- Home

- »

- Next Generation Technologies

- »

-

Vertical Software Market Size & Share, Industry Report, 2033GVR Report cover

![Vertical Software Market Size, Share & Trends Report]()

Vertical Software Market (2025 - 2033) Size, Share & Trends Analysis Report By Organization Size, By Application (Enterprise Resource Planning, Supply Chain Management, Human Resource Management), By Deployment, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-703-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Vertical Software Market Summary

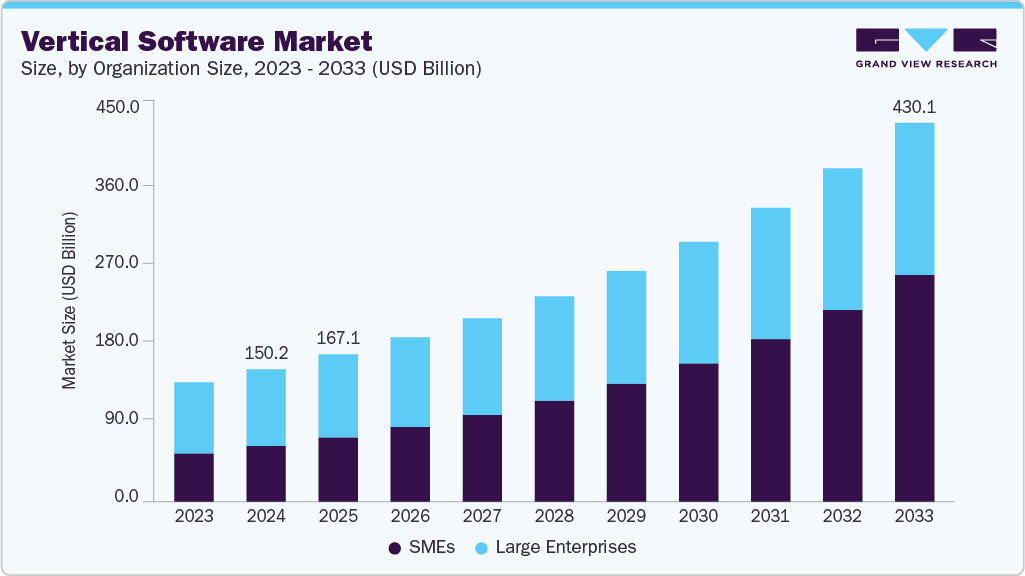

The global vertical software market size was valued at USD 150.25 billion in 2024 and is projected to reach USD 430.12 billion by 2033, growing at a CAGR of 12.5% from 2025 to 2033. This growth is driven by the increasing demand for industry-specific software solutions that enhance operational efficiency, regulatory compliance, and customer engagement across healthcare, BFSI, retail, and manufacturing sectors.

Key Market Trends & Insights

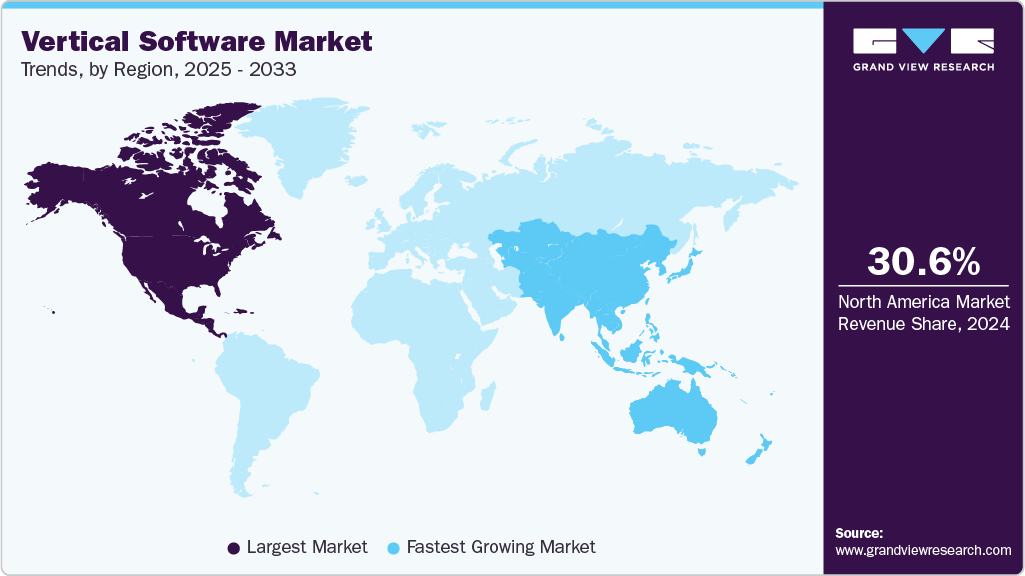

- North America dominated the global vertical software market with the largest revenue share of 30.6% in 2024.

