- Home

- »

- Medical Devices

- »

-

Vaccine Delivery Devices Market Size, Industry Report, 2030GVR Report cover

![Vaccine Delivery Devices Market Size, Share & Trends Report]()

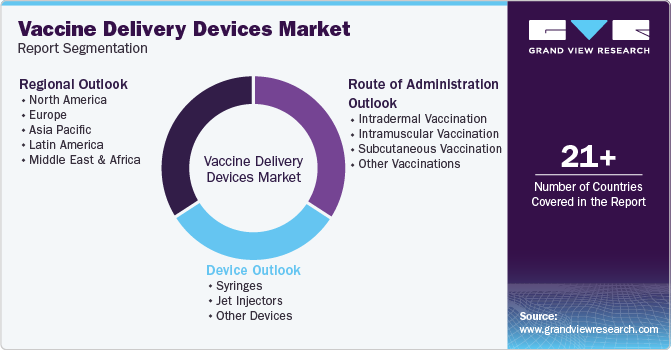

Vaccine Delivery Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Device (Syringes, Jet Injectors), By Route Of Administration (Intradermal Vaccination, Intramuscular Vaccination, Subcutaneous Vaccination), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-502-1

- Number of Report Pages: 170

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Vaccine Delivery Devices Market Summary

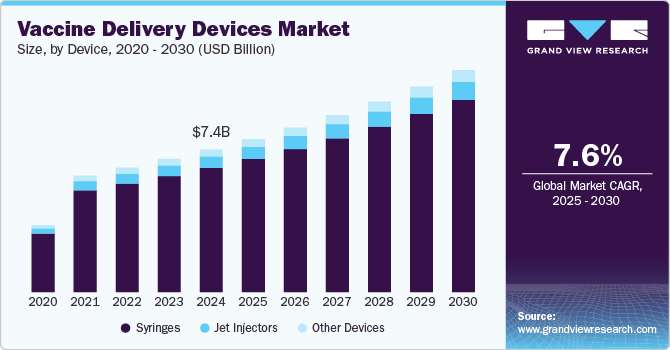

The global vaccine delivery devices market size was estimated at USD 7.4 billion in 2024 and is anticipated to reach USD 11.5 billion by 2030, growing at a CAGR of 7.6% from 2025 to 2030. Key devices include syringes, jet injectors, and microneedles designed for efficient, safe, and painless vaccine administration.

Key Market Trends & Insights

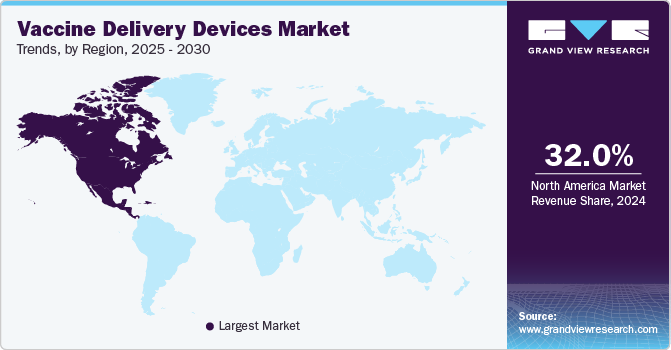

- North American vaccine delivery devices market held a dominant position, capturing 32.0% of the global revenue share in 2024.

- The vaccine delivery devices market in the U.S. held a significant share in 2024.

- Based on device, the syringes segment accounting for over 87.1% of the revenue share in 2024.

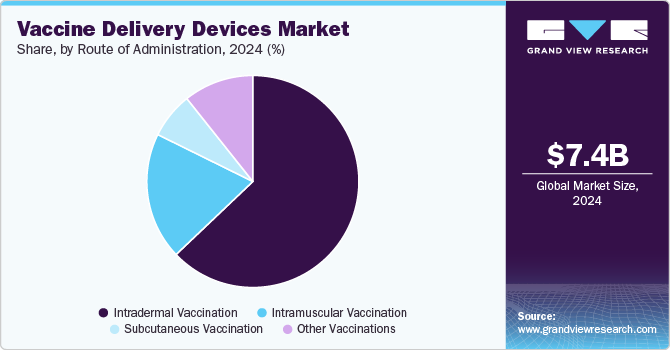

- Based on route of administration, the intradermal vaccination segment accounted for the largest revenue share of 62.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 7.4 Billion

