- Home

- »

- Animal Health

- »

-

Veterinary Endotracheal Tubes Market, Industry Report, 2030GVR Report cover

![Veterinary Endotracheal Tubes Market Size, Share & Trends Report]()

Veterinary Endotracheal Tubes Market (2025 - 2030) Size, Share & Trends Analysis Report By Animal (Dog, Cat), By Product (Cuffed, Uncuffed), By End-use (Hospitals, Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-152-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

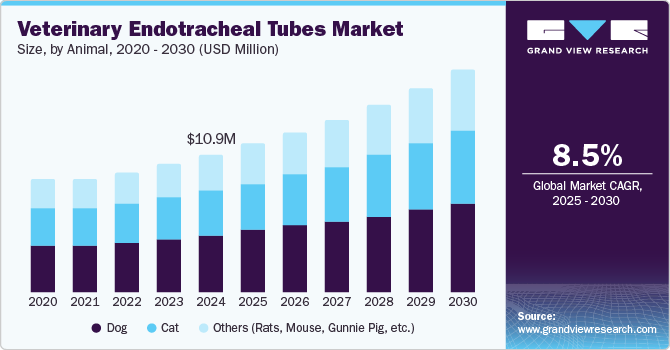

The global veterinary endotracheal tubes market size was estimated at USD 10.91 million in 2024 and is projected to grow at a CAGR of 8.50% from 2025 to 2030. The increasing prevalence of respiratory diseases in animals, such as the recent outbreak of Canine Infectious Respiratory Disease Complex (CIRDC), significantly drives the market growth. According to the data published in February 2024, during the latter half of 2023, states such as Oregon, Colorado, California, Florida, and New Hampshire, along with parts of Canada, reported a rise in cases of canine respiratory illnesses, including pneumonia.

For example, Colorado State University's Veterinary Teaching Hospital observed more than double the cases of canine pneumonia from September to November 2023 compared to the same period in 2022. These outbreaks highlight the critical need for advanced airway management tools, such as veterinary endotracheal tubes, to support animals with compromised respiratory systems during treatment and recovery. As veterinarians handle increasing caseloads of respiratory diseases, the demand for reliable and effective endotracheal tubes is expected to rise, ensuring adequate ventilation and preventing complications during medical procedures.

In addition, technological advancements in veterinary equipment also fuel product adoption and promote market growth. Manufacturers are increasingly developing innovative endotracheal tubes with improved flexibility, reinforced materials, and cuff designs that reduce the risk of complications like airway injuries or aspiration. These innovations cater to a variety of animal sizes and species, making the devices more versatile and effective. In addition, the integration of disposable and eco-friendly materials addresses concerns about infection control and environmental sustainability, which are becoming increasingly important in modern veterinary practices.

The expansion of veterinary services and facilities further supports the growth of the veterinary endotracheal tube industry. Governments and private organizations are investing in the development of animal healthcare infrastructure, leading to increased availability and affordability of veterinary care. Furthermore, the rising focus on livestock health and welfare, driven by the agriculture and dairy industries, contributes to the demand for endotracheal tubes in veterinary medicine. For instance, the Oregon Department of Agriculture (ODA), along with OSU’s Carlson College of Veterinary Medicine, the Oregon Veterinary Diagnostic Laboratory, and the USDA’s National Veterinary Services Laboratory and other specialists together investigated the causative agent behind the respiratory disease outbreak in canines. This combination of factors ensures steady growth for the market, catering to both companion animals and farm animals.

Animal Insights

The dog segment accounted for 40.82% of revenue share in 2024, driven by the high global population of pet dogs and their significant share in veterinary healthcare services. According to the American Pet Products Association, there were over 65.1 million pet dogs in the United States alone in 2023, highlighting the widespread adoption of dogs as companion animals. Dogs often require veterinary care for surgical procedures, anesthesia, and respiratory management, all of which necessitate the use of endotracheal tubes. In addition, the increasing awareness of canine health and the availability of advanced medical treatments for conditions such as brachycephalic airway syndrome and other respiratory disorders contribute to the dominance of the dog segment in this market. The growing emphasis on improving surgical outcomes and ensuring airway safety in dogs further strengthens their leading position in the veterinary endotracheal tube industry.

The cat segment is projected to grow at a CAGR of 9.01% from 2025 to 2030. This growth is attributed to an increasing number of cat adoptions and a rising focus on feline health care. According to the data published in November 2024 by the American Veterinary Medical Association, cats are the second most popular pet in the United States, with over 73.8 million pet cats reported in recent years. Feline-specific health challenges, such as asthma, airway obstructions, and respiratory infections, have highlighted the need for precise and specialized medical interventions, including the use of appropriately sized endotracheal tubes. In addition, advancements in veterinary anesthesia techniques and growing awareness among cat owners about the benefits of preventive and surgical care are boosting the demand for endotracheal tubes tailored for cats. The segment's rapid growth is further supported by innovations in tube design, which ensure better compatibility and safety for smaller airway anatomies.

