- Home

- »

- Automotive & Transportation

- »

-

Van Market Size, Share And Growth, Industry Report, 2030GVR Report cover

![Van Market Size, Share & Trends Report]()

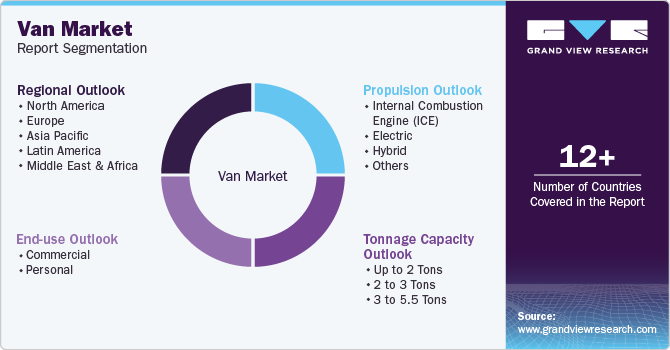

Van Market (2025 - 2030) Size, Share & Trends Analysis Report By Tonnage Capacity (Up To 2 Tons, 2 To 3 Tons, 3 To 5.5 Tons), By Propulsion (Electric, Hybrid, Internal Combustion Engine), By End-use (Commercial, Personal), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-499-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Van Market Summary

The global van market size was estimated at USD 160.90 billion in 2024 and is anticipated to reach USD 214.24 billion by 2030, growing at a CAGR of 4.8% from 2025 to 2030. The market’s growth is driven by several factors, including boom in e-commerce and last-mile delivery and the shift toward electric vans.

Key Market Trends & Insights

- North America dominated the global van industry in 2024 with a revenue share of 32.6%.

- The U.S. van industry is expected to grow at a significant CAGR from 2025 to 2030.

- By tonnage capacity, the up to 2 tons segment accounted for the largest share of 44.5% in 2024.

- By propulsion, the Internal Combustion Engine (ICE) segment held the largest market share in 2024.

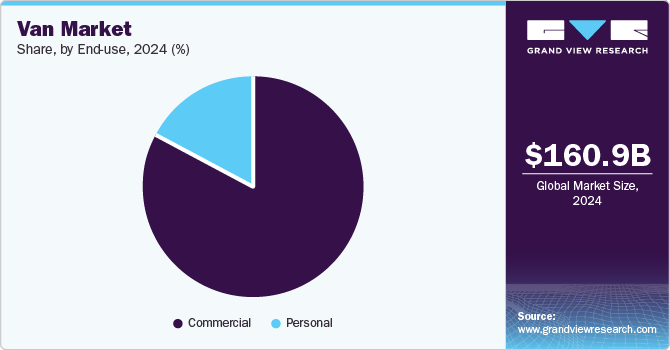

- By end use, the commercial segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 160.90 Billion

- 2030 Projected Market Size: USD 214.24 Billion

- CAGR (2025-2030): 4.8%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Compact and versatile vans are increasingly preferred for urban freight transport and shared mobility applications due to their fuel efficiency and maneuverability. Moreover, infrastructure development in emerging markets, such as the expansion of road networks and industrialization in regions such as Asia Pacific and Latin America, are boosting van sales for commercial applications. The rising preference for electric vans is driving the growth of the global van industry as businesses and governments prioritize sustainability and carbon emission reduction. According to the European Automobile Manufacturers’ Association (ACEA), in 2023, electric van sales surged by 56.8% in the European Union (EU) from 2022. Regulatory policies, subsidies, and incentives for electric vehicles (EVs) have encouraged fleet operators to adopt electric vans, particularly in the logistics and delivery sectors. Additionally, advancements in battery technology and the expansion of charging infrastructure have improved the affordability and practicality of electric vans. These factors, combined with rising fuel costs and increasing awareness of environmental impacts, are accelerating the transition to electric vans globally.

The growing demand for urban mobility solutions is propelling the global van industry’s growth as cities increasingly prioritize efficient and compact transportation for goods and passengers. Vans, particularly those with smaller tonnage capacities, are ideal for navigating congested urban environments and meeting the needs of last-mile delivery, ride-sharing, and on-demand services. Rising e-commerce activities and the need for flexible logistics solutions further amplify this demand. Additionally, urban-focused policies promoting sustainable transportation are encouraging the adoption of eco-friendly vans, including electric and hybrid models.