- 2030 Projected Market Size: USD 11.5 Billion

- CAGR (2025-2030): 7.6%

- North America: Largest market in 2024

Growing immunization programs and their increasing coverage, development of novel vaccines, various campaigns and initiatives, growing research in the field of vaccination, and increasing government support and investment are some of the key factors that are contributing to the growth of the market. Biotech and pharmaceutical companies in partnership with governments across the globe are working towards the strategy for supply network disruptions in vaccine delivery and the development of effective vaccinations. In January 2022, to facilitate the urgency of transforming vaccine doses into protected and vaccinated communities, UNICEF, Gavi, and the WHO launched the COVID-19 Vaccine Delivery Partnership (CoVDP). The partnership was aimed at providing immediate operational support to 34 countries that had 10% or below vaccination coverage. Overall, the partnership targeted vaccine delivery and supply chain management for 92 countries. Increasing demand for the treatment of hepatitis A and B, meningitis, and influenza has propelled the market growth. In addition, the global surge in demand for COVID-19 vaccination provided a significant opportunity for the market. Overall, the COVID-19 epidemic had a positive impact on the market and is expected to further fuel growth due to the introduction of booster vaccination doses.

Increasing research and investment in the development of vaccines is also one of the key drivers of the market. The Canadian Institutes of Health Research Institute of Infection and Immunity supports and funds research activities aimed at reducing the burden of infectious diseases, allergies, and immune-mediated diseases. The institute invests around USD 1 million per year to support the research of hepatitis C, USD 45.7 million through partnerships for pandemic influenza research, and USD 22.5 million to support the CIHR HIV/AIDS Research Initiative.

Furthermore, technological advancements for the efficient delivery of vaccines are expected to propel market growth. The need for needle-free delivery of these products has risen owing to needle stick injuries, risk of infections due to the reuse of needles, and transmission of blood-borne infections due to improper sterilization of needles. The growing interest of key players and various international organizations and institutions in novel delivery technologies is also expected to drive the market in the future. For instance, in January 2022, Pfizer Inc. and Acuitas Therapeutics entered into a strategic partnership agreement to collaborate on the development of a lipid nanoparticle delivery system designed specifically for mRNA vaccines and therapeutics. This collaboration aims to leverage the expertise of both companies to enhance the delivery efficiency and effectiveness of mRNA-based treatments and vaccines.

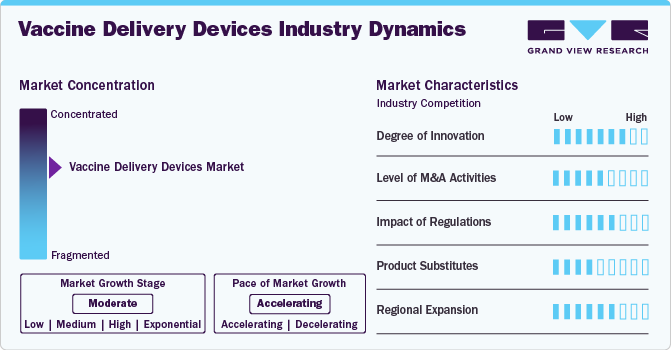

Market Concentration & Characteristics

The vaccine delivery devices industry is moderately fragmented, with key players such as Becton Dickinson, Gerresheimer, and SCHOTT leading alongside emerging innovators. It includes syringes, jet injectors and other devices, catering to diverse vaccine types. The industry's focus is on precision, safety, and ease of use, with features such as auto-disable mechanisms and dose accuracy gaining prominence. Growth drivers include rising immunization programs, demand for self-administration, and advancements in device technology. Regulatory compliance and eco-friendly designs are crucial, with single-use and recyclable devices gaining traction. Emerging markets and pandemic preparedness further shape the industry's dynamics, fostering innovation and global accessibility.

The degree of innovation in the vaccine delivery devices industry is significant, driven by advancements aimed at improving patient comfort, safety, and ease of use. Innovations include ultra-fine needles, shorter lengths for less discomfort, and designs that reduce the risk of intramuscular injections. Companies are focusing on features such as smoother, flatter needle bases for better skin contact and devices that prevent accidental needlestick injuries. For instance, in November 2024, evercare vaccine delivery devices were introduced as an innovative solution for type I diabetes patients. These needles offer enhanced comfort, reduce the risk of intramuscular injections, and minimize accidental needlestick injuries. Designed for ease of use, they feature a wider grip, making them particularly beneficial for elderly users.