Product Insights

Cuffed veterinary endotracheal tubes held the largest market share in 2024. Cuffed tubes are especially favored for use in larger animals and during prolonged procedures that require enhanced safety measures. In addition, their effectiveness in reducing complications such as ventilator-associated pneumonia has made them the preferred choice among veterinarians. For instance, Medtronic’s Shiley Cuffed Basic Endotracheal Tube features enhanced functionality and safety. These tubes, which cater to various patient sizes, including infants, pediatrics, and adults, offer critical benefits such as latex-free materials, ensuring compatibility with sensitive patients. Features like radiopaque markers facilitate accurate placement, while the inflatable cuff provides a secure airway seal to prevent aspiration and ensure effective ventilation during procedures. The sterile and high-quality design of these tubes aligns with the stringent safety and reliability requirements in veterinary practices, further solidifying their dominance in the market.

The uncuffed veterinary endotracheal tubes segment is expected to grow with a significant CAGR during the forecast period. This growth is primarily due to their increasing use in small animals, neonates, and certain avian species. These tubes are particularly advantageous in scenarios where airway anatomy is delicate, as they reduce the risk of tracheal trauma and pressure-related injuries. The demand for uncuffed tubes is driven by their simplicity, cost-effectiveness, and suitability for short-duration procedures where aspiration risk is minimal. In addition, the growing adoption of minimally invasive techniques in veterinary care and the rising focus on specialized care for smaller pets have boosted the use of uncuffed tubes and thus propelled market growth.

End Use Insights

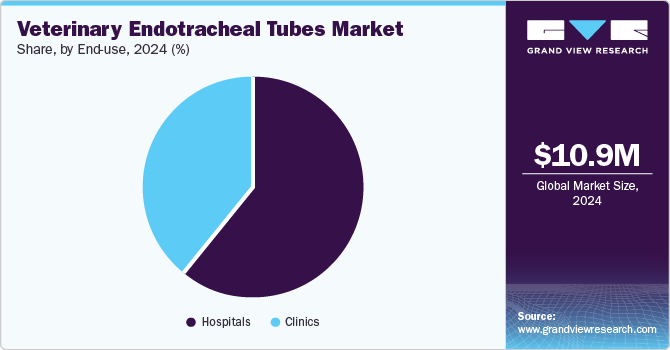

The hospitals segment dominated the market in 2024, driven by the higher number of complex surgical procedures and critical care cases handled in these facilities. Veterinary hospitals are equipped with advanced medical infrastructure and skilled professionals capable of managing a wide range of conditions requiring endotracheal intubation, including surgeries, respiratory support, and emergency airway management. The availability of specialized departments and intensive care units in hospitals further enhances their capacity to use endotracheal tubes effectively. In addition, hospitals often serve as referral centers for complicated cases, ensuring a consistent demand for high-quality airway management devices, including endotracheal tubes, to cater to diverse animal species and sizes.

The clinics segment is projected to grow at the fastest CAGR over the forecast period owing to the increasing number of small and mid-sized veterinary clinics globally. These clinics cater to a significant share of routine surgeries, anesthesia procedures, and emergency care for companion animals, which are key applications for endotracheal tubes. The rising trend of pet ownership, coupled with a growing preference for accessible and localized veterinary services, has expanded the role of clinics in delivering quality healthcare. Advances in medical equipment and affordable endotracheal tube options have further enabled clinics to adopt these tools for a broader range of procedures. In addition, the growing focus on preventive care and early intervention at the clinic level has increased the need for reliable airway management solutions, fueling the segment's rapid growth.

Regional Insights

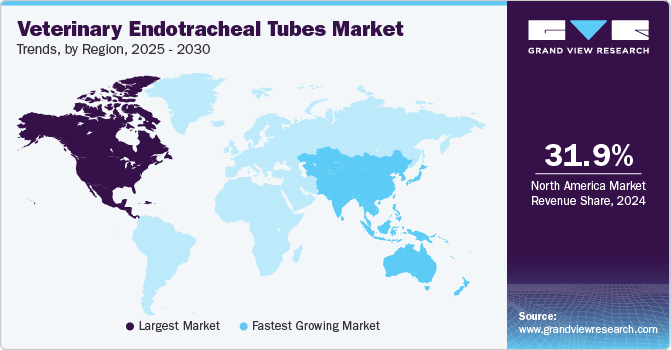

North America veterinary endotracheal tubes market held the largest revenue share globally at 31.90% in 2024. This dominance is attributed to factors such as a growing number of insured pets and an advanced veterinary healthcare system. In Canada, for instance, the total number of insured pets grew by 13.6%, with an average annual growth rate of 17.6% since 2019. This trend highlights the increasing investment in pet healthcare by owners, particularly for dogs, which account for 75.5% of insured pets and cats at 24.5%. Moreover, robust infrastructure and the willingness of pet owners to invest in high-quality care have solidified North America's market.

