- Home

- »

- Clinical Diagnostics

- »

-

U.S. Tissue Diagnostics Market Size, Industry Report, 2030GVR Report cover

![U.S. Tissue Diagnostics Market Size, Share & Trends Report]()

U.S. Tissue Diagnostics Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology & Product (IHC, Primary & Special Staining), By Application (Breast Cancer, NSCLC), And Segment Forecasts

- Report ID: GVR-4-68038-270-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Tissue Diagnostics Market Trends

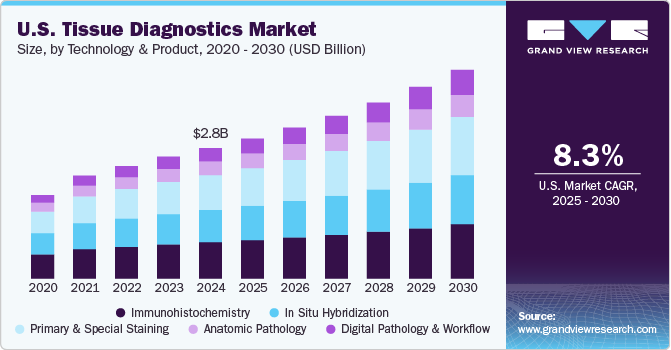

The U.S. tissue diagnostics market size was estimated at USD 2.76 billion in 2024 and is projected to grow at a CAGR of 8.3% from 2025 to 2030. The market is primarily influenced by new solutions in digital tissue diagnostics, improvements in imaging technologies, rising accessibility to diagnostics, and the expansion of personalized medicine and diagnostics.

The adoption of digital slides has grown substantially due to advantages like adjustable magnification and the ability to access slides remotely. In addition, the increasing focus on precision medicine, backed by various organizations and companies in the U.S., is anticipated to drive market growth. Furthermore, advancements in genome sequencing techniques and diagnostic tools have played a key role in the progression of personalized medicine in recent years. For instance, in June 2024, Guardant Health announced the launch of the Guardant360 TissueNext test for the diagnosis of cancer biomarkers. The test is likely to help the company expand its business for cancer diagnosis.

Companies are actively advancing precision medicine by introducing innovative oncology solutions. For example, QIAGEN launched its QCI Interpret One software solution for tumor genomic profiling in May 2020, contributing to the development of personalized cancer treatments. In addition, developments in imaging technologies is expected to further drive market growth. Breast cancer remains the most prevalent cancer diagnosed among women in the U.S. According to the American Cancer Society, breast cancer accounted for about 30% of new cancer cases in women in 2023. These developments highlight the growing focus on early detection and targeted therapies in oncology.

Technological advancements in imaging have significantly enhanced the sensitivity of breast cancer detection and diagnosis. Expanding capabilities in breast tissue analysis now include digital techniques, tomosynthesis, and computer-aided detection (CAD) for evaluating gene expression, cellular biochemistry, and molecular biology. However, the global COVID-19 pandemic has impacted pathology laboratories, affecting specimen workflow, biosafety measures, staffing, finances, and training programs for residents.

Histological specimens continue to be collected and processed using traditional methods, such as paraffin embedding followed by hematoxylin and eosin staining. Despite these advancements, challenges remain, such as non-value-based reimbursement policies and the high costs associated with tissue diagnostics. The expenses related to clinical research in the U.S. are driven by various factors, including administrative staffing, clinical procedure costs, and site monitoring, which may hinder further market growth.

Technology & Product Insights

Based on technology & product, the immunohistochemistry segment led the market with the largest revenue share of 27.74% in 2024. Immunohistochemistry (IHC) technology plays a crucial role in the clinical research and development of cancer diagnostics and therapeutics, contributing to its significant market share. IHC is an essential tool for examining tissue specimens and facilitating early disease diagnosis, prognosis, and therapy response prediction in cancer patients.

IHC is often favored over traditional enzyme staining methods, which only detect a limited array of enzymes, tissue structures, and proteins. In contrast, IHC tests offer specificity and effectively differentiate between various cancer types. This capability positions IHC as the most profitable sub-segment within tissue diagnostics. In addition, slide-staining systems have been key revenue drivers for the IHC segment, underscoring the importance of advanced staining techniques in enhancing diagnostic accuracy and improving patient outcomes.