Regulations in the vaccine delivery device industry ensure safety, efficacy, and quality, profoundly shaping device development and market dynamics. Regulatory bodies such as the FDA, EMA, and WHO establish stringent guidelines for manufacturing, sterilization, and biocompatibility. Compliance with ISO standards, such as ISO 11608 for needle-based systems, is essential for approval. These regulations also emphasize proper labeling, packaging, and safe disposal to minimize environmental impact. Stringent approval processes can delay market entry but drive innovation by encouraging advanced designs and safer materials. Emerging mandates on eco-friendly practices are spurring development of sustainable, recyclable, and single-use delivery devices for global health initiatives.

Mergers and acquisitions (M&A) in the vaccine delivery device industry have been growing as companies seek to expand their technological capabilities, product portfolios, and market presence. In August 2022, GSK plc has finalized the acquisition of Affinivax, Inc., a Cambridge-based clinical-stage biopharmaceutical company specializing in innovative vaccines. This acquisition supports GSK’s focus on expanding its portfolio of specialty medicines and vaccines. It includes AFX3772, a next-generation 24-valent pneumococcal vaccine in Phase II trials, and a 30-plus valent vaccine in preclinical development. Such strategic moves enable companies to improve operational efficiency and accelerate innovation, further driving competition and growth within the industry.

Product substitutes in the vaccine delivery devices industry include alternative methods such as oral vaccines, transdermal patches, and needle-free injection systems. These substitutes address challenges such as needle phobia, disposal of sharps, and the risk of needlestick injuries. Oral vaccines, for instance, eliminate the need for syringes, while transdermal patches offer painless delivery with minimal training required. Needle-free systems use high-pressure streams to deliver vaccines, improving patient compliance. Advances in these technologies are gaining traction, particularly in regions with limited healthcare infrastructure, presenting competition to traditional syringes and autoinjectors while improving accessibility and reducing healthcare-associated risks.

The vaccine delivery devices industry is experiencing significant regional expansion, driven by increased vaccination efforts and technological advancements. Notably in November 2024, Bavarian Nordic, a Danish biotech company, has secured orders worth approximately USD 340 million for its mpox and smallpox vaccines for 2025, indicating robust demand in Europe. In addition, the Asia Pacific region is witnessing rapid growth due to government initiatives and increased healthcare spending, further contributing to the industry's global expansion.

Device Insights

The syringes segment dominated the vaccine delivery devices market, accounting for over 87.1% of the revenue share in 2024. Syringes are commonly used to administer vaccines. They are largely used in routine immunization and mass vaccination programs as they are inexpensive and effective. Novel and technologically advanced syringes such as auto-disposable syringes and prefilled syringes are gaining popularity.

However, many people have a phobia of needles used in syringes because of the pain caused by them. Improper sterilization of needles and their reuse increases the risk of various infections. Thus, auto-disable syringes, which are safe and meant for single use, are being widely used in immunization campaigns. Adoption of prefilled syringes is also increasing due to various advantages associated with their usages such as operational efficiency, minimized vaccine wastage, and improved patient safety.

Route of Administration Insights

The intradermal vaccination segment accounted for the largest revenue share of 62.9% in 2024. This route of vaccine delivery has attracted interest in the past few years owing to benefits such as dose sparing, improved safety, and improved access to vaccines. These factors are expected to contribute to the growth of this segment over the following years. Furthermore, an increase in the studies of alternative methods for intradermal administration with novel devices such as jet injectors and microneedles is anticipated to drive the segment.

The intramuscular vaccination material segment is estimated to register the fastest CAGR over the forecast period. The majority of vaccines are administered through the intramuscular route. Delivery through this route reduces adverse reactions at the injection site. Intramuscular injections are widely adopted because they deliver medications deep inside muscle tissues, which results in quick absorption.

Regional Insights

North American vaccine delivery devices market held a dominant position, capturing 32.0% of the global revenue share in 2024. Growing immunization coverage, increasing investments in R&D for new vaccines, and the high prevalence of infectious diseases are key contributors to the growth of the market. In addition, sophisticated healthcare infrastructure and high awareness among the public as well as healthcare professionals have contributed to the large share of the market.