U.S. Veterinary Endotracheal Tubes Market Trends

The U.S. veterinary endotracheal tubes market acquired a significant share in the North America region in 2024 due to the increasing demand for advanced veterinary care and a rising number of surgical procedures performed on animals. According to the American Pet Products Association (APPA), over 70% of U.S. households own pets, leading to a growing need for veterinary services, including airway management during surgeries and critical care. In addition, the U.S. has a well-established network of veterinary clinics, hospitals, and emergency care centers that rely heavily on endotracheal tubes for anesthesia and respiratory support, thus increasing adoption and thereby propelling market growth.

Europe Veterinary Endotracheal Tubes Market Trends

Europe veterinary endotracheal tubes market was identified as a lucrative region in 2024. The region benefits from a strong presence of key players in the industry supported by local players such as Ace Vets Supplies. The market is also driven by the availability of innovative products designed to improve the efficiency and safety of airway management in animals. For instance, Vet tubes is the first disposable endotracheal tube in the European market, specifically designed straight for small pets. These tubes are more suitable for the anatomy of pets, minimize the risk of damage to sensitive tissues, reduce the likelihood of tube damage when maneuvering around sharp teeth, and enhance ease of intubation. Furthermore, the tubes' features-such as harmless PVC material, a high-volume low-pressure cuff, and an innovative inflation system-highlight the region's commitment to advancing veterinary care through safer, more effective tools.

The UK veterinary endotracheal tubes market is propelled by the country’s focus on advancing animal healthcare, supported by organizations like Veterinary Instrumentation, which has been at the forefront of the veterinary community for over three decades and plays a significant role in driving the market growth. In addition, growing awareness of animal welfare and the increasing demand for specialized veterinary services contribute to the adoption of such cutting-edge solutions in the UK. A key example is the Safe-Seal ET Tube, which features the Blaine Bafflex System, offering a unique design that eliminates the need for an inflation cuff to seal the tube in the trachea. This innovation reduces the risk of pressure-related damage to the trachea and improves overall airway management during veterinary surgeries.

Asia Pacific Veterinary Endotracheal Tubes Market Trends

The Asia Pacific veterinary endotracheal tubes market is anticipated to grow at the fastest CAGR of 9.81% during the forecast period, driven by several factors, including the increasing demand for veterinary care due to rising pet ownership, growing livestock industries, and expanding veterinary infrastructure. The region has witnessed a significant rise in the number of pet owners, particularly in countries such as China, Japan, and South Korea, where pets are increasingly considered family members. This has led to a growing need for advanced veterinary services, including surgeries that require endotracheal tubes for proper anesthesia and respiratory support. The expanding veterinary hospitals and clinics across the Asia Pacific, along with improvements in animal healthcare practices, are key contributors to the market's growth in the region.

The veterinary endotracheal tube market in Japan is driven by the country’s high pet ownership rates, advancements in veterinary care, and a strong emphasis on animal welfare. According to the Japan Pet Food Association, Japan has one of the highest pet ownership rates in Asia, with millions of households owning dogs and cats, which increases the demand for veterinary services, including surgeries and anesthesia procedures that require endotracheal tubes.

Latin America Veterinary Endotracheal Tubes Market Trends

The Latin America veterinary endotracheal tubes market is driven by steadily rising pet ownership across countries such as Brazil and Argentina, leading to a greater demand for veterinary care, including surgical procedures that need endotracheal tubes for anesthesia and respiratory support. In addition, the growing middle class and rising disposable incomes have allowed more pet owners to seek advanced healthcare for their animals, contributing to the market’s growth.

The veterinary endotracheal tube market in Brazil is primarily driven by the country's growing pet population, increased demand for veterinary care, and advancements in veterinary medicine. Brazil has one of the largest pet populations in the world, with millions of households owning dogs, cats, and other pets, creating a strong need for veterinary services, including surgeries and emergency procedures that require endotracheal tubes for safe anesthesia and respiratory support. The rising awareness of animal health, particularly regarding respiratory diseases and the benefits of advanced medical treatments, is also contributing to the market growth.

