- Home

- »

- Medical Devices

- »

-

U.S. Vascular Grafts Market Size, Industry Report, 2030GVR Report cover

![U.S. Vascular Grafts Market Size, Share & Trends Report]()

U.S. Vascular Grafts Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Hemodialysis Access Grafts, Endovascular Stent Grafts), By Application (Cardiac Aneurysm, Kidney Failure, Vascular Occlusion), By Raw Material, And Segment Forecasts

- Report ID: GVR-4-68040-218-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Vascular Grafts Market Size & Trends

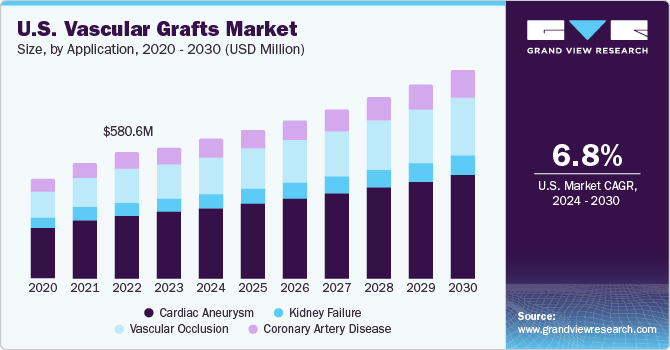

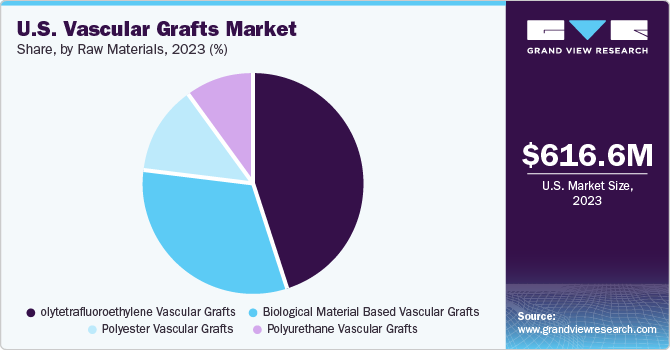

The U.S. vascular grafts market size was valued at USD 616.6 million in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2030. Key factors driving market growth include the increasing prevalence of cardiovascular diseases, diabetes, and end-stage renal disease. A rise in the number of people suffering from these conditions is expected to boost the demand vascular grafts in the coming years. Moreover, development of novel technologies, such as tissue-engineered materials, is expected to boost market revenue over the forecast period.

There is a high burden of CVDs in the region owing to the aging population and unhealthy lifestyle. Economic development and the presence of advanced research centers, hospitals, medical device manufacturers, & universities are among the key factors boosting development and commercialization of new products in this region. The presence of a supportive reimbursement framework and sophisticated health infrastructure is also expected to contribute to market growth.

CVDs are the leading cause of death in Americas. As per CDC estimates, per year nearly, 1% or about 40,000 births are affected by Congenital Heart Defects (CHDs) in the U.S. The most common type of heart defect across the world is ventricular septal defect. The growing prevalence of heart diseases in the region, advancements in technologies & procedural techniques, and growing preference for minimally invasive surgeries are some of the factors further propelling the market growth.

Ongoing research activities about the modification of ePTFE vascular grafts with O-carboxymethylchitosan, which enhances the hydrophilicity of ePTFE grafts, are expected to drive the demand for prosthetic grafts. Supportive reimbursement policies for vascular surgeries, increase in patient spending power, and a rise in the demand for advanced vascular grafts are anticipated to create lucrative growth opportunities over the forecast period.

Market Concentration & Characteristics

The market growth stage is moderate and the pace of the market growth is accelerating. The market is concentrated due to the presence of prominent industry players holding most of the shares. With several innovations, partnerships, and R&D activities, the market is projected to witness a considerable amount of growth and expansion.

The market is currently experiencing a phase of rapid growth. Advancements in the fields of molecular chemistry, cell biology, clinical pharmacology, and vascular surgery had a significant impact on the growth of the cardiovascular repair and reconstruction devices market. Technology has been a key factor in market growth and expansion. Technological advancements have a multidimensional impact on the development of new products, product design, raw material sourcing, raw material fabrication, clinical evaluation, preservation solutions, and preservation techniques.

