therefore, the use of these cells, along with strategic initiatives by market players, could lead to the development of potential personalized medicines soon.

The market has moderately expanded across regions, making advanced stem cell technologies more accessible to local healthcare providers and researchers. This improved access has led to major progress in personalized medicine, tissue engineering, and several therapeutic uses of stem cells. Consequently, the market is set for considerable growth, thanks to the beneficial effects of these advancements on improving healthcare abilities, spurring innovation in medical treatments, and broadening the horizons of regenerative medicine.

Application Insights

Regenerative medicine dominated the market and held the highest revenue market share of 85.46% in 2023, owing to growing adoption & ongoing development of companion diagnostics & personalized medicine for usage in oncology and other chronic infections. The International Space Station National Lab is engaged in the fields of regenerative medicine, which includes discovering the advantages of stem cell research in the environment of microgravity for therapeutic applications, as microgravity enables delicate tissues to advance and strengthen without disintegrating. Moreover, continuous research being carried out in this area involving the use of pluripotent as well as non-pluripotent stem cells for introduction of a breakthrough technology to eradicate tumor and develop transplant methodologies is among the few factors expected to enhance the market growth over the forecast period.

Drug discovery and development is expected to grow at a faster CAGR of 10.73% from 2024 to 2030. Ongoing research in the field of stem cells for developing therapeutic models for effective treatment of nervous disorders such as Parkinson’s disease & Alzheimer’s disease and amyotrophic lateral sclerosis is anticipated to drive the growth in this sector over the forecast period. Market products are gaining more traction in the drug discovery process due to their usefulness in studying the causes of human diseases, identifying disease mechanisms, and developing strategies to combat various diseases. iPSC-based models, which can replicate the molecular and cellular phenotypes of patients, are favoured over phenotypic screening. These models allow pharmaceutical companies to cost-effectively test proposed drug mechanisms in vitro before proceeding to clinical trials.

Product Insights

Adult stem cells dominated the market and held the largest share of 71.77% of the market in 2023, as the usage of these cells is not associated with ethical hindrances, which is the case with embryonic stem cells. Furthermore, there is no risk of graft rejection in the case of adult stem cells. The development of cell banking services and advancements in bio-preservation and cryopreservation are expected to further boost the demand for adult stem cells. Lesser ethical concerns surrounding adult stem cells further propel the growth of this segment. The benefits of adult stem cell banking such as the capacity for autologous transformation, low risk of tumor formation, and availability of established treatment options are the factors that are expected to boost the growth of this segment during the forecast period.

Induced pluripotent stem cells (iPSCs) is expected to grow at the fastest CAGR of 17.5% from 2024 to 2030. iPS cells, with their potential to advance drug development and clinical research, are expected to grow rapidly. They can link disease properties with cell physiology for genetic linkage exploration in drug discovery. The availability of self-renewing human Pluripotent Stem Cells (PSCs) helps overcome limitations of animal model disorders. They can model human diseases, changing the study of complex disorders. Therapies are being derived using patient-specific iPSCs, opening new possibilities for model establishment and drug screening. A 2022 study highlighted the potential of xeno-free iPSCs and Neural Progenitor Cells (NPCs) in developing cell therapy for brain injuries, as no regenerative therapy currently exists for neurodegenerative diseases.

Technology Insights

Cell acquisition dominated the market and held largest revenue share of 33.69% in 2023 and is expected to grow at the highest CAGR during the forecast period. The advent of embryonic stem cells has opened new avenues for disease treatment due to their pluripotent nature, which allows them to transform into various cell types. However, ethical issues arise from sourcing these cells directly from embryos. As a solution, researchers have turned to induced pluripotent stem cells (iPSCs). In 2020, a joint research team from Singapore and Australia explored the molecular transformations when adult skin cells are converted into iPSCs. This research led to the generation of stem cells capable of forming placenta tissue, potentially offering new remedies for placenta-related pregnancy complications. Cell acquisition methods include bone marrow harvest, umbilical blood cord, and apheresis, with bone marrow harvest leading in revenue due to increased awareness, rising blood cancer prevalence, and easy access to bone marrow transplant therapy.