- The U.S. vertical software industry is expected to grow significantly in 2024.

- By organization size, the large enterprises led the market, holding the largest revenue share of 57.9% in 2024.

- By deployment, the cloud segment held the dominant position in the market.

- By end use, the BFSI segment held the dominant position in the market.

Market Size & Forecast

- 2024 Market Size: USD 150.25 Billion

- 2033 Projected Market Size: USD 430.12 Billion

- CAGR (2025-2033): 12.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The vertical software market reflects broad adoption across industry sectors, shaped by rising demand for industry-specific applications that streamline complex processes and ensure regulatory compliance. Organizations invest in solutions addressing the needs of healthcare, retail, manufacturing, and government sectors, emphasizing specialized workflows, embedded analytics, and seamless integration with existing technology stacks. Key contributors to the market’s scale include the growth of cloud computing, which facilitates rapid deployment and adaptability, alongside ongoing digital transformation efforts across large enterprises and SMEs.Moreover, the market is driven by industries prioritizing modernization and improved decision-making through advanced software capabilities. Real-time data analytics, automation, and AI-driven insights shape the development of tailored vertical solutions, enhancing process efficiency and customer engagement. The rise of remote work and distributed operations nurtures demand for scalable, secure, and interoperable platforms that support collaboration and continuity. Furthermore, increasing regulatory complexity across sectors compels organizations to adopt specialized software that ensures compliance and reduces operational risks, strengthening adoption trends.

Furthermore, the market is driven by continuous transitions to cloud-based models offering easier upgrades, global scalability, and reduced total cost of ownership. Vendors increasingly integrate emerging technologies such as Internet of Things (IoT), edge computing, and blockchain to deepen customization, improve data accuracy, and enable real-time decision-making within vertical-specific applications. Focused investments in cybersecurity and compliance tools address sector regulations, safeguard sensitive information, and build user confidence amid rising cyber threats. In addition, partner ecosystems and industry collaborations facilitate innovation, accelerate solution development, and ensure alignment with evolving business needs and technical standards, sustaining long-term market momentum.

Organization Size Insights

The large enterprises segment led the market in 2024, accounting for 57.9% of global revenue. These organizations require highly customized, scalable solutions to manage complex workflows, regulatory requirements, and large-scale operations across multiple business units and geographic locations. Large companies invest in vertical software to enhance operational efficiency, ensure compliance, and facilitate integration with legacy systems, enabling seamless data flow throughout the enterprise. Their significant resources allow for the adoption of advanced features such as embedded analytics, AI-driven automation, and real-time reporting, supporting informed decision-making at all organizational levels. This deep integration and the broad functional coverage provided by vertical software make it indispensable for streamlining functions in large, heterogeneous business environments.

The SMEs segment is predicted to experience the fastest growth in the forecast years as smaller businesses increasingly prioritize digital transformation to remain competitive and agile within their industries. Cost-effective, cloud-based vertical software solutions offer SMEs unprecedented access to tools that automate routine processes, improve regulatory adherence, and enhance customer engagement without the complexity and overhead of traditional enterprise systems. Easy scalability, intuitive user interfaces, and streamlined onboarding accelerate software adoption among SMEs, enabling them to innovate and adapt swiftly to market changes. As vertical software becomes more accessible and tailored to distinct industry needs, smaller organizations can harness capabilities previously reserved for larger enterprises, fueling rapid segment expansion.

Application Insights

The Enterprise Resource Planning (ERP) segment accounted for the largest market revenue share 2024. ERP systems capture a large share by enabling organizations to unify processes specific to industry needs, such as finance, procurement, inventory, and human resources. Vertical market ERP platforms enhance cross-departmental visibility and data consistency, supporting real-time analytics and operational agility. These solutions help manage compliance, reduce operational costs, and improve resource allocation. Their configurability to industry regulations and standards makes them indispensable for large-scale enterprise operations across sectors.