Partnerships, collaborations, and mergers & acquisitions are among the key strategies adopted by these players to gain a competitive edge in the market. Big companies usually acquire or collaborate with potential start-ups to minimize the threat of new entrants. For instance, in November 2019, Terumo Corporation announced the acquisition of Aortica Corporation. The acquisition was aimed at supporting growth of the company’s vascular grafts business and contributing toward personalized aortic therapy.

The presence of stringent regulations for medical devices approvals is increasing the challenge for the new manufacturers. Various acts of the U.S. FDA, such as section 361 of Public Health Services Act, serve as strength for this market because they regulate human cellular and tissue products to prevent spread of several communicable diseases, such as HIV-1 & 2, thus, improving the overall treatment scenario. The requirement of state licensing, which governs transportation, storage, and preservation of human organ & tissue, is one of the weaknesses of biological cardiovascular products, such as biological grafts and patches. This is hampering the entry of smaller market players in the U.S.

Growing R&D activities by key companies to expand their applications is one of the key strengths of this market. The market players are making huge investments in identifying new market opportunities for product development & enhancement and are also acquiring third-party technologies, which is expected to drive this market over the forecast period. Several products in the company pipeline and products under pre-market approval process are expected to propel the market growth over the forecast period.

Application Insights

The cardiac aneurysm market led the vascular grafts market with a revenue share of 51.0% in 2023. This can be attributed to an increase in the prevalence of cardiovascular diseases and improvements in the development of advanced tissue-engineered grafts for pediatric congenital heart surgeries. Furthermore, the market is expected to grow during the forecast period due to key factors such as the development of novel prosthetic grafts with improved porosity & efficiency coupled with growing acceptance of these grafts. The increasing prevalence of unruptured saccular aneurysms, affecting the flow of intracranial arteries, is expected to boost the market for vascular grafts over the forecast period.

The vascular occlusion segment is expected to witness the highest growth over the forecast period. The increasing prevalence of vascular occlusive diseases and easy availability of graft procedures, especially the saphenous vein graft, are expected to drive the demand for vascular grafts during the forecast period. Technological advancements resulting in the development of novel therapies, such as warfarin, which help reduce the severity of acute ischemia after occlusion of PTFE grafts, are anticipated to minimize the risks associated with prosthetic vascular grafts. This, in turn, is expected to drive the adoption of vascular grafts during the forecast period.

Raw Materials Insights

The polytetrafluoroethylene (PTFE) vascular grafts segment led the vascular grafts market with a revenue share of 45.5% in 2023. Key factors responsible for the largest share include rising demand for novel engineered prosthetics and technologically advanced products. Furthermore, low risk of degradation and infection due to polytetrafluoroethylene grafts is a key factor contributing to the largest share of this segment. PTFE is made using a technologically sophisticated design that results in low blood loss and high delamination resistance, also used in extra anatomical procedures and peripheral bypasses. Hence, these vascular grafts are anticipated to gain more market share during the forecast period.

The polyester vascular grafts segment is expected to witness considerable growth over the forecast period. Easy availability of raw materials, high tensile strength, and durability are key factors that can be attributed to its market share. Furthermore, extensive use of Dacron durable polyester incorporated with mitogenic properties and an increasing number of clinical trials for the development of highly durable polyester grafts are expected to drive the market growth over the forecast period.

Product Insights

The endovascular stent grafts segment led the vascular grafts market with a revenue share of 64.20% in 2023. This can be attributed to the increasing number of abdominal aortic aneurysm procedures with less potential for access-site complications. Furthermore, the reduced mortality rate associated with this treatment and technological advancements in novel product development are among the factors expected to positively influence market growth during the forecast period. In addition, these stent-grafts, in combination with antibiotics, can be used as an alternative for the treatment of mycotic aneurysms. As open surgeries consume longer time and there is excessive blood loss associated with them, minimally invasive endovascular stent grafts are expected to gain momentum during the forecast period.

