- Home

- »

- Medical Devices

- »

-

U.S. Thoracic Catheter Market Size, Industry Report, 2033GVR Report cover

![U.S. Thoracic Catheter Market Size, Share & Trends Report]()

U.S. Thoracic Catheter Market (2025 - 2033) Size, Share & Trends Analysis Report By Material (PVC, Silicone), By Product Type, By End Use, By Application, And Segment Forecasts

- Report ID: GVR-4-68040-816-8

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Thoracic Catheter Market Summary

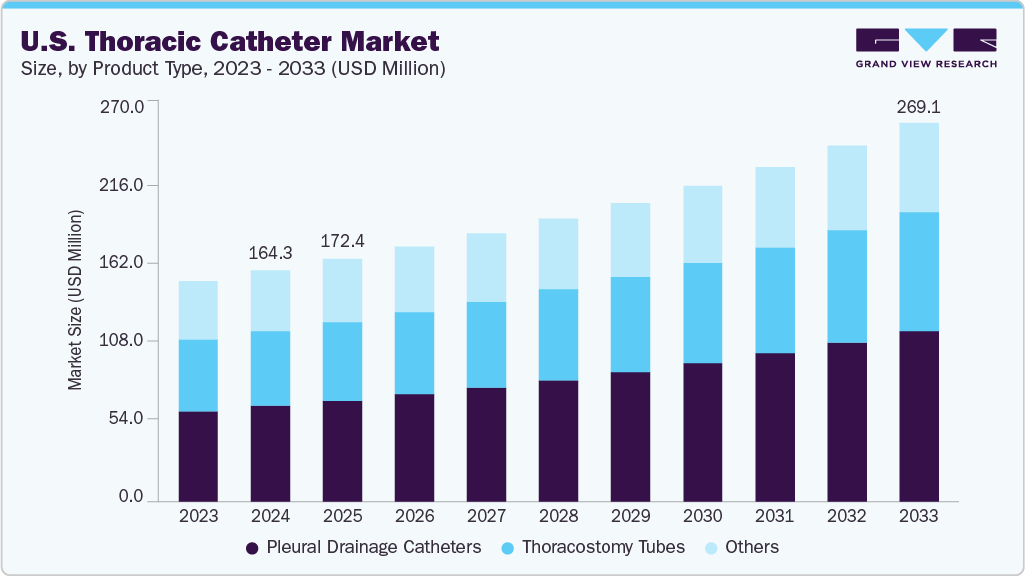

The U.S. thoracic catheter market size was estimated at USD 164.28 million in 2024 and is projected to reach USD 269.05 million by 2033, growing at a CAGR of 5.73% from 2025 to 2033. This growth is driven by the rising prevalence of respiratory disorders, traumatic injuries, and postoperative complications that require efficient thoracic drainage solutions, along with the increasing demand for minimally invasive procedures that improve patient recovery times.

Key Market Trends & Insights

- By product type, the pleural drainage catheters segment accounted for the largest market revenue share in 2024.

- By application, the pneumothorax segment accounted for the largest market revenue share in 2024.

- By material, the silicone segment accounted for the largest market revenue share in 2024.