MEA Veterinary Endotracheal Tubes Market Trends

The veterinary endotracheal tube market in the Middle East and Africa is driven by several key factors, including the region's emphasis on livestock health, particularly in countries with large agricultural sectors like South Africa and Egypt, which further supports the need for veterinary endotracheal tubes in farm animal care. Improvements in veterinary infrastructure, coupled with rising disposable incomes and a growing middle class, also contribute to the market expansion. Furthermore, greater awareness of respiratory diseases and advancements in animal healthcare are encouraging the use of advanced veterinary equipment, including endotracheal tubes, in both companion animals and livestock management.

Saudi Arabia's veterinary endotracheal tubes market is primarily driven by growing investments in the country’s veterinary infrastructure, with a notable increase in the number of veterinary clinics and hospitals offering advanced medical services. The government’s focus on improving animal health, both for pets and livestock, has led to a rise in demand for quality medical equipment, including endotracheal tubes, to ensure proper respiratory management during procedures.

Key Veterinary Endotracheal Tubes Company Insights

The veterinary endotracheal tubes industry is relatively competitive and fragmented due to multiple small and large companies. Moreover, companies are increasingly adopting various strategies, such as mergers and acquisitions, geographic expansions, and product launches, to expand their market shares. Owing to constant research initiatives, this industry can be seen as moderate to high in innovation.

Key Veterinary Endotracheal Tubes Companies:

The following are the leading companies in the veterinary endotracheal tubes market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Conduct Science

- Harvard Apparatus (Harvard Bioscience Inc.)

- Jorgensen Laboratories

- Vetamac, Inc.

- RWD Life Science Co., LTD

Recent Developments

-

In March 2024, Medline Industries acquired the manufacturing rights and intellectual property of AG Cuffill from Hospitech Respiration, strengthening its airway management portfolio. It enhances precision in airway management, offering safer cuff pressure monitoring for endotracheal tubes, with applications in veterinary care to improve patient outcomes.

-

In November 2022, MILA International, Inc. launched a new endotracheal tube designed for delivering anesthetic gases, supporting ventilation, and obtaining lower airway samples. The tube features a distal sampling port for easy sample collection without disconnecting the system and a universal connector compatible with most large animal breathing systems. It is available in eight sizes.

Veterinary Endotracheal Tubes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.75 million

Revenue forecast in 2030

USD 17.66 million

Growth rate

CAGR of 8.50% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Animal, product, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, South Korea, Australia, Thailand, Brazil, Argentina, Saudi Arabia, UAE, South Africa and Kuwait

Key companies profiled

Medtronic, Conduct Science, Harvard Apparatus (Harvard Bioscience Inc.), Jorgensen Laboratories, Vetamac, Inc., RWD Life Science Co., LTD

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Veterinary Endotracheal Tubes Market Report Segmentation

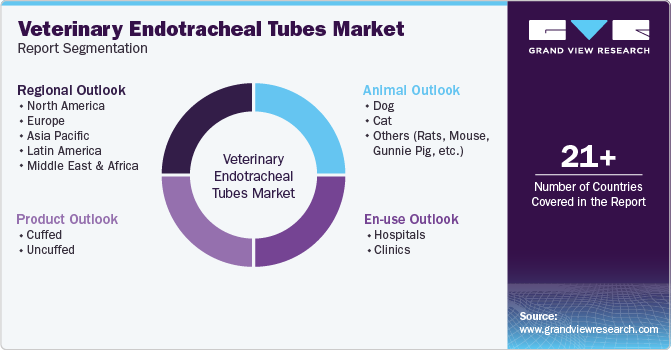

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global veterinary endotracheal tubes market report based on animal, product, end use, and region:

-

Animal Outlook (Revenue, USD Million, 2018 - 2030)

-

Dog

-

Cat

-

Others (Rats, Mouse, Gunnie Pig, etc.)

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cuffed

-

Uncuffed

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global veterinary endotracheal tubes market size was estimated at USD 10.91 million in 2024 and is expected to reach USD 11.75 million in 2025.

b. The global veterinary endotracheal tubes market is expected to grow at a compound annual growth rate of 8.50% from 2025 to 2030 to reach USD 17.66 million by 2030.

b. By animal, dog segment accounted for 40.82% of revenue share in 2024, driven by the high global population of pet dogs and their significant share in veterinary healthcare services.

b. Several prominent companies, including MMedtronic, Conduct Science, Harvard Apparatus (Harvard Bioscience Inc.), Jorgensen Laboratories, Vetamac, Inc., RWD Life Science Co., LTD compete for market share in the veterinary endotracheal tubes market

b. Key drivers contributing to this growth include rising hospitalization & surgical procedures coupled with pet insurance adoption, rising pet expenditure, increasing prevalence of respiratory diseases in animals, such as the recent outbreak of Canine Infectious Respiratory Disease Complex (CIRDC) and critical care visit. The pet population has increased significantly over the past few years due to the increasing number of households that want to adopt a pet for a better quality of life.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.