- Home

- »

- Animal Health

- »

-

Veterinary CRO And CDMO Market, Industry Report, 2030GVR Report cover

![Veterinary CRO And CDMO Market Size, Share & Trends Report]()

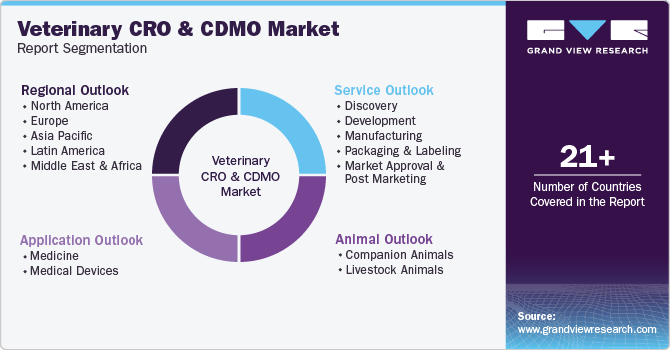

Veterinary CRO And CDMO Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal (Companion Animals, Livestock Animals), By Service (Discovery, Development), By Application (Medicine, Medical Devices), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-053-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Veterinary CRO And CDMO Market Summary

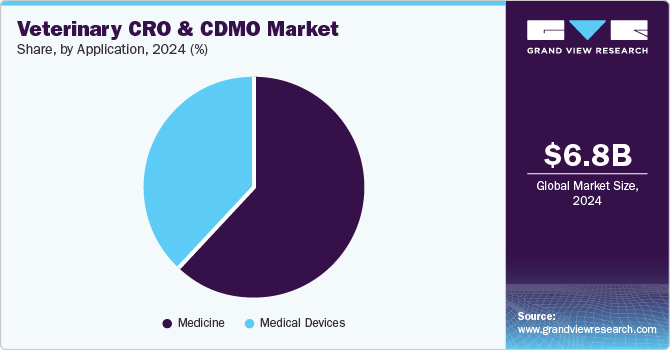

The global veterinary CRO and CDMO market size was estimated at USD 6.79 billion in 2024 and is projected to reach USD 11.42 billion by 2030, growing at a CAGR of 9.2% from 2025 to 2030. The adoption of veterinary outsourcing services is propelled by the vast therapeutic experience of Contract Development & Manufacturing Organizations (CDMOs) and Contract Research Organizations (CROs).

Key Market Trends & Insights

- North America veterinary CRO and CDMO market dominated the global veterinary CRO and CDMO industry with 35.1% of the revenue share in 2024.

- The U.S. veterinary CRO and CDMO market held the largest revenue share of the regional market in 2024.

- Based on animal, the livestock animal segment dominated the industry with a revenue share of 59.3% in 2024.

- By application, the medicine segment dominated the global veterinary CRO and CDMO market in 2024.

- Based on service, the development segment held the largest revenue share of the global industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.79 Billion

- 2030 Projected Market Size: USD 11.42 Billion

- CAGR (2025-2030): 9.2%

- North America: Largest market in 2024

In addition, technical competence, high reliability, quality & cost efficiency in outsourcing product development processes, and improved geographic convenience with local players are key growth driving factors. On-time development & delivery of final products, coupled with the smooth introduction of novel veterinary drugs or devices into the market in compliance with specific regulatory standards, boosts the market growth.The key players operating in the animal health industry prefer contract outsourcing over in-house manufacturing, considering its associated benefits. For instance, Zoetis, one of the major players in the veterinary industry, has reported having only 29 in-house manufacturing sites. However, it employs a network of 132 third-party contract manufacturing organizations. Animal health drug or device manufacturers solely outsource key stages of production to expert CROs and CDMOs, owing to the complex manufacturing processes of certain veterinary products. Outsourcing activities enable companies to reduce financial risk and encourage more research & development in the field.

The key players operating in the animal health industry prefer contract outsourcing over in-house manufacturing, considering its associated benefits. For instance, Zoetis, one of the major players in the veterinary industry, has reported having only 29 in-house manufacturing sites. However, it employs a network of 132 third-party contract manufacturing organizations. Animal health drug or device manufacturers solely outsource key stages of production to expert CROs and CDMOs, owing to the complex manufacturing processes of certain veterinary products. Outsourcing activities enable companies to reduce financial risk and encourage more research & development in the field.