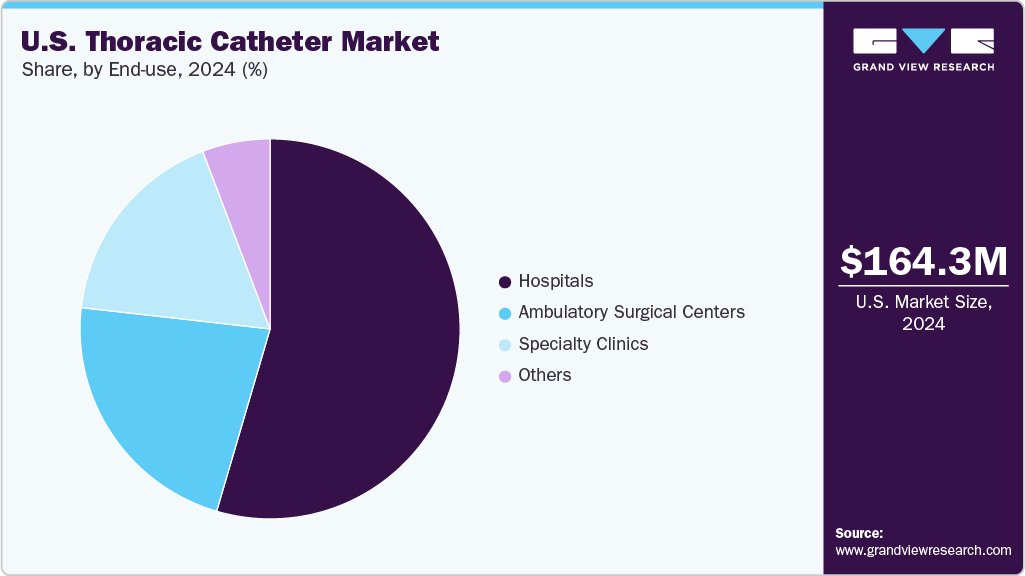

- By end use, the hospital segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 164.28 Million

- 2033 Projected Market Size: USD 269.05 Million

- CAGR (2025-2033): 5.73%

Advancements in catheter materials, such as silicone-based and antimicrobial-coated designs, are further enhancing safety and clinical outcomes, supporting higher adoption across hospitals and specialty clinics.

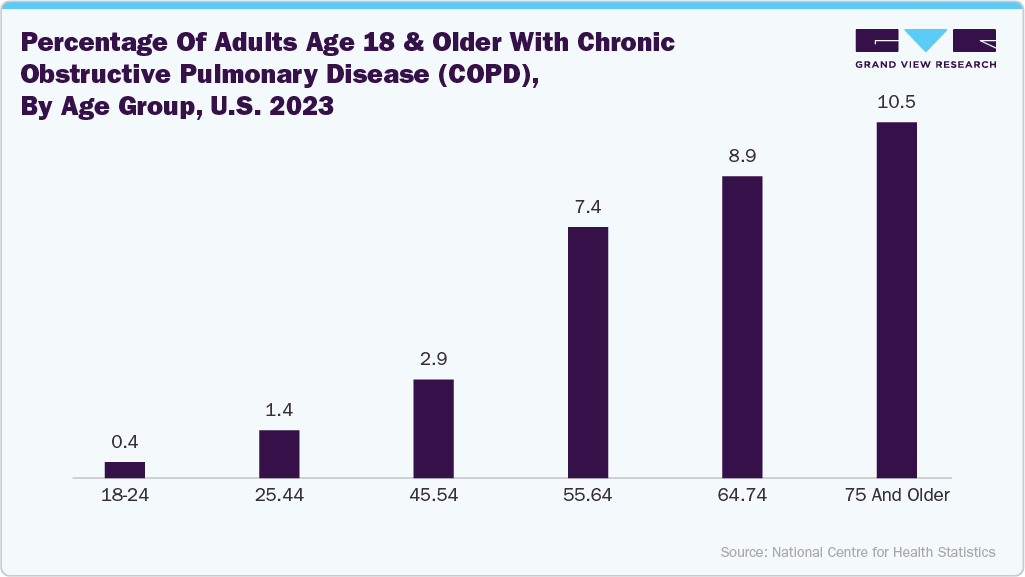

Chronic obstructive pulmonary disease is a significant driver of the U.S. thoracic catheter industry, as the condition often leads to complications such as pneumothorax, pleural effusion, and severe respiratory distress that require timely thoracic drainage. As COPD prevalence continues to rise due to aging populations, prolonged exposure to environmental pollutants, and high smoking rates, healthcare facilities are increasingly relying on thoracic catheters to manage these acute exacerbations and improve patient outcomes. Thoracic catheters play a critical role in relieving trapped air or fluid in the pleural space, enabling better lung expansion and respiratory function in COPD patients. The growing clinical need for efficient, minimally invasive drainage solutions in emergency care, intensive care units, and pulmonology practices directly supports higher utilization of advanced thoracic catheter systems, thereby accelerating overall market growth.

