- Home

- »

- Medical Devices

- »

-

U.S. Urinary Catheters Market Size, Industry Report, 2030GVR Report cover

![U.S. Urinary Catheters Market Size, Share & Trends Report]()

U.S. Urinary Catheters Market (2024 - 2030) Size, Share & Trends Analysis Report By Product Type (Intermittent Catheters, Foley/Indwelling Catheters, External Catheters), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-236-7

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Urinary Catheters Market Size & Trends

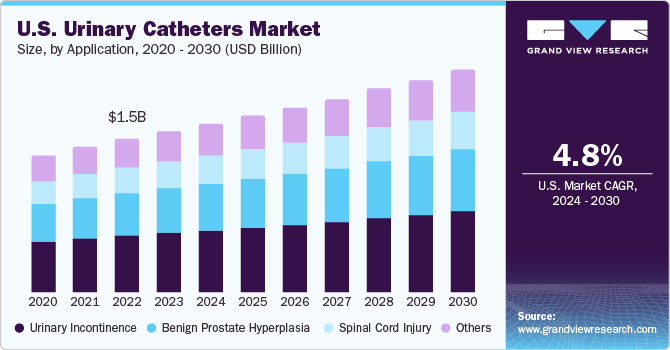

The U.S. urinary catheters market size was estimated at USD 1.66 billion in 2023 and is expected to grow a CAGR of 4.78% from 2024 to 2030. The demand for urinary catheters is projected to rise due to the growing prevalence of urinary incontinence, neurogenic bladder, and increasing spinal cord injuries. Moreover, an aging population and supportive reimbursement policies contribute to this increase in demand.

U.S. urinary catheter market accounts for around 30.0% in the global urinary catheter market. Urinary catheter usage varies among genders, age groups, settings, and specialties. Generally, males, younger individuals, hospital critical care units, and patients undergoing endourological surgeries have higher usage rates. Factors contributing to this variation include:

-

A high prevalence of prostate cancer in males

-

Increasing urinary incontinence cases.

-

A growing number of surgical procedures

Launched in 2001, the CDC's Urologic Diseases in America project revealed that Americans spend approximately USD 11.0 billion annually on medical care for urologic diseases, underscoring the substantial financial burden linked to these health issues.

The market growth for urinary catheters is expected to be fueled by the rising incidence of chronic kidney diseases and urological disorders, highlighting their significance in addressing diverse health concerns. Healthcare-associated UTIs are a considerable concern, with an estimated 139,000 catheter-related UTIs occurring annually, according to the NCBI. These infections contribute to higher morbidity, mortality, and healthcare expenses. Risk factors for UTIs in catheter users involve longer catheterization duration, being female, older age, and not employing a closed drainage system.

Advancements in urinary catheter offerings are anticipated to fuel market growth. Notable examples include coated catheters that combine medical devices with medicinal substances, providing extra benefits and enhancing patient outcomes. Another focus has been developing indwelling urethral catheters, such as Foley catheters, commonly utilized in various clinical scenarios like urinary retention, immobilized patients, and critically ill patients needing frequent urine output measurements. The continuous progression of urinary catheter technologies reflects a commitment to enhancing patient care and reducing complications related to catheterization procedures.

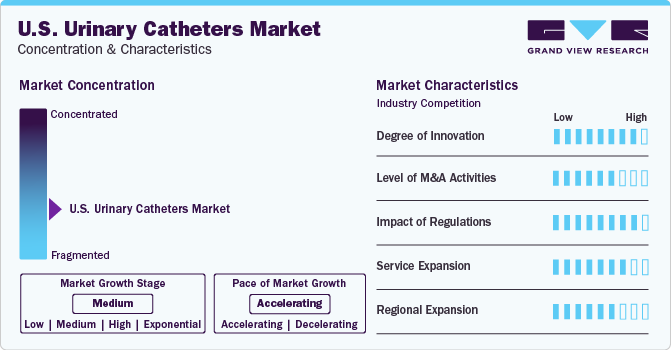

Market Concentration & Characteristics

In the U.S., advancements in urinary catheters have been substantial. Innovations include antimicrobial coatings and material modifications to reduce catheter-associated infections and are driving industry research, development, and collaborations. In March 2023, the American Urological Association selected ten companies for its first Innovation Nexus Showcase after a competitive process. This event provided researchers, startups, and mid-sized firms with a platform to present their urology-related innovations to potential investors.