The Supply Chain Management (SCM) segment is expected to grow at the highest CAGR during the forecast period, driven by escalating efforts by industries to gain greater supply chain visibility, mitigate risks, and improve responsiveness amid complex global networks. Vertical market SCM applications incorporate real-time tracking technologies, AI-driven demand forecasting, and blockchain-based transparency solutions tailored to sector-specific logistics and compliance challenges. Infusing IoT devices and AI-driven analytics enables predictive insights that optimize inventory management, supplier coordination, and transportation scheduling. Increasing emphasis on sustainability and supply chain resilience further accelerates the adoption of specialized SCM platforms, empowering companies to maintain competitive advantage.

Deployment Insights

The cloud segment accounted for the prominent market revenue share in 2024 due to unparalleled scalability, cost efficiency, and agility advantages for running vertical software applications across multiple sectors. Cloud platforms facilitate rapid provisioning, seamless updates, and easy integration with AI, data analytics, and collaboration tools important for customized industry workflows. Businesses leverage private, public, and hybrid cloud models to balance data privacy concerns with the need for operational flexibility and global accessibility. Enhanced security features, multi-cloud strategies, and disaster recovery capabilities strengthen enterprise confidence in cloud-based vertical solutions, promoting extensive adoption.

The on-premises segment is anticipated to grow significantly during the forecast period. On-premises deployment continues to hold importance for sectors with stringent data sovereignty, compliance, and security requirements, such as healthcare, finance, and government. Organizations benefit from deeper customization and tighter integration with legacy systems, which are vital for mission-critical operations and minimal latency. Hybrid cloud architectures that link on-premises capabilities with cloud services gain traction, enabling enterprises to optimize resource utilization while maintaining control over sensitive information.

End-use Insights

The BFSI segment accounted for the largest market revenue share in 2024 due to complex regulatory frameworks and the necessity for strong risk management. Industry-specific solutions facilitate fraud detection, regulatory compliance reporting, KYC processes, and customer relationship management with embedded analytics and automation. Increasing digital transformation initiatives in BFSI focus on improving operational efficiency, enhancing customer experience, and supporting real-time data processing across transactional channels. Growing cyber threat concerns push the adoption of advanced security-integrated vertical software tailored to financial workflows and sensitive data handling.

The healthcare segment is anticipated to grow at the highest CAGR during the forecast period as providers and payers address challenges related to EHR, patient data interoperability, telehealth, and regulatory compliance. These solutions support real-time clinical analytics, population health management, personalized medicine, and optimized patient care workflows. Increasing focus on privacy laws such as HIPAA, interoperability standards such as HL7 and FHIR, and efforts toward value-based care intensify demand for specialized software. Integrating AI, IoT devices, and remote monitoring technologies further enhances diagnostics, treatment plans, and healthcare resource management, driving rapid growth in this sector.

Regional Insights

North America dominated the vertical software industry with a revenue share of 30.6% in 2024 due to mature IT infrastructure, rapid digital transformation efforts, and extensive cloud ecosystem adoption across businesses and government entities. The region hosts a significant concentration of major technology vendors, innovation hubs, and startup ecosystems driving the development and deployment of vertical-specific solutions. Supportive regulatory frameworks, including strict data privacy laws and compliance mandates, increase reliance on industry-tailored software.

U.S. Vertical Software Market Trends

The U.S. vertical software industry is expected to grow significantly in 2024, driven by aggressive government digital transformation programs and widespread private sector adoption of cloud-native, AI-driven vertical software applications. Federal, state, and local agencies integrate vertical solutions to enhance citizen service delivery, improve transparency, and ensure regulatory compliance. The vibrant technology ecosystem and significant R&D investment facilitate rapid development of custom software tailored to diverse industry verticals.

Europe Vertical Software Market Trends

The vertical software market in Europe is expected to grow significantly over the forecast period, driven by harmonized regulations emphasizing data protection, ethical AI use, and cross-border compliance within the European Union and member states. Investments in digital skills development, smart infrastructure, and innovation incentives prepare public and private sectors for accelerated software adoption. The market’s multilingual and multicultural environment encourages production of localized, compliant software platforms tailored to diverse customer bases.

Asia Pacific Vertical Software Market Trends

The vertical software industry in the Asia Pacific region is anticipated to at the fastest CAGR over the forecast period, driven by expanding digital economy investments, extensive cloud migration, and high technology adoption rates among a young, tech-savvy population. Governments promote smart city initiatives, digital healthcare, e-commerce, and manufacturing modernization projects reliant on vertical software solutions. The region’s diverse regulatory environments stimulate demand for flexible, scalable platforms that address localized compliance and operational needs.

Key Vertical Software Company Insights

Some key companies in the vertical software industry are IBM Corporation, SAP SE, Oracle, and Microsoft.

