- Home

- »

- Organic Chemicals

- »

-

U.S. Trona Market Size, Share And Growth Report, 2030GVR Report cover

![U.S. Trona Market Size, Share & Trends Report]()

U.S. Trona Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Soda Ash, Animal Feed, Air Pollution Control), By End-use (Glass, Chemicals, Detergents, Others), Segment Forecasts

- Report ID: GVR-2-68038-724-7

- Number of Report Pages: 62

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The U.S. trona market size was valued at USD 1.21 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 3.5% from 2023 to 2030. The market is anticipated to be driven by increasing demand for trona from animal feed, air pollution control, and soda ash industries. Trona is primarily used to manufacture soda ash, by heating it to a very high temperature and converting it to sodium bicarbonate. Soda ash is used as a raw material in detergents, textiles, and glass. The market is strengthened by the availability of huge bedded and interbedded trona reserves situated in the Green River Basin of Wyoming. Most of the trona in the region is mined through conventional continuous as well as room and pillar mining methods. The companies engaged in the mining business are focused on improving the mining technique solutions to increase product recovery.

Stringent government regulations regarding the reduction of air pollution along with increasing adoption of Dry Sorbent Injection (DSI) systems in fossil-fuel power plants are projected to boost the product demand in flue gas desulphurization market. Dry scrubbers have comparatively lower annual and capital costs than wet systems as their waste disposal is less complex and requires less water. Synthetic or unnatural soda ash production leaves several byproducts, such as residual chloride, calcium carbonate, and other limestone components.

Such components are additional waste, which is discharged into waterways leading to water pollution. This is likely to contribute to the demand for natural soda ash as well as trona. U.S. trona miners are running at full utilization due to substantial demand for natural soda ash across the globe. Trona mined in the U.S. has a lower (nearly 36%) Greenhouse Gas (GHG) footprint than Chinese synthetic soda ash. This is expected to drive trona mining in the U.S. A severance tax on minerals in the state of Wyoming is likely to contribute further to the industry growth and in the economic development of the U.S. However, rising export competition from China along with increasing production capacity in Turkey is projected to remain a key challenge for the existing suppliers.

Soda ash production is the largest application of trona. When heated at temperatures above 800 degrees Celsius, in combination with calcium carbonate and sand, and then instantly cooled, the result is soft soda glass. Soda is manufactured in two forms, high density and low density. While heavy soda is widely used in the glass industry, light soda is used in the production of chemicals and detergents. Unlike synthetic soda ash, natural soda ash is void of liquid pollutants such as chlorides and other solids. Soda ash is mostly used by glass, chemicals, soap & detergents, flue gas desulfurization (FGD), pulp & paper, and water treatment industries.

Soda ash plays a vital role in animal feed for nutrition, the product is used as a diary-based cow feed supplement. The product is also preferred as an alternative to salt in poultry food owing to its ability to manage litter while providing a healthier living ambiance.

The U.S. trona market is expected to grow in the coming years owing to the upward shift in demand for products from industries such as the chemical, oil & gas, and glass sectors. The cement industry emerged as a steady consumer of trona owing to its utilization in cement kilns as well as to controlling cement contamination.

The chemical industry in the U.S. is witnessing growth in demand over the past few years owing to the increasing investment in construction activities across the country. The cement industry is regulated under various standards such as National Emission Standards for Hazardous Air Pollutants from Portland Chemicals Manufacturing Industry (PC MACT), Commercial and Industrial Solid Waste Incinerator (CISWI), New Source Performance Standards, Boiler MACT, etc.

Increasing industrial activities across the region along with the suitability and comparatively low cost of soda ash in comparison to other available alternatives are likely to develop the product demand across the country. Currently, China and India are two major competitors for the U.S. in the production of synthetic soda ash from natural trona.

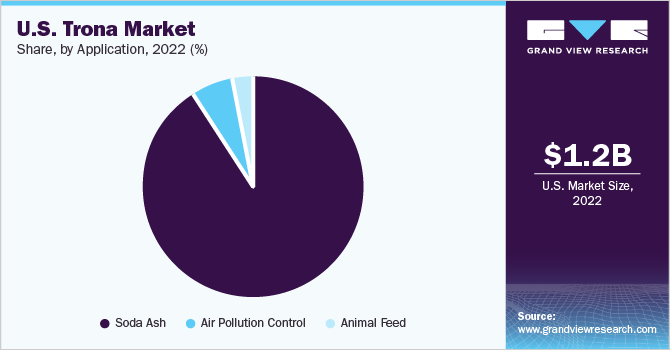

Application Insights

The soda ash segment accounted for the largest revenue share of 90.6% in 2022. Soda ash production emerged as the largest application segment for the market. Soda ash is extensively used in glass manufacturing, water treatment, pulp and paper, and chemical industries. The rapid growth of the chemical industry along with the expansion of soda ash production facilities has majorly contributed to the product demand.

Trona is also used in animal feed for dietary buffers for mitigating the metabolic disorder problems linked with high-concentration diets and the segment is expected to grow with a CAGR of 3.2% over the forecast period. The inclusion of such a product in the proper feed program for cattle has proved to increase the quality and production of milk. The rising use of trona as a rumen buffer for cows in the dairy industry is projected to augment the product demand in the animal feed application segment.