The industry is marked by substantial mergers and acquisitions, which highlight its dynamic nature and strategic initiatives among key players. In January 2024, medical device company Boston Scientific announced its acquisition of Axonics Inc. to enter the sacral neuromodulation sector, a minimally invasive treatment for overactive bladder and fecal incontinence.

According to the U.S. Food and Drug Administration (FDA), urinary catheters fall under the class II category, which determines special controls. Manufacturers are focusing on research and development and FDA approvals of urinary catheters with advanced features to avoid complications associated with urinary catheter insertion. For instance, in December 2023, Medtronic received FDA approval for its innovative PulseSelect Pulsed Field Ablation System to treat atrial fibrillation. This approval marked the first PFA technology in the U.S. and followed the European CE Mark in November.

In July 2023, Teleflex, Inc. revealed its intention to acquire Palette Life Sciences, a company focused on gel-based solutions for urological disorders, for $600 million, reflecting the industry’s response to the growing prevalence of urological diseases and the increasing geriatric population, fostering innovation and product development in the industry.

In December 2023, Bactiguard Holding AB and Becton Dickinson & Company (BD) formed an exclusive global license for Bactiguard-coated Foley catheters, bolstering their partnership. This move supported the industry by offering sales exclusivity for Foleys and mitigating supply disruptions for distributors and customers, while Bactiguard focused on other aspects of its business.

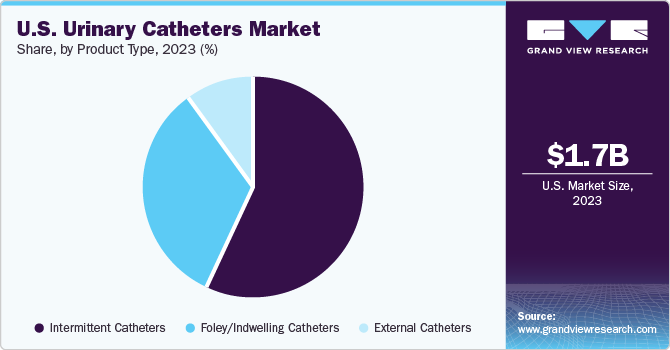

Product Type Insights

Intermittent catheters led the market in 2023, accounting for over 55.0% of the revenue share. Indwelling catheters are not commonly used as they can often result in UTIs. On the other hand, intermittent catheters are preferred due to their lower risk of infection. Moreover, the fact that Medicaid and Medicare programs offer reimbursement for these catheters has contributed significantly to their widespread use and popularity in the market.

External catheters are anticipated to register the fastest growth from 2024 to 2030. As these catheters are worn outside the body, they present a lower risk of urethra damage due to frequent catheterization than intermittent ones. The increasing instances of urinary incontinence contribute to the segment’s growth, as external catheters are widely applicable in such cases. Moreover, their noninvasive nature, in contrast to other types, fosters the expansion of this segment within the market.

Application Insights

Urinary incontinence is identified to account for the largest application of urinary catheters in 2023, occupying nearly 38.0% of the revenue share generated. The National Association for Continence states that in the U.S., around 25 million people suffer from some form of incontinence, with 75% to 80% of the female population. With the rise in sedentary lifestyles and the geriatric population, the incidence of this condition has seen a rise, increasing the requirement for urinary catheters catering to patients afflicted with the condition.

Benign prostate hyperplasia finds increasing usage of urinary catheters and is expected to grow fastest over the forecast period. Benign Prostatic Hyperplasia (BPH), a common issue among aged individuals, causes urinary retention and affects over 50-year-old men. Catheterization helps with bladder emptying. Transurethral methods are used to treat severe cases, with around 150,000 U.S. men undergoing surgeries yearly. Rising BPH prevalence, demand for urinary retention treatment, and growing awareness about its impact on quality of life drive the urinary catheters market.

