- Home

- »

- Network Security

- »

-

V2X Cybersecurity Market Size, Share, Industry Report, 2030GVR Report cover

![V2X Cybersecurity Market Size, Share & Trends Report]()

V2X Cybersecurity Market (2025 - 2030) Size, Share & Trends Analysis Report By Unit (On-board Units, Roadside Units), By Connectivity (DSRC, Cellular), By Communication, By Propulsion, By Vehicle, By Security, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-140-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

V2X Cybersecurity Market Summary

The global V2X cybersecurity market size was estimated at USD 2.80 billion in 2024 and is projected to reach USD 7.97 billion by 2030, growing at a CAGR of 19.1% from 2025 to 2030. The market growth is attributed to rapid technological advancements in vehicle-to-everything technologies, rising cyberattacks on vehicles, and increasing public & private investment to propel the digitization in the automobile industry.

Key Market Trends & Insights

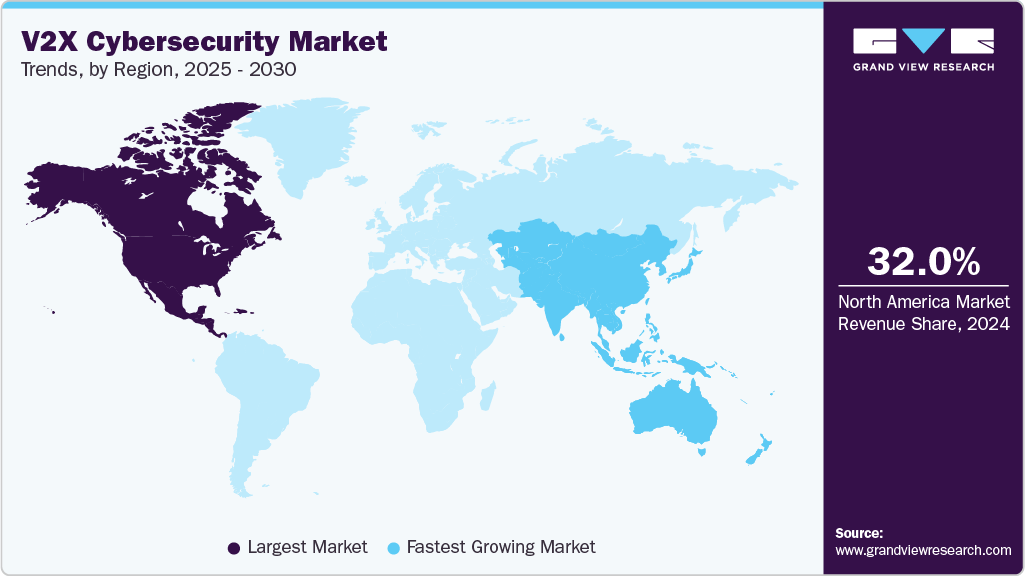

- North America V2X cybersecurity industry held the largest global revenue share of over 32.0% in 2024.

- The V2X cybersecurity industry in the U.S. is expected to register a notable CAGR from 2025 to 2030.

- By unit, the on-board units segment dominated the market in 2024 and accounted for a revenue share of over 59.0%.

- By connectivity, the DSRC segment accounted for the largest revenue share in 2024, contributing over 64.0% of the overall revenue.

- By communication, the Vehicle-to-Vehicle(V2V) segment accounted for the largest revenue share of over 33.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.80 Billion

- 2030 Projected Market Size: USD 7.97 Billion

- CAGR (2025-2030): 19.1%

- North America: Largest market in 2024

In addition, end users emphasize connected technology in cars, extensive portfolio of cybersecurity solutions by market players, and notable penetration of advanced analytics in the automobile industry is further anticipated to propel the growth of the vehicle-to-everything (V2X) cybersecurity industry. Vehicle-to-everything is a communication ecosystem enabling vehicles to securely communicate with infrastructure, road users, and other vehicles for energy savings, traffic efficiency, and improved road safety. In addition, the V2X technology-equipped vehicles use radio modules to exchange messages such as location, speed, position, and other kinematic data with connected vehicles or users. Moreover, to avoid data loss, this technology requires a security solution that securely transmits messages to the authorized user, creating a positive outlook for the vehicle-to-everything cybersecurity market. Further advancements in various V2X components, such as vehicle-to-device (V2D) communication systems, vehicle-to-grid (V2G), and vehicle-to-infrastructure (V2I), are fueling the expansion of V2X cybersecurity market.