Stringent regulatory requirements associated with clinical research and manufacturing also play a vital role in expanding collaborations among CROs and companies that offer veterinary products. New product developments, applications for approval, and ongoing clinical studies are expected to influence market growth. For instance, in April 2025, a Poland-based company, Bioceltix, submitted an application to the European Medicines Agency (EMA) for approval of a stem cell-based drug developed for horses.

The growing inclination among companies to collaborate with CDMOs to manufacture therapies and improve finished goods is anticipated to fuel growth over the forecast period. For instance, in May 2024, a contract development and manufacturing service provider-EUROAPI-announced it had collaborated with a global animal health organization. As per the contract, EUROAPI is set to supply key veterinary products to its clients from 2025 to 2029.

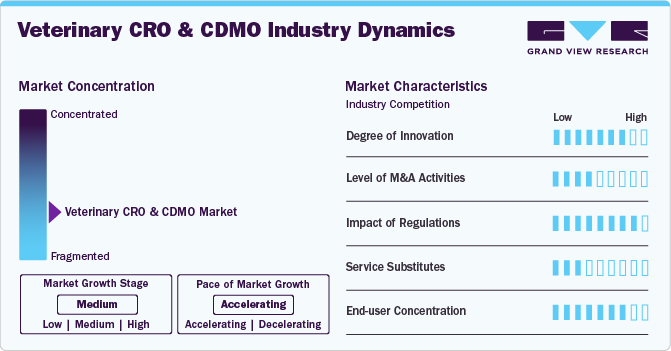

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. Significant growth in the number of CROs and CDMOs, increasing reliance on outsourcing services, and significant contributions by key service providers in ongoing research and development activities have resulted in a fragmented market scenario.

Increasing adoption of technologically advanced equipment, use of modern technologies such as AI in research activities, and focus on embracing innovation-based processes for manufacturing, client communication, and other functions drive innovation in this market. The availability of advanced equipment in developed economies, such as the U.S., and some developing countries, such as India, is expected to support innovation over the forecast period.

Mergers and acquisitions also play crucial roles in the market's growth. Multiple CROs and CDMOs focus on attaining growth by acquiring innovation-driven startups and small or medium-scale organizations operating in the industry. For instance, in March 2024, a telehealth and diagnostics company, eMed LLC, acquired CRO support and decentralized clinical trial solutions provider Science 37 Holdings, Inc.

The threat of service substitutes is low in this market as CROs and CDMOs provide services backed by technical competencies, advanced technology-powered processes, and regulatory expertise. These services are primarily adopted by companies that provide animal health and nutrition solutions, leading to a high end-use concentration.

Animal Insights

The livestock animal segment dominated the veterinary CRO and CDMO industry with a revenue share of 59.3% in 2024. The high production rate of vaccines, pharmaceuticals, and infectious disease diagnostic products specifically for livestock animals is a primary segment driver. Multiple disease outbreaks in livestock animals across various countries, including the U.S., have stimulated research and new product developments for effective treatments. For instance, in March 2024, the U.S. experienced a multi-state outbreak of bird flu HPAI A (H5N1) in dairy cows. According to the CDC, since 2022, APHIS has reported the detection of HPAI A (H5N1) in nearly 200 mammals in the U.S. Growing investments in research and development associated with livestock animal health are expected to influence this segment. For instance, in November 2024, Ceva, one of the global animal health companies, invested in expanding its facility in Hungary to further its commitment to European vaccine manufacturing.

The companion animal segment is expected to experience the fastest CAGR during the projected period. Growing pet adoption in developed countries has directly increased expenditure on pet care, pet health, and pet food. This has increased research and development activities associated with products designed for companion animals. For instance, in August 2024, Akston Biosciences Corporation, one of the global companies operating in the animal health industry, announced a strategic partnership with Energesis Pharmaceuticals to develop products related to treating obesity in companion animals. According to the announcement, Akston is set to serve as a Contract Development and Manufacturing Organization (CDMO) to develop and manufacture therapeutics in its facility in Massachusetts, U.S.