The digital pathology and workflow segment is anticipated to grow at the fastest CAGR of 11.0% during the forecast period, driven by the rising adoption of digital pathology technologies across both large and small laboratories. Leading market players are developing digital software that is typically designed to work with their proprietary scanners. However, the emergence of software compatible with scanners from various manufacturers is expected to enhance the adoption of digital pathology in smaller laboratories. This flexibility will likely encourage more facilities to integrate digital pathology solutions, thereby improving efficiency, accuracy, and accessibility in diagnostic processes

Application Insights

Based on application, the breast cancer segment led the market with the largest revenue share of 50.45% in 2024. Tissue diagnostics play a vital role in assessing breast cancer in patients. The most frequently employed tissue biopsy tests for breast cancer include fine-needle aspiration biopsy, core needle biopsy, and surgical biopsy. To address the challenges posed by breast cancer variants that have limited treatment options and poor prognoses, companies have developed companion diagnostics. These tests are designed to identify specific biomarkers or genetic mutations, enabling more tailored treatment strategies and improving the chances of successful outcomes for patients. By enhancing the precision of diagnoses and treatment plans, companion diagnostics contribute significantly to the overall management of breast cancer.

The emergence of new diagnostic techniques for breast cancer is also a major factor for market growth. For instance, in February 2023, a group of researchers at Breast Cancer Research Foundation developed a next-generation liquid biopsy technology that has been developed to analyze blood samples, enabling precise differentiation between individuals with breast cancer and those without the disease. This innovative approach offers a comprehensive overview of various rare tumor-related factors that can be detected in the bloodstream.

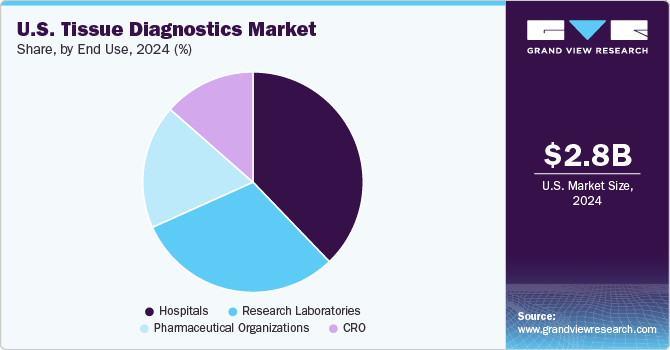

End Use Insights

Based on end use, the hospitals segment led the market with the largest revenue share of 37.82% in 2024. The usage of tissue diagnostic systems and services in hospitals & clinics has increased over the years. In several hospitals and clinics, physicians are switching to tissue diagnostic tests from conventional testing procedures. The long turnover time associated with conventional processes is boosting the adoption of tissue diagnostic tests as these aid in reducing the timelines.

The CRO segment is expected to grow at a lucrative CAGR of 12.8% over the forecast period. Contract Research Organizations (CROs) are crucial users of tissue diagnostics due to their essential role in supporting pharmaceutical and biotechnology companies throughout the drug development lifecycle. CROs offer specialized services that include preclinical and clinical testing, where tissue diagnostics play a key role. They provide expert analysis using advanced technologies that may not be available in-house, ensuring high-quality and accurate data for drug development. During preclinical studies, CROs use tissue diagnostics to assess the pharmacokinetics, pharmacodynamics, and toxicity of new compounds, while in clinical trials, these diagnostics are vital for monitoring treatment effects and validating drug efficacy.

Key U.S. Tissue Diagnostics Company Insights

The competitive scenario in the U.S. tissue diagnostics industry is dynamic, with key players such as Merck KGaA, Thermo Fisher Scientific, Inc., F. Hoffmann-La Roche Ltd., Abbott Laboratories, Siemens Healthineers AG, Danaher, bioMérieux SA, QIAGEN, holding significant positions. Major companies are focusing on partnership strategies to compete in the market. For instance, in February 2024, F. Hoffmann-La Roche Ltd. partnered with PathAI to create AI-enabled digital pathology algorithms for the companion diagnostics market. This partnership would improve the demand for personalized medicines. By integrating AI-driven algorithms into digital pathology, Roche aims to streamline the diagnostic process, making it faster and more accurate.

Key U.S. Tissue Diagnostics Companies:

- Merck KGaA

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-La Roche Ltd.

- Abbott Laboratories

- Siemens Healthineers AG

- Danaher

- bioMérieux SA

- QIAGEN

- Becton, Dickinson & Company (BD)

- Agilent Technologies, Inc.

- General Electric Company (GE Healthcare)

- BioGenex

- Cell Signaling Technology, Inc.

- Bio SB

- DiaGenic ASA

- Sakura Finetek Japan Co., Ltd.

- Abcam plc

- Enzo Life Sciences, Inc.

- VITRO SA (Master Diagnóstica)

- TissueGnostics GmbH

Recent Developments

-

In February 2024, Roche partnered with PathAI to create AI-enabled digital pathology algorithms for the companion diagnostics market. This partnership would improve the demand for personalized medicines. By integrating AI-driven algorithms into digital pathology, Roche aims to streamline the diagnostic process, making it faster and more accurate.