Various country’s governments, such as the U.S., India, China, Brazil, Norway, South Africa, and Australia, are taking supportive initiatives to improve the connected vehicle infrastructure, thereby supporting the market growth. For instance, in April 2022, the government of the U.S. announced an investment of USD 6.4 billion over five years to support the V2X infrastructure projects and reduce greenhouse gas emissions across the U.S. With this investment, various state departments, such as the Colorado Department of Transportation, Tampa Hillsborough Expressway Authority, among others, will deploy advanced V2X and V2X cybersecurity solutions across the states in the next five years.

The growing investment in developing the connected vehicle infrastructure is creating a favorable environment for the market. The companies offering connected vehicle solutions are adopting strategic initiatives that are expected to propel the growth of the vehicle-to-everything cybersecurity industry. For instance, in August 2024, Salesforce, Inc. launched Connected Vehicle, a new Automotive Cloud app that helps automakers quickly deliver personalized driving experiences. It features a unified console, low-code tools, and bidirectional over-the-air (OTA) updates for seamless cloud-vehicle data sharing and software updates.

The growing demand for V2X cybersecurity solutions encourages various market players to invest in R&D for new solution development and maximize their profits from this potential market. For instance, in April 2025, BMW launched the new 5 Series in China, its first model equipped with V2X technology developed by JOYNEXT, a German AutoTech company. It highlights BMW’s efforts to advance intelligent connectivity and reinforces its commitment to deeper local collaboration and innovation in China's automotive ecosystem.

Unit Insights

The on-board units segment dominated the market in 2024 and accounted for a revenue share of over 59.0%. The on-board units are sleek and sophisticated in design, ensuring robust connectivity of Vehicle to Infrastructure (V2I) and creating a seamless driving experience for users. The on-board units are quick & easy to deploy, and they assist in setting up end-to-end applications for personal stations (mobile devices) and roadside stations, which ensures secured communication between them and central Intelligent Transportation System (ITS) stations, creative significant opportunities in the V2X cybersecurity market.

The Roadside Units (RSUs) segment is expected to register a CAGR of 18.0% over the forecast period. The growth of the roadside units can be attributed to the RSUs' assistance in improving safety & emergency response, smooth traffic flow, and providing other additional services. The market players are developing RSU units integrated with enhanced cybersecurity solutions to secure data transfer and avoid loss.

Connectivity Insights

The DSRC segment accounted for the largest revenue share in 2024, contributing over 64.0% of the overall revenue. The DSRC segment's significant growth can be attributed to its low latency, high reliability, and ability to create very little interference in extreme weather conditions. Further, in DSRC, vehicles validate the authenticity of the received messages and immediately notify the driver or user if incoming messages are found suspicious, supporting the segment growth. The DSRC also provides a key foundation for V2I and Vehicle-to-Vehicle (V2V) safety by offering robust connectivity between users, creating a positive segment outlook in the V2X cybersecurity market.

The cellular segment is expected to register the fastest CAGR during the forecast period. The cellular segment is experiencing significant growth owing to technological advancements in automotive 5G infrastructure and market players’ initiatives to counter digital threats. Moreover, cellular connectivity has multiple benefits, such as long-range, real-time vehicle telematics and end-to-end remote monitoring & management of the automotive Internet-of-Things (IoT). Therefore, the factors above are projected to drive the growth of the cellular segment in the V2X cybersecurity market in the upcoming years.

Communication Insights

The Vehicle-to-Vehicle (V2V) segment accounted for the largest revenue share of over 33.0% in 2024. The V2V segment’s significant market share can be attributed to increasing usage of telematics systems in the vehicles and rising awareness among fleet companies for vehicle tracking and driver safety. Increasing hackers’ unauthorized entry through Electronic Control Units (ECUs), infotainment & telematics systems and On-Board Diagnostic (OBD) connectors is creating favourable environment for V2V cybersecurity solutions, driving the segment growth in V2X cybersecurity market growth.

The Vehicle-to-Grid (V2G) segment is expected to register the fastest CAGR from 2025 to 2030. The V2G segment is experiencing significant growth due to this technology's increasing adoption to enable electric vehicles to securely push back power to the grid. Increasing market players' focus on improving the efficiency of V2G technology is expected to create robust opportunities for segment growth in the vehicle-to-everything cybersecurity market. For instance, in December 2022, electric transmission & distribution company Oncor Electric Delivery (Oncor) collaborated with Toyota Motor North America for a pilot project to develop the V2G technology to support the Electric Vehicle (EV) charging ecosystem in the U.S.