Traumatic injuries are a major factor driving the growth of the U.S. thoracic catheter industry, as chest trauma frequently leads to life-threatening conditions such as pneumothorax, hemothorax, and pleural effusion that require immediate thoracic drainage. Road accidents, falls, sports-related injuries, and workplace trauma often damage the ribs, lungs, or pleural cavity, creating an urgent need for chest tube placement to restore respiratory function and stabilize the patient. With trauma cases remaining a leading cause of emergency department admissions, hospitals increasingly depend on thoracic catheters for rapid decompression and effective fluid or air evacuation. The rise in high-impact injuries, coupled with improved trauma care protocols and expanding emergency medical services, is boosting the adoption of advanced catheter designs that offer safer insertion, lower infection risk, and quicker patient management.

According to the National Highway Traffic Safety Administration (NHTSA), an estimated 17,140 people lost their lives in motor vehicle crashes from January through June 2025, down from 18,680 fatalities during the same period in 2024.

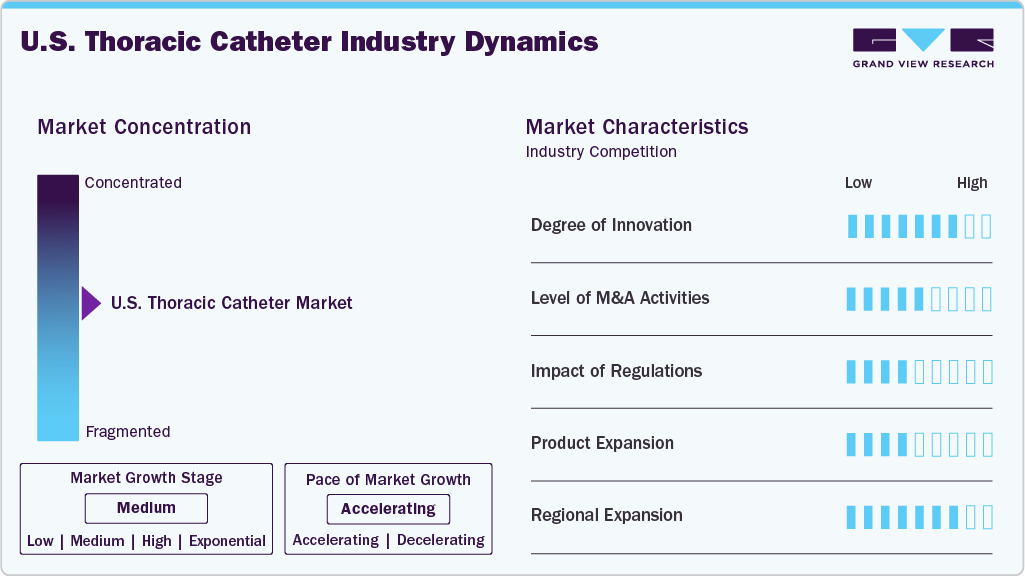

Market Characteristics & Concentration

The U.S. thoracic catheter industry growth stage is significant, and pace of the market growth is accelerating.

The U.S. thoracic catheter industry exhibits a high degree of innovation, driven by advancements in materials science, catheter design, and minimally invasive technologies. Manufacturers are integrating biocompatible polymers, antimicrobial coatings, and kink-resistant tubing to enhance patient safety and procedural reliability. The rise of image-guided thoracic interventions, combined with improved drainage systems featuring precision-controlled valves and digital monitoring capabilities, is further enhancing clinical outcomes.

Regulation plays a critical role in shaping the U.S. thoracic catheter industry, as the FDA enforces stringent quality, safety, and performance standards for all thoracic drainage and aspiration devices. The requirement for robust clinical evidence, adherence to Good Manufacturing Practices (GMP), and ongoing post-market surveillance ensures that only high-quality, safe products enter the market. While this regulatory oversight increases compliance costs for manufacturers, it builds strong clinician confidence and minimizes risks associated with device malfunctions and infections.

Product expansion is a major growth lever in the U.S. thoracic catheter industry as companies broaden their portfolios to meet the diverse needs of thoracic surgeries, trauma care, and chronic respiratory disease management. Manufacturers are offering comprehensive product lines-including pigtail catheters, trocar catheters, indwelling pleural catheters, and hybrid drainage systems-to support a wider range of indications such as pneumothorax, pleural effusion, and postoperative drainage.