Technological advancements are driving the growth of the global market by enhancing vehicle efficiency, safety, and connectivity. Features like telematics, driver assistance systems, and IoT-enabled monitoring improve fleet management and reduce operational costs, making vans more appealing to businesses. In October 2023, Amazon.com, Inc. implemented AI-powered Automated Vehicle Inspection (AVI) technology to enhance the safety and efficiency of its delivery van fleet. By conducting rapid, detailed scans of vans, AVI identifies issues like tire deformities, undercarriage wear, and body damage in seconds, helping Delivery Service Partners (DSPs) prevent on-road problems, improve van safety, and minimize delivery delays for customers.

Customization for business needs is trending in the global van industry as businesses increasingly demand tailored solutions to meet their specific operational requirements. Vans are being designed with modular interiors, specialized storage compartments, and custom features to support industries like logistics, healthcare, retail, and construction. This adaptability enhances efficiency and functionality, making vans an ideal choice for small and medium enterprises (SMEs) and niche service providers. The growing emphasis on purpose-built vehicles is also encouraging manufacturers to offer more flexible and scalable van models.

Tonnage Capacity Insights

The up to 2 tons segment accounted for the largest share of 44.5% in 2024. The segment's growth is driven by the rising demand for compact, fuel-efficient, and cost-effective vehicles, especially for last-mile delivery and urban logistics. These vans are ideal for navigating congested city streets and offer businesses the flexibility to transport smaller loads efficiently. Additionally, the growth of e-commerce and same-day delivery services has significantly increased the need for lightweight vans in logistics operations. Their lower operating costs and versatility make them a preferred choice for small and medium enterprises (SMEs) and service-based industries.

The 2 to 3 tons segment is expected to grow at the fastest CAGR during the forecast period. The segment's growth is driven by the increasing need for medium-duty vans that provide a greater payload capacity while still being versatile enough for urban and regional logistics. Unlike the up to 2 tons segment, this category caters to businesses that require a higher load capacity for more diverse applications, such as bulk deliveries, equipment transportation, and service-based industries like plumbing or electrical work. These vans strike a balance between the compact size of lighter vans and the higher efficiency of larger vehicles, making them ideal for companies looking to scale operations without compromising maneuverability.

Propulsion Insights

The Internal Combustion Engine (ICE) segment held the largest market share in 2024. The growth of the segment is driven by the continued demand for reliable, cost-effective, and widely available vehicles. ICE-powered vans offer well-established infrastructure, including fueling stations, which makes them a practical choice for businesses operating in regions with limited electric vehicle (EV) charging networks. Additionally, the upfront cost of ICE vans is often lower than that of electric or hybrid models, making them more attractive to small and medium enterprises (SMEs) and fleet operators with budget constraints. Despite the rise of alternative energy sources, ICE vans continue to dominate markets where range, fuel availability, and purchase price remain key decision-making factors.

The electric segment is expected to register the fastest CAGR during the forecast period. The segment's growth is driven by the increasing demand for eco-friendly and sustainable transportation solutions, especially in urban logistics and e-commerce. Electric vans offer advantages such as reduced emissions, government incentives, and a long-term reduction in maintenance costs compared to internal combustion engine (ICE) vans. As the charging infrastructure expands and battery technology improves, electric vans are becoming more practical for businesses seeking to meet sustainability goals. Although the upfront cost may be higher than ICE vans, the lower operating and fuel costs over time make electric vans an attractive long-term investment, particularly for companies focused on reducing their environmental footprint.

End-use Insights

The commercial segment dominated the market in 2024.The growth of the commercial segment is driven by the increasing demand for vans in logistics, e-commerce, and various service-based industries. Vans are essential for businesses requiring efficient transportation solutions for goods, deliveries, and personnel, particularly in urban areas. The rapid expansion of online retail, along with the need for last-mile delivery solutions, has significantly boosted the demand for commercial vans. Additionally, the flexibility and customization options of vans make them a preferred choice for diverse commercial applications, from delivery services to construction and maintenance operations.