Cell production is expected to have a lucrative growth during the forecast period owing to the introduction of novel reagents and kits that are useful for optimizing the production of stem cells. It involves advanced manufacturing technology for the quantitation of stem cells and the incorporation of improvements using multi-cellular therapy. Moreover, protocols required for optimizing the stem cell yield are anticipated to contribute to the segment's revenue growth.

Therapy Insights

Allogenic dominated and held the largest market revenue share of 59.28% in 2023. This sector’s growth is driven by factors such as high costs and the expansion of stem cell banking. Furthermore, a shift towards the development of allogenic cell therapy products is being observed among numerous cell therapy companies, which is anticipated to significantly boost this segment’s growth. Key market players are also engaging in strategic activities to enhance their product offerings, providing promising opportunities in the forecast period. For example, in March 2021, Acepodia secured USD 47 million in Series B funding to progress its allogenic cell therapy candidate pipeline. In June 2022, Immatics and Bristol Myers Squibb broadened their strategic partnership to develop gamma delta allogeneic cell therapy programs.

Autologous is expected to witness the fastest CAGR of during the forecast period, primarily due to their lower risk of complications. Other factors driving this segment’s growth include cost-effectiveness, enhanced patient survival rates, the absence of a need for an HLA-matched donor, and no risk of graft-versus-host diseases. Moreover, autologous Mesenchymal Stem Cells (MSCs) are being explored for their potential in treating osteoarthritis, given their ability to differentiate into bone and cartilage tissues. MSCs can migrate to injury sites, promote tissue repair through the release of anabolic cytokines, inhibit pro-inflammatory pathways, and differentiate into specialized connective tissues. The increasing use of autologous MSCs in regenerative medicine is expected to further drive market growth in the forecast period.

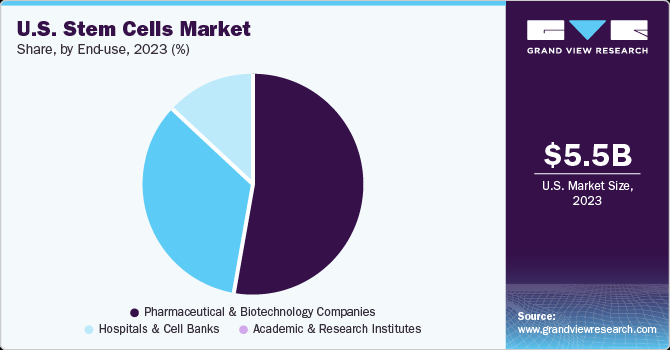

End-use Insights

Pharmaceutical and biotechnology companies dominated and held the largest market share of 53.0% in 2023 and is expected to grow at the fastest CAGR from 2024 to 2030. The segment’s share can be attributed to several factors, including the increasing incidence of chronic diseases, a rise in clinical trials, a surge in strategic activities, and enhancements in healthcare services. For example, in August 2022, StemCyte, Inc. received U.S. FDA approval for their Phase II clinical trial for Post-COVID Syndrome using stem cell therapy derived from umbilical cord blood. Furthermore, in April 2022, the U.S. FDA approved BioCardia’s Investigational New Drug (IND) application, allowing the initiation of a Phase I/II clinical trial of BCDA-04 in adults recovering from acute respiratory distress syndrome associated with COVID-19.

Hospitals & cell banks is expected to witness a lucrative growth during the forecast period. Hospitals and cell banks are major settings to conduct stem cell research and preservation programs. With the increase in the number of clinical trials, participation from patients in various hospitals across countries has witnessed a significant boost. Increase in burden of chronic diseases along with rise in awareness about therapeutic applications of stem cells for treating damaged tissues are two major factors for the segment growth. The growth in hematopoietic stem cell transplant procedures and rise in the number of skin graft procedures in specialty clinics are likely to drive the segment in coming years.

Key U.S. Stem Cells Company Insights

The U.S. stem cells market is characterized by the existence of both established companies and startups that concentrate on specialized therapeutics. Major market participants are innovating new products and engaging in partnerships to expand their product range, customer base, and global footprint. These tactics are anticipated to stimulate market growth in the future as more competitors join the market and strive to consolidate their market standing. Notable market players include Pluristem Therapeutics, Inc., STEMCELL Technologies, Inc., Bristol-Myers Squibb, Lisata Therapeutics, Cellular Engineering Technologies, Lineage Cell Therapeutics, BrainStorm Cell Therapeutics, among others.