-

In May 2024, QIAGEN developed a globally scalable, kit-based test designed to detect homologous recombination deficiency in partnership with Myriad Genetics. This NGS test plays a crucial role in advancing personalized medicine research across various solid tumor types, including ovarian cancer. By enabling more precise identification of genetic deficiencies, this innovation is poised to enhance the accuracy and effectiveness of targeted therapies, contributing to the tissue diagnostics market growth.

-

In June 2024, Navinci and Leica Biosystems formed a strategic partnership to advance cancer treatment innovation by enabling automated in situ proximity ligation assays using the BOND RX Fully Automated Research Stainer. This collaboration enables precise and efficient analysis of protein interactions within tissue samples, enhancing the capabilities of cancer diagnostics.

-

In January 2024, Agilent Technologies Inc. and Incyte entered into a strategic agreement leveraging Agilent’s extensive expertise in Companion Diagnostics (CDx) research. This collaboration aims to advance the development and commercialization of Incyte’s hematology and oncology portfolio. By integrating Agilent’s proven capabilities in CDx, the partnership would enhance the effectiveness and precision of diagnostic solutions, thereby making a significant impact on the tissue diagnostic market through improved integration and innovation in hematology and oncology diagnostics.

-

In October 2023, NeoGenomics, Inc. broadened its innovative cancer diagnostic portfolio by introducing two new tests. The early-stage Non-Small Cell Lung Cancer (NSCLC) Panel is designed to assist in treatment selection for patients with early-stage NSCLC. Moreover, the Neo Comprehensive-Heme Cancers panel offers a comprehensive genomic profile of hematopoietic malignancies through Next-Generation Sequencing (NGS).

U.S. Tissue Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.96 billion

Revenue forecast in 2030

USD 4.40 billion

Growth rate

CAGR of 8.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology & product, application, end use, region

Country scope

U.S.

Key companies profiled

Merck KGaA; Thermo Fisher Scientific, Inc; F. Hoffmann-La Roche Ltd; Abbott Laboratories; Siemens Healthineers AG; Danaher; bioMérieux SA; QIAGEN; Becton, Dickinson & Company (BD); Agilent Technologies, Inc.; General Electric Company (GE Healthcare); BioGenex; Cell Signaling Technology, Inc.; Bio SB; DiaGenic ASA; Sakura Finetek Japan CO., LTD; Abcam plc; Enzo Life Sciences, Inc.; VITRO SA (Master Diagnóstica); TissueGnostics GmbH

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Tissue Diagnostics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. tissue diagnostics market report on the basis of technology & product, application, and end-use:

-

Technology & Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Immunohistochemistry

-

Instruments

-

Slide Staining Systems

-

Tissue Microarrays

-

Tissue Processing Systems

-

Slide Scanners

-

Other Products

-

-

Consumables

-

Reagents

-

Antibodies

-

Kits

-

-

-

In situ Hybridization

-

Instruments

-

Consumables

-

Software

-

-

Primary & Special Staining

-

H&E Staining

-

Special Staining

-

-

Digital Pathology & Workflow

-

Whole Slide Imaging

-

Image Analysis Informatics

-

Information Management System Storage & Communication

-

-

Anatomic Pathology

-

Instruments

-

Microtomes & Cryostat Microtomes

-

Tissue Processors

-

Automatic Strainers

-

Other Products

-

-

Consumables

-

Reagents & Antibodies

-

Probes & Kits

-

Others

-

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Breast Cancer

-

Non-Small Cell Lung Cancer

-

Prostate Cancer

-

Other Cancers

-

Gastric Cancer

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Research Laboratories

-

Pharmaceutical Organizations

-

CRO

-

Frequently Asked Questions About This Report

b. The U.S. tissue diagnostics market size was estimated at USD 2.76 billion in 2024 and is expected to reach USD 2.96 billion in 2025.

b. The U.S. tissue diagnostics market is expected to grow at a compound annual growth rate of 8.3% from 2025 to 2030 to reach USD 4.40 billion by 2030.

b. The Immunohistochemistry (IHC) segment dominated the U.S. tissue diagnostics market in 2024 accounting for a revenue share of 27.74%.

b. Some key players operating in the U.S. tissue diagnostics market include Merck KGaA; Thermo Fisher Scientific, Inc; F. Hoffmann-La Roche Ltd; Abbott Laboratories; Siemens Healthineers AG; Danaher; bioMérieux SA; QIAGEN; and Becton, Dickinson & Company (BD).

b. The U.S. tissue diagnostics market is driven by emerging solutions pertaining to digital tissue diagnostics, advancements in imaging techniques & increasing affordability of diagnostics, and growth of personalized therapeutics and diagnostics.

b. The breast cancer application segment accounted for the highest revenue share of over 50.45% in 2024 in the U.S. tissue diagnostics market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.