The personal segment is anticipated to grow significantly during the forecast period. The segment's growth is driven by the increasing consumer preferences for spacious and versatile vehicles for family and recreational use. Vans offer ample seating capacity and storage space, making them ideal for large families, road trips, and outdoor activities. The rising popularity of camper vans and van conversions for travel and leisure further fuels this segment's expansion. Additionally, advancements in comfort, safety features, and customization options have made vans more appealing to individual buyers seeking multi-purpose vehicles.

Regional Insights

North America dominated the global van industry in 2024 with a revenue share of 32.6%. This growth is driven by the region's strong infrastructure, coupled with a high rate of urbanization, which supports the growing need for efficient transportation solutions in densely populated areas. Additionally, the popularity of recreational vans for road trips and outdoor activities is rising, particularly in the U.S. and Canada, where travel culture is prominent. Government incentives for electric vehicles and the adoption of advanced technologies in fleet management are also key factors driving the market in North America.

U.S. Van Market Trends

The U.S. van industry is expected to grow at a significant CAGR from 2025 to 2030. The growth is driven by the increasing demand for versatile vehicles tailored to the country's diverse industries, including agriculture, construction, and small businesses. The rise of van customization services has enabled businesses and individuals to adapt vans for unique purposes, such as mobile offices, food trucks, and specialized service vehicles. Additionally, the cultural trend of "van life" has gained significant traction in the U.S., with many individuals converting vans into mobile homes for travel and minimalistic living. Virginia, U.S.-based VanLife LLC is a veteran-owned family business that offers an adventurous and convenient VanLife experience. The company provides a fleet of well-equipped rental vans designed to give travelers the freedom to explore the open road.

Europe Van Market Trends

The van market in Europe is expected to grow at a significant CAGR from 2025 to 2030. The growth is driven by stringent environmental regulations encouraging the adoption of low-emission and electric vans, particularly in urban areas with low-emission zones. The region's strong focus on sustainability and green logistics has pushed businesses to invest in eco-friendly transportation solutions. Additionally, Europe's dense network of small and medium-sized enterprises (SMEs) heavily relies on vans for localized deliveries and operations. The popularity of compact vans suited for narrow city streets, coupled with government incentives for electric and hybrid vehicles, is further fueling the market's expansion in the region.

The growth of the van market in the UK is driven by the surging demand for home delivery services, fueled by the rapid expansion of e-commerce and grocery delivery. Additionally, the UK's transition to electric vehicles is driven by government-backed initiatives, such as grants for electric van purchases and the phasing out of petrol and diesel vehicles by 2030. The increasing adoption of vans for tradespeople, such as plumbers and electricians, who require compact yet spacious vehicles for tools and materials, also contributes significantly to the market's growth.

The Germany van market held a substantial market share in 2024. The market growth is driven by the country’s strong industrial and manufacturing sectors, which rely on vans for efficient transportation of goods and equipment. Germany’s leadership in automotive innovation has spurred the development of high-performance vans equipped with advanced technologies, such as driver-assistance systems and telematics.

Asia Pacific Van Market Trends

The Asia Pacific van industry is anticipated to grow at a significant CAGR during the forecast period. The growth is driven by the rapid expansion of e-commerce and last-mile delivery services in emerging economies like India and Southeast Asia. The region’s high population density and growing urbanization have increased the demand for compact and fuel-efficient vans for intra-city logistics. Additionally, the rise of small and medium-sized enterprises (SMEs) in the region has created a need for cost-effective transportation solutions for goods and services.

Japan's van market is expected to grow at a moderate CAGR during the forecast period. The growth is driven by the country's focus on precision logistics and the increasing demand for small, fuel-efficient vans for urban delivery in densely populated areas. Japan's advanced automotive manufacturing industry is fostering the development of technologically sophisticated vans. Additionally, the aging population and shrinking workforce are prompting logistics companies to adopt compact vans that are easier to operate and maintain.