Propulsion Insights

The Internal Combustion Engine (ICE) segment held the largest market share of around 60.0% in 2024. The significant market share can be attributed to the increasing usage of telematics in ICE vehicles to improve the driver’s safety by establishing connections with other safety & driver assistance systems. The V2X cybersecurity solutions ensure secure and accurate transmission of traffic information, route suggestions, and internal hazard warnings to the users, thereby creating robust opportunities for segment growth.

The electric & hybrid segment is anticipated to grow at the fastest CAGR during the forecast period. The segment growth can be attributed to the initiatives by market players to increase the productivity of electric & hybrid vehicles. For instance, in May 2023, infrastructure solution provider InCharge Energy launched a vehicle-to-everything DC charger range for electric vehicles. This charging management system enables fleet managers to digitally monitor, operate, and maintain their EV charging infrastructure, supporting segment growth.

Vehicle Insights

The passenger cars segment held the largest market share of over 68.0% in 2024 and is expected to maintain its dominance over the forecast period. The significant market share can be attributed to the increasing use of V2X cybersecurity solutions in hybrid and electric passenger cars. Increasing Channel Denial of Service (DoS), in which malicious bots intentionally disturb the electromagnetic channels used for V2X communication, is fueling the growth of the market for V2X cybersecurity in passenger cars.

The commercial vehicles segment is anticipated to register the fastest CAGR during the forecast period. The significant growth can be attributed to the initiatives by the governments of various countries to improve safety on the road using digital technologies. The governments are partnering with smart transportation solution providers for managing the Intelligent Transportation System (ITS) solutions, creating robust opportunities for the V2X cybersecurity market growth. For instance, in September 2023, the Florida Department of Transportation selected engineering services company Jacobs to operate and maintain the intelligent transportation systems for its division, Florida's Turnpike Enterprise. The company will manage, operate, and maintain the ITS system of more than 500 miles of connected highway across the state.

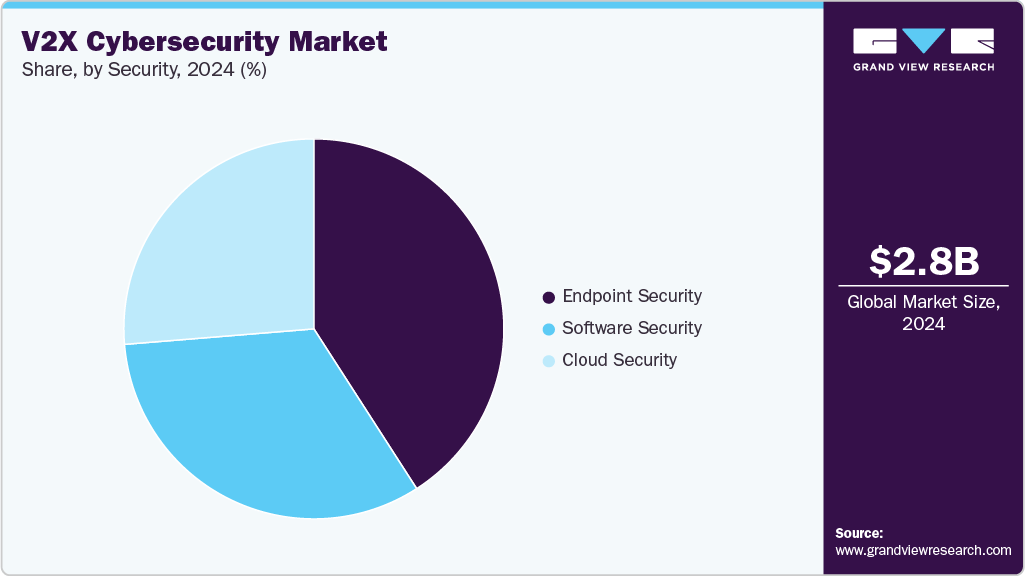

Security Insights

The endpoint security segment held the largest revenue share of over 40.0% of the overall market in 2024. Endpoint security provides policy-based network security, which requires the devices to comply with specific policies before gaining access to the network. The companies operating in the market are adopting various business strategies to advertise their endpoint security solutions, supporting the vehicle-to-everything cybersecurity market.

The cloud security segment is expected to register the fastest CAGR from 2025 to 2030. The rising adoption of cloud-based solutions in the market, owing to their various benefits, such as low operating costs, diverse product portfolios offered by market players, robust synchronization between connected devices or systems, and enhanced security, is creating a positive outlook for cloud security solutions in the market.