U.S. Vaccine Delivery Devices Market Trends

The vaccine delivery devices market in the U.S. held a significant share of North America's vaccine delivery devices market in 2024. The U.S. plays a leading role in the vaccine delivery devices market, supported by its robust healthcare infrastructure and extensive immunization programs. Factors such as strong government initiatives, high public awareness of vaccination, and advanced R&D capabilities drive market growth. The adoption of innovative delivery technologies, including microneedles and jet injectors, further strengthens the industry. Recent developments emphasize the expansion of domestic vaccine manufacturing capabilities and enhanced supply chain efficiency.

Europe Vaccine Delivery Devices Market Trends

Europe dominated the vaccine delivery devices market with 25.3% share in 2024 driven by advanced healthcare systems and strong public health initiatives. In September 2024, Europe's leadership was evident in its response to the mpox outbreak, with HERA delivering 100,000 MVA-BN vaccine doses to the DRC. In addition, nine European countries, including France, Germany, and Spain, pledged 351,500 doses through Team Europe, bringing total donations to 566,500. These contributions underscore Europe's commitment to global health and its role in combating disease outbreaks by ensuring equitable vaccine access and fostering international collaboration.

The UK vaccine delivery devices market is experiencing steady growth, bolstered by government initiatives such as the UK Vaccine Innovation Pathway. This cross-sector program aligns with "The Future of UK Clinical Research Delivery," a shared vision aimed at fostering faster, more efficient, and innovative clinical research, positioning the UK as a global leader in research excellence.

The vaccine delivery devices market in France is growing, driven by robust government healthcare initiatives. Increased adoption of innovative delivery technologies, such as needle-free systems and auto-disable syringes, reflects France’s commitment to improving vaccination safety and efficiency. Collaborative efforts with global organizations to address vaccine accessibility and public health challenges further strengthen the market.

The German vaccine delivery devices market is expected to grow due to the country’s significant support for global vaccination efforts. Germany has contributed 3.21 billion to the ACT-Accelerator, with most of its donations directed through COVAX. Since August 2021, it has donated approximately 119 million doses to over 146 countries.

Asia Pacific Vaccine Delivery Devices Market Trends

The Asia Pacific region is experiencing robust growth, driven by the region's large-scale vaccination campaigns. With diverse vaccine approvals and rapid distribution, countries in the region are leveraging advanced packaging solutions to ensure efficient delivery. Key factors include innovations in cold-chain technology, local vaccine production, and collaborations with global health organizations to expand access. These trends reflect the region's efforts to meet vaccination demands, improve storage, and support future public health initiatives across diverse, large populations.

The vaccine delivery devices market in Japan is expected to grow. New developments, such as Moderna's updated Spikevax vaccine formulation, received approval from Japan's Ministry of Health, Labour and Welfare (MHLW) in August 2024. This updated vaccine targets the SARS-CoV-2 variant JN.1, further advancing Japan's vaccination efforts.

The vaccine delivery devices market in China is set for growth, with eight vaccines approved and 35 in clinical trials. Sinovac and Sinopharm lead vaccine production, with Sinovac supplying 848 million doses to 48 countries, while Sinopharm has donated 103 million doses to 79 countries, according to December 2022 data.

The vaccine delivery devices market in India is experiencing significant growth, fueled by substantial financial support. In November 2021, the Asian Development Bank approved a USD1.5 billion loan, alongside an additional USD 500 million from the Asian Infrastructure Investment Bank, to secure 667 million doses, aiding India's vaccination efforts for 317 million people. This funding supports the country's large-scale vaccination campaign and enhances its ability to deliver vaccines efficiently to the population.

Latin America Vaccine Delivery Devices Market Trends

The Latin American vaccine delivery devices market is growing rapidly, driven by widespread vaccine distribution. Nearly 1.3 billion doses were administered across the region. Vaccines are estimated to have saved between 610,000 and 2.61 million lives in 17 countries within the first 1.5 years, as per research from Yale University, Brazil, and PAHO, published in September 2024. This growth reflects the region’s robust vaccination efforts and underscores the importance of efficient vaccine delivery and packaging systems.