The van market in China held a substantial revenue share in 2024, driven by the rapid expansion of its e-commerce sector, which has fueled the demand for efficient last-mile delivery solutions across urban and rural areas. Additionally, China’s vast logistics network and growing export-oriented industries rely heavily on versatile and durable vans to support supply chain operations. Innovations in connected vehicle technology, such as fleet management systems tailored for large-scale delivery operations, are also contributing to the market’s growth.

Key Van Company Insights

Some of the key companies in the van industry include Mercedes-Benz Group AG, Mercedes-Benz Group AG, Stellantis NV, and Nissan Motor Co., Ltd. Organizations are focusing on integrating advanced technologies into their offerings to maintain competitive advantages. Therefore, key players are taking several strategic initiatives, such as new product launches, mergers and acquisitions, and partnerships.

-

Mercedes-Benz Group AG is a key player in the global van market, known for its premium offerings such as the Sprinter and Vito models. The company focuses on innovation, including electric vans, to meet growing demand in logistics, transportation, and mobility sectors worldwide.

-

Volkswagen Group is a prominent global van manufacturer, offering a diverse range of models, including the Transporter and Crafter. The company is advancing in electric mobility with its ID. Buzz electric van, aiming to meet increasing demand for sustainable and efficient commercial and personal transportation solutions worldwide.

Key Van Companies:

The following are the leading companies in the van market. These companies collectively hold the largest market share and dictate industry trends.

- Ford Motor Company

- Mercedes-Benz Group AG

- Volkswagen Group

- Renault Group

- TOYOTA MOTOR CORPORATION

- Nissan Motor Co., Ltd.

- Hyundai Motor Company

- MITSUBISHI MOTORS CORPORATION

- ISUZU MOTORS LIMITED

- Stellantis NV

Recent Developments

-

In December 2024, Mercedes-Benz Group AG announced the introduction of the VAN.EA platform, advancing its electrification strategy, is set to underpin all medium and large vans starting in 2026. This new modular electric architecture will cater to both luxury private vans and premium commercial vans, incorporating cutting-edge technologies like the Mercedes-Benz Operating System (MB.OS), 800-volt charging, and 22 kW AC charging to meet diverse customer needs.

-

In March 2024, Volkswagen Group introduced the ID. Buzz GTX, featuring a 4MOTION all-wheel-drive system with dual electric motors. Available in two wheelbases and with two battery sizes, the ID. Buzz GTX offers high towing capacity, fast charging, and an enhanced design, making it a versatile and powerful electric vehicle.

Van Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 169.56 billion

Revenue forecast in 2030

USD 214.24 billion

Growth rate

CAGR of 4.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Tonnage capacity, propulsion, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Ford Motor Company; Mercedes-Benz Group AG; Volkswagen Group; Renault Group; TOYOTA MOTOR CORPORATION; Nissan Motor Co., Ltd.; Hyundai Motor Company; MITSUBISHI MOTORS CORPORATION; ISUZU MOTORS LIMITED; Stellantis NV

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Van Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global van market report based on tonnage capacity, propulsion, end-use, and region:

-

Tonnage Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Up to 2 Tons

-

2 to 3 Tons

-

3 to 5.5 Tons

-

-

Propulsion Outlook (Revenue, USD Million, 2018 - 2030)

-

Internal Combustion Engine (ICE)

-

Electric

-

Hybrid

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Personal

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global van market size was estimated at USD 160.90 billion in 2024 and is expected to reach USD 169.56 billion in 2025.

b. The global van market is expected to grow at a compound annual growth rate of 4.8% from 2025 to 2030 to reach USD 214.24 billion by 2030.

b. North America dominated the van market with a share of 32.62% in 2024. The growth of the van market in North America is driven by the region's strong infrastructure, coupled with a high rate of urbanization, which supports the growing need for efficient transportation solutions in densely populated areas.

b. Some key players operating in the van market include Ford Motor Company, Mercedes-Benz Group AG, Volkswagen Group, Renault Group, TOYOTA MOTOR CORPORATION, Nissan Motor Co., Ltd., Hyundai Motor Company, MITSUBISHI MOTORS CORPORATION, ISUZU MOTORS LIMITED, Stellantis NV.

b. Key factors that are driving the market growth include the growth in e-commerce and last-mile delivery services and the rising demand for electric and sustainable transportation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.