-

Microsoft provides a diverse suite of vertical software solutions that cater to the specific needs of retail, healthcare, government, and manufacturing industries. Its broad portfolio includes cloud-based applications, enterprise resource planning, customer relationship management, and analytics tools tailored for sector-specific workflows. Microsoft’s platforms, like Dynamics 365 and Azure, support integration with existing business processes, enhance operational efficiency, and streamline regulatory compliance in various verticals.

-

Oracle delivers comprehensive vertical software offerings that address industry-specific requirements across fields such as finance, communications, utilities, public sector, manufacturing, and healthcare. The company designs modular cloud and on-premises applications, allowing organizations to manage complex business processes, regulatory compliance, and data integration unique to their sectors. Oracle’s vertical solutions are built with industry expertise, supporting advanced analytics, workflow automation, and embedded AI to drive operational efficiency.

Key Vertical Software Companies:

The following are the leading companies in the vertical software market. These companies collectively hold the largest market share and dictate industry trends.

- Microsoft

- Oracle

- SAP SE

- Salesforce, Inc.

- Adobe Inc.

- IBM Corporation

- Intuit Inc.

- Epic Systems Corporation

- Infor

- Constellation Software Inc.

Recent Developments

-

In July 2025, Valsoft Corporation Inc. announced the acquisition of SEV Tidsystem AB., a Sweden-based cloud-based staffing and scheduling solutions provider with a strong presence in the restaurant, retail, and hospitality sectors. This acquisition represents Valsoft Corporation Inc.’s ninth investment within the workforce management vertical, enhancing its strategic position. SEV Tidsystem AB. contributes extensive domain expertise and a well-established reputation in the Swedish market, serving some of the nation’s retail chains and the largest supermarket.

-

In June 2025, Constellation Software Inc. and its subsidiary Topicus.com Inc. announced the completion of the acquisition of Cipal Schaubroeck NV by Topicus.com, Inc.’s subsidiary Total Specific Solutions (TSS) B.V. This transaction involved the transfer of all issued and outstanding shares of Cipal Schaubroeck NV to TSS, thereby expanding TSS’s portfolio in the public sector software market. The acquisition is positioned to strengthen Topicus.com Inc.’s service offerings and enhance its market presence in software solutions for local government and public administration.

-

In June 2025, EXA Capital, Inc. announced the acquisition of PrecisionCare Software, a provider of a SaaS platform specializing in care management solutions and Electronic Health Records (EHR) tailored for the behavioral health and long-term care sectors. This acquisition significantly strengthens EXA Capital Inc.’s footprint in the healthcare technology sector and broadens its portfolio to include critical care management solutions.

Vertical Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 167.07 billion

Revenue forecast in 2033

USD 430.12 billion

Growth Rate

CAGR of 12.5% from 2025 to 2033

Actual data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, end-use, organization size, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; U.K.; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Microsoft; Oracle; SAP SE; Salesforce, Inc.; Adobe Inc.; IBM Corporation; Intuit Inc.; Epic Systems Corporation; Infor; Constellation Software Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Vertical Software Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global vertical software market report based on organization size, application, deployment, end-use, and region:

-

Organization Size Outlook (Revenue, USD Million, 2021 - 2033)

-

SMEs

-

Large Enterprises

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Customer Relationship Management (CRM)

-

Enterprise Resource Planning (ERP)

-

Supply Chain Management (SCM)

-

Human Resource Management (HRM)

-

Other

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

On-premises

-

Cloud

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

Media & Entertainment

-

Healthcare

-

IT & Telecom

-

Retail & E-commerce

-

Government & Public Sectors

-

Travel & Hospitality

-

Education

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global vertical software market size was estimated at USD 150.25 billion in 2024 and is expected to reach USD 167.07 billion in 2025.

b. The global vertical software market is expected to grow at a compound annual growth rate of 12.5% from 2025 to 2033 to reach USD 430.12 billion by 2033.

b. North America dominated the vertical software market with a share of 30.6% in 2024 due to mature IT infrastructure, rapid digital transformation efforts, and extensive cloud ecosystem adoption across businesses and government entities.

b. Some key players operating in the vertical software market include Microsoft; Oracle; SAP SE; Salesforce, Inc.; Adobe Inc.; IBM Corporation; Intuit Inc.; Epic Systems Corporation; Infor; Constellation Software Inc.

b. Key factors driving market growth include the increasing demand for industry-specific software solutions that enhance operational efficiency, regulatory compliance, and customer engagement across healthcare, BFSI, retail, and manufacturing sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.