Regional Insights

North America V2X cybersecurity industry held the largest global revenue share of over 32.0% in 2024. In North America, the vehicle-to-everything cybersecurity industry is expanding owing to rapid technological advancements in the automotive sector, significant sales of autonomous cars, and supportive government initiatives for smart transportation systems.

U.S. V2X Cybersecurity Market Trends

The V2X cybersecurity industry in the U.S. is expected to register a notable CAGR from 2025 to 2030, driven by the rapid adoption of connected and autonomous vehicles and the increasing complexity of vehicular communication systems. In addition, the growth is driven by the rising number of cyber threats targeting connected vehicles, including hacking, unauthorized access, and data breaches, which pose critical safety and security risks. As vehicles increasingly communicate with each other, infrastructure, pedestrians, and networks, there is an urgent need for advanced cybersecurity solutions to protect data integrity and ensure safe transportation systems.

Europe V2X Cybersecurity Market Trends

The V2X cybersecurity industry in Europe is expected to register a CAGR of 19.4% from 2025 to 2030, driven by the increasing deployment of connected and autonomous vehicle technologies that require protection against rising cyber threats. The region benefits from a stringent regulatory environment and a well-established automotive industry, which promotes the adoption of advanced cybersecurity solutions to safeguard vehicular communications and infrastructure. Also, European initiatives such as Cooperative Intelligent Transport Systems (C-ITS) further support the integration of V2X technologies with robust security measures.

The UK V2X cybersecurity industry is expected to grow rapidly in the coming years, with growing investments in smart transportation infrastructure and connected vehicle technologies. UK-based automotive and technology companies are actively collaborating to develop and implement cybersecurity measures that protect V2X communications against rising cyber threats, in line with broader European cybersecurity standards and policies.

The Germany V2X cybersecurity industry held a notable market share in 2024, propelled by its leading automotive industry, with major manufacturers such as BMW, Audi, and Mercedes-Benz integrating advanced V2X cybersecurity features. Germany benefits from supportive government initiatives and regulations promoting Cooperative Intelligent Transport Systems (C-ITS), which foster the deployment of V2X technologies and the need for secure communication management.

Asia Pacific V2X Cybersecurity Market Trends

The Asia Pacific V2X cybersecurity industry is expected to register the fastest CAGR of 20.7% from 2025 to 2030, owing to the growing adoption of connected and autonomous vehicles alongside government initiatives promoting smart transportation and intelligent infrastructure. Countries in this region are investing heavily in the development of V2X technologies, supported by advancements in 5G networks and the integration of IoT devices, which enhance vehicle communication but also increase cybersecurity risks. The automotive manufacturing hubs in Asia Pacific offer significant opportunities for embedding advanced cybersecurity solutions during vehicle production, while smart city projects further drive demand for secure V2X communication systems.

China V2X cybersecurity industry is driven by the strong government backing through strategic initiatives aimed at intelligent vehicle innovation and development of wireless communication networks such as LTE-V2X. Chinese automakers are actively deploying connected vehicle technologies, supported by policies that promote widespread adoption of intelligent vehicles and integration of vehicle-road-cloud systems. This comprehensive approach accelerates the need for robust cybersecurity solutions to protect V2X communications against cyber threats.

India V2X cybersecurity industry is emerging as a promising market with increasing investments in smart mobility infrastructure and connected vehicle technologies. The growing automotive sector, combined with government efforts to enhance road safety and digital infrastructure, is creating a conducive environment for V2X cybersecurity adoption. Although challenges remain in terms of regulatory standardization and cybersecurity awareness, ongoing technological advancements and collaborations among industry players are expected to drive market growth.

Key V2X Cybersecurity Company Insights

Key players operating in the V2X cybersecurity industry are Continental AG, ETAS (ESCRYPT), Qualcomm Technologies, Inc., DENSO CORPORATION, Infineon Technologies AG, and others. Companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

-

In May 2025, NXP Semiconductors partnered with Drive TLV, a Tel Aviv-based firm for smart and sustainable mobility innovation, to drive forward advancements in next-generation automotive technologies. The collaboration focuses on accelerating developments in areas such as autonomous driving, radar systems, AI-powered automotive applications, and autonomous mobile robots (AMRs).