The peripheral vascular grafts segment is expected to witness considerable growth over the forecast period. The market for peripheral vascular grafts is mainly driven by a wide number of medical applications and improvements in the development of intraoperative techniques. The rising prevalence of Peripheral Artery Diseases (PADs) is one of the key factors that can be attributed to market growth. Technological advancements in the development of novel products for the treatment of PAD are anticipated to drive demand for peripheral vascular grafts during the forecast period.

Key U.S. Vascular Grafts Company Insights

Medtronic, Terumo Corporation, BD, and Abbott are some of the prominent companies in U.S. vascular grafts market. These key players are identified based on their product portfolios, revenues, collaborations, and other strategic initiatives adopted by them.

The increasing use of vascular grafts in primary heart care is expected to boost the regional market. Key players are investing and expanding their businesses in the region, boosting regional market growth. This is attributed to several factors, such as increased adoption of such devices, rising technological advancements, and increased product launches by the key players operating in the market.

Key U.S. Vascular Grafts Companies:

- Medtronic

- Terumo Corporation

- LeMaitre Vascular, Inc.

- Getinge AB

- BD (Becton Dickinson)

- Abbott

- B. Braun Melsungen AG.

- Abbott

- W. L. Gore and Associates, Inc.

- MicroPort Scientific Corporation

- Endologix

Recent Developments

-

In February 2024, Gore announced its FDA approval of a new lower-profile VBX stent graft. The device is combined with flexibility strength and deployment accuracy to treat the most complex cases

-

In October 2023, Marizyme, Inc. announced the receiving of clearance from the FDA for its first-in-class product, DuraGraft for use as a vascular conduit solution indicated for adult patients undergoing Coronary Artery Bypass Grafting (CABG) surgeries. It is intended for the flushing and storage of the saphenous vein grafts used in CABG surgery

-

In March 2021, Vascular Grafts Solutions Ltd. received FDA clearance for a new device called Viola for clampless proximal anastomosis in coronary artery bypass grafting (CABG)

U.S. Vascular Grafts Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 655.6 million

Revenue forecast in 2030

USD 970.7 million

Growth rate

CAGR of 6.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million, number of patients treated in thousands, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Application, Raw Material

Country scope

U.S.

Key companies profiled

Medtronic, Terumo Corporation, LeMaitre Vascular, Inc., Getinge AB, BD (Becton Dickinson), Abbott, B. Braun Melsungen AG., W. L. Gore and Associates, Inc., MicroPort Scientific Corporation, Endologix

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Vascular Grafts Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. vascular grafts market report based on product, application, and raw material:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hemodialysis Access Grafts

-

Endovascular Stent Grafts

-

Coronary Artery By-Pass Grafts

-

Vascular Grafts for Aorta Disease

-

Peripheral Vascular Grafts

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiac Aneurysm

-

Endovascular Stent Graft

-

Vascular Graft

-

-

Kidney Failure

-

Vascular Occlusion

-

Coronary Artery Disease

-

-

Raw Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Synthetic Vascular Grafts

-

Polytetrafluoroethylene (PTFE) Grafts

-

Polyester Grafts

-

Polyurethane Grafts

-

-

Biological Vascular Grafts

-

Autografts

-

Allografts

-

Xenografts

-

-

Hybrid Vascular Grafts

-

Frequently Asked Questions About This Report

b. The U.S. vascular grafts market size was valued at USD 616.6 million in 2023 and is expected to reach USD 655.6 million in 2024.

b. The U.S. vascular grafts market is expected to grow at a CAGR of 6.8% from 2024 to 2030 to reach USD 970.7 million by 2030.

b. The endovascular stent grafts segment led the vascular grafts market with a revenue share of 64.20% in 2023. This can be attributed to the increasing number of abdominal aortic aneurysm procedures with less potential for access-site complications.

b. Medtronic, Terumo Corporation, BD, and Abbott are some of the prominent companies in U.S. vascular grafts market. These key players are identified based on their product portfolios, revenues, collaborations, and other strategic initiatives adopted by them.

b. Key factors driving market growth include the increasing prevalence of cardiovascular diseases, diabetes, and end-stage renal disease. A rise in the number of people suffering from these conditions is expected to boost the demand vascular grafts in the coming years.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.