Key U.S. Urinary Catheters Company Insights

The market is fragmented, marked by constant strategic collaborations and mergers & acquisitions to move closer to consolidation. Key U.S. urinary catheter market companies include Hollister, Inc.; Medtronic PLC; Boston Scientific Corp.; BD (C.R. Bard, Inc.); Cook Medical; ConvaTec, Inc.; and Teleflex, Inc.

Players in the U.S. urinary catheters market are undertaking various strategic initiatives to strengthen their product portfolios, broaden their market strength, and offer their customers diverse, technologically advanced, and innovative products.

Key U.S. Urinary Catheters Companies:

- Hollister, Inc.

- Medtronic PLC

- Boston Scientific Corp.

- BD (C.R. Bard, Inc.)

- Cook Medical

- ConvaTec, Inc.

- Teleflex, Inc.

- Coloplast

- B. Braun Melsungen AG

- Medline Industries, Inc.

- J and M Urinary Catheters LLC

- Edwards Lifesciences Corporation

- Abbott Laboratories

Recent Developments

-

In January 2024, Boston Scientific Corporation received FDA approval for the FARAPULSE™ Pulsed Field Ablation (PFA) System, offering an innovative alternative to standard-of-care thermal ablation treatment for drug-refractory, recurrent, symptomatic paroxysmal atrial fibrillation patients.

-

In September 2023, Cook Medical partnered with Bedal International, specializing in catheter securement devices under the FlexGRIP brand. This collaboration introduced FlexGRIP devices to Cook’s portfolio of percutaneous drainage products, which became accessible to Cook’s customers in Europe, Canada, and the United States.

-

In August 2023, Boston Scientific Corporation received FDA approval for the POLARx™ Cryoablation System, which offers adjustable balloon sizes (28 and 31mm) in a single device, addressing the limitations of previous cryoablation systems.

U.S. Urinary Catheters Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 2.30 billion

Growth rate

CAGR of 4.78% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product type, application

Country scope

U.S.

Key companies profiled

Hollister, Inc.; Medtronic PLC; Boston Scientific Corp.; BD (C.R. Bard, Inc.); Cook Medical; ConvaTec, Inc.; Teleflex, Inc.; Coloplast; B. Braun Melsungen AG; Medline Industries, Inc.; J and M Urinary Catheters LLC; Edwards Lifesciences Corporation; Abbott Laboratories

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Urinary Catheters Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. urinary catheters market report based on product type, and application:

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Intermittent Catheters

-

Foley/Indwelling Catheters

-

External Catheters

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Benign Prostate Hyperplasia

-

Urinary Incontinence

-

Spinal Cord Injury

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. urinary catheter market size was estimated at USD 1.66 billion in 2023 and is expected to reach USD 1.7 billion in 2024.

b. The U.S. urinary catheter market is expected to grow at a compound annual growth rate of 4.78% from 2024 to 2030 to reach USD 2.30 billion by 2030.

b. The intermittent catheters segment led the market in 2023 and accounted for the largest revenue share . An intermittent catheter is a medical device used to empty the bladder. It offers an effective solution to a continuously draining catheter. Intermittent catheterization is the gold standard of emptying the bladder in patients suffering from spinal cord lesions and neurogenic bladder problems.

b. Some prominent players in the global urinary catheters market include Hollister, Inc., Medtronic PLC, Boston Scientific Corp., BD (C.R. Bard, Inc.), Cook Medical, ConvaTec, Inc., Teleflex, Inc., Coloplast, B. Braun Melsungen AG, Medline Industries, Inc.

b. An increase in the number of patients suffering from Urinary Tract Infections (UTIs) and blockages in the urethra, rising cases of tumors in the urinary tract or reproductive organs, and the rapidly growing geriatric population are some of the key factors driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.