Trona is used in various industries, such as waste incineration, cement production, gold, and other precious metal refining, and coal-fired electric power generation to effectively remove acid gases including oxides of Sulphur (SO2 and SO3), Hydrofluoric acid (HF), and Hydrochloric acid (HCL) from flue gas emission.

The application of powdered trona for Flue Gas Desulphurization (FGD) through Dry Sorbent Injection (DSI) systems has gained widespread acceptance. Its use enables industrial plants to meet Mercury and Air Toxic Standards (MATS) and Cross-State Air Pollution Rule (CSAPR). Strict government regulations to control air pollution are also anticipated to propel the product demand over the forecast period.

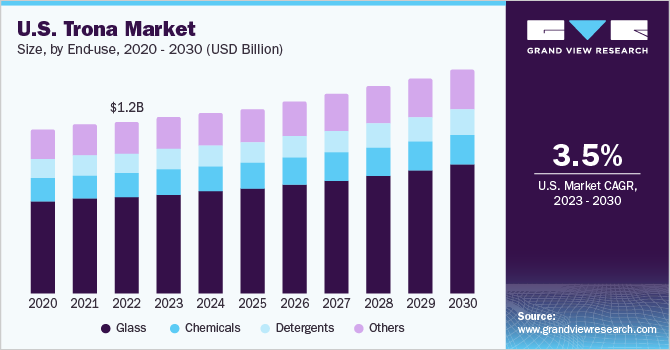

End-use Insights

The glass segment accounted for the largest revenue share of 56.3% in 2022 and is expected to grow at a CAGR of 3.8% during the forecast period. In the U.S., more than half of the soda ash produced from trona is used in glass manufacturing. Increasing demand for glass from major industries, such as construction and automotive, is estimated to drive the market. Robust growth of the glass container manufacturing industry is also likely to further contribute to the market. Product demand in the steel industry is likely to increase on account of wide usage of soda ash as a de-phosphorizer, dentrider, de-sulfurizer, and flux.

Its typical usage in blast furnaces includes the removal of sulfur from iron ore. Soda ash also provides fluidity to slag, which enables the blast furnace to operate continuously without aberration and flaws. Furthermore, it also helps reduce the operational and manufacturing costs of steel manufacturing. Soda ash also has a high demand for waste management applications. It is widely used in the treatment of gaseous and aqueous emissions.

Rising industrial activities across the country along with the low cost of the product than other alternatives for waste management are expected to propel the demand further. Dry and wet scrubbing systems are the types of technologies used in air pollution control. Comparing both systems, the dry scrubbing system has advantages regarding installation costs, ease of retrofit, and maintenance complexity.

Key Companies & Market Share Insights

The market competition is based on several factors, such as favorable logistics, consistent customer service, and prices. Manufacturers are focused on developing mining and processing techniques for cost-effective production and recovery of the minerals. American Natural Soda Ash Corporation (ANSAC) holds great significance in the industry. Being a non-profit foreign sales association, it supports its members in the sale and export of mined products. Some of the major companies in the U.S. trona market include:

-

Genesis Energy, LP

-

FMC Corporation

-

Tata Chemicals Ltd.

-

Ciner Resources LP

-

Solvay

-

Tata Chemicals Ltd.

-

Searless Valley Minerals, Inc.

-

TRInternational.

Recent Development

-

In November 2022, Solvay announced that it would resume its soda ash plant construction with a 600 kT capacity in Green River, Wyoming, U.S. The plant is expected to start production towards the end of 2024 strengthening the company’s standing in the segment.

-

In November 2022, Kew Soda Ltd. declared that it would invest USD 4 billion in Project West, a greenfield project in Wyoming, U.S. The move is expected to add a capacity of 6 million metric tons per annum by 2030.

-

In March 2023, Orion Resource Partners sold a minority share in Sweetwater Royalties, a company specializing in industrial minerals. The stake was sold to the Ontario Teachers' Pension Plan, representing 25% of the company's equity and yielding a total of USD 221.6 million.

U.S. Trona Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.58 billion

Growth rate

CAGR of 3.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use

Country scope

U.S.

Key companies profiled

Genesis Energy, LP; FMC Corporation; Tata Chemicals Ltd.; Ciner Resources LP; Solvay; Tata Chemicals Ltd. ; Searles Valley Minerals, Inc.; TRInternational

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Trona Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. trona market based on application and end-use:

-

Application Outlook (Volume in Kilotons, Revenue in USD Million, 2018 - 2030)

-

Soda Ash

-

Animal Feed

-

Air Pollution Control

-

-

End-use Outlook (Volume in Kilotons, Revenue in USD Million, 2018 - 2030)

-

Glass

-

Chemicals

-

Detergents

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. trona market size was estimated at USD 1.21 billion in 2022 and is expected to reach USD 1.24 billion in 2023.

b. The U.S. trona market is expected to grow at a compound annual growth rate of 3.5% from 2023 to 2030 to reach USD 1.58 billion by 2030.

b. Soda ash dominated the U.S. trona market with a share of 90% in 2022. This is attributable to chemical industry growth along with expansion of soda ash production facilities.

b. Some key players operating in the U.S. trona market include Genesis Energy L.P.; FMC Corp.; Tata Chemicals Ltd.; Ciner Resources LP; Solvay SA; and TRInternational, Inc.

b. Key factors that are driving the market growth include rising need for flue-gas desulfurization (FGD) systems and demand from various countries for the purest form of natural soda ash.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.