Key U.S. Stem Cells Companies:

- Thermo Fisher Scientific, Inc.

- STEMCELL Technologies Inc.

- Merck KGaA

- CellGenix GmbH

- PromoCell GmbH

- Takara Bio

- Lonza

- Cellartis AB

- ATCC

- AcceGen

Recent Developments

- In February 2024, Takara Bio has revealed their intention to introduce two essential tools for cancer research: kits for automated single-cell total RNA-seq and DNA-seq library preparation. Utilizing the innovative Shasta™ technologies, Takara Bio is set to launch pioneering large-scale solutions capable of detecting significant genetic events overlooked by other technologies. The increased throughput and sensitivity offered by these solutions lead to greater confidence in the results and enable breakthroughs that were previously unattainable.

- In October 2023, Thermo Fisher Scientific, Inc. introduced several innovative products to the market. These include the Thermo Scientific Glacios 2 Cryo-TEM, which is designed to speed up structure-based drug discovery. They have also launched the Gibco CTS DynaCellect Magnetic Separation System, a tool aimed at improving the production of cell therapies. In addition, they have developed the SeCore CDx HLA Sequencing System.

- In September 2022, Gamida Cell Ltd. announced that it would present the follow-up data of patients treated with omidubicel. The presentation at the Society of Hematologic Oncology (SOHO) of the results is anticipated to develop positive brand value for the company among its peer companies and other stakeholders.

U.S. Stem Cells Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.04 billion

Revenue forecast in 2030

USD 10.39 billion

Growth rate

CAGR of 9.46% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, technology, therapy, end-use

Country scope

U.S.

Key companies profiled

Thermo Fisher Scientific, Inc.; STEMCELL Technologies Inc.; Merck KGaA; CellGenix GmbH; PromoCell GmbH; Takara Bio; Lonza; Cellartis AB; ATCC; AcceGen; Bio-Techne

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Stem Cells Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. stem cells market report based on product, application, technology, therapy, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult Stem Cells (ASCs)

-

Hematopoietic

-

Mesenchymal

-

Neural

-

Epithelial/Skin

-

Others

-

-

Human Embryonic Stem Cells (HESCs)

-

Induced Pluripotent Stem Cells (iPSCs)

-

Very Small Embryonic Like Stem Cells

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Regenerative Medicine

-

Neurology

-

Orthopedics

-

Oncology

-

Hematology

-

Cardiovascular & Myocardial Infraction

-

Injuries

-

Diabetes

-

Liver Disorder

-

Incontinence

-

Others

-

-

Drug Discovery And Development

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell Acquisition

-

Bone Marrow Harvest

-

Umbilical Blood Cord

-

Apheresis

-

-

Cell Production

-

Therapeutic Cloning

-

In-vitro Fertilization

-

Cell Culture

-

Isolation

-

-

Cryopreservation

-

Expansion And Sub-Culture

-

-

Therapy Outlook (Revenue, USD Million, 2018 - 2030)

-

Autologous

-

Allogenic

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Hospitals & Cell Banks

-

Academic & Research Institutes

-

Frequently Asked Questions About This Report

b. The U.S. stem cells market size was estimated at USD 4.79 billion in 2023

b. The U.S. stem cells market is expected to grow at a compound annual growth rate of 9.5% from 2024 to 2030 to reach USD 9.12 billion by 2030.

b. Based on the product, adult stem cells dominated the market and captured the largest market share of 83.2% in 2023.

b. Some of the key players in the market are Thermo Fisher Scientific, Inc.; STEMCELL Technologies Inc.; Merck KGaA; CellGenix GmbH; PromoCell GmbH; Takara Bio; Lonza; Cellartis AB; ATCC; AcceGen; and Bio-Techne.

b. Some of the key factors driving the market include Ongoing developments in regenerative medicine, rising funds for accelerating stem cell research, and growing demand for stem cell banking

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.