Product Type Insights

The pleural drainage catheters segment accounted for the largest market revenue share in 2024, due to their widespread clinical use, versatility, and critical role in managing pleural effusions, pneumothorax, and other thoracic conditions. These catheters are extensively utilized in hospitals, emergency care, and post-surgical procedures to drain excess air or fluid from the pleural space, ensuring effective lung re-expansion and improved patient recovery. Technological advancements, including enhanced biocompatible materials, antimicrobial coatings, and minimally invasive insertion techniques, have further improved their safety, efficiency, and patient comfort. In addition, the rising incidence of respiratory diseases, lung cancers, and chronic obstructive pulmonary disorders globally has increased the demand for pleural drainage catheters. Their broad adoption by healthcare professionals, coupled with consistent product innovations and favorable reimbursement scenarios, solidifies their dominant position within the thoracic catheters market.

The thoracostomy tubes segment is expected to grow at a significant CAGR during the forecast period, driven by their critical role in emergency and post-surgical management of thoracic conditions such as pneumothorax, hemothorax, and pleural effusion. The rising prevalence of respiratory disorders, chest trauma, and thoracic surgeries has increased the demand for these tubes across hospitals and trauma centers. In addition, the shift toward minimally invasive surgical procedures and advancements in tube design, such as the use of softer, biocompatible materials and enhanced drainage efficiency, have improved clinical outcomes and patient comfort, further supporting their adoption.

Material Insights

The silicone material segment accounted for the largest market revenue share in 2024, due to its superior biocompatibility, flexibility, and durability compared to other materials such as PVC or latex. Its non-reactive and hypoallergenic nature makes it ideal for long-term placement within the thoracic cavity, minimizing tissue irritation and the risk of infection. Silicone catheters maintain their shape while allowing easy insertion and comfortable placement, which enhances patient outcomes and reduces complications during drainage procedures. In addition, silicone’s high thermal and chemical stability allows for effective sterilization and reuse in specific medical settings, further improving cost efficiency for healthcare providers. Manufacturers also prefer silicone because it can be easily molded into various tube designs with integrated radiopaque lines or anti-kinking features. The growing preference for minimally invasive and patient-friendly devices, combined with increasing clinical evidence supporting the safety and performance of silicone, continues to drive its dominance in the thoracic catheters market.

The polyurethane segment is expected to grow at the fastest CAGR during the forecast period, due to its superior combination of strength, flexibility, and biocompatibility, which make it ideal for a wide range of drainage and surgical applications. Polyurethane offers superior kink resistance and durability while maintaining patient comfort during long-term use. Its ability to be engineered into thin-walled designs without compromising structural integrity enhances fluid drainage efficiency and ease of insertion. Moreover, ongoing advancements, such as antimicrobial coatings, improved radiopacity, and multi-durometer formulations, have further enhanced clinical performance. Manufacturers and healthcare providers are adopting polyurethane catheters, as they offer enhanced safety, reduced infection risk, and improved compatibility with minimally invasive procedures.

Application Insights

The pneumothorax segment accounted for the largest market revenue share in 2024 and is also projected to grow at the fastest CAGR during the forecast period, driven by its high incidence and the critical need for immediate clinical intervention. Thoracic catheters, particularly chest and pleural drainage tubes, play a crucial role in managing pneumothorax by removing trapped air from the pleural cavity and restoring normal lung expansion. The rising prevalence of spontaneous and traumatic pneumothorax cases linked to factors such as chronic obstructive pulmonary disease, lung infections, mechanical ventilation, and chest injuries has significantly increased demand for these devices. In addition, the growing adoption of minimally invasive thoracic procedures and the improvement of emergency care infrastructure across hospitals and trauma centers support wider catheter utilization. Technological advancements in catheter materials, such as silicone and polyurethane, which offer enhanced flexibility, biocompatibility, and safety, further improve treatment outcomes.

The pleural effusion application segment is expected to grow at a significant CAGR during the forecast period, driven by the increasing prevalence of chronic respiratory diseases, congestive heart failure, malignancies, and infections that lead to fluid accumulation in the pleural space. Thoracic catheters are essential for draining this excess fluid, alleviating symptoms, and preventing complications such as lung collapse or respiratory distress. The growing aging population and the rising incidence of cancer-related effusions have further accelerated the demand for pleural drainage procedures.