Service Insights

The development segment held the largest revenue share of the global veterinary CRO and CDMO industry in 2024. Growth of this segment is mainly driven by aspects such as the increasing focus of animal health organizations on developing novel products, such as vaccines and drugs, to prevent and cure numerous diseases in livestock and companion animals. The development processes of veterinary medicines or medical devices generally involve early phase/preclinical and late phase/clinical stages. Several animal product manufacturing companies outsource the early-phase stages to CROs that can help with preformulation development, pharmacology, toxicology drug testing in the case of medicines, and concept & feasibility analysis in the case of devices. Similarly, the late-phase/clinical stage processes, such as clinical trials & NDA submissions for drugs and designing, verifying, & validating designs for medical equipment, are outsourced to CDMOs.

According to a survey article published by Pharma’s Almanac in June 2022, 94% of surveyed veterinary product manufacturers reported that their companies outsourced the late-phase development stages and manufacturing processes to CDMOs and CMOs. The same source also suggests that most veterinary players consider the developing & manufacturing stages the greatest challenge due to the need for procurement of quality raw materials and related resources. Therefore, contract organizations offer high-quality development and manufacturing services, contributing to their significant shares.

The discovery service segment is expected to grow at the fastest rate over the forecast period. This growth can be attributed to the increasing outsourcing of multiple processes such as target identification, preclinical studies, lead identification, and lead optimization. Multiple CROs conduct numerous in vitro and in vivo studies for global animal health companies to evaluate lead candidates’ safety, efficacy, and pharmacokinetic properties. Large organizations often outsource these functions due to factors such as cost-effectiveness, key competencies offered by CROs, technical capabilities, and utilization of modern technologies by CROs and others.

Application Insights

The medicine segment dominated the global veterinary CRO and CDMO market in 2024. The medicine segment is further divided into pharmaceuticals, biologics, and others. The rising incidence of zoonotic disease outbreaks, growing concerns, and preventative measures support increased production of vaccines and pharmaceutical products by key veterinary players. New infectious disease outbreaks are, in turn, increasing veterinary research and development activities with significant expenditure on novel drug launches.

The medical devices segment is expected to experience the fastest growth from 2025 to 2030. This segment is primarily influenced by technological advancements in veterinary diagnostics, growing animal healthcare expenditures, and the easy availability of contract veterinary device manufacturers & raw material suppliers. Furthermore, companies are investing more in the expansion of their production capacities by employing large networks of CROs & CDMOs, which positively influences and supports the subsequent growth rate.

Regional Insights

North America veterinary CRO and CDMO market dominated the global veterinary CRO and CDMO industry with 35.1% of the revenue share in 2024. This market is mainly driven by the robust animal health industry operating in the region, growing clinical trial activities, and increasing expenditure on animal healthcare. Increasing demand for novel products that support the prevention and treatment of diseases in livestock and companion animals is projected to drive further growth over the forecast period.

U.S. Veterinary CRO And CDMO Market Trends

The U.S. veterinary CRO and CDMO market held the largest revenue share of the regional market in 2024. The growth of this industry is significantly influenced by factors such as the presence of multiple animal health companies in the country, the active network of numerous facilities run by veterinary CROs and CDMOs across various states, and increasing expenditure on companion animal health. Disease outbreaks, especially in livestock animals, are also expected to result in growing research and development activities linked with animal health products.

Europe Veterinary CRO And CDMO Market Trends

Europe veterinary CRO and CDMO market was identified as one of the key regions of the global industry in 2024. A growing number of companion animals and increasing animal health expenditure, primarily in urban areas, are expected to drive regional growth. The presence of a strong dairy industry in multiple countries such as Germany, France, Ireland, and the Netherlands has resulted in a large number of dairy cows in the region. In addition, significant pork consumption by European customers and the influence of meat and meat products are expected to increase animal health expenditure on livestock animals.

Asia Pacific Veterinary CRO And CDMO Market Trends

Asia Pacific veterinary CRO and CDMO market is projected to experience the fastest CAGR from 2025 to 2030. This market is mainly driven by the key benefits offered by CROs and CDMOs operating in the region, such as cost savings, easy availability of materials, and flexible sourcing, and the rising focus of countries such as China and India on establishing partnerships with large animal health companies from North America and Europe. Rising pet ownership in the region and the growing livestock industry also contribute to regional growth.