Middle East & Africa Vaccine Delivery Devices Market Trends

The vaccine delivery devices market in the Middle East and Africa is witnessing growth, driven by rising immunization initiatives and increasing healthcare investments. Regional governments and global organizations are collaborating to improve vaccine accessibility and address preventable diseases. Technological advancements in delivery devices, such as auto-disabled syringes and needle-free systems, enhance efficiency and safety.

The vaccine delivery devices market in Saudi Arabia is expanding, driven by the Kingdom's commitment to global health initiatives. In April 2024, Saudi Arabia pledged USD 500 million to the Global Polio Eradication Initiative (GPEI). This funding will support vaccine delivery, protect over 370 million children annually, and enhance health systems, addressing polio and other health threats. This contribution strengthens Saudi Arabia's role in global vaccination efforts.

Key Vaccine Delivery Devices Company Insights

Significant funding for R&D and new product launches are crucial strategies adopted by leading companies to capture a larger share of the global market. For instance, in August 2021, Vaccines developed by the Serum Institute of India acquired a 50% share in a pharma packing firm, Schott Kaisha. This initiative positions the Serum Institute of India in a joint venture with Schott AG, a specialty glass company based in Germany. In addition, various initiatives taken by government agencies to develop new vaccines provide opportunities for growth in the market.

For instance, in March 2022, the National Institute of Allergy and Infectious Diseases (NIAID) introduced a clinical trial for the evaluation of three HIV vaccines in their experimental phase. The vaccines are based on a messenger RNA (mRNA) platform, which is a technology previously used in multiple approved Covid-19 vaccines.

Key Vaccine Delivery Devices Companies:

The following are the leading companies in the vaccine delivery devices market. These companies collectively hold the largest market share and dictate industry trends.

- Becton Dickinson & Company

- Bioject Medical Technologies, Inc. (Inovio Pharmaceutical Inc.)

- PharmaJet

- Vaxxas

- Gerresheimer AG

- SCHOTT AG

- Corium International, Inc.

- 3M

Recent Developments

-

In September 2024, Molex announced that Phillips Medisize, acquired by Molex in 2016, entered an agreement to acquire Vectura Group Limited, a UK-based contract development and manufacturing organization. Vectura specializes in inhalation drug device design, formulation, and development for various drug delivery methods, expanding Phillips Medisize's capabilities in the pharmaceutical sector.

-

In January 2024, Kindeva Drug Delivery acquired Summit Biosciences Inc., a contract development and manufacturing organization (CDMO) specializing in intranasal drug delivery. This acquisition introduces a new drug-delivery platform, enhancing Kindeva's capabilities in developing a broader range of complex drug-device combination products.

Vaccine Delivery Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.9 billion

Revenue forecast in 2030

USD 11.5 billion

Growth rate

CAGR of 7.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device, route of administration

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Becton Dickinson & Company; Bioject Medical Technologies, Inc. (Inovio Pharmaceutical Inc.); PharmaJet; Vaxxas; Gerresheimer AG SCHOTT AG; Corium International, Inc.; 3M

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vaccine Delivery Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the vaccine delivery devices market report on the basis of device, route of administration, and region:

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Syringes

-

Jet Injectors

-

Other Devices

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Intradermal Vaccination

-

Intramuscular Vaccination

-

Subcutaneous Vaccination

-

Other Vaccinations

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global vaccine delivery devices market size was estimated at USD 7.4 billion in 2024 and is expected to reach USD 7.9 billion in 2025.

b. The global vaccine delivery devices market is expected to grow at a compound annual growth rate of 7.6% from 2025 to 2030 to reach USD 11.5 billion by 2030.

b. North America dominated the vaccine delivery devices market with a share of 32.0% in 2024. This is attributable to growing immunization coverage, increasing investments in R&D for new vaccines, and the high prevalence of infectious diseases in the region.

b. Some key players operating in the vaccine delivery devices market include Becton Dickinson & Company; Bioject Medical Technologies, Inc. (Inovio Pharmaceutical Inc.); PharmaJet; Vaxxas; Gerresheimer AG; SCHOTT AG; Corium International, Inc.; and 3M.

b. Key factors that are driving the vaccine delivery devices market growth include the widespread occurrence of infectious diseases, increasing government support, and growing research in the field of vaccination.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.