End Use Insights

The hospital segment led the market with the largest revenue share of 54.54% in 2024, due to the high volume of thoracic procedures and emergency interventions performed in these settings. Hospitals are the primary centers for managing critical conditions such as pneumothorax, pleural effusion, hemothorax, and post-surgical thoracic drainage, all of which require immediate and precise catheter placement under medical supervision. The availability of advanced diagnostic and imaging technologies, skilled thoracic surgeons, and well-equipped intensive care units further supports the extensive use of thoracic catheters in hospitals. Furthermore, hospitals handle a large number of trauma and post-operative cases that necessitate continuous monitoring and drainage management, driving consistent demand for these devices. Favorable reimbursement policies, the presence of multidisciplinary care teams, and the growing number of thoracic surgeries globally also strengthen hospitals’ dominant market position.

The ambulatory surgical centers segment is expected to grow at the fastest CAGR during the forecast period, driven by the global shift toward outpatient and minimally invasive procedures. ASCs offer cost-effective, efficient, and patient-friendly alternatives to traditional hospital settings, making them preferred for elective thoracic interventions, such as pleural drainage and the management of minor pneumothorax. The growing adoption of advanced thoracic catheters, which enable safe, quick, and minimally invasive drainage procedures, supports their use in these centers.

Key U.S. Thoracic Catheter Company Insight

The market players of U.S. thoracic catheter industry are undertaking several strategic initiatives such as acquisitions, partnerships, and collaborations. Moreover, the launch of novel products is anticipated to boost the competitive rivalry in the U.S. thoracic catheter industry.

Key U.S. Thoracic Catheter Companies:

- Teleflex Incorporated

- Smiths Medical (ICU Medical, Inc.)

- B. Braun Melsungen AG

- Vygon SA

- Cook Medical

- Terumo Corporation

- Nipro Corporation

- Asahi Kasei Corporation

- Becton, Dickinson and Company

- Dongguan Jiajie Medical Tech Co., Ltd.

Recent Developments

-

In February 2025, Teleflex Incorporated announced its plan to separate into two independent publicly traded companies. The new entity, referred to as “NewCo,” will comprise the company’s Urology, Acute Care, and OEM businesses, while “RemainCo” will focus on the vascular access, Interventional, and Surgical segments. The spin-off is expected to be completed by mid-2026.

-

In February 2024, Terumo Medical Corporation commenced construction of a new manufacturing facility at its existing site in Puerto Rico, marking a significant expansion of its global production capabilities. The new facility is part of Terumo’s strategic plan to strengthen its medical device manufacturing network and meet the growing global demand for high-quality healthcare products.

U.S. Thoracic Catheter Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 172.35 million

Revenue forecast in 2033

USD 269.05 million

Growth rate

CAGR of 5.73% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Product type, material, application, end use

Regional scope

U.S.

Key companies profiled

Teleflex Incorporated; Smiths Medical (ICU Medical, Inc.); B. Braun Melsungen AG; Vygon SA; Cook Medical; Terumo Corporation; Nipro Corporation; Asahi Kasei Corporation; Becton; Dickinson and Company; Dongguan Jiajie Medical Tech Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Thoracic Catheter Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. thoracic catheter market report based on the material, product type, application, and end-use:

-

Product Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Thoracostomy Tubes

-

Pleural Drainage Catheters

-

Others

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Silicone

-

Polyurethane

-

PVC

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Pneumothorax

-

Pleural Effusion

-

Hemothorax

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals

-

Specialty Clinics

-

Ambulatory Surgical Centers (ASCs)

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. thoracic catheter market size was estimated at USD 164.28 million in 2024 and is expected to reach USD 172.35 million in 2025.

b. The U.S. thoracic catheter market is expected to grow at a compound annual growth rate of 5.73% from 2025 to 2033 to reach USD 269.05 million by 2033.

b. By product type, the pleural drainage catheters segment led the market, accounting for the largest revenue share in 2024.

b. Key players in the U.S. thoracic catheter market include Teleflex Incorporated, Smiths Medical (ICU Medical, Inc.), B. Braun Melsungen AG, Vygon SA, Cook Medical, Terumo Corporation, Nipro Corporation, Asahi Kasei Corporation, Becton, Dickinson and Company, and Dongguan Jiajie Medical Tech Co., Ltd.

b. The U.S. thoracic catheter market is primarily driven by the rising burden of respiratory diseases, including COPD, pleural effusion, pneumothorax, and lung cancer, which increases the need for effective thoracic drainage.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.