China veterinary CRO and CDMO market held the largest revenue share of the Asia Pacific veterinary CRO and CDMO market in 2024. The growing meat and meat products market in China, the presence of a strong livestock industry, increasing demand for effective vaccines and medicines for animal health, and rising expenditure on research and development activities related to animal health are anticipated to drive further growth of this market. Cost-effective labor, advanced technological capabilities, a strong materials industry, and robust supply capacities add to market growth.

Key Veterinary CRO And CDMO Company Insights

Some of the key companies operating in the global veterinary CRO and CDMO industry are Clinvet (Clinglobal), Fortrea, Charles River Laboratories, KLIFOVET GmbH (Argenta Group), and IDEXX. Multiple market participants have embraced strategies such as collaborations, partnerships, and advanced technology adoption.

-

Clinvet, part of Clinglobal, is a global veterinary CRO specializing in in vitro, preclinical, and clinical trials evaluating animal health products' safety, efficacy, and metabolism. Its service offerings include preclinical development, clinical development, regulatory affairs and consulting, data sciences, molecular laboratory R&D services, and microbiology and diagnostics R&D services.

-

Fortrea, a global CROs, offers a variety of clinical solutions, such as clinical pharmacology services, consulting, clinical development, and MedTech expertise. Its clinical development solutions include clinical trials, mobile clinical solutions, digital health solutions, clinical trial management, and data management.

Key Veterinary CRO And CDMO Companies:

The following are the leading companies in the veterinary CRO and CDMO market. These companies collectively hold the largest market share and dictate industry trends.

- Fortrea

- Charles River Laboratories

- Clinvet (Clinglobal)

- KLIFOVET GmbH (Argenta Group)

- OCRvet (Clinglobal)

- Knoell - Triveritas

- Veterinary Research Management

- VETSPIN SRL

- Inotiv

- IDEXX

- Vetio

- TriRx Pharmaceutical Services

Recent Developments

-

In April 2025, GemPharmatech, one of the players in preclinical contract research services, expanded its footprint in the U.S. by launching a facility in San Diego. Strategic expansion in the U.S. is expected to support its regional market commitments.

-

In February 2025, Fortrea and the Society for Clinical Research Sites (SCRS) announced a partnership. Fortrea is set to sponsor the SCRS Collaborate Forward working group, comprising 16 global impact partner organizations. This group plans to explore and develop novel practices that can reduce the administrative burdens involved in clinical research.

-

In January 2025, Argenta announced a strategic realignment of its CRO platform and its structuring into two key segments, including Americas CRO and Europe CRO. The realignment is expected to strengthen its efforts to enhance its potential in animal health services.

-

In December 2024, Clinglobal added a new brand to its group, Clinaxel. The brand was formed to provide high-quality field clinical trials and regulatory affairs services in animal health and nutrition across North America, Europe, and Africa. The portfolio entails offerings related to clinical trials, regulatory affairs, and research services.

-

In October 2024, Clinglobal acquired OCRvet, a European CRO operating in animal health field trials. The acquisition has reinforced its market position in Europe while adding crucial capabilities related to medical devices and translational medicine.

Veterinary CRO And CDMO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.37 billion

Revenue forecast in 2030

USD 11.42 billion

Growth rate

CAGR of 9.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Animal, service, application, region

Regional Scope

North America; Europe; Asia Pacific;

Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; Colombia; Chile; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Fortrea; Charles River Laboratories; Clinvet (Clinglobal); KLIFOVET GmbH (Argenta Group); OCRvet (Clinglobal); Knoell - Triveritas; Veterinary Research Management; VETSPIN SRL; Inotiv; IDEXX; Vetio; TriRx Pharmaceutical Services

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary CRO And CDMO Market Report Segmentation

This report forecasts revenue growth at global, regional and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary CRO and CDMO market report based on animal, service, application, and region.

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Companion Animals

-

Livestock Animals

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Discovery

-

Development

-

Early Phase/Preclinical

-

Late phase/Clinical

-

-

Manufacturing

-

Packaging & Labeling

-

Market Approval & Post Marketing

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medicine

-

Pharmaceuticals

-

Biologics

-

Others

-

-

Medical Devices

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Chile

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.