-

In November 2024,VicOne signed a memorandum of understanding (MOU) with Inventec Group to jointly enhance cybersecurity for smart in-vehicle cockpit systems. Under this collaboration, VicOne will supply its vulnerability scanning and software bill of materials (SBOM) management solution, xZETA, to strengthen the network security of Inventec’s in-vehicle systems and ensure compliance with the ISO/SAE 21434 standard.

-

In May 2024, Continental AG introduced a High-Performance Computer (HPC) cross-domain in a vehicle, integrating cockpit and driving safety functions. The demonstration vehicle uses Continental AG’s cloud-based Automotive Edge (CAEdge) platform to showcase the potential of software-defined vehicles (SDVs). This advancement is powered by Qualcomm Technologies’ Snapdragon Ride Flex SoC, which includes a pre-integrated Snapdragon Ride Vision perception stack.

Key V2X Cybersecurity Companies:

The following are the leading companies in the V2X cybersecurity market. These companies collectively hold the largest market share and dictate industry trends.

- Aptiv

- AUTOCRYPT Co., Ltd.

- Autotalks

- Continental AG

- DENSO CORPORATION

- ETAS (ESCRYPT)

- Green Hills Software

- HARMAN International

- ID Quantique

- Infineon Technologies AG

- Karamba Security

- Lear Corporation

- NXP Semiconductors

- Qualcomm Technologies, Inc.

- Vector Informatik GmbH

V2X Cybersecurity Market Report Scope

Report Attribute

Details

Market size in 2025

USD 3.32 billion

Revenue forecast in 2030

USD 7.97 billion

Growth rate

CAGR of 19.1% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Report updated

May 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Unit, connectivity, communication, propulsion, vehicle, security, and region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Argentina; UAE; Kingdom of Saudi Arabia (KSA); South Africa

Key companies profiled

Aptiv; AUTOCRYPT Co., Ltd.; Autotalks; Continental AG; DENSO CORPORATION; ETAS (ESCRYPT); Green Hills Software; HARMAN International; ID Quantique; Infineon Technologies AG; Karamba Security; Lear Corporation; NXP Semiconductors; Qualcomm Technologies, Inc.; and Vector Informatik GmbH;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global V2X Cybersecurity Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global V2X Cybersecurity market report based on unit, connectivity, communication, propulsion, vehicle, security, and region.

-

Unit Outlook (Revenue, USD Million, 2018 - 2030)

-

On-board Units (OSUs)

-

Roadside Units (RSUs)

-

-

Connectivity Outlook (Revenue, USD Million, 2018 - 2030)

-

Dedicated Short Range Communications (DSRC)

-

Cellular

-

-

Communication Outlook (Revenue, USD Million, 2018 - 2030)

-

Vehicle-to-Vehicle (V2V)

-

Vehicle-to-Infrastructure (V2I)

-

Vehicle-to-Grid (V2G)

-

Vehicle-to-Pedestrian (V2P)

-

Vehicle-to-Cloud (V2C)

-

-

Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

-

Internal Combustion Engine (ICE)

-

Electric & Hybrid

-

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

-

Security Outlook (Revenue, USD Million, 2018 - 2030)

-

Endpoint Security

-

Software Security

-

Cloud Security

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global V2X cybersecurity market size was estimated at USD 2.80 billion in 2024 and is expected to reach USD 3.32 billion by 2025.

b. The global V2X cybersecurity market is expected to grow at a compound annual growth rate of 19.1% from 2025 to 2030 to reach USD 7.97 billion by 2030.

b. The Vehicle-to-Vehicle (V2V) segment accounted for the largest revenue share of more than 33.0% in 2024. The V2V segment’s significant market share can be attributed to the increasing usage of telematics systems in vehicles and rising awareness among fleet companies for vehicle tracking and driver safety.

b. The key players operating in the V2X cybersecurity market include Aptiv, AUTOCRYPT Co., Ltd., Autotalks, Continental AG, DENSO CORPORATION, ETAS (ESCRYPT), Green Hills Software, HARMAN International, ID Quantique, Infineon Technologies AG, Karamba Security, Lear Corporation, NXP Semiconductors, Qualcomm Technologies, Inc., and Vector Informatik GmbH.

b. The considerable V2X cybersecurity market growth can be attributed to rapid technological advancements in vehicle-to-everything technologies, rising cyberattacks on vehicles, and increasing public & private investment to propel digitization in the automobile industry. Various country’s governments, such as the U.S., India, China, Brazil, Norway, South Africa, and Australia, are taking supportive initiatives to improve the connected vehicle infrastructure, thereby supporting the V2